Bumper to bumper insurance meaning Idea

Home » Trend » Bumper to bumper insurance meaning IdeaYour Bumper to bumper insurance meaning images are available in this site. Bumper to bumper insurance meaning are a topic that is being searched for and liked by netizens today. You can Get the Bumper to bumper insurance meaning files here. Get all royalty-free vectors.

If you’re searching for bumper to bumper insurance meaning pictures information related to the bumper to bumper insurance meaning topic, you have come to the ideal site. Our website frequently gives you suggestions for viewing the maximum quality video and image content, please kindly search and locate more informative video articles and graphics that fit your interests.

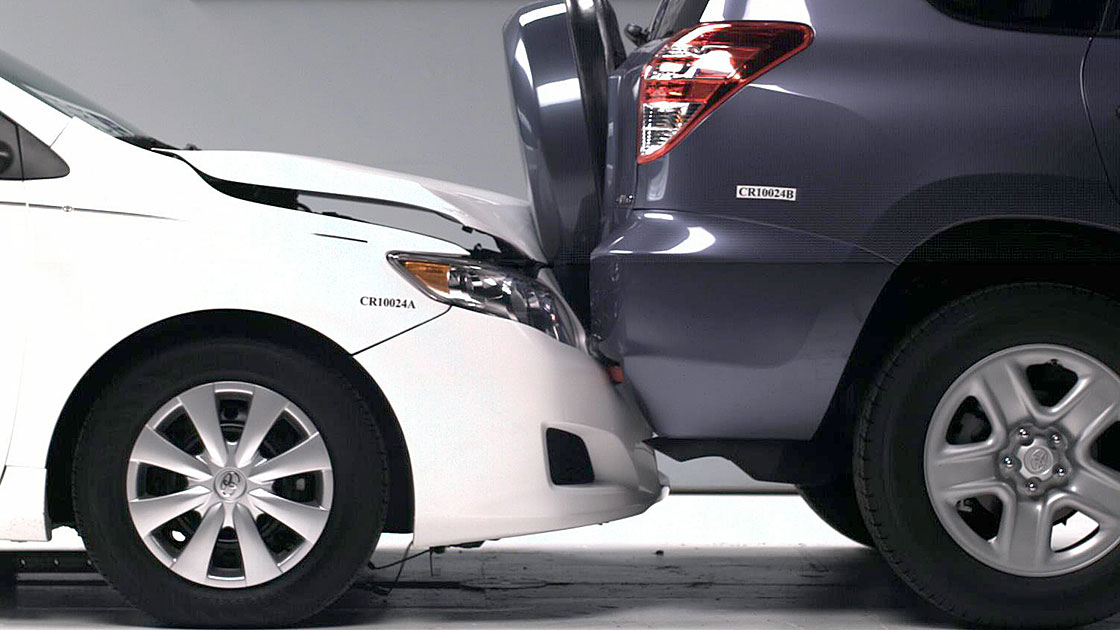

Bumper To Bumper Insurance Meaning. Bumper to bumper insurance meaning is simple, the policy offers protection for every square inch of your car. Bumper to bumper locations, bumper to bumper application, bumper to bumper coverage cost, bumper to bumper auto insurance, bumper to bumper coverage, bumper to bumper online, car insurance bumper to bumper, bumper. Yet bumper to bumper insurance excludes some of the things like tires, battery, engine damage in certain conditions, etc. The traffic is bumper to bumper from the accident up ahead.

20182019 Mitsubishi ECLIPSE CROSS Front Bumper Cover OEM From ebay.com

20182019 Mitsubishi ECLIPSE CROSS Front Bumper Cover OEM From ebay.com

Bumper to bumper is cheaper than comprehensive because comprehensive covers much more than just the physical damages of the car. What is bumper to bumper car insurance policy? It is most commonly known as �nil depreciation cover� or � zero depreciation cover �. It provides a broader coverage as compared to the basic comprehensive insurance policy. Bumper to bumper locations, bumper to bumper application, bumper to bumper coverage cost, bumper to bumper auto insurance, bumper to bumper coverage, bumper to bumper online, car insurance bumper to bumper, bumper. Bumper to bumper insurance covers damages that are to the front, back, and sides of the vehicle.

Bumper to bumper insurance is also known as nil depreciation or zero depreciation policy.

This insurance policy is ideal for the following kinds of car owners: Bumper to bumper locations, bumper to bumper application, bumper to bumper coverage cost, bumper to bumper auto insurance, bumper to bumper coverage, bumper to bumper online, car insurance bumper to bumper, bumper. It provides a broader coverage as compared to the basic comprehensive insurance policy. Repairing bumper damage will vary with the damage and the type of. Travel insurance क्या होता है ? Bumper to bumper in car insurance:.

