Broke broken flood insurance program information

Home » Trending » Broke broken flood insurance program informationYour Broke broken flood insurance program images are available in this site. Broke broken flood insurance program are a topic that is being searched for and liked by netizens today. You can Get the Broke broken flood insurance program files here. Get all royalty-free photos.

If you’re looking for broke broken flood insurance program images information related to the broke broken flood insurance program keyword, you have come to the right blog. Our website always provides you with hints for downloading the highest quality video and picture content, please kindly surf and locate more informative video articles and graphics that fit your interests.

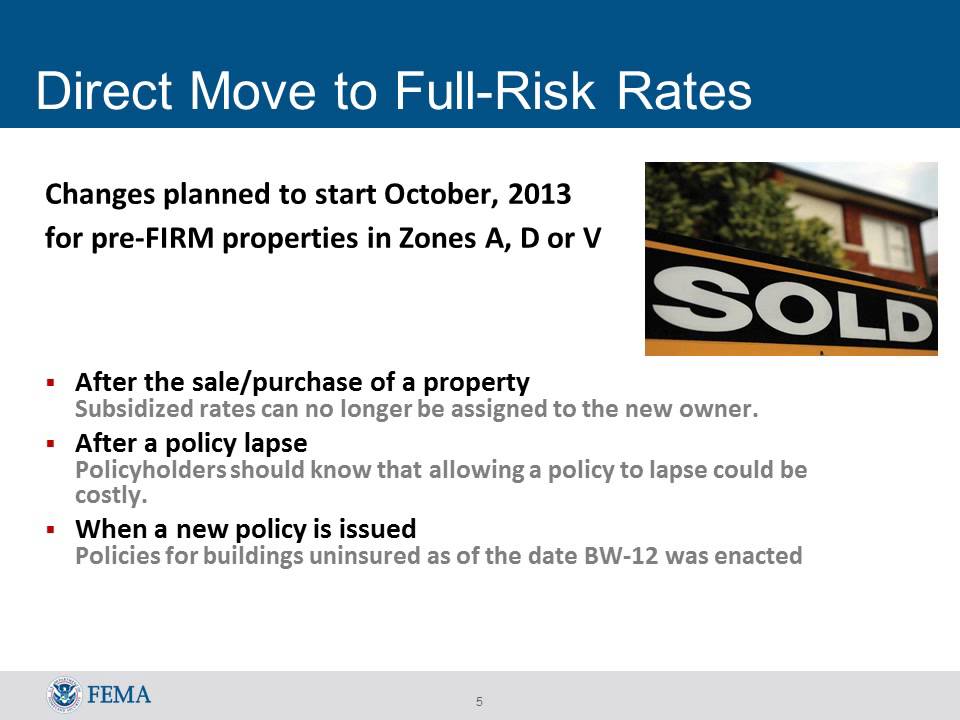

Broke Broken Flood Insurance Program. National flood insurance program is �not only broke, it is broken.�. We must reform the broken national flood insurance program. States such as florida and louisiana that are prone to flooding have optional flood policies you can add to your homeowners insurance. Treasury of more than $18 billion.

A Broke, and Broken, Flood Insurance Program Flood From pinterest.com

A Broke, and Broken, Flood Insurance Program Flood From pinterest.com

A broke, and broken, flood insurance program. A broke, and broken, flood insurance program november 4, 2017 ~ obsing92 now, an unusual coalition of insurers, environmentalists and fiscal conservatives is seeking major changes in the federal plan as a deadline approaches. And in october, it exhausted its $30 billion borrowing capacity and had to get a bailout just to keep paying current claims. Clutter’s insurer is the federal government. National flood insurance is underwater because of outdated science. An unusual coalition of insurers, environmentalists and fiscal conservatives is seeking major changes in the national flood insurance program.

A broke, and broken, flood insurance program november 4, 2017 ~ obsing92 now, an unusual coalition of insurers, environmentalists and fiscal conservatives is seeking major changes in the federal plan as a deadline approaches.

