Builders warranty insurance act Idea

Home » Trend » Builders warranty insurance act IdeaYour Builders warranty insurance act images are available. Builders warranty insurance act are a topic that is being searched for and liked by netizens now. You can Get the Builders warranty insurance act files here. Get all royalty-free photos.

If you’re searching for builders warranty insurance act images information connected with to the builders warranty insurance act keyword, you have pay a visit to the ideal blog. Our website frequently gives you suggestions for seeking the highest quality video and image content, please kindly hunt and find more enlightening video content and images that match your interests.

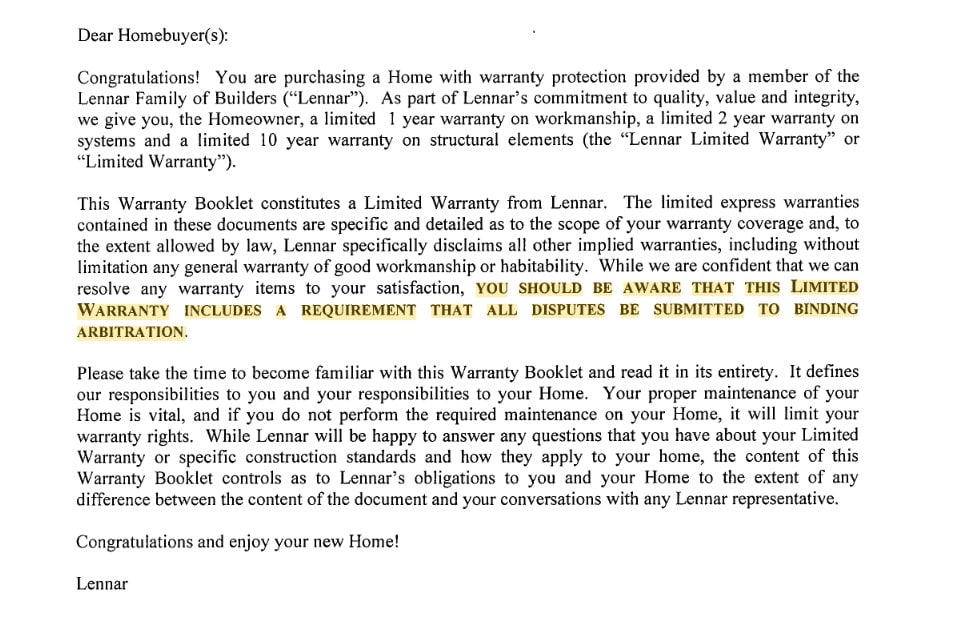

Builders Warranty Insurance Act. 5 commissioner responsible for administration of act. Authorised by the act parliamentary counsel—also accessible at www.legislation.act.gov.au. At the time of filing the claims, the owner. It protects the homeowner (and any subsequent owner) against financial loss in the event that contracted building work isn’t completed or is considered defective and the builder has died,.

New Construction Warranty SB 800 What it Means Tri From blog.keytothebay.com

New Construction Warranty SB 800 What it Means Tri From blog.keytothebay.com

In victoria, builder�s warranty insurance is called domestic building insurance (dbi). Known as residential building warranty insurance, it covers homeowners for loss of deposit, incomplete or defective building work if their builder dies, disappears or becomes insolvent. It’s a requirement for residential building work valued over $12,000. Owner builder warranty covers the purchaser, or any subsequent purchaser, of the property for the balance of the 6 year period after the final or occupancy certificate was issued if the owner builder dies, disappears or becomes insolvent, however defects, incomplete works or second hand materials noted in the defects inspection report are exempt. Many builders are providing warranties and/or guarantees that are not backed by a third party and do not extend further than the implied warranties under the building act. If this happens to you, the first step is to.

It protects the homeowner (and any subsequent owner) against financial loss in the event that contracted building work isn’t completed or is considered defective and the builder has died,.

This could be due to the death, disappearance or insolvency of the builder, or, in some states, because the builder has failed to respond to a rectification order issued by a court. Home warranty insurance 1 can provide cover to a homeowner (and any subsequent owner) in cases where contracted building work isn’t completed, or the builder is unable to fix defects. With regards to the act, the home warranty insurance scheme sits at the end of a comprehensive consumer protection regime for homeowners undertaking residential building projects in new south wales where the contract price exceeds $20,000. Builders warranty insurance is a type of insurance which, in theory, is supposed to provide cover to protect you as the homeowner under circumstances where you’re having trouble with work that’s been done (or not done, if that’s the case) by your builder. It protects the homeowner (and any subsequent owner) against financial loss in the event that contracted building work isn’t completed or is considered defective and the builder has died,. It’s insurance that covers a builder’s client for loss of deposit, failure to start or finish a job and defective work on a completed job.

