Business income insurance formula Idea

Home » Trend » Business income insurance formula IdeaYour Business income insurance formula images are available in this site. Business income insurance formula are a topic that is being searched for and liked by netizens today. You can Download the Business income insurance formula files here. Download all free images.

If you’re looking for business income insurance formula pictures information connected with to the business income insurance formula topic, you have come to the ideal site. Our website frequently gives you suggestions for refferencing the maximum quality video and picture content, please kindly search and find more enlightening video content and images that match your interests.

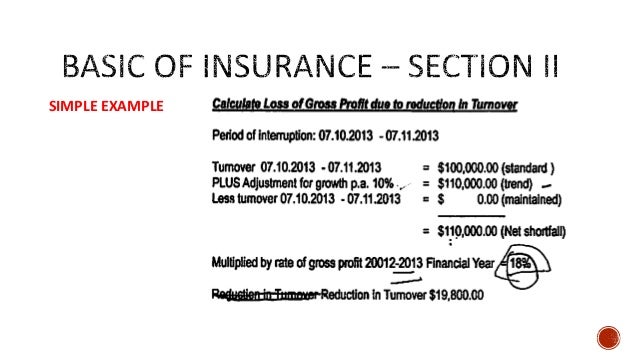

Business Income Insurance Formula. (actual amount of insurance ) x amount of loss = amount of claim (required amount of insurance) inserting the amounts above in the formula produces the following calculation: Documenting a business interruption claim, february 2001). Reena has income from salary, business, and property. Here�s how your insurer calculates your loss payment:

