Builders risk insurance soft costs information

Home » Trending » Builders risk insurance soft costs informationYour Builders risk insurance soft costs images are available. Builders risk insurance soft costs are a topic that is being searched for and liked by netizens today. You can Find and Download the Builders risk insurance soft costs files here. Download all free photos and vectors.

If you’re searching for builders risk insurance soft costs images information linked to the builders risk insurance soft costs keyword, you have come to the right site. Our website always provides you with hints for downloading the highest quality video and image content, please kindly search and locate more informative video articles and images that match your interests.

Builders Risk Insurance Soft Costs. • additional interest (both on construction and permanent financing) • real estate taxes • advertising expenses • insurance • architect fees Insurance costs for construction are also ongoing and can continue after construction ends. Proof that the costs would not have been incurred but for the delay must be provided. Builders risk insurance provides valuable protection in the event of a direct property loss experienced by a contractor, project owner, or other insured parties during the construction process.however, when a catastrophic loss delays a project, indirect costs, such as soft costs and lost business income, can create substantial financial exposures for the businesses involved.

4 Best Design Construction Cost Estimation Methods Fohlio From fohlio.com

4 Best Design Construction Cost Estimation Methods Fohlio From fohlio.com

Additional interest (both on construction and permanent financing) real estate taxes advertising expenses insurance architect fees Is there insurance for soft costs? Most builders risk policies do not include soft costs automatically as they are generally provided as an endorsement or extension. Soft costs most builders risk policies include coverage for additional soft costs incurred as result of the delay in construction. Fci notified the insurer of the loss and was paid $3,079,519 for physical damage to the project and $238,897 for soft costs. Proof that the soft costs were necessary and reasonable must be provided.

Insurance fees are a soft cost because being insured doesn�t directly impact the development of a new construction project.

Is there insurance for soft costs? Construction companies may purchase multiple types of insurance to protect themselves and their assets: It is intended to provide a general overview of the program described. Soft cost items soft osts potentially overed under uilder [s risk policies 1) architect and engineering fees 2) building inspection fees 3) construction loan fees 4) insurance premiums 5) interest expense 6) legal fees 7) lost tax credits 8) advertising costs 9) leasing expenses (renegotiation costs) Soft costs can be things such as additional real estate taxes and any possible penalties owed to local governmental agencies. If a standard builder’s risk policy does not have the soft costs coverage, these types of losses will not be paid to the insured.

Source: scrivens.ca

The policy included a coverage extension for soft costs with a $1 million limit. The types of soft costs must be set forth in the policy endorsement. Examples of soft costs builders risk “soft costs” in this context means reasonable. Fci purchased a builders risk policy from travelers (insurer). Some builders risk policies will also cover costs such as debris removal in the event of property damage to structures and building materials that will need to be removed from the property before the project can recommence.

Source: contractortalk.com

Source: contractortalk.com

Builder’s risk insurance costs typically range between 1% and 4% of the total construction costs, or around $1,000 to $4,000 per $100,000 of construction costs depending on the project details. Sounds simple enough, but the process of procuring the correct builders risk policy starts with an understanding of the project costs, construction timeline, and imagining potential claim scenarios. Some builders risk policies will also cover costs such as debris removal in the event of property damage to structures and building materials that will need to be removed from the property before the project can recommence. It is intended to provide a general overview of the program described. If a standard builder’s risk policy does not have the soft costs coverage, these types of losses will not be paid to the insured.

Source: sbci.com

Source: sbci.com

Builder’s risk insurance costs typically range between 1% and 4% of the total construction costs, or around $1,000 to $4,000 per $100,000 of construction costs depending on the project details. Proof that the soft costs were necessary and reasonable must be provided. Builders risk insurance provides valuable protection in the event of a direct property loss experienced by a contractor, project owner, or other insured parties during the construction process.however, when a catastrophic loss delays a project, indirect costs, such as soft costs and lost business income, can create substantial financial exposures for the businesses involved. Simply put, soft costs are costs incurred as a result of the covered losses that are not labor and materials. Most builders risk policies do not include soft costs automatically as they are generally provided as an endorsement or extension.

Source: plm.automation.siemens.com

This should include all construction overhead costs, such as: • additional interest (both on construction and permanent financing) • real estate taxes • advertising expenses • insurance • architect fees Without soft cost coverage in place, any costs aside from labor or materials that arise during a construction project would not be covered under a builders risk policy, and therefore the owner, contractor or developer would have to pay additional expenses. Examples of soft costs builders risk “soft costs” in this context means reasonable. It is intended to provide a general overview of the program described.

Source: kpa.io

Source: kpa.io

Soft costs can be things such as additional real estate taxes and any possible penalties owed to local governmental agencies. In november 2017, the project experienced insured water damage. Some builders risk policies will also cover costs such as debris removal in the event of property damage to structures and building materials that will need to be removed from the property before the project can recommence. Proof that the costs would not have been incurred but for the delay must be provided. The types of soft costs must be set forth in the policy endorsement.