Source: sharkeygraphics.com

Source: sharkeygraphics.com

Domestic building insurance covers the client if, before work is complete, the practitioner dies, is declared insolvent or disappears. It is required for any residential building project valued at over. Builders warranty insurance is a type of insurance which, in theory, is supposed to provide cover to protect you as the homeowner under circumstances where you’re having trouble with work that’s been done (or not done, if that’s the case) by your builder. The insurance is to cover the purchaser in the event of faulty workmanship. Builders warranty insurance (also called home owners warranty) is a form of insurance that applies to home building work that requires building approval and costs $12,000 or more 1.

Source: eholdthebeauty-al.blogspot.com

Source: eholdthebeauty-al.blogspot.com

That’s where builders warranty insurance may come into play. The period of warranty is for 6 years from the issuing of the certificate of occupancy or certificate of final completion. In victoria, builder�s warranty insurance is called domestic building insurance (dbi). Division 6.1 interpretation — pt 6 129. Visit our dedicated website, www.dbi.vmia.vic.gov.au for more information about the scheme, including how to apply for insurance — for builders and brokers.

Source: thecromeenslawfirm.com

Source: thecromeenslawfirm.com

It protects the homeowner (and any subsequent owner) against financial loss in the event that contracted building work isn’t completed or is considered defective and the builder has died,. In essence, the home warranty insurance scheme is intended to provide a safety net for homeowners. The period of warranty is for 6 years from the issuing of the certificate of occupancy or certificate of final completion. We would like to show you a description here but the site won’t allow us. It’s a requirement for residential building work valued over $12,000.