Taxable Formula Calculator (Examples with Excel From educba.com

Taxable Formula Calculator (Examples with Excel From educba.com

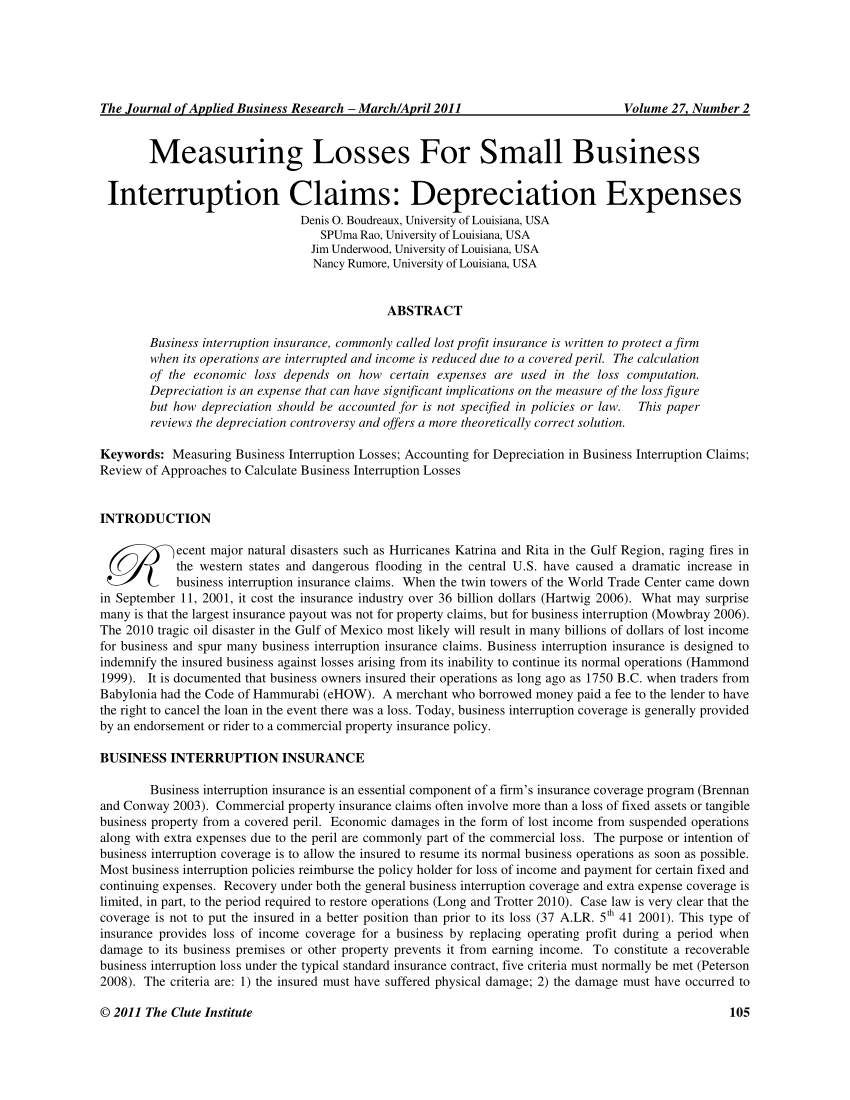

Ironically, insurance policies define coverage, but they never show how to put a claim together (see beyond the policy: Your net income will be your business income. Business value = annual future earnings/required rate of return just to be clear, under this approach, there is no growth in cash flows. In basic terms, business interruption insurance protects businesses against losses that arise due to a shutdown of a business as a result of damage caused by a. Hence claimed for 80 c. Some suggest that should is developed by adding the insured�s net income to all usual and customary operating expenses then multiplying that total by the chosen coinsurance percentage.

Basic formula # 2 net income + continuing expenses + extra/additional expenses = business loss (aka “bottom up” approach) the other way to determine net income loss is to calculate the projected net income first.

Certainly the formula bi = t x q x v is never found in any policy. The gross profit or earnings—the primary source for meeting operating expenses—is the focus of the coverage. Then add in all the expenses occurred by the business. Two occasions may necessitate the need for the insured to purchase. Certainly the formula bi = t x q x v is never found in any policy. • maximum coinsurance percentage x 12 months business income calculation (j.1. or j.2. amount) = amount subject to loss.

Source: irmi.com

Source: irmi.com

Then add in all the expenses occurred by the business. Some suggest that should is developed by adding the insured�s net income to all usual and customary operating expenses then multiplying that total by the chosen coinsurance percentage. Calculate the net sales of the business. The amount of business income purchased can and usually will match the calculated amount subject to loss or be slightly higher; Net income (net profit or loss before income taxes) that would have been earned or incurred;.

![Business Interruption Insurance Calculation [2 Simple Methods] Business Interruption Insurance Calculation [2 Simple Methods]](https://denmonpearlman.com/wp-content/uploads/2020/05/2020-05-05-12_44_29-BV-Schedules-Sanderford.xlsx.png) Source: denmonpearlman.com

Source: denmonpearlman.com

Some suggest that should is developed by adding the insured�s net income to all usual and customary operating expenses then multiplying that total by the chosen coinsurance percentage. Business income from a corporation is reported on form 1120. Two occasions may necessitate the need for the insured to purchase. Some suggest that should is developed by adding the insured�s net income to all usual and customary operating expenses then multiplying that total by the chosen coinsurance percentage. The limit of insurance should be at least $100,000 x 90% = $90,000 because the building limit meets the minimum amount of insurance required under the coinsurance clause, the amount due on a claim is not affected:

