Breach of warranty insurance information

Home » Trend » Breach of warranty insurance informationYour Breach of warranty insurance images are available. Breach of warranty insurance are a topic that is being searched for and liked by netizens today. You can Get the Breach of warranty insurance files here. Download all free vectors.

If you’re looking for breach of warranty insurance images information connected with to the breach of warranty insurance keyword, you have pay a visit to the right blog. Our website frequently provides you with hints for downloading the maximum quality video and image content, please kindly search and locate more informative video content and graphics that match your interests.

Breach Of Warranty Insurance. Warranties are meant to protect the recipient against loss, should the fact be or become untrue. Section 55(1) of the insurance act 2003 states that, “in a contract of insurance, a breach of term whether called a warranty or a condition shall not give rise to any right by or afford a defence to the insured unless the term is material and relevant to. Instead, if a warranty is breached, cover will simply be suspended from the time of the breach A thing that we all generally know and accept is that, typically, a commercial general liability insurance policy doesn’t cover breaches of contract.

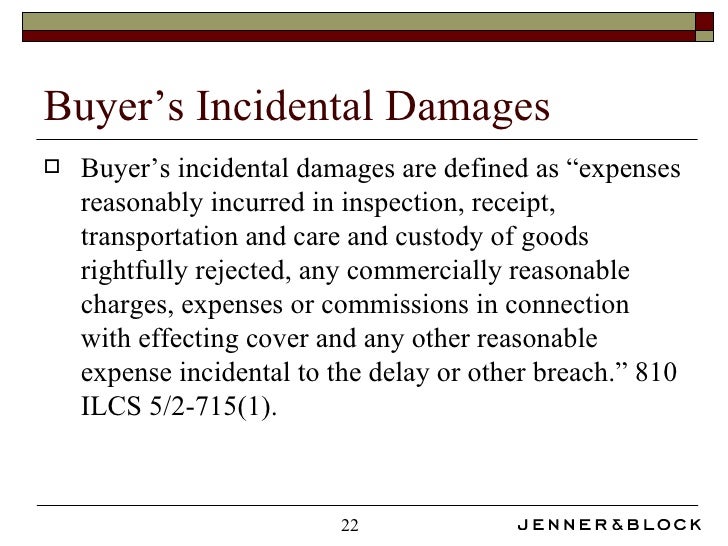

An Overview of Breach of Warranty Claims From wegnerlegal.com

An Overview of Breach of Warranty Claims From wegnerlegal.com

Representations and warranties insurance is an insurance policy used in mergers and acquisitions to protect against losses arising due to the seller’s breach of certain of its representations in. A “breach or violation by the insured of any warranty, condition, or provision” only excuses the insurer from paying—essentially, it only constitutes a. Instead, if a warranty is breached, cover will simply be suspended from the time of the breach Breach of warranty clause — a lienholder�s or lessor�s interest endorsement that causes the policy to continue to protect the financial interest of a lienholder or lessor even when the insured breaches a condition, thereby voiding coverage. Section 55(1) of the insurance act 2003 states that, “in a contract of insurance, a breach of term whether called a warranty or a condition shall not give rise to any right by or afford a defence to the insured unless the term is material and relevant to. Our proposals are designed to bring warranties to the insured’s attention and to limit insurers’ right

Breach of warranty refers to the failure of a seller to fulfill the terms of a promise, claim, or representation made concerning the quality or type of the product.

The breach of warranty is an endorsement that extends coverage to the lienholder in case your insurance policy terms were breached. In general, a breach of warranty is less severe than a breach of contract. The law assumes that a seller gives certain warranties concerning goods that are sold and that he or she must stand behind these assertions. For example, a warranty for a refrigerator may explicitly state that it will last for at least 15 years. The supreme court concluded that the insurance policy involved in this case plainly stated that a breach of a warranty in the application for the policy rendered the policy void ab initio, that is, from its inception. A common basis for denying policy response is a breach of a condition precedent to liability or policy.

Source: attorneydocs.com

Source: attorneydocs.com

The language of the policy was controlling and was the sole guide The law assumes that a seller gives certain warranties concerning goods that are sold and that he or she must stand behind these assertions. For example, a warranty for a refrigerator may explicitly state that it will last for at least 15 years. In a breach of contract case, because one party did not meet the terms of the. Representations and warranties insurance is an insurance policy used in mergers and acquisitions to protect against losses arising due to the seller’s breach of certain of its representations in.

