Bump insurance not on motor tax list information

Home » Trending » Bump insurance not on motor tax list informationYour Bump insurance not on motor tax list images are available in this site. Bump insurance not on motor tax list are a topic that is being searched for and liked by netizens now. You can Download the Bump insurance not on motor tax list files here. Get all royalty-free vectors.

If you’re searching for bump insurance not on motor tax list pictures information linked to the bump insurance not on motor tax list topic, you have come to the right site. Our website frequently provides you with hints for refferencing the highest quality video and image content, please kindly surf and locate more enlightening video articles and graphics that fit your interests.

Bump Insurance Not On Motor Tax List. Satisfiedthat at least 80% of the use of the motor vehicle for the tax year will be for business purposes This rule does not apply if you receive a settlement amount under. Check if your insurance is sufficient for road tax renewal. The most important factor will be flexibility.

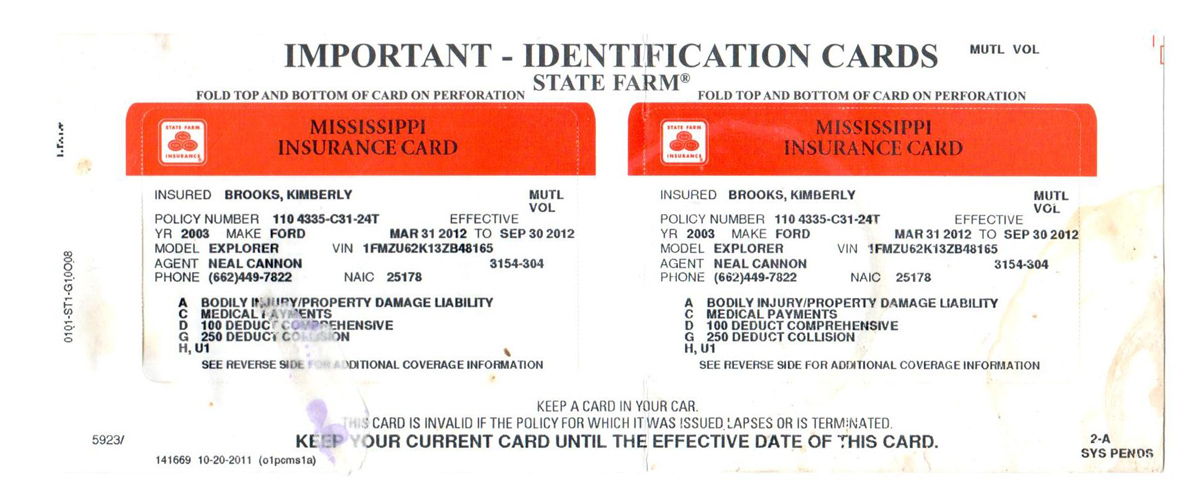

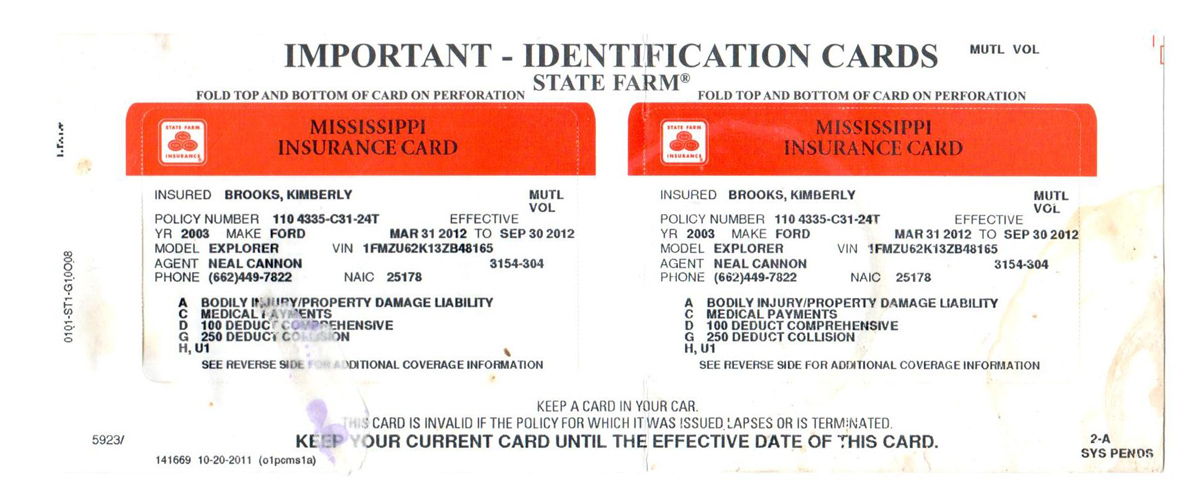

State Farm claim Alan Mims driver From neo-geo.com

State Farm claim Alan Mims driver From neo-geo.com

Goods or service) offered does not exceed $500 and the staff discount is available to all staff. If the beneficiary makes claims for two or more term insurance policies, then they should follow the steps as per the guidelines of the insurance regulatory and development authority of india. No matter how much you’ve spent on fully comprehensive car insurance, it won’t be valid if. The most important factor will be flexibility. It covers your employees when they’re driving or working on your customers’ vehicles, as well as those owned by the business. Regardless of whether your beneficiaries collect the life insurance payout by lump sum or installments, any interest earned on payouts is taxable.

The most important factor will be flexibility.

The penalty for this offence includes a fine of up to $1,000 or imprisonment of up to 3 months or both, and a mandatory disqualification from holding a driving licence for at least 12 months. Tax on a specificretirement fund lump sum withdrawal benefit (lump sum x) is equal to: The lump sum must however be less than 50% of the entire death benefit. Other drivers using your car. Actual amount of expenditure incurred by the employer on the running and maintenance of motor car including remuneration paid by the employer to the chauffeur and increased by the amount representing normal wear and tear of the motor car at 10% p.a. Satisfiedthat at least 80% of the use of the motor vehicle for the tax year will be for business purposes

