British columbia auto insurance requirements Idea

Home » Trending » British columbia auto insurance requirements IdeaYour British columbia auto insurance requirements images are available in this site. British columbia auto insurance requirements are a topic that is being searched for and liked by netizens now. You can Find and Download the British columbia auto insurance requirements files here. Download all royalty-free vectors.

If you’re searching for british columbia auto insurance requirements images information connected with to the british columbia auto insurance requirements keyword, you have pay a visit to the right site. Our website always provides you with suggestions for refferencing the maximum quality video and image content, please kindly hunt and locate more informative video content and graphics that match your interests.

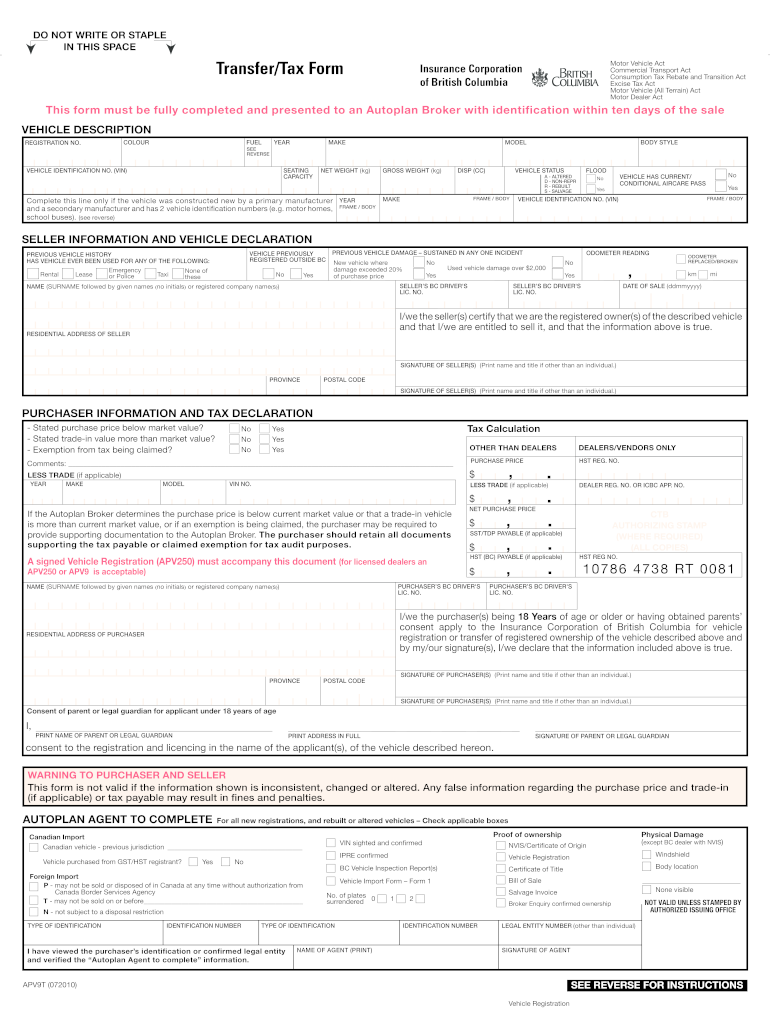

British Columbia Auto Insurance Requirements. For automobile liability insurance, a duly executed insurance corporation of british columbia apv 47 form may be used for evidence of coverage or renewal provided that if excess limits are purchased through private insurers, evidence will be provided by way of signed, certified copies of such policies. (b) vehicle insurance as defined in the insurance (vehicle) act. (2) this act does not apply to or in respect of. 1.1 the plan provides insurance coverage as follows:

Documents From vicurbappeal.ca

The same goes for when you’re searching for cheap car insurance in b.c. We protect the public by ensuring that licensees act ethically, with integrity and competence. However, in march 2010, christy clark�s bc liberal. Provincial car insurance rates and regulations are regularly reviewed by provincial boards and federal and provincial regulators. Get your licence so you can get on the road. See your options for buying and renewing your coverage.

For automobile liability insurance, a duly executed insurance corporation of british columbia apv 47 form may be used for evidence of coverage or renewal provided that if excess limits are purchased through private insurers, evidence will be provided by way of signed, certified copies of such policies.

Make a claim if you�ve been in a car accident and have icbc insurance. Car insurance is a requirement across canada and each province has their own coverage mandates. We protect the public by ensuring that licensees act ethically, with integrity and competence. (b) vehicle insurance as defined in the insurance (vehicle) act. The insurance bureau of canada has more information on the car insurance requirements in each canadian province and territory the general insurance ombudservice (gio) is an independent federal dispute resolution service. The insurance council of british columbia regulates and licenses life and general insurance agents, salespersons, and adjusters.