Source: policyholderinsurancelaw.com

The law on breach of warranty has the potential to cause considerable unfairness to policyholders by allowing insurers to avoid paying claims for technical reasons, which are unconnected with the loss that has occurred. In a breach of contract case, because one party did not meet the terms of the. The insured failed to do so and tried to enforce the contracts claiming, unsuccessfully, that it did not need to comply with the warranty. A common basis for denying policy response is a breach of a condition precedent to liability or policy. Warranties are meant to protect the recipient against loss, should the fact be or become untrue.

Source: wegnerlegal.com

Source: wegnerlegal.com

Breach of warranty clause — a lienholder�s or lessor�s interest endorsement that causes the policy to continue to protect the financial interest of a lienholder or lessor even when the insured breaches a condition, thereby voiding coverage. Representations and warranties insurance is an insurance policy used in mergers and acquisitions to protect against losses arising due to the seller’s breach of certain of its representations in. A “breach or violation by the insured of any warranty, condition, or provision” only excuses the insurer from paying—essentially, it only constitutes a. Your insurance carrier could deny coverage based on breaching the pilot warranty. The breach of warranty is an endorsement that extends coverage to the lienholder in case your insurance policy terms were breached.

Source: attorneydocs.com

Source: attorneydocs.com

But, there are exceptions to that rule, and according to one recent decision those exceptions include breach of warranty claims. The law assumes that a seller gives certain warranties concerning goods that are sold and that he or she must stand behind these assertions. Warranties are meant to protect the recipient against loss, should the fact be or become untrue. Any loss recoveries under this clause are payable only to the lienholder or lessor. Warranties often take the form of assurances from the seller as to the condition of the target company or business.

Source: andywisechoices.com

Source: andywisechoices.com

An award of damages for breach of warranty aims to put the claimant in the position it would have been in had the warranty been true, subject to the usual contractual rules on mitigation and remoteness. However, because your policy includes a breach of warranty to. Warranties are meant to protect the recipient against loss, should the fact be or become untrue. Ohio requires a warranty while other states allow misrepresentation or concealment of a material fact to rescind a policy from its inception. A common basis for denying policy response is a breach of a condition precedent to liability or policy.

Source: printablelegaldoc.com

Source: printablelegaldoc.com

The law on breach of warranty has the potential to cause considerable unfairness to policyholders by allowing insurers to avoid paying claims for technical reasons, which are unconnected with the loss that has occurred. The insured failed to do so and tried to enforce the contracts claiming, unsuccessfully, that it did not need to comply with the warranty. Section 55(1) of the insurance act 2003 states that, “in a contract of insurance, a breach of term whether called a warranty or a condition shall not give rise to any right by or afford a defence to the insured unless the term is material and relevant to. The law on breach of warranty has the potential to cause considerable unfairness to policyholders by allowing insurers to avoid paying claims for technical reasons, which are unconnected with the loss that has occurred. A breach of warranty clause helps ensure that your company is protected against claims or lawsuits made by clients for not guaranteeing that your products or services are not of proper quality.