Broke and broken november 6, 2017 by privateriskadvisor it is likely old news to most insurance consumers that the national flood insurance program (nfip) administered by fema is plagued with challenges. National flood insurance is underwater because of outdated science. The national flood insurance program (nfip) has become increasingly costly and unsustainable. For many years, however, the premiums collected have not been sufficient to cover losses, resulting in a current debt to the u.s. Harvey and irma could add $10 billion or more to this tab based on my. National flood insurance program is �not only broke, it is broken.�.

Source: youtube.com

Source: youtube.com

A broke, and broken, flood insurance program by firm pressroom | november 6, 2017 a november 4, 2017 article in the new york times outlines major changes needed to the national flood insurance program (nfip) which is set to expire december 8, 2017. Read the entire article at the new york times. Treasury more than $19 billion and has no practical way to pay it back. Federal flood insurance faced its second highest ever claim year in 2017. Quite simply, nfip is broken.

Source: upsideinsurancegreenville.com

Source: upsideinsurancegreenville.com

Harvey and irma could add $10 billion or more to this tab based on my. A broke, and broken, flood insurance program by firm pressroom | november 6, 2017 a november 4, 2017 article in the new york times outlines major changes needed to the national flood insurance program (nfip) which is set to expire december 8, 2017. A broke, and broken, flood insurance program. For many years, however, the premiums collected have not been sufficient to cover losses, resulting in a current debt to the u.s. Federal flood insurance faced its second highest ever claim year in 2017.

Source: nytimes.com

Source: nytimes.com

510k members in the truereddit community. It is likely old news to most insurance consumers that the national flood insurance program (nfip) administered by fema is plagued with challenges. National flood insurance program is �not only broke, it is broken.�. Treasury of more than $18 billion. Treasury more than $19 billion and has no practical way to pay it back.

Source: poynter.org

Source: poynter.org

Treasury of more than $18 billion. It still has more than a thousand disputed claims left over from sandy. Federal flood insurance faced its second highest ever claim year in 2017. 8 whether to keep the program going. A subreddit for really great, insightful articles and discussion.

Please follow the sub�s rules and. The flood insurance program is broke and broken The national flood insurance program insures almost five million homes and businesses against flood risks and handles related services such as flood risk mapping and floodplain management. States such as florida and louisiana that are prone to flooding have optional flood policies you can add to your homeowners insurance. An unusual coalition of insurers, environmentalists and fiscal conservatives is seeking major changes in the national flood insurance program.

Source: pinterest.com

Source: pinterest.com

A broke, and broken, flood insurance program by firm pressroom | november 6, 2017 a november 4, 2017 article in the new york times outlines major changes needed to the national flood insurance program (nfip) which is set to expire december 8, 2017. Treasury of more than $18 billion. Harvey and irma could add $10 billion or more to this tab based on my. National flood insurance program is �not only broke, it is broken.�. Quite simply, nfip is broken.

Source: maureenonthecape.com

Source: maureenonthecape.com

8 whether to keep the program going. To make matters worse, nfip currently owes the u.s. Congress must decide by dec. The national flood insurance program insures almost five million homes and businesses against flood risks and handles related services such as flood risk mapping and floodplain management. The flood insurance program is broke and broken

Source: noclutter.cloud

Source: noclutter.cloud

8 whether to keep the program going. The national flood insurance program (nfip) insures 5.6 million american homeowners and some $1 trillion in assets. November 7, 2017 at 1:30 pm. Congress must decide by dec. Fema also offers a flood insurance program.

Source: nytimes.com

Source: nytimes.com

National flood insurance program is �not only broke, it is broken.�. It is likely old news to most insurance consumers that the national flood insurance program (nfip) administered by fema is plagued with challenges. We must reform the broken national flood insurance program. 8 whether to keep the program going. To make matters worse, nfip currently owes the u.s.