Source: thebalance.com

Source: thebalance.com

Regardless of whether your beneficiaries collect the life insurance payout by lump sum or installments, any interest earned on payouts is taxable. The nominee should submit the details of the existing term life insurance plan while purchasing a. An individual is not required to pay provisional tax if he or she does not carry on any business, and the individual�s taxable. If the value of the item exceeds $500, the full amount of staff discount, i.e. The insured has the option to restrict coverage for third party property damage to rs 6,000 and this will result in a lower ”liability only” premium.

Source: jotajesse.blogspot.com

Source: jotajesse.blogspot.com

When not to file a claim. This insurance covers all vehicles that are not used for personal use. Determined in accordance with the fringe benefits tax assessment act 1986 (cth) and our fringe benefits ruling. Under earlier service tax regime “rent a cab services” covers all type of motor cab including bus (that is renting of any motor vehicle) , but in gst regime there is no clarification regarding bus services with passenger capacity of more than 12 taken by one of the company to carry their employees from one office premises to factory premises. Now, imagine a situation where the engine of the car is submerged in a waterlogged area.

Source: gov.uk

Source: gov.uk

The difference being paid as annuities, will be taxable. You must clearly display a current insurance disc on your vehicle at all times when driving and you must produce a current certificate of insurance to pay motor tax. This rule does not apply if you receive a settlement amount under. It is an offence to use a vehicle without valid insurance coverage. Meals provided by the employer for an employee.

Source: thefinancehacker.com

Source: thefinancehacker.com

This rule does not apply if you receive a settlement amount under. Determined in accordance with the fringe benefits tax assessment act 1986 (cth) and our fringe benefits ruling. Regardless of whether your beneficiaries collect the life insurance payout by lump sum or installments, any interest earned on payouts is taxable. This insurance covers all vehicles that are not used for personal use. This document aims to provide practical guidance and advice on how motor insurance works in ireland.