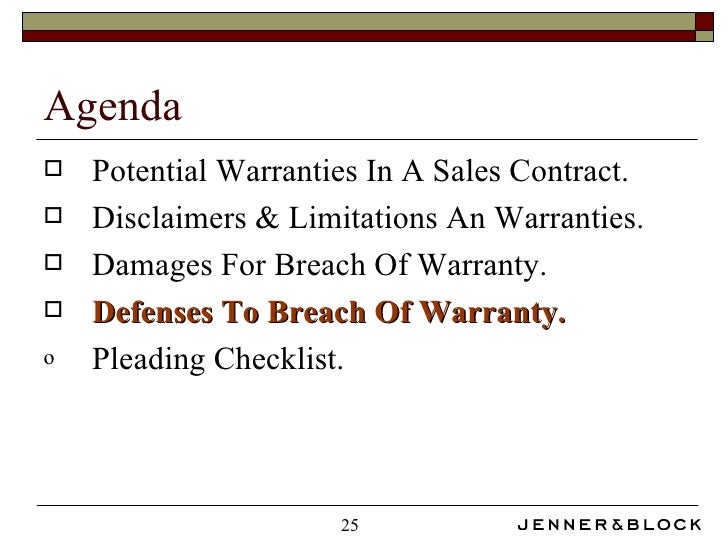

Source: slideshare.net

Source: slideshare.net

For example, a warranty for a refrigerator may explicitly state that it will last for at least 15 years. Representations and warranties insurance is an insurance policy used in mergers and acquisitions to protect against losses arising due to the seller’s breach of certain of its representations in. Guam industrial breached the warranty because the dry dock was never navy certified. For example, a warranty for a refrigerator may explicitly state that it will last for at least 15 years. For example, an unapproved pilot flies your aircraft an has an accident.

Source: cajikoww.blogspot.com

Instead, if a warranty is breached, cover will simply be suspended from the time of the breach The insurer’s liability for cover is suspended only But, there are exceptions to that rule, and according to one recent decision those exceptions include breach of warranty claims. For example, a warranty for a refrigerator may explicitly state that it will last for at least 15 years. A thing that we all generally know and accept is that, typically, a commercial general liability insurance policy doesn’t cover breaches of contract.

Source: onebridge.io

Source: onebridge.io

However, because your policy includes a breach of warranty to. The insured failed to do so and tried to enforce the contracts claiming, unsuccessfully, that it did not need to comply with the warranty. Our proposals are designed to bring warranties to the insured’s attention and to limit insurers’ right The law on breach of warranty has the potential to cause considerable unfairness to policyholders by allowing insurers to avoid paying claims for technical reasons, which are unconnected with the loss that has occurred. The insurer’s liability for cover is suspended only

Source: slideshare.net

Source: slideshare.net

This cannot be contracted out of. Warranties often take the form of assurances from the seller as to the condition of the target company or business. A warranty is a stipulation that a particular fact related to the subject of the contract is or will be as promised or stated. The language of the policy was controlling and was the sole guide Section 55(1) of the insurance act 2003 states that, “in a contract of insurance, a breach of term whether called a warranty or a condition shall not give rise to any right by or afford a defence to the insured unless the term is material and relevant to.

Source: slideshare.net

Source: slideshare.net

Policy coverage (breach of warranty or general condition) in considering any sizeable claim, insurers will be looking closely at the terms of the policy to check that it responds to the claim and that its terms have been fully complied with. Ohio requires a warranty while other states allow misrepresentation or concealment of a material fact to rescind a policy from its inception. The breach of warranty is an endorsement that extends coverage to the lienholder in case your insurance policy terms were breached. Any loss recoveries under this clause are payable only to the lienholder or lessor. But, there are exceptions to that rule, and according to one recent decision those exceptions include breach of warranty claims.