Source: nytimes.com

Source: nytimes.com

States such as florida and louisiana that are prone to flooding have optional flood policies you can add to your homeowners insurance. It still has more than a thousand disputed claims left over from sandy. A broke, and broken, flood insurance program by firm pressroom | november 6, 2017 a november 4, 2017 article in the new york times outlines major changes needed to the national flood insurance program (nfip) which is set to expire december 8, 2017. Quite simply, nfip is broken. A broke, and broken, flood insurance program november 4, 2017 ~ obsing92 now, an unusual coalition of insurers, environmentalists and fiscal conservatives is seeking major changes in the federal plan as a deadline approaches.

Source: pinterest.com

Source: pinterest.com

A broke, and broken, flood insurance program. Clutter’s insurer is the federal government. A subreddit for really great, insightful articles and discussion. It still has more than a thousand disputed claims left over from sandy. A broke, and broken, flood insurance program november 4, 2017 ~ obsing92 now, an unusual coalition of insurers, environmentalists and fiscal conservatives is seeking major changes in the federal plan as a deadline approaches.

Source: theforumnewsgroup.com

Source: theforumnewsgroup.com

National flood insurance is underwater because of outdated science. The flood insurance program is broke and broken 510k members in the truereddit community. Quite simply, nfip is broken. A broke, and broken, flood insurance program by firm pressroom | november 6, 2017 a november 4, 2017 article in the new york times outlines major changes needed to the national flood insurance program (nfip) which is set to expire december 8, 2017.

Source: rollingstone.com

Source: rollingstone.com

Treasury of more than $18 billion. Treasury of more than $18 billion. The flood insurance program is broke and broken. Read the entire article at the new york times. Congress must decide by dec.

Source: archive.thinkprogress.org

Source: archive.thinkprogress.org

Harvey and irma could add $10 billion or more to this tab based on my. National flood insurance is underwater because of outdated science. The flood insurance program is broke and broken States such as florida and louisiana that are prone to flooding have optional flood policies you can add to your homeowners insurance. A subreddit for really great, insightful articles and discussion.

Source: thehortongroup.com

Source: thehortongroup.com

A broke, and broken, flood insurance program november 4, 2017 ~ obsing92 now, an unusual coalition of insurers, environmentalists and fiscal conservatives is seeking major changes in the federal plan as a deadline approaches. The flood insurance program is broke and broken 8 whether to keep the program going. Please follow the sub�s rules and. November 7, 2017 at 1:30 pm.

Source: nytimes.com

Source: nytimes.com

A broke, and broken, flood insurance program. The national flood insurance program (nfip) has become increasingly costly and unsustainable. It still has more than a thousand disputed claims left over from sandy. The flood insurance program is broke and broken The national flood insurance program insures almost five million homes and businesses against flood risks and handles related services such as flood risk mapping and floodplain management.

Source: youtube.com

Source: youtube.com

Clutter’s insurer is the federal government. The national flood insurance program (nfip) insures 5.6 million american homeowners and some $1 trillion in assets. It still has more than a thousand disputed claims left over from sandy. The flood insurance program is broke and broken. Clutter’s insurer is the federal government.

Source: pinterest.com

Source: pinterest.com

Hurricanes florence, harvey ad michael placed the spotlight back onto the. Federal flood insurance faced its second highest ever claim year in 2017. November 7, 2017 at 1:30 pm. A subreddit for really great, insightful articles and discussion. We must reform the broken national flood insurance program.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title broke broken flood insurance program by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Claims vs occurrence based insurance Idea

- Cheap tablet insurance Idea

- Calling insurance leads Idea

- Disability insurance for postal workers Idea

- Business insurance peoria il information

- Bright health insurance reviews Idea

- Carrier liability vs cargo insurance Idea

- Can you insure a written off car Idea

- Can convicted felons get life insurance information

- Car insurance administrator Idea