Source: cpcinsurance.com

Source: cpcinsurance.com

If the beneficiary makes claims for two or more term insurance policies, then they should follow the steps as per the guidelines of the insurance regulatory and development authority of india. Now, imagine a situation where the engine of the car is submerged in a waterlogged area. Under earlier service tax regime “rent a cab services” covers all type of motor cab including bus (that is renting of any motor vehicle) , but in gst regime there is no clarification regarding bus services with passenger capacity of more than 12 taken by one of the company to carry their employees from one office premises to factory premises. You can also get motor insurance for your commercial vehicles. If the beneficiary makes claims for two or more term insurance policies, then they should follow the steps as per the guidelines of the insurance regulatory and development authority of india.

Source: neo-geo.com

Source: neo-geo.com

Employer, who is not an investment holding company, tax exempt body or service company that adopts the cost plus mark up basis of tax assessment, can elect not to claim a tax deduction for the said group insurance premiums in the corporate/business tax filing for the relevant year so that the group insurance premiums will be exempt from tax in the hands of the employees. Are some vehicles that are covered under this insurance. Employer, who is not an investment holding company, tax exempt body or service company that adopts the cost plus mark up basis of tax assessment, can elect not to claim a tax deduction for the said group insurance premiums in the corporate/business tax filing for the relevant year so that the group insurance premiums will be exempt from tax in the hands of the employees. It is a general insurance cover that offers financial protection to your vehicles from loss due to accidents, damage, theft, fire or natural calamities. The difference being paid as annuities, will be taxable.

Source: motor1.com

Source: motor1.com

This rule does not apply if you receive a settlement amount under. It is an offence to use a vehicle without valid insurance coverage. In india, you cannot drive or ride without motor insurance. Expiry date of insurance certificate under road traffic act 1961 , as amended. Compulsory motor vehicle third party insurance.

Source: theselfemployed.com

Source: theselfemployed.com

An individual is not required to pay provisional tax if he or she does not carry on any business, and the individual�s taxable. This document aims to provide practical guidance and advice on how motor insurance works in ireland. You can�t claim a gst credit on compulsory third party motor vehicle insurance premiums where the cover started before 1 july 2003. The difference between the market value of the item and the amount paid by the employee, is taxable. It is a general insurance cover that offers financial protection to your vehicles from loss due to accidents, damage, theft, fire or natural calamities.

Source: thebalance.com

Source: thebalance.com

Satisfiedthat at least 80% of the use of the motor vehicle for the tax year will be for business purposes If the value of the item exceeds $500, the full amount of staff discount, i.e. When it comes to homeowners and car insurance policies, the general rule is that settlements are not taxable as long as they do no more than make you financially “whole” after a mishap, such as a car accident or damage to your home.if the insurance money paid to you replaces lost property or serves as compensation for injuries or lost wages, you will likely not. This rule does not apply if you receive a settlement amount under. Motor insurance is for your car or bike what health insurance is for your health.

Source: victorypubg.co.uk

Source: victorypubg.co.uk

Employer, who is not an investment holding company, tax exempt body or service company that adopts the cost plus mark up basis of tax assessment, can elect not to claim a tax deduction for the said group insurance premiums in the corporate/business tax filing for the relevant year so that the group insurance premiums will be exempt from tax in the hands of the employees. Basically, if you aren’t the one to have final say on whether your details are accurate then there’s the potential your policy documents could be littered with errors and result in a cancelled policy. If the value of the item exceeds $500, the full amount of staff discount, i.e. No matter how much you’ve spent on fully comprehensive car insurance, it won’t be valid if. Regardless of whether your beneficiaries collect the life insurance payout by lump sum or installments, any interest earned on payouts is taxable.

Source: iselect.com.au

Source: iselect.com.au

When it comes to homeowners and car insurance policies, the general rule is that settlements are not taxable as long as they do no more than make you financially “whole” after a mishap, such as a car accident or damage to your home.if the insurance money paid to you replaces lost property or serves as compensation for injuries or lost wages, you will likely not. Now, imagine a situation where the engine of the car is submerged in a waterlogged area. Report at g1 (total sales) the amount of the settlement you must pay gst on. Determined in accordance with the fringe benefits tax assessment act 1986 (cth) and our fringe benefits ruling. His type of insurance covers all those vehicles which are not used for personal purpose.