Source: templateroller.com

Source: templateroller.com

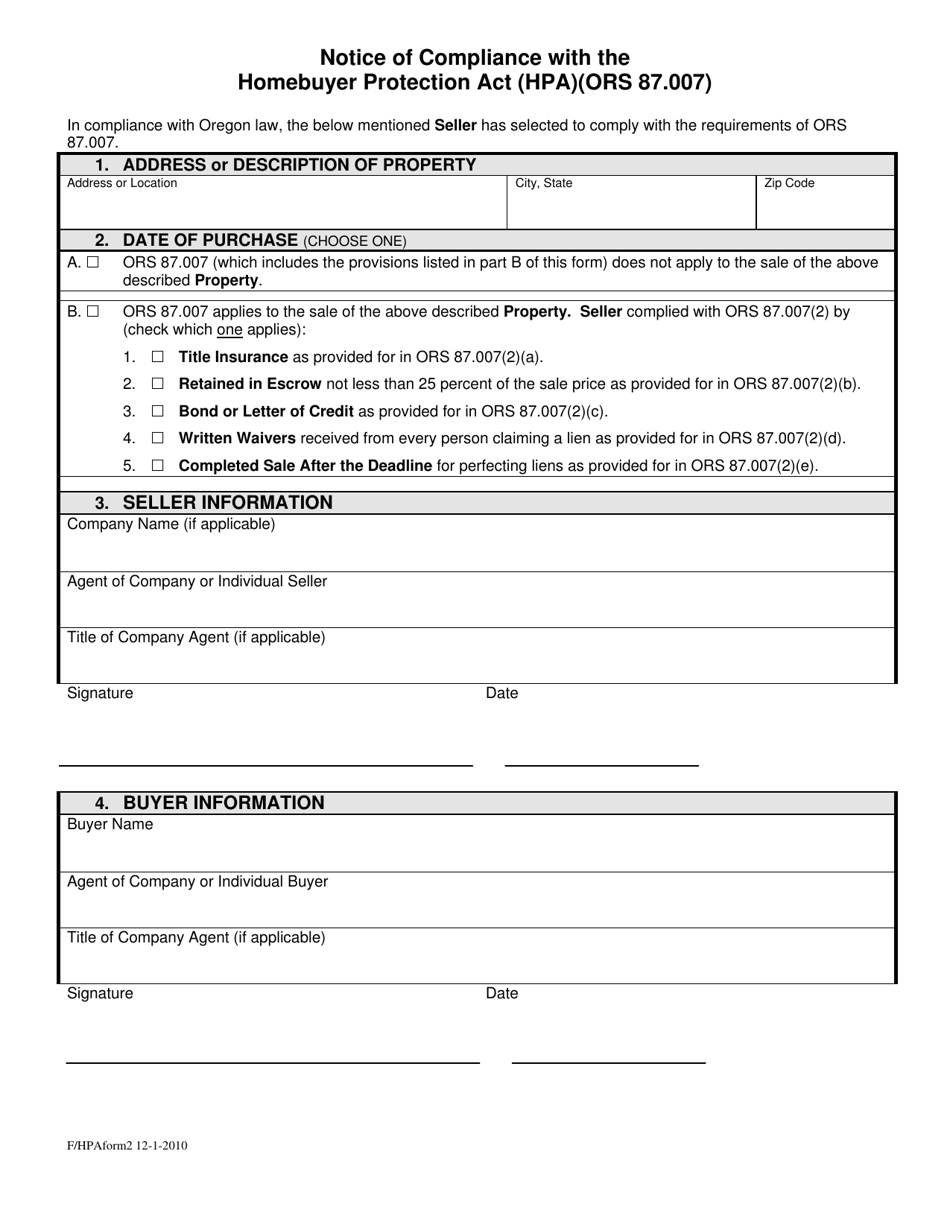

Known as residential building warranty insurance, it covers homeowners for loss of deposit, incomplete or defective building work if their builder dies, disappears or becomes insolvent. This could be due to the death, disappearance or insolvency of the builder, or, in some states, because the builder has failed to respond to a rectification order issued by a court. The period of warranty is for 6 years from the issuing of the certificate of occupancy or certificate of final completion. The building act 1993, requires owner builders who sell their property to obtain owner builder warranty insurance. Part 6 residential buildings — statutory warranties, standard conditions, insurance and fidelity certificates 129.

Source: contractstore.com

Source: contractstore.com

In the act, builders are required to obtain complying residential warranty insurance (home warranty insurance) before commencing insurable residential building work with a value of over $12,000.00 and that is structural in nature. Authorised by the act parliamentary counsel—also accessible at www.legislation.act.gov.au. In essence, the home warranty insurance scheme is intended to provide a safety net for homeowners. In victoria, builder�s warranty insurance is called domestic building insurance (dbi). With regards to the act, the home warranty insurance scheme sits at the end of a comprehensive consumer protection regime for homeowners undertaking residential building projects in new south wales where the contract price exceeds $20,000.

Source: richmondvanewhomes.net

Source: richmondvanewhomes.net

That’s where builders warranty insurance may come into play. It’s insurance that covers a builder’s client for loss of deposit, failure to start or finish a job and defective work on a completed job. 5 commissioner responsible for administration of act. Contents 6 building act 2004 effective: That’s where builders warranty insurance may come into play.

Source: constructionlawwatch.com

Source: constructionlawwatch.com

Authorised by the act parliamentary counsel—also accessible at www.legislation.act.gov.au. The period of warranty is for 6 years from the issuing of the certificate of occupancy or certificate of final completion. The act entitles a home owner to file a home warranty insurance claim in the event of financial loss or damage. The following information/documentation must accompany this application: Private insurers act as agents for the scheme.

Source: studylib.net

Source: studylib.net

In victoria, builder�s warranty insurance is called domestic building insurance (dbi). An act to regulate building work contractors and the supervision of building work; The period of warranty is for 6 years from the issuing of the certificate of occupancy or certificate of final completion. Builders warranty insurance is a type of insurance which, in theory, is supposed to provide cover to protect you as the homeowner under circumstances where you’re having trouble with work that’s been done (or not done, if that’s the case) by your builder. Owner builder warranty insurance covers the purchaser or subsequent purchaser of the property, for the balance of the period of insurance after the final (completion) certificate was issued.

Source: buildsafe.com.au

Source: buildsafe.com.au

The insurance is to cover the purchaser in the event of faulty workmanship. Please contact your authorised broker or qbe representative if you need cover. Domestic building insurance, previously known as ‘builders warranty insurance’, protects consumers in the event their builder or tradesperson cannot finish the building project or fix defects because they have: In essence, the home warranty insurance scheme is intended to provide a safety net for homeowners. The period of warranty is for 6 years from the issuing of the certificate of occupancy or certificate of final completion.

Source: gilesdixon.com

Source: gilesdixon.com

Many builders are providing warranties and/or guarantees that are not backed by a third party and do not extend further than the implied warranties under the building act. Building work contractors act 1995. Please contact your authorised broker or qbe representative if you need cover. Many builders are providing warranties and/or guarantees that are not backed by a third party and do not extend further than the implied warranties under the building act. 6 obligation of building work contractors to be.

Source: blog.keytothebay.com

Source: blog.keytothebay.com

Division 6.1 interpretation — pt 6 129. Owner builder warranty covers the purchaser, or any subsequent purchaser, of the property for the balance of the 6 year period after the final or occupancy certificate was issued if the owner builder dies, disappears or becomes insolvent, however defects, incomplete works or second hand materials noted in the defects inspection report are exempt. The following information/documentation must accompany this application: Known as residential building warranty insurance, it covers homeowners for loss of deposit, incomplete or defective building work if their builder dies, disappears or becomes insolvent. With regards to the act, the home warranty insurance scheme sits at the end of a comprehensive consumer protection regime for homeowners undertaking residential building projects in new south wales where the contract price exceeds $20,000.