Source: lovewordssss.blogspot.com

Source: lovewordssss.blogspot.com

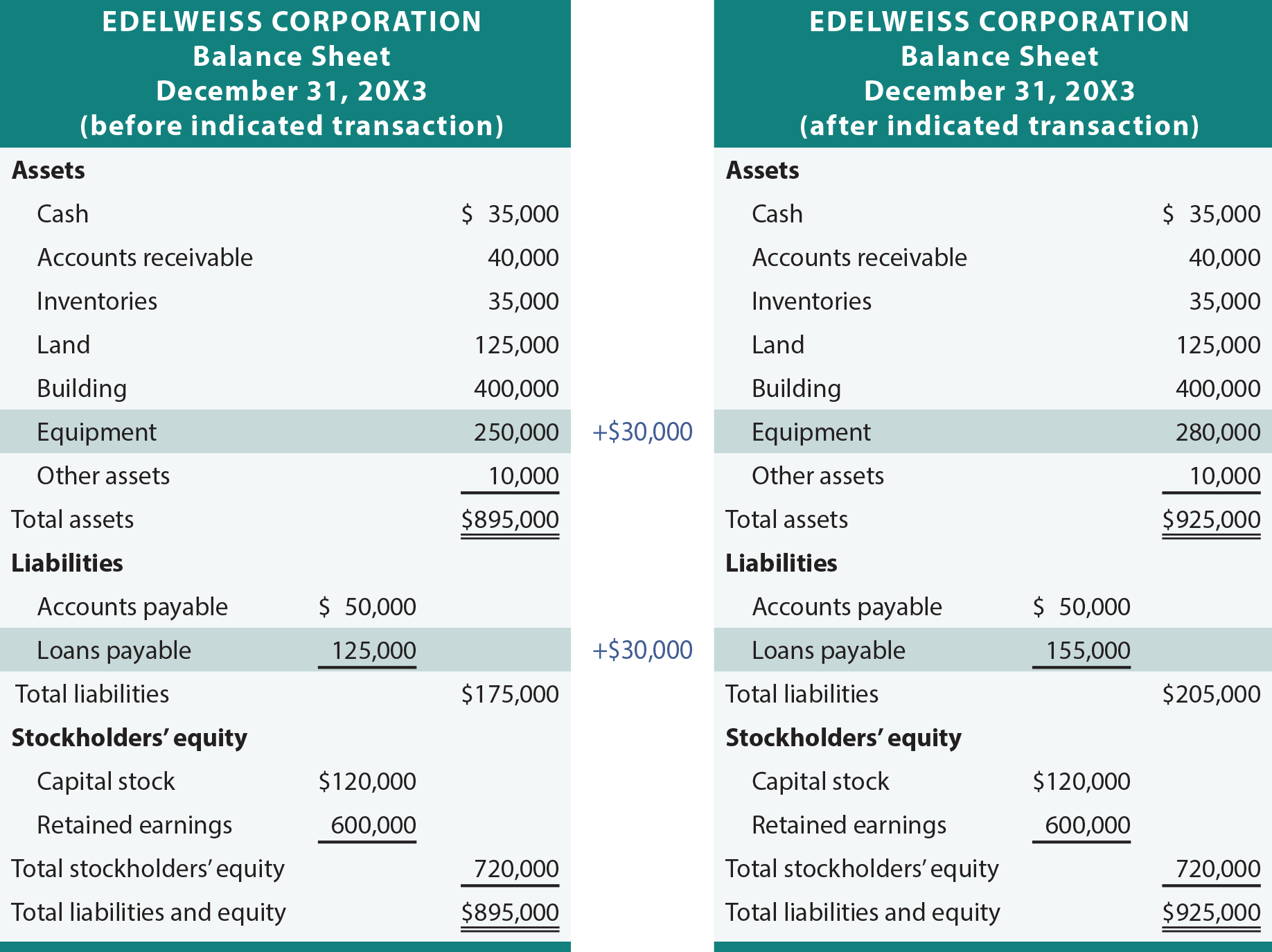

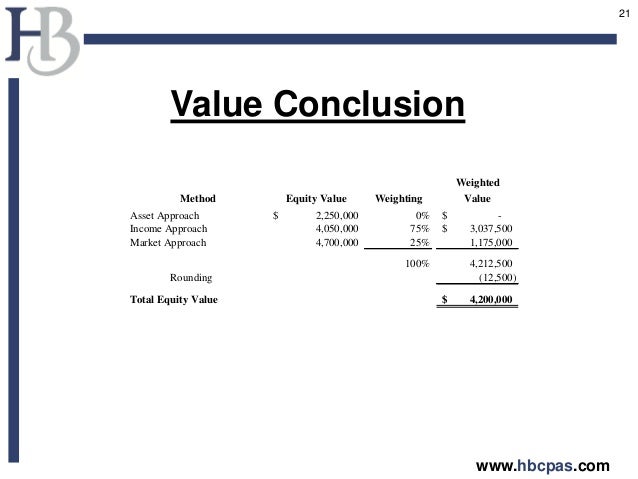

The aim of business income insurance is to provide a business, whose operations have been interrupted by a loss, with income equal to what the firm would have earned if the loss had not taken place. Below is an example to understand this method better. The aim of business income insurance is to provide a business, whose operations have been interrupted by a loss, with income equal to what the firm would have earned if the loss had not taken place. Then add in all the expenses occurred by the business. Business value = annual future earnings/required rate of return just to be clear, under this approach, there is no growth in cash flows.

Source: irmi.com

Source: irmi.com

Two occasions may necessitate the need for the insured to purchase. Insurance services office (iso) worksheets can be helpful when calculating business income. Documenting a business interruption claim, february 2001). Ironically, insurance policies define coverage, but they never show how to put a claim together (see beyond the policy: Basic formula # 2 net income + continuing expenses + extra/additional expenses = business loss (aka “bottom up” approach) the other way to determine net income loss is to calculate the projected net income first.

Source: chegg.com

Source: chegg.com

The cost to repair the covered damage is $20,000 the deductible is. Deduct taxes from this amount to find you business’s net income. The gross profit or earnings—the primary source for meeting operating expenses—is the focus of the coverage. In basic terms, business interruption insurance protects businesses against losses that arise due to a shutdown of a business as a result of damage caused by a. Business income insurance coverage is a type of business insurance that helps your company replace lost income if it’s unable to operate due to covered property damage.

Source: lovewordssss.blogspot.com

Source: lovewordssss.blogspot.com

In basic terms, business interruption insurance protects businesses against losses that arise due to a shutdown of a business as a result of damage caused by a. The gross profit or earnings—the primary source for meeting operating expenses—is the focus of the coverage. The limit of insurance should be at least $100,000 x 90% = $90,000 because the building limit meets the minimum amount of insurance required under the coinsurance clause, the amount due on a claim is not affected: Using the simple formula for business, the net income calculation would like this: Here�s how your insurer calculates your loss payment:

