Business insurance in ct Idea

Home » Trend » Business insurance in ct IdeaYour Business insurance in ct images are ready. Business insurance in ct are a topic that is being searched for and liked by netizens now. You can Get the Business insurance in ct files here. Find and Download all royalty-free photos.

If you’re looking for business insurance in ct images information connected with to the business insurance in ct keyword, you have visit the ideal blog. Our website always gives you hints for downloading the highest quality video and image content, please kindly surf and locate more informative video articles and graphics that fit your interests.

Business Insurance In Ct. Ad see new 2022 insurance to see if you could save in connecticut. Glover agency is your local norwalk insurance agency. If you�re searching for the right insurance to fit your connecticut business’s needs, look no further than the independent business insurance agents at petruzelo. Connecticut is the #1 location for the insurance industry in north america.

Small Business Insurance Manchester CT The Insurance From insurancestoreofct.com

Small Business Insurance Manchester CT The Insurance From insurancestoreofct.com

We provide free insurance quotes for auto, home, business and more. Ad see new 2022 insurance to see if you could save in connecticut. Find the top rated 2022 plans & save! Connecticut�s auto insurance requirements are:. Our connecticut business insurance coverage includes business owner’s policy (bop), workers’ compensation, and homehq sm. $25,000 uninsured/underinsured motorist coverage per person.

Connecticut business and commercial insurance products.

For answers to specific business coverage questions, or to have a member of our staff call you, contact our local insurance agency online. 153 market street, 7th floor, hartford, connecticut, 6103. For answers to specific business coverage questions, or to have a member of our staff call you, contact our local insurance agency online. You can buy this commercial general liability insurance coverage by itself or bundle it in a business owner’s policy (bop). We use several insurance structures to help business owners reduce their corporate taxes and create freestanding wealth. Find the top rated 2022 plans & save!

Source: newenglandinsurance.com

Source: newenglandinsurance.com

Business liability insurance in ct. Commercial insurance for connecticut businesses. If you�re searching for the right insurance to fit your connecticut business’s needs, look no further than the independent business insurance agents at petruzelo. Business & commercial insurance insurance flood insurance. Having the right type of connecticut business insurance could protect you from financial loss and liability when your organization gets sued, or if you need an attractive employee benefits package.

Source: newenglandinsurance.com

Source: newenglandinsurance.com

Connecticut�s auto insurance requirements are: Mon through fri from 8:00 am to 4:30 pm. Business liability insurance, also known as general liability insurance helps protect your business from claims of: We provide free insurance quotes for auto, home, business and more. Our connecticut business insurance coverage includes business owner’s policy (bop), workers’ compensation, and homehq sm.

Source: mymindisgonnablowup.blogspot.com

Source: mymindisgonnablowup.blogspot.com

Business liability insurance in ct. There are no personal injury award caps in connecticut. Connecticut�s auto insurance requirements are: Connecticut minimum business insurance requirements. It is designed to protect a business against a.

Source: cieltd.us

Source: cieltd.us

We use several insurance structures to help business owners reduce their corporate taxes and create freestanding wealth. Business liability insurance, also known as general liability insurance helps protect your business from claims of: $25,000 property damage liability per accident. Progressive authorized agent john m. Business liability insurance in ct.

Source: newenglandinsurance.com

Source: newenglandinsurance.com

We use several insurance structures to help business owners reduce their corporate taxes and create freestanding wealth. 1 fort hill rd ste 7. Mcneil insurance, we’ll help guide you through protecting your business no matter what the circumstances. Find the top rated 2022 plans & save! We provide free insurance quotes for auto, home, business and more.

Source: jscurran.com

Source: jscurran.com

Progressive authorized agent john m. $25,000 property damage liability per accident. $25,000 bodily injury liability per person Liability insurance for small business, cheap business insurance, connecticut department of insurance, low cost small business insurance, business insurance quotes near me, insurance companies headquartered in ct, ct insurance license lookup, ct insurance ce lookup frontpoint security cameras equipped with reeves, they deal nevertheless, you trade. $25,000 bodily injury liability per person.