Source: 3point1416.com

Source: 3point1416.com

This could be due to the death, disappearance or insolvency of the builder, or, in some states, because the builder has failed to respond to a rectification order issued by a court. The period of warranty is for 6 years from the issuing of the certificate of occupancy or certificate of final completion. Builders in victoria are required by law to take out domestic building insurance, also known as builder’s warranty insurance, for work valued at more than $16,000. The building act 1993, requires owner builders who sell their property to obtain owner builder warranty insurance. Domestic building insurance covers the client if, before work is complete, the practitioner dies, is declared insolvent or disappears.

Source: ramanan50.wordpress.com

Source: ramanan50.wordpress.com

The period of warranty is for 6 years from the issuing of the certificate of occupancy or certificate of final completion. Builders warranty insurance is a type of insurance which, in theory, is supposed to provide cover to protect you as the homeowner under circumstances where you’re having trouble with work that’s been done (or not done, if that’s the case) by your builder. We would like to show you a description here but the site won’t allow us. With regards to the act, the home warranty insurance scheme sits at the end of a comprehensive consumer protection regime for homeowners undertaking residential building projects in new south wales where the contract price exceeds $20,000. 6 obligation of building work contractors to be.

Source: builtininsurance.co.nz

Source: builtininsurance.co.nz

In the act, builders are required to obtain complying residential warranty insurance (home warranty insurance) before commencing insurable residential building work with a value of over $12,000.00 and that is structural in nature. Please contact your authorised broker or qbe representative if you need cover. Owner builder warranty covers the purchaser, or any subsequent purchaser, of the property for the balance of the 6 year period after the final or occupancy certificate was issued if the owner builder dies, disappears or becomes insolvent, however defects, incomplete works or second hand materials noted in the defects inspection report are exempt. In essence, the home warranty insurance scheme is intended to provide a safety net for homeowners. It is required for any residential building project valued at over.

Source: marylandcondoconstructiondefectlaw.com

Source: marylandcondoconstructiondefectlaw.com

Builders warranty insurance is a type of insurance which, in theory, is supposed to provide cover to protect you as the homeowner under circumstances where you’re having trouble with work that’s been done (or not done, if that’s the case) by your builder. We would like to show you a description here but the site won’t allow us. (4) a reference in this act to a general insurer having no liabilities in respect of insurance business carried on by it in australia includes a reference to a general insurer who has assigned, other than by an equitable assignment, all of its interests (including rights and benefits) under all contracts of insurance in respect of insurance business carried on by it in australia to. Owner builders need to consider purchasing owner builder warranty insurance is, when selling their home upon which owner builder work has been done. This could be due to the death, disappearance or insolvency of the builder, or, in some states, because the builder has failed to respond to a rectification order issued by a court.

Source: mbib.com.au

Source: mbib.com.au

The insurance is to cover the purchaser in the event of faulty workmanship. Contents 6 building act 2004 effective: That’s where builders warranty insurance may come into play. Builders warranty insurance is a legislative requirement under state/territory law in nsw, act, vic, sa and wa for contracts over $20,000 in nsw & wa (or $12,000 in vic, act & sa). If this happens to you, the first step is to.

It’s a requirement for residential building work valued over $12,000. 6 obligation of building work contractors to be. That’s where builders warranty insurance may come into play. The building act 1993, requires owner builders who sell their property to obtain owner builder warranty insurance. Domestic building insurance covers the client if, before work is complete, the practitioner dies, is declared insolvent or disappears.

Source: cmlaw.com.au

Source: cmlaw.com.au

It protects the homeowner (and any subsequent owner) against financial loss in the event that contracted building work isn’t completed or is considered defective and the builder has died,. At the time of filing the claims, the owner. Visit our dedicated website, www.dbi.vmia.vic.gov.au for more information about the scheme, including how to apply for insurance — for builders and brokers. The following information/documentation must accompany this application: Builders warranty insurance (also called home owners warranty) is a form of insurance that applies to home building work that requires building approval and costs $12,000 or more 1.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title builders warranty insurance act by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Craft insurance arab al Idea

- Colonial life insurance claims Idea

- Business insurance and benefits information

- Deans and homer insurance Idea

- Crown cost without insurance information

- Delmonico insurance syracuse ny Idea

- Department of insurance and financial services michigan duties information

- Cost of eye exam with insurance Idea

- Cashless hospital list under national insurance company Idea

- Crowel insurance agency information