Source: infographicszone.com

Source: infographicszone.com

When not to file a claim. Motor trade insurance or traders insurance is used by a wide range of businesses, and usually by those who are involved in repairing or selling vehicles. Basically, if you aren’t the one to have final say on whether your details are accurate then there’s the potential your policy documents could be littered with errors and result in a cancelled policy. If by chance, you have paid taxes in excess and have invested in ppf, lic and mediclaim, you can claim deductions under section 80c. Goods or service) offered does not exceed $500 and the staff discount is available to all staff.

Source: team-bhp.com

Source: team-bhp.com

The lump sum must however be less than 50% of the entire death benefit. Check if your insurance is sufficient for road tax renewal. If the value of the item exceeds $500, the full amount of staff discount, i.e. It covers your employees when they’re driving or working on your customers’ vehicles, as well as those owned by the business. Insurance company name (not broker) insurance policy no.

Source: file4me.com

Source: file4me.com

The insured has the option to restrict coverage for third party property damage to rs 6,000 and this will result in a lower ”liability only” premium. The penalty for this offence includes a fine of up to $1,000 or imprisonment of up to 3 months or both, and a mandatory disqualification from holding a driving licence for at least 12 months. Mechanical or electrical breakdowns are not covered under a regular motor policy. Employer, who is not an investment holding company, tax exempt body or service company that adopts the cost plus mark up basis of tax assessment, can elect not to claim a tax deduction for the said group insurance premiums in the corporate/business tax filing for the relevant year so that the group insurance premiums will be exempt from tax in the hands of the employees. The difference between the market value of the item and the amount paid by the employee, is taxable.

Source: etmoney.com

Source: etmoney.com

If by chance, you have paid taxes in excess and have invested in ppf, lic and mediclaim, you can claim deductions under section 80c. Tax on a specificretirement fund lump sum withdrawal benefit (lump sum x) is equal to: Actual amount of expenditure incurred by the employer on the running and maintenance of motor car including remuneration paid by the employer to the chauffeur and increased by the amount representing normal wear and tear of the motor car at 10% p.a. Determined in accordance with the fringe benefits tax assessment act 1986 (cth) and our fringe benefits ruling. Are some vehicles that are covered under this insurance.

Source: revisi.net

Source: revisi.net

Under earlier service tax regime “rent a cab services” covers all type of motor cab including bus (that is renting of any motor vehicle) , but in gst regime there is no clarification regarding bus services with passenger capacity of more than 12 taken by one of the company to carry their employees from one office premises to factory premises. Insurance company name (not broker) insurance policy no. Meals provided by the employer for an employee. The most important factor will be flexibility. No matter how much you’ve spent on fully comprehensive car insurance, it won’t be valid if.

Satisfiedthat at least 80% of the use of the motor vehicle for the tax year will be for business purposes The nominee should submit the details of the existing term life insurance plan while purchasing a. Regardless of whether your beneficiaries collect the life insurance payout by lump sum or installments, any interest earned on payouts is taxable. Check if your insurance is sufficient for road tax renewal. It is a general insurance cover that offers financial protection to your vehicles from loss due to accidents, damage, theft, fire or natural calamities.

Source: pinterest.com

Source: pinterest.com

If by chance, you have paid taxes in excess and have invested in ppf, lic and mediclaim, you can claim deductions under section 80c. Other drivers using your car. Of the cost of vehicle less any amount charged from the employee for such use is taxable The nominee should submit the details of the existing term life insurance plan while purchasing a. The difference between the market value of the item and the amount paid by the employee, is taxable.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title bump insurance not on motor tax list by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Claims vs occurrence based insurance Idea

- Cheap tablet insurance Idea

- Calling insurance leads Idea

- Disability insurance for postal workers Idea

- Business insurance peoria il information

- Bright health insurance reviews Idea

- Carrier liability vs cargo insurance Idea

- Can you insure a written off car Idea

- Can convicted felons get life insurance information

- Car insurance administrator Idea