Source: revisi.net

Source: revisi.net

Hence claimed for 80 c. The aim of business income insurance is to provide a business, whose operations have been interrupted by a loss, with income equal to what the firm would have earned if the loss had not taken place. Also hear it referred to as business income, profits insurance, or earnings insurance. Then add in all the expenses occurred by the business. Then compare to actual income to determine the net income loss.

Source: learnmanagement2.com

Business income insurance is put into place to protect against this revenue, or income loss and should enable the business owner to recover the proper dollars as if there was no effect to the business income stream. The standard business income (and extra expense) coverage form cp 00 30 04 02 says, we will pay for the actual loss of business income you sustain due to the necessary ‘suspension’ of your ‘operations’ during the ‘period of restoration.’ business income is defined as: If extra expense is to be covered, show the And property rent of rs.60000. Estimated business income exposure amount (d) x(e) g.

Source: insurancefunda.in

Source: insurancefunda.in

Business income insurance is put into place to protect against this revenue, or income loss and should enable the business owner to recover the proper dollars as if there was no effect to the business income stream. But it should certainly never be lower. Deduct taxes from this amount to find you business’s net income. Then add in all the expenses occurred by the business. Hence claimed for 80 c.

Source: saveelon.com

Source: saveelon.com

The limit of insurance should be at least $100,000 x 90% = $90,000 because the building limit meets the minimum amount of insurance required under the coinsurance clause, the amount due on a claim is not affected: Then add in all the expenses occurred by the business. And income from a fashion boutique is rs.50000 after all exemptions. Number of months required to recover from a total destruction of property (show the # of months as a percentage of a year. • maximum coinsurance percentage x 12 months business income calculation (j.1. or j.2. amount) = amount subject to loss.