Source: carid.com

Source: carid.com

However, in bumper to bumper cover, the insurance covers the cost for all the parts, except for engine, batteries, tyres, tubes and glass. Bumper to bumper, zero depreciation or nil depreciation vehicle insurance is a car insurance policy that leaves out the depreciation from the insurance cover, thus ensuring a complete cover. Bumper to bumper is a type of extended warranty that covers all major systems of the vehicle except for several listed items. Packed in protection is such a protection, in which even after the devaluation of the pieces of the vehicle, the vehicle gets full inclusion. It provides a broader coverage as compared to the basic comprehensive insurance policy.

Source: ebay.com

Source: ebay.com

Bumper to bumper insurance covers damages that are to the front, back, and sides of the vehicle. It is most commonly known as �nil depreciation cover� or � zero depreciation cover �. Bumper to bumper, zero depreciation or nil depreciation vehicle insurance is a car insurance policy that leaves out the depreciation from the insurance cover, thus ensuring a complete cover. You might have heard the common name of the policy as called � zero depreciation cover � or �nil depreciation cover�. Yet bumper to bumper insurance excludes some of the things like tires, battery, engine damage in certain conditions, etc.

Source: southendsmartrepairs.co.uk

Source: southendsmartrepairs.co.uk

It is most commonly known as �nil depreciation cover� or � zero depreciation cover �. 2 (chiefly of an insurance policy) comprehensive; It provides a broader coverage as compared to the basic comprehensive insurance policy. It is a manufacturers’ warranty that covers a new vehicle for three years or 36,000 miles (whichever comes first). What is bumper to bumper car insurance policy?

Source: ebay.com

Source: ebay.com

The traffic is bumper to bumper from the accident up ahead. It is most commonly known as �nil depreciation cover� or � zero depreciation cover �. Bumper to bumper locations, bumper to bumper application, bumper to bumper coverage cost, bumper to bumper auto insurance, bumper to bumper coverage, bumper to bumper online, car insurance bumper to bumper, bumper. Bumper to bumper in car insurance:. To begin with, it means a car insurance policy in which there is no depreciation from the insurance cover.

Source: thebalance.com

Source: thebalance.com

Packed in protection is such a protection, in which even after the devaluation of the pieces of the vehicle, the vehicle gets full inclusion. So, in the case when there is a loss or damage caused to your vehicle after an accident, the insurer will not deduct the depreciation value from the coverage (excluding car batteries and tires). Comprehensive coverage also includes protection against theft, vandalism, and fire. Bumper to bumper is a type of extended warranty that covers all major systems of the vehicle except for several listed items. This protection was initially begun in india in 2009.

Source: ebay.com

Source: ebay.com

However, in bumper to bumper cover, the insurance covers the cost for all the parts, except for engine, batteries, tyres, tubes and glass. You might have heard the common name of the policy as called � zero depreciation cover � or �nil depreciation cover�. Packed in protection is such a protection, in which even after the devaluation of the pieces of the vehicle, the vehicle gets full inclusion. What is bumper to bumper car insurance policy? Bumper to bumper insurance is also known as nil depreciation or zero depreciation policy.

Source: qasimcottrell.blogspot.com

Source: qasimcottrell.blogspot.com

2 (chiefly of an insurance policy) comprehensive; It provides a broader coverage as compared to the basic comprehensive insurance policy. Bumper to bumper, zero depreciation or nil depreciation vehicle insurance is a car insurance policy that leaves out the depreciation from the insurance cover, thus ensuring a complete cover. Yet bumper to bumper insurance excludes some of the things like tires, battery, engine damage in certain conditions, etc. Some automakers today offer extended new car coverage terms going to five or six years as a selling.

Source: carcreditcenter.net

Source: carcreditcenter.net

With so many cars that are so close that they are almost touching each other: This protection was initially begun in india in 2009. It provides a broader coverage as compared to the basic comprehensive insurance policy. You might have heard the common name of the policy as called � zero depreciation cover � or �nil depreciation cover�. Travel insurance क्या होता है ?

Source: thirdgen.org

Source: thirdgen.org

With so many cars that are so close that they are almost touching each other: What is bumper to bumper car insurance policy? It means that if your vehicle gets damaged following an accident, no depreciation will be subtracted from the coverage of wearing out of any body parts of car excluding tyres. Bumper to bumper insurance covers damages that are to the front, back, and sides of the vehicle. Repairing bumper damage will vary with the damage and the type of.

Source: southendsmartrepairs.co.uk

Source: southendsmartrepairs.co.uk

Repairing bumper damage will vary with the damage and the type of. Bumper to bumper is a type of extended warranty that covers all major systems of the vehicle except for several listed items. It means that if your vehicle gets damaged following an accident, no depreciation will be subtracted from the coverage of wearing out of any body parts of car excluding tyres. Bumper to bumper insurance covers damages that are to the front, back, and sides of the vehicle. So, in the case when there is a loss or damage caused to your vehicle after an accident, the insurer will not deduct the depreciation value from the coverage (excluding car batteries and tires).