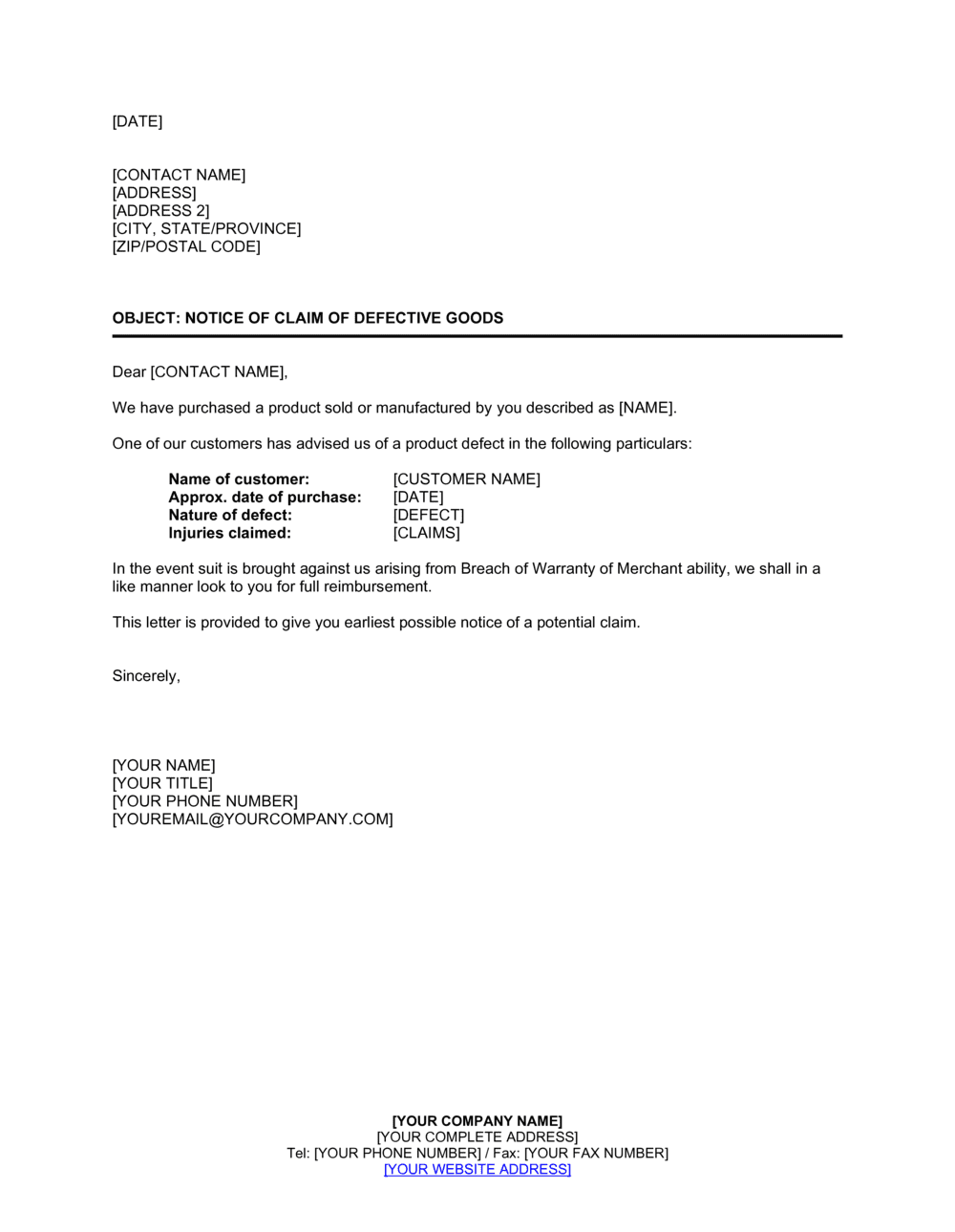

Source: business-in-a-box.com

Source: business-in-a-box.com

Your insurance carrier could deny coverage based on breaching the pilot warranty. The language of the policy was controlling and was the sole guide Insurer’s remedies for breach of warranty one of the biggest changes that will be brought in by the act is that, if a warranty is breached, automatic and permanent termination of cover will no longer be the insurer’s sole remedy for breach of warranty. Representations and warranties insurance is an insurance policy used in mergers and acquisitions to protect against losses arising due to the seller’s breach of certain of its representations in. Breach of warranty refers to the failure of a seller to fulfill the terms of a promise, claim, or representation made concerning the quality or type of the product.

Source: heinonline.org

Source: heinonline.org

A common basis for denying policy response is a breach of a condition precedent to liability or policy. A “breach or violation by the insured of any warranty, condition, or provision” only excuses the insurer from paying—essentially, it only constitutes a. The law on breach of warranty has the potential to cause considerable unfairness to policyholders by allowing insurers to avoid paying claims for technical reasons, which are unconnected with the loss that has occurred. Breach of warranty refers to the failure of a seller to fulfill the terms of a promise, claim, or representation made concerning the quality or type of the product. Breach of warranty refers to the failure of a seller to fulfill the terms of a promise, claim, or representation made concerning the quality or type of the product.

Source: cupsoguepictures.com

Source: cupsoguepictures.com

For example, a warranty for a refrigerator may explicitly state that it will last for at least 15 years. Guam industrial breached the warranty because the dry dock was never navy certified. Ultimately, whether derived from federal admiralty law or state law, the ninth circuit concluded that the law requires strict compliance with marine insurance policy warranties, even when the breach of the warranty did not cause the loss. Warranties often take the form of assurances from the seller as to the condition of the target company or business. Breach of warranty refers to the failure of a seller to fulfill the terms of a promise, claim, or representation made concerning the quality or type of the product.