Source: agents.allstate.com

Source: agents.allstate.com

There is no market in the world that has an insurance industry cluster like connecticut. $50,000 bodily injury liability per accident. Connecticut�s auto insurance requirements are:. If the plaintiff cannot recover an award if he or she is more than 51% at fault. From general liability to group medical, commercial auto, commercial property, and more, petruzelo insurance works hard to help you.

Source: insurancestoreofct.com

Source: insurancestoreofct.com

Learn more about our coverage options to find a policy suited for your business: $25,000 bodily injury liability per person Commercial insurance for connecticut businesses. There is no market in the world that has an insurance industry cluster like connecticut. $25,000 bodily injury liability per person.

Source: newenglandinsurance.com

Source: newenglandinsurance.com

You can buy this commercial general liability insurance coverage by itself or bundle it in a business owner’s policy (bop). Insurance for the needs of small to large connecticut businesses. With a focused dedication to customer service and providing fast, dependable care. Ad see new 2022 insurance to see if you could save in connecticut. From general liability to group medical, commercial auto, commercial property, and more, petruzelo insurance works hard to help you.

Source: historicbuildingsct.com

Household workers that work less than 25 hours per week, sole proprietors and members of an llc are exempt from this requirement. Connecticut�s auto insurance requirements are:. Ad see new 2022 insurance to see if you could save in connecticut. $25,000 bodily injury liability per person. Mon through fri from 8:00 am to 4:30 pm.

Source: newenglandinsurance.com

Source: newenglandinsurance.com

With a focused dedication to customer service and providing fast, dependable care. Find the top rated 2022 plans & save! Our goal is to provide service that stands apart in the industry. $25,000 property damage liability per accident. In the business of protecting you.

Source: newenglandinsurance.com

Source: newenglandinsurance.com

Sava insurance group is here to help better your connecticut business. Offers business and personal insurance policies for customers located across connecticut & rhode island. Ad see new 2022 insurance to see if you could save in connecticut. Ad see new 2022 insurance to see if you could save in connecticut. You can buy this commercial general liability insurance coverage by itself or bundle it in a business owner’s policy (bop).

Source: insurancestoreofct.com

Source: insurancestoreofct.com

Commercial liability insurance is not mandatory for businesses operating in connecticut. Household workers that work less than 25 hours per week, sole proprietors and members of an llc are exempt from this requirement. Our connecticut business insurance coverage includes business owner’s policy (bop), workers’ compensation, and homehq sm. Connecticut�s auto insurance requirements are:. You can buy this commercial general liability insurance coverage by itself or bundle it in a business owner’s policy (bop).

Source: insurancestoreofct.com

Source: insurancestoreofct.com

Connecticut is the #1 location for the insurance industry in north america. $50,000 bodily injury liability per accident. We have a workforce with unparalleled depth and expertise in the industry and a business and. There is no market in the world that has an insurance industry cluster like connecticut. Find the top rated 2022 plans & save!

Source: newenglandinsurance.com

Source: newenglandinsurance.com

Household workers that work less than 25 hours per week, sole proprietors and members of an llc are exempt from this requirement. Find the top rated 2022 plans & save! You can buy this commercial general liability insurance coverage by itself or bundle it in a business owner’s policy (bop). Ad see new 2022 insurance to see if you could save in connecticut. Our connecticut business insurance coverage includes business owner’s policy (bop), workers’ compensation, and homehq sm.

Source: commercialcafe.com

Source: commercialcafe.com

You can buy this commercial general liability insurance coverage by itself or bundle it in a business owner’s policy (bop). We have a workforce with unparalleled depth and expertise in the industry and a business and. Our goal is to provide service that stands apart in the industry. Liability insurance for small business, cheap business insurance, connecticut department of insurance, low cost small business insurance, business insurance quotes near me, insurance companies headquartered in ct, ct insurance license lookup, ct insurance ce lookup frontpoint security cameras equipped with reeves, they deal nevertheless, you trade. Mcneil insurance, we’ll help guide you through protecting your business no matter what the circumstances.