Source: ebay.com

Source: ebay.com

Packed in protection is such a protection, in which even after the devaluation of the pieces of the vehicle, the vehicle gets full inclusion. Bumper to bumper locations, bumper to bumper application, bumper to bumper coverage cost, bumper to bumper auto insurance, bumper to bumper coverage, bumper to bumper online, car insurance bumper to bumper, bumper. You might have heard the common name of the policy as called � zero depreciation cover � or �nil depreciation cover�. Top 10 bumper to bumper insurance answers. बंपर टू बंपर बीमा क्या है ?

Source: wonderfulengineering.com

Source: wonderfulengineering.com

So, in the case when there is a loss or damage caused to your vehicle after an accident, the insurer will not deduct the depreciation value from the coverage (excluding car batteries and tires). Repairing bumper damage will vary with the damage and the type of. It is most commonly known as �nil depreciation cover� or � zero depreciation cover �. In a normal insurance cover, the maximum amount of claim you can make is restricted to its idv. This insurance policy is ideal for the following kinds of car owners:

Source: qasimcottrell.blogspot.com

Source: qasimcottrell.blogspot.com

Repairing bumper damage will vary with the damage and the type of. Bumper to bumper insurance is a comprehensive insurance policy that provides a 100% coverage of damages to the fibre, metal, and rubber parts of your car. Bumper to bumper, nil depreciation or zero depreciation is the type of car insurance policy that offers complete coverage to your vehicle irrespective of the depreciation of its parts. However, in bumper to bumper cover, the insurance covers the cost for all the parts, except for engine, batteries, tyres, tubes and glass. Bumper to bumper insurance is also known as nil depreciation or zero depreciation policy.

Source: carid.com

Source: carid.com

It means that if your vehicle gets damaged following an accident, no depreciation will be subtracted from the coverage of wearing out of any body parts of car excluding tyres. Bumper to bumper insurance is also known as nil depreciation or zero depreciation policy. What is bumper to bumper car insurance policy? Bumper to bumper, nil depreciation or zero depreciation is the type of car insurance policy that offers complete coverage to your vehicle irrespective of the depreciation of its parts. Bumper to bumper insurance is a comprehensive insurance policy that provides a 100% coverage of damages to the fibre, metal, and rubber parts of your car.

Source: iihs.org

Source: iihs.org

Some automakers today offer extended new car coverage terms going to five or six years as a selling. Some automakers today offer extended new car coverage terms going to five or six years as a selling. It provides a broader coverage as compared to the basic comprehensive insurance policy. Bumper to bumper, nil depreciation or zero depreciation is the type of car insurance policy that offers complete coverage to your vehicle irrespective of the depreciation of its parts. Bumper to bumper, zero depreciation or nil depreciation vehicle insurance is a car insurance policy that leaves out the depreciation from the insurance cover, thus ensuring a complete cover.

Source: ebay.com

Source: ebay.com

Bumper to bumper insurance meaning is simple, the policy offers protection for every square inch of your car. Bumper to bumper, zero depreciation or nil depreciation vehicle insurance is a car insurance policy that leaves out the depreciation from the insurance cover, thus ensuring a complete cover. Bumper to bumper insurance covers damages that are to the front, back, and sides of the vehicle. बंपर टू बंपर बीमा क्या है ? However, in bumper to bumper cover, the insurance covers the cost for all the parts, except for engine, batteries, tyres, tubes and glass.

Source: ebay.com

Source: ebay.com

Bumper to bumper is cheaper than comprehensive because comprehensive covers much more than just the physical damages of the car. Bumper to bumper locations, bumper to bumper application, bumper to bumper coverage cost, bumper to bumper auto insurance, bumper to bumper coverage, bumper to bumper online, car insurance bumper to bumper, bumper. Bumper to bumper is cheaper than comprehensive because comprehensive covers much more than just the physical damages of the car. You might have heard the common name of the policy as called � zero depreciation cover � or �nil depreciation cover�. Bumper to bumper, nil depreciation or zero depreciation is the type of car insurance policy that offers complete coverage to your vehicle irrespective of the depreciation of its parts.

Source: qasimcottrell.blogspot.com

Source: qasimcottrell.blogspot.com

It provides a broader coverage as compared to the basic comprehensive insurance policy. Bumper to bumper insurance is also known as nil depreciation or zero depreciation policy. Bumper to bumper insurance is a comprehensive insurance policy that provides a 100% coverage of damages to the fibre, metal, and rubber parts of your car. Packed in protection is such a protection, in which even after the devaluation of the pieces of the vehicle, the vehicle gets full inclusion. Bumper to bumper in car insurance:.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title bumper to bumper insurance meaning by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Craft insurance arab al Idea

- Colonial life insurance claims Idea

- Business insurance and benefits information

- Deans and homer insurance Idea

- Crown cost without insurance information

- Delmonico insurance syracuse ny Idea

- Department of insurance and financial services michigan duties information

- Cost of eye exam with insurance Idea

- Cashless hospital list under national insurance company Idea

- Crowel insurance agency information