Source: mccanninjurylaw.com

Source: mccanninjurylaw.com

A thing that we all generally know and accept is that, typically, a commercial general liability insurance policy doesn’t cover breaches of contract. For example, a warranty for a refrigerator may explicitly state that it will last for at least 15 years. Section 55(1) of the insurance act 2003 states that, “in a contract of insurance, a breach of term whether called a warranty or a condition shall not give rise to any right by or afford a defence to the insured unless the term is material and relevant to. The law on breach of warranty has the potential to cause considerable unfairness to policyholders by allowing insurers to avoid paying claims for technical reasons, which are unconnected with the loss that has occurred. However, because your policy includes a breach of warranty to.

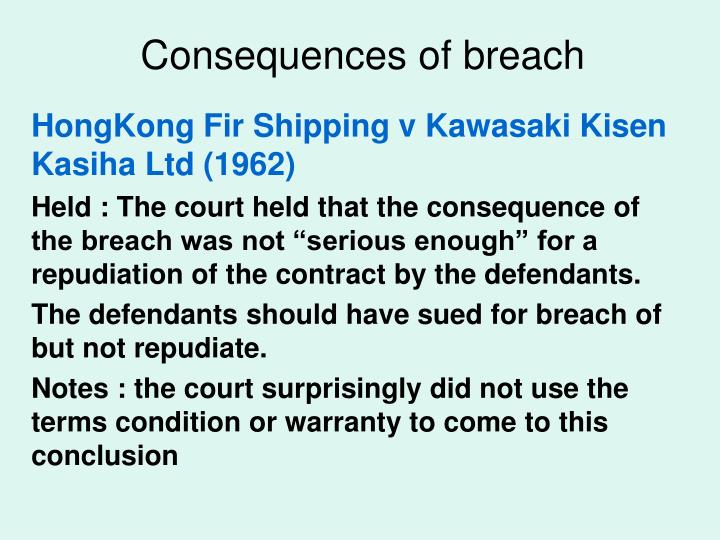

Source: studylib.net

Source: studylib.net

A breach of warranty clause helps ensure that your company is protected against claims or lawsuits made by clients for not guaranteeing that your products or services are not of proper quality. The breach of warranty is an endorsement that extends coverage to the lienholder in case your insurance policy terms were breached. Breach of warranty refers to the failure of a seller to fulfill the terms of a promise, claim, or representation made concerning the quality or type of the product. Breach of warranty clause — a lienholder�s or lessor�s interest endorsement that causes the policy to continue to protect the financial interest of a lienholder or lessor even when the insured breaches a condition, thereby voiding coverage. The law on breach of warranty has the potential to cause considerable unfairness to policyholders by allowing insurers to avoid paying claims for technical reasons, which are unconnected with the loss that has occurred.

Source: clydeco.com

The breach of warranty is an endorsement that extends coverage to the lienholder in case your insurance policy terms were breached. Ohio requires a warranty while other states allow misrepresentation or concealment of a material fact to rescind a policy from its inception. Any loss recoveries under this clause are payable only to the lienholder or lessor. This cannot be contracted out of. Breach of warranty refers to the failure of a seller to fulfill the terms of a promise, claim, or representation made concerning the quality or type of the product.

Source: sslieneuj.blogspot.com

Insurer’s remedies for breach of warranty one of the biggest changes that will be brought in by the act is that, if a warranty is breached, automatic and permanent termination of cover will no longer be the insurer’s sole remedy for breach of warranty. Breach of warranty refers to the failure of a seller to fulfill the terms of a promise, claim, or representation made concerning the quality or type of the product. The insured failed to do so and tried to enforce the contracts claiming, unsuccessfully, that it did not need to comply with the warranty. Breach warranty affecting contracts of insurance. Breach of warranty clause — a lienholder�s or lessor�s interest endorsement that causes the policy to continue to protect the financial interest of a lienholder or lessor even when the insured breaches a condition, thereby voiding coverage.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title breach of warranty insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Craft insurance arab al Idea

- Colonial life insurance claims Idea

- Business insurance and benefits information

- Deans and homer insurance Idea

- Crown cost without insurance information

- Delmonico insurance syracuse ny Idea

- Department of insurance and financial services michigan duties information

- Cost of eye exam with insurance Idea

- Cashless hospital list under national insurance company Idea

- Crowel insurance agency information