Source: trustedchoice.com

Source: trustedchoice.com

If a standard builder’s risk policy does not have the soft costs coverage, these types of losses will not be paid to the insured. How much does builders risk insurance cost? Simply put, soft costs are costs incurred as a result of the covered losses that are not labor and materials. Some builders risk policies will also cover costs such as debris removal in the event of property damage to structures and building materials that will need to be removed from the property before the project can recommence. This should include all construction overhead costs, such as:

Source: programbusiness.com

Source: programbusiness.com

Fci notified the insurer of the loss and was paid $3,079,519 for physical damage to the project and $238,897 for soft costs. Some builders risk policies will also cover costs such as debris removal in the event of property damage to structures and building materials that will need to be removed from the property before the project can recommence. It is intended to provide a general overview of the program described. Do builders need all risk insurance? Sounds simple enough, but the process of procuring the correct builders risk policy starts with an understanding of the project costs, construction timeline, and imagining potential claim scenarios.

Source: www4.slideteam.net

Source: www4.slideteam.net

Fci purchased a builders risk policy from travelers (insurer). How much should builders risk insurance cost? Builders risk | soft cost worksheet this document is for illustrative purposes only and is not a contract. Builders risk insurance provides valuable protection in the event of a direct property loss experienced by a contractor, project owner, or other insured parties during the construction process.however, when a catastrophic loss delays a project, indirect costs, such as soft costs and lost business income, can create substantial financial exposures for the businesses involved. Do builders need all risk insurance?

Source: esub.com

Source: esub.com

Proof that the soft costs were necessary and reasonable must be provided. Said another way, soft costs builders risk are addendums to builders risk policies that arise from a delay in project completion. Builders risk | soft cost worksheet this document is for illustrative purposes only and is not a contract. Sounds simple enough, but the process of procuring the correct builders risk policy starts with an understanding of the project costs, construction timeline, and imagining potential claim scenarios. Examples of soft costs builders risk “soft costs” in this context means reasonable.

Source: go.usassure.com

Source: go.usassure.com

• additional interest (both on construction and permanent financing) • real estate taxes • advertising expenses • insurance • architect fees But unlike standard commercial property insurance, most builder�s risk policies do not include soft costs automatically. Sounds simple enough, but the process of procuring the correct builders risk policy starts with an understanding of the project costs, construction timeline, and imagining potential claim scenarios. Soft cost items soft osts potentially overed under uilder [s risk policies 1) architect and engineering fees 2) building inspection fees 3) construction loan fees 4) insurance premiums 5) interest expense 6) legal fees 7) lost tax credits 8) advertising costs 9) leasing expenses (renegotiation costs) This should include all construction overhead costs, such as:

