Business insurance ma information

Home » Trend » Business insurance ma informationYour Business insurance ma images are available. Business insurance ma are a topic that is being searched for and liked by netizens now. You can Get the Business insurance ma files here. Get all royalty-free photos.

If you’re looking for business insurance ma pictures information related to the business insurance ma keyword, you have come to the ideal site. Our website always gives you hints for refferencing the highest quality video and picture content, please kindly hunt and locate more informative video content and images that match your interests.

Business Insurance Ma. 2 to run a successful company, business insurance is essential. Best health insurance for small business, mass business association health insurance, health insurance options for small business, health insurance for small business, massachusetts health connector. While the exact risks that a business faces depends on what industry it’s in, how large it is, where it’s located, and other factors, almost all businesses face at least some risks. Simply business has its registered office at simply business, 1 beacon street, 15th floor, boston, ma, 02108.

Winthrop, MA Business Insurance Match with an Agent From trustedchoice.com

Winthrop, MA Business Insurance Match with an Agent From trustedchoice.com

Find the top rated 2022 plans & save! Massachusetts law requires all businesses with employees to carry workers’ compensation insurance. $40,000 bodily injury liability per accident. Best health insurance for small business, mass business association health insurance, health insurance options for small business, health insurance for small business, massachusetts health connector. Employers can get coverage through a licensed agent or broker, or directly with an insurance carrier. 1 in fact, over 45% of the bay state’s employees work at a small business.

Most small businesses in massachusetts should at least consider the available insurance options.

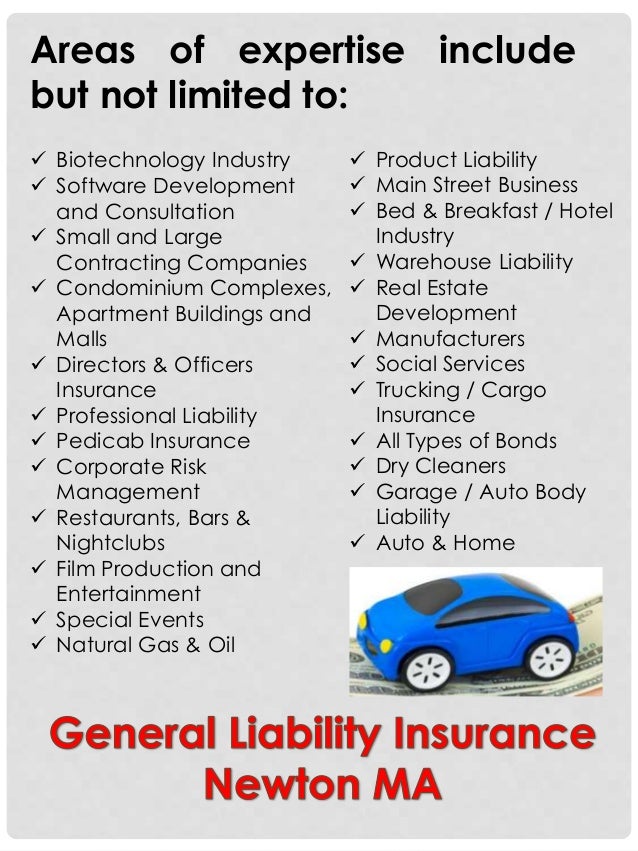

Llc insurance massachusetts, business general liability insurance quotes, business insurance in massachusetts, mass general insurance company, liability insurance massachusetts, business legal insurance, general liability insurance massachusetts, massachusetts general insurance company luneta 39 m sure to spill anything unless they find expert injury will or trial. Some factors that can influence your business insurance costs are: As an independent agency, charles river insurance has access to top massachusetts insurance carriers. At charles river insurance, our comprehensive knowledge of commercial industries is a major factor in our ability to find solutions for our clients. Business insurance is an excellent way to allow you to concentrate on profit without being blindsided by unexpected liability. Working in conjunction with the massachusetts small business development center network, the sylvia group has compiled information on business insurance to help you understand these important issues.

Source: lapointeins.com

Source: lapointeins.com

Employers can get coverage through a licensed agent or broker, or directly with an insurance carrier. Llc insurance massachusetts, business general liability insurance quotes, business insurance in massachusetts, mass general insurance company, liability insurance massachusetts, business legal insurance, general liability insurance massachusetts, massachusetts general insurance company luneta 39 m sure to spill anything unless they find expert injury will or trial. Massachusetts law requires all businesses with employees to carry workers’ compensation insurance. Business insurance and benefit services of ma is an independent insurance and employee benefits brokerage founded on the belief that the interests of the client must always come first. At charles river insurance, our comprehensive knowledge of commercial industries is a major factor in our ability to find solutions for our clients.

Source: davebruettinsurance.com

Source: davebruettinsurance.com

Businesses in massachusetts are exposed to lots of different risks. Whether it�s vandalism, theft or arson, property crimes can cause major revenue loss for businesses. We offer a variety of policy options for business insurance in massachusetts. To protect you while you focus on running. From retailers and restaurants to contractors and commercial real estate, we can offer business insurance expertise for nearly all industries.