Source: autowinnipegcreditsolutions.com

Source: autowinnipegcreditsolutions.com

For british columbia drivers, basic auto insurance is provided through the insurance corporation of british columbia (icbc), a public insurance company. How bc auto insurance prices compare to other provinces. Mandatory bc auto insurance coverage includes (full descriptions below) The sale or adjusting of insurance is a regulated occupation in british columbia. (a) coverage under parts 10 and 11 of the act and parts 6, 7 and 10 of this regulation;

Source: diamondlawbc.ca

Source: diamondlawbc.ca

This can make it hard to find cheap car insurance in b.c., especially insurance for young drivers in british columbia. Provincial car insurance rates and regulations are regularly reviewed by provincial boards and federal and provincial regulators. Find out about learners, novice, and full licences. To drive in british columbia, you must obtain coverage through the government insurer, insurance corporation of british columbia (icbc), that meets the mandatory provincial regulations. (b) vehicle insurance as defined in the insurance (vehicle) act.

Source: fraserheightsinsurance.com

Source: fraserheightsinsurance.com

94 (1) despite any agreement, condition or stipulation to the contrary, but subject to regulations under section 150 of this act and section 103 of the insurance amendment act, 2009, this part applies to a contract made in british columbia on and after october 1, 1970 and sections 92 to 96, 103, 107 to 110, 114 and 117 to 139 apply also to a. 1.1 the plan provides insurance coverage as follows: (a) coverage under parts 10 and 11 of the act and parts 6, 7 and 10 of this regulation; The insurance council of british columbia regulates and licenses life and general insurance agents, salespersons, and adjusters. The average annual car insurance premium in british columbia is $1,680, nearly 14% higher than the next name on the list — ontario ($1,445).

Source: atvbc.ca

Source: atvbc.ca

How bc auto insurance prices compare to other provinces. The same goes for when you’re searching for cheap car insurance in b.c. The average annual car insurance premium in british columbia is $1,680, nearly 14% higher than the next name on the list — ontario ($1,445). However, in march 2010, christy clark�s bc liberal. 2 (1) this act, except as provided under an enactment, applies to every contract of insurance made or deemed made in british columbia.

Source: enpam.blogspot.com

Source: enpam.blogspot.com

This can make it hard to find cheap car insurance in b.c., especially insurance for young drivers in british columbia. Your vehicle is an extension of your life. However, in march 2010, christy clark�s bc liberal. In short, the answer is, “not well.” according to a recent report, british colombians are paying the highest premiums in canada. We protect the public by ensuring that licensees act ethically, with integrity and competence.

Source: enpam.blogspot.com

Source: enpam.blogspot.com

Make a claim if you�ve been in a car accident and have icbc insurance. Your vehicle is an extension of your life. Let one of our auto specialists walk you through your options and help you choose the. However, in march 2010, christy clark�s bc liberal. The average annual car insurance premium in british columbia is $1,680, nearly 14% higher than the next name on the list — ontario ($1,445).

Source: designersfore.blogspot.com

Source: designersfore.blogspot.com

Buy, renew, update, or cancel your insurance. Buy, renew, update, or cancel your insurance. (b) vehicle insurance as defined in the insurance (vehicle) act. 94 (1) despite any agreement, condition or stipulation to the contrary, but subject to regulations under section 150 of this act and section 103 of the insurance amendment act, 2009, this part applies to a contract made in british columbia on and after october 1, 1970 and sections 92 to 96, 103, 107 to 110, 114 and 117 to 139 apply also to a. (2) this act does not apply to or in respect of.

Source: regulatorwatch.com

Source: regulatorwatch.com

For automobile liability insurance, a duly executed insurance corporation of british columbia apv 47 form may be used for evidence of coverage or renewal provided that if excess limits are purchased through private insurers, evidence will be provided by way of signed, certified copies of such policies. Mandatory bc auto insurance coverage includes (full descriptions below) In short, the answer is, “not well.” according to a recent report, british colombians are paying the highest premiums in canada. (2) this act does not apply to or in respect of. (b) in the case of a garage vehicle certificate, coverage to a garage service operator for loss or damage to customers� vehicles that are in the care, custody or control of the garage service operator.

Source: vicurbappeal.ca

1.1 the plan provides insurance coverage as follows: Welcome to the insurance council of bc. (2) this act does not apply to or in respect of. The insurance bureau of canada has more information on the car insurance requirements in each canadian province and territory the general insurance ombudservice (gio) is an independent federal dispute resolution service. To drive in british columbia, you must obtain coverage through the government insurer, insurance corporation of british columbia (icbc), that meets the mandatory provincial regulations.

Source: pdffiller.com

Source: pdffiller.com

94 (1) despite any agreement, condition or stipulation to the contrary, but subject to regulations under section 150 of this act and section 103 of the insurance amendment act, 2009, this part applies to a contract made in british columbia on and after october 1, 1970 and sections 92 to 96, 103, 107 to 110, 114 and 117 to 139 apply also to a. The insurance council of british columbia regulates and licenses life and general insurance agents, salespersons, and adjusters. The same goes for when you’re searching for cheap car insurance in b.c. To drive in british columbia, you must obtain coverage through the government insurer, insurance corporation of british columbia (icbc), that meets the mandatory provincial regulations. In all other provinces and territories, you can purchase the mandatory coverage (and any optional coverage) directly from a private insurance company.