Source: dandzelia-z.blogspot.com

Source: dandzelia-z.blogspot.com

Deduct taxes from this amount to find you business’s net income. Below is an example to understand this method better. Calculate the net sales of the business. Basic formula # 2 net income + continuing expenses + extra/additional expenses = business loss (aka “bottom up” approach) the other way to determine net income loss is to calculate the projected net income first. Then add in all the expenses occurred by the business.

Source: chripchirp.blogspot.com

Ironically, insurance policies define coverage, but they never show how to put a claim together (see beyond the policy: Business value = annual future earnings/required rate of return just to be clear, under this approach, there is no growth in cash flows. Business income insurance acts as business interruption insurance or income protection insurance. This figure is arrived at by subtracting adjustments from gross sales. Your net income will be your business income.

Source: principlesofaccounting.com

Source: principlesofaccounting.com

Business income insurance coverage is a type of business insurance that helps your company replace lost income if it’s unable to operate due to covered property damage. The gross profit or earnings—the primary source for meeting operating expenses—is the focus of the coverage. Also hear it referred to as business income, profits insurance, or earnings insurance. Business income insurance coverage is a type of business insurance that helps your company replace lost income if it’s unable to operate due to covered property damage. If extra expense is to be covered, show the

Source: slideshare.net

Source: slideshare.net

Various methods are used to quantify revenue and expenses to arrive at the business income loss in dollars and cents. The cost to repair the covered damage is $20,000 the deductible is. The limit of insurance should be at least $100,000 x 90% = $90,000 because the building limit meets the minimum amount of insurance required under the coinsurance clause, the amount due on a claim is not affected: Ironically, insurance policies define coverage, but they never show how to put a claim together (see beyond the policy: 9 months =.75, etc.) f.