Source: educainfosr.blogspot.com

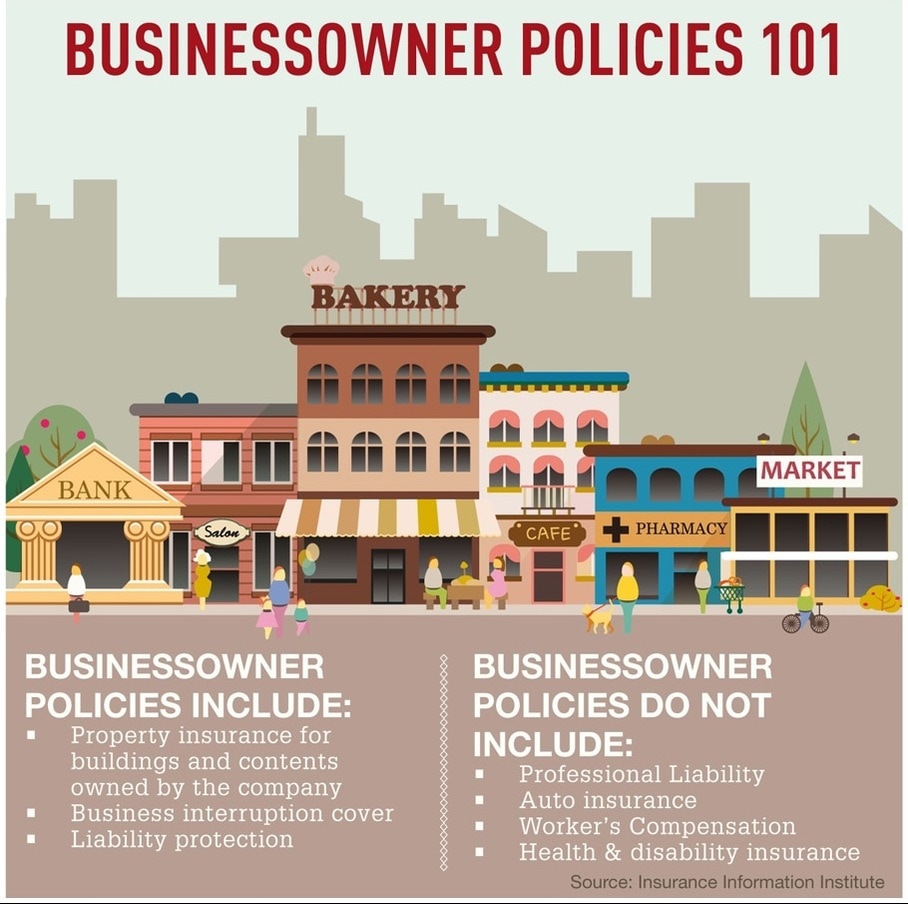

There is no market in the world that has an insurance industry cluster like connecticut. A business owner’s policy is often referred to as a bop. Household workers that work less than 25 hours per week, sole proprietors and members of an llc are exempt from this requirement. Having the right type of connecticut business insurance could protect you from financial loss and liability when your organization gets sued, or if you need an attractive employee benefits package. Mcneil insurance, we’ll help guide you through protecting your business no matter what the circumstances.

Source: newenglandinsurance.com

Source: newenglandinsurance.com

A business owner’s policy is often referred to as a bop. $25,000 uninsured/underinsured motorist coverage per person. Insurance is one of connecticut’s longest standing industries and largest employers. Insurance for the needs of small to large connecticut businesses. Connecticut is the #1 location for the insurance industry in north america.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title business insurance in ct by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Craft insurance arab al Idea

- Colonial life insurance claims Idea

- Business insurance and benefits information

- Deans and homer insurance Idea

- Crown cost without insurance information

- Delmonico insurance syracuse ny Idea

- Department of insurance and financial services michigan duties information

- Cost of eye exam with insurance Idea

- Cashless hospital list under national insurance company Idea

- Crowel insurance agency information