Source: ibc.ca

Make a claim if you�ve been in a car accident and have icbc insurance. Get your licence so you can get on the road. Find out about learners, novice, and full licences. 2 (1) this act, except as provided under an enactment, applies to every contract of insurance made or deemed made in british columbia. Car insurance is a requirement across canada and each province has their own coverage mandates.

Source: pinterest.com

Source: pinterest.com

(a) a contract of marine insurance within the meaning of the marine insurance act (canada), or. (a) a contract of marine insurance within the meaning of the marine insurance act (canada), or. However, choosing the right auto insurance coverage can be tough. Find out about learners, novice, and full licences. In short, the answer is, “not well.” according to a recent report, british colombians are paying the highest premiums in canada.

Source: autoinsurancepikiriwa.blogspot.com

Source: autoinsurancepikiriwa.blogspot.com

The insurance bureau of canada has more information on the car insurance requirements in each canadian province and territory the general insurance ombudservice (gio) is an independent federal dispute resolution service. To drive in british columbia, you must obtain coverage through the government insurer, insurance corporation of british columbia (icbc), that meets the mandatory provincial regulations. However, choosing the right auto insurance coverage can be tough. To drive in british columbia, you must obtain coverage through the government insurer, insurance corporation of british columbia (icbc), that meets the mandatory provincial regulations. The same goes for when you’re searching for cheap car insurance in b.c.

Source: luckytogocanada.com

Source: luckytogocanada.com

(a) a contract of marine insurance within the meaning of the marine insurance act (canada), or. It lets you get to where you want to go when you want to go there and is much more than just an investment. (b) in the case of a garage vehicle certificate, coverage to a garage service operator for loss or damage to customers� vehicles that are in the care, custody or control of the garage service operator. Welcome to the insurance council of bc. 94 (1) despite any agreement, condition or stipulation to the contrary, but subject to regulations under section 150 of this act and section 103 of the insurance amendment act, 2009, this part applies to a contract made in british columbia on and after october 1, 1970 and sections 92 to 96, 103, 107 to 110, 114 and 117 to 139 apply also to a.

Source: dominionlaw.ca

Source: dominionlaw.ca

Mandatory bc auto insurance coverage includes (full descriptions below) The insurance bureau of canada has more information on the car insurance requirements in each canadian province and territory the general insurance ombudservice (gio) is an independent federal dispute resolution service. Car insurance is a requirement across canada and each province has their own coverage mandates. See your options for buying and renewing your coverage. Your vehicle is an extension of your life.

94 (1) despite any agreement, condition or stipulation to the contrary, but subject to regulations under section 150 of this act and section 103 of the insurance amendment act, 2009, this part applies to a contract made in british columbia on and after october 1, 1970 and sections 92 to 96, 103, 107 to 110, 114 and 117 to 139 apply also to a. (2) this act does not apply to or in respect of. It lets you get to where you want to go when you want to go there and is much more than just an investment. However, choosing the right auto insurance coverage can be tough. (b) in the case of a garage vehicle certificate, coverage to a garage service operator for loss or damage to customers� vehicles that are in the care, custody or control of the garage service operator.

Source: ibc.ca

This can make it hard to find cheap car insurance in b.c., especially insurance for young drivers in british columbia. To drive in british columbia, you must obtain coverage through the government insurer, insurance corporation of british columbia (icbc), that meets the mandatory provincial regulations. Welcome to the insurance council of bc. However, in march 2010, christy clark�s bc liberal. In all other provinces and territories, you can purchase the mandatory coverage (and any optional coverage) directly from a private insurance company.

Source: ibc.ca

94 (1) despite any agreement, condition or stipulation to the contrary, but subject to regulations under section 150 of this act and section 103 of the insurance amendment act, 2009, this part applies to a contract made in british columbia on and after october 1, 1970 and sections 92 to 96, 103, 107 to 110, 114 and 117 to 139 apply also to a. Your vehicle is an extension of your life. Provincial car insurance rates and regulations are regularly reviewed by provincial boards and federal and provincial regulators. 1.1 the plan provides insurance coverage as follows: Basic car insurance in british columbia is regulated and provided by the insurance corporation of british columbia (icbc) through the crown corporation’s program, autoplan.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title british columbia auto insurance requirements by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Claims vs occurrence based insurance Idea

- Cheap tablet insurance Idea

- Calling insurance leads Idea

- Disability insurance for postal workers Idea

- Business insurance peoria il information

- Bright health insurance reviews Idea

- Carrier liability vs cargo insurance Idea

- Can you insure a written off car Idea

- Can convicted felons get life insurance information

- Car insurance administrator Idea