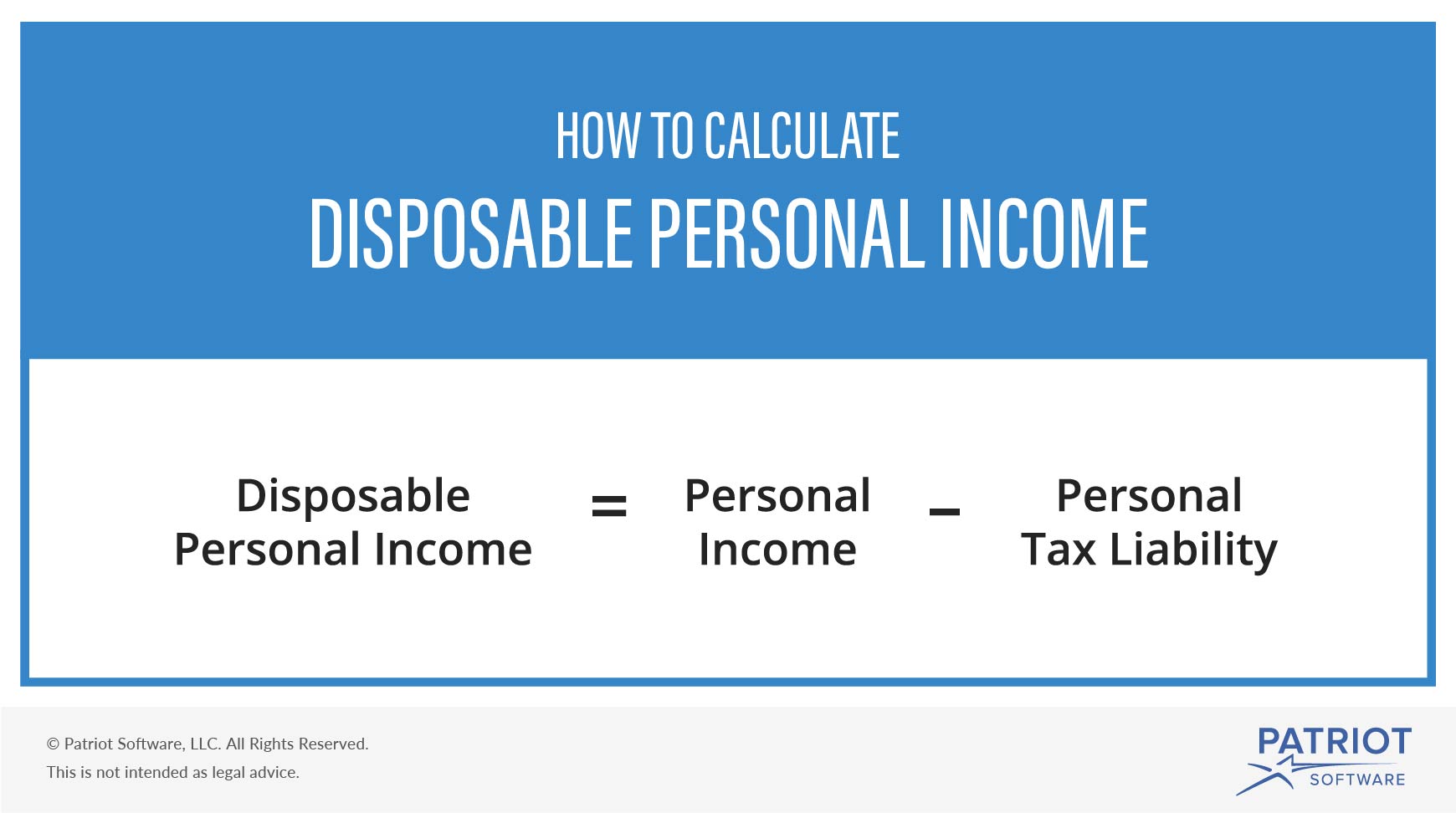

Source: patriotsoftware.com

Source: patriotsoftware.com

And property rent of rs.60000. Certainly the formula bi = t x q x v is never found in any policy. Here is the income approach business valuation formula for this method: Estimated business income exposure amount (d) x(e) g. This figure is arrived at by subtracting adjustments from gross sales.

Source: educba.com

Source: educba.com

Documenting a business interruption claim, february 2001). The equation for business income is: Calculate the net sales of the business. The limit of insurance should be at least $100,000 x 90% = $90,000 because the building limit meets the minimum amount of insurance required under the coinsurance clause, the amount due on a claim is not affected: Various methods are used to quantify revenue and expenses to arrive at the business income loss in dollars and cents.

Source: educba.com

Source: educba.com

Insurance services office (iso) worksheets can be helpful when calculating business income. She gets the total income salary of rs.3l post all possible deductions/ exemptions. The amount of business income purchased can and usually will match the calculated amount subject to loss or be slightly higher; This type of insurance is also known as profits insurance or income insurance. Then add in all the expenses occurred by the business.

Source: retipster.com

Source: retipster.com

Business value = annual future earnings/required rate of return just to be clear, under this approach, there is no growth in cash flows. The limit of insurance should be at least $100,000 x 90% = $90,000 because the building limit meets the minimum amount of insurance required under the coinsurance clause, the amount due on a claim is not affected: (actual amount of insurance ) x amount of loss = amount of claim (required amount of insurance) inserting the amounts above in the formula produces the following calculation: Business income insurance is put into place to protect against this revenue, or income loss and should enable the business owner to recover the proper dollars as if there was no effect to the business income stream. But it should certainly never be lower.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title business income insurance formula by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Craft insurance arab al Idea

- Colonial life insurance claims Idea

- Business insurance and benefits information

- Deans and homer insurance Idea

- Crown cost without insurance information

- Delmonico insurance syracuse ny Idea

- Department of insurance and financial services michigan duties information

- Cost of eye exam with insurance Idea

- Cashless hospital list under national insurance company Idea

- Crowel insurance agency information