Source: www4.slideteam.net

Source: www4.slideteam.net

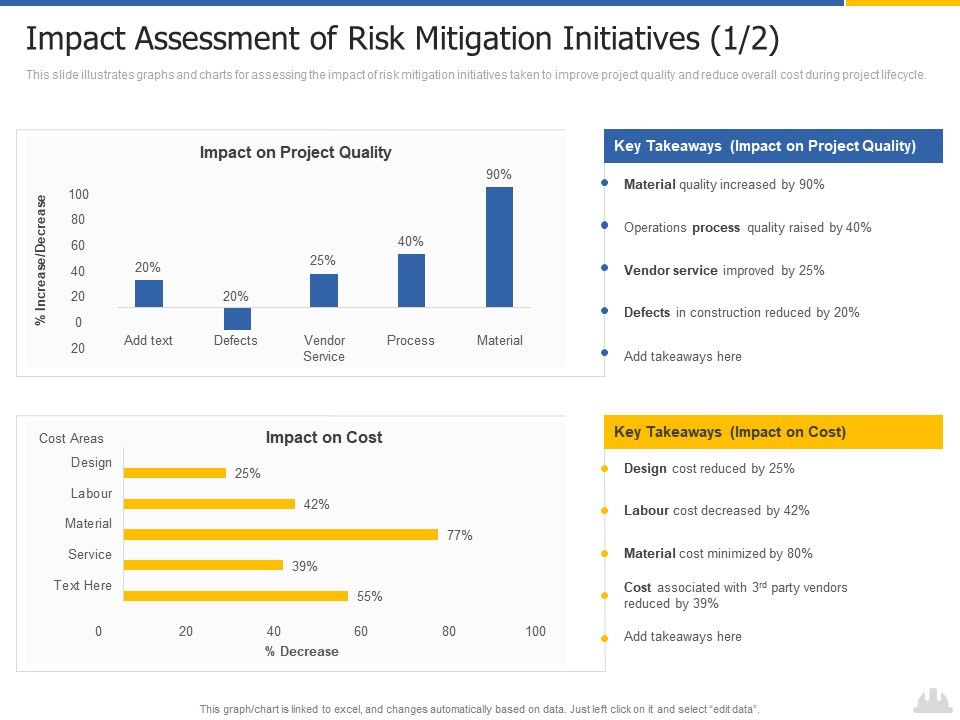

The types of soft costs must be set forth in the policy endorsement. Sounds simple enough, but the process of procuring the correct builders risk policy starts with an understanding of the project costs, construction timeline, and imagining potential claim scenarios. The average price of a standard $1,000,000/$2,000,000 general liability insurance policy for a small builders risk policy ranges from $37 to $78 per month based on location and project size and duration. One of the benefits of builder’s risk insurance is the availability of an option called soft costs coverage. Under a builders risk policy, soft costs are covered during the delay period.

Source: esub.com

Source: esub.com

The delay period is typically defined as a period of time that commences with the anticipated completion date and ends when the project is actually completed. Insurance for building construction or renovation is generally classified as a hard cost. The cost of builder’s risk insurance typically accounts for 1% to 5% of a business’s total construction budget. Builders risk | soft cost worksheet this document is for illustrative purposes only and is not a contract. • additional interest (both on construction and permanent financing) • real estate taxes • advertising expenses • insurance • architect fees

Source: adjustersinternational.com

Source: adjustersinternational.com

The delay period is typically defined as a period of time that commences with the anticipated completion date and ends when the project is actually completed. Fci purchased a builders risk policy from travelers (insurer). The cost of builder’s risk insurance typically accounts for 1% to 5% of a business’s total construction budget. Sounds simple enough, but the process of procuring the correct builders risk policy starts with an understanding of the project costs, construction timeline, and imagining potential claim scenarios. The policy included a coverage extension for soft costs with a $1 million limit.

Source: myexpnces.blogspot.com

Source: myexpnces.blogspot.com

This can be a valuable addition to any construction company’s risk management strategy. This can be a valuable addition to any construction company’s risk management strategy. Construction soft costs include engineering, permits paid, marketing, and project management expenses. One of the benefits of builder’s risk insurance is the availability of an option called soft costs coverage. The cost of builder’s risk insurance typically accounts for 1% to 5% of a business’s total construction budget.

Source: abexinsurance.com

Source: abexinsurance.com

Proof that the soft costs were necessary and reasonable must be provided. The types of soft costs must be set forth in the policy endorsement. Sounds simple enough, but the process of procuring the correct builders risk policy starts with an understanding of the project costs, construction timeline, and imagining potential claim scenarios. Simply put, soft costs are costs incurred as a result of the covered losses that are not labor and materials. Fci notified the insurer of the loss and was paid $3,079,519 for physical damage to the project and $238,897 for soft costs.

Source: info.thealsgroup.com

Source: info.thealsgroup.com

If a standard builder’s risk policy does not have the soft costs coverage, these types of losses will not be paid to the insured. Additional interest (both on construction and permanent financing) real estate taxes advertising expenses insurance architect fees In november 2017, the project experienced insured water damage. Builder’s risk insurance costs typically range between 1% and 4% of the total construction costs, or around $1,000 to $4,000 per $100,000 of construction costs depending on the project details. To cover this gap in coverage and reduce financial exposure a builder or owner can add soft costs coverage to a builders risk insurance policy.

Source: constructionblog.autodesk.com

Source: constructionblog.autodesk.com

Do builders need all risk insurance? Some builders risk policies will also cover costs such as debris removal in the event of property damage to structures and building materials that will need to be removed from the property before the project can recommence. This can be a valuable addition to any construction company’s risk management strategy. Soft costs most builders risk policies include coverage for additional soft costs incurred as result of the delay in construction. Simply put, soft costs are costs incurred as a result of the covered losses that are not labor and materials.

Source: pinterest.com

Source: pinterest.com

Additional interest (both on construction and permanent financing) real estate taxes advertising expenses insurance architect fees In november 2017, the project experienced insured water damage. Most builders risk policies do not include soft costs automatically as they are generally provided as an endorsement or extension. Under a builders risk policy, soft costs are covered during the delay period. Some builders risk policies will also cover costs such as debris removal in the event of property damage to structures and building materials that will need to be removed from the property before the project can recommence.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title builders risk insurance soft costs by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Claims vs occurrence based insurance Idea

- Cheap tablet insurance Idea

- Calling insurance leads Idea

- Disability insurance for postal workers Idea

- Business insurance peoria il information

- Bright health insurance reviews Idea

- Carrier liability vs cargo insurance Idea

- Can you insure a written off car Idea

- Can convicted felons get life insurance information

- Car insurance administrator Idea