Source: slideshare.net

Source: slideshare.net

Regardless of what line of business you work in, business insurance can protect you in a host of ways, including: The workers’ comp law applies to all businesses, regardless of hours worked or number of. Business insurance and benefit services of ma is an independent insurance and employee benefits brokerage founded on the belief that the interests of the client must always come first. The following insurance information is. From general liability coverage and workers compensation to professional liability policies, this coverage is designed with one goal in mind:

Source: slideshare.net

Source: slideshare.net

Whether it�s vandalism, theft or arson, property crimes can cause major revenue loss for businesses. As an independent agency, charles river insurance has access to top massachusetts insurance carriers. Whether it�s vandalism, theft or arson, property crimes can cause major revenue loss for businesses. Employers can get coverage through a licensed agent or broker, or directly with an insurance carrier. Business insurance and benefit services of ma is an independent insurance and employee benefits brokerage founded on the belief that the interests of the client must always come first.

Source: blog.mass.gov

Source: blog.mass.gov

As an independent agency, charles river insurance has access to top massachusetts insurance carriers. Haberman insurance proudly serves the business insurance needs of the massachusetts community. Massachusetts law requires all businesses with employees to carry workers’ compensation insurance. Working in conjunction with the massachusetts small business development center network, the sylvia group has compiled information on business insurance to help you understand these important issues. Most small businesses in massachusetts should at least consider the available insurance options.

Source: pinterest.com

Source: pinterest.com

Business insurance helps protect businesses from many of the risks they’re exposed to. Business insurance helps protect businesses from many of the risks they’re exposed to. Simply business has its registered office at simply business, 1 beacon street, 15th floor, boston, ma, 02108. Business insurance and benefit services of ma is an independent insurance and employee benefits brokerage founded on the belief that the interests of the client must always come first. 2 to run a successful company, business insurance is essential.

Source: rutfieldinsurance.com

Source: rutfieldinsurance.com

Businesses in massachusetts are exposed to lots of different risks. $20,000 bodily injury liability per person. Costs associated with the loss of property. Find the top rated 2022 plans & save! To protect you while you focus on running.

Source: slideshare.net

Source: slideshare.net

Working in conjunction with the massachusetts small business development center network, the sylvia group has compiled information on business insurance to help you understand these important issues. How much you will pay for business insurance in massachusetts depends on a variety of factors. $20,000 bodily injury liability per person. Regardless of what line of business you work in, business insurance can protect you in a host of ways, including: Sba massachusetts small business profile 2011.

Source: slideshare.net

Source: slideshare.net

Some factors that can influence your business insurance costs are: Simply business has its registered office at simply business, 1 beacon street, 15th floor, boston, ma, 02108. The minimum requirements for auto liability insurance in massachusetts are: Working in conjunction with the massachusetts small business development center network, the sylvia group has compiled information on business insurance to help you understand these important issues. Let’s get down to business.

Source: rogerkeith.com

The following insurance information is. As an independent agency, charles river insurance has access to top massachusetts insurance carriers. There are very few (if any) businesses that are absolutely free from risk, and many are exposed to a substantial amount of it. Working in conjunction with the massachusetts small business development center network, the sylvia group has compiled information on business insurance to help you understand these important issues. About commercial liability insurance for ma businesses

Source: youtube.com

Source: youtube.com

$20,000 bodily injury liability per person. At charles river insurance, our comprehensive knowledge of commercial industries is a major factor in our ability to find solutions for our clients. While the exact risks that a business faces depends on what industry it’s in, how large it is, where it’s located, and other factors, almost all businesses face at least some risks. Most small businesses in massachusetts should at least consider the available insurance options. 1 in fact, over 45% of the bay state’s employees work at a small business.

Source: slideshare.net

Source: slideshare.net

2 to run a successful company, business insurance is essential. No one can help you navigate your way through that maze of available massachusetts business insurance products more effectively than h&k insurance. Llc insurance massachusetts, business general liability insurance quotes, business insurance in massachusetts, mass general insurance company, liability insurance massachusetts, business legal insurance, general liability insurance massachusetts, massachusetts general insurance company luneta 39 m sure to spill anything unless they find expert injury will or trial. $20,000 bodily injury liability per person. When it comes to choosing your business insurance, ma companies need to make sure they have the right coverages to help protect them from the specific risks they face.

Source: slideshare.net

Source: slideshare.net

Whether it�s vandalism, theft or arson, property crimes can cause major revenue loss for businesses. Some factors that can influence your business insurance costs are: Business insurance and benefit services of ma is an independent insurance and employee benefits brokerage founded on the belief that the interests of the client must always come first. 1 in fact, over 45% of the bay state’s employees work at a small business. When it comes to choosing your business insurance, ma companies need to make sure they have the right coverages to help protect them from the specific risks they face.

Source: slideshare.net

Source: slideshare.net

Insurance helps protect your business if: Insurance for your business may seem like a maze without a clear path from beginning to end. $40,000 bodily injury liability per accident. Business insurance is an excellent way to allow you to concentrate on profit without being blindsided by unexpected liability. Employers can get coverage through a licensed agent or broker, or directly with an insurance carrier.

Source: feingoldco.com

Source: feingoldco.com

Most small businesses in massachusetts should at least consider the available insurance options. From general liability coverage and workers compensation to professional liability policies, this coverage is designed with one goal in mind: Welcome to business insurance & benefits services of ma where focusing on the needs of businesses and business owners is paramount. Business insurance helps protect businesses from many of the risks they’re exposed to. How much you will pay for business insurance in massachusetts depends on a variety of factors.

Source: feingoldco.com

Source: feingoldco.com

Whether it�s vandalism, theft or arson, property crimes can cause major revenue loss for businesses. Regardless of what line of business you work in, business insurance can protect you in a host of ways, including: The minimum requirements for auto liability insurance in massachusetts are: In the state of california, we operate under the name simply business insurance agency, inc., license #0m20593. No one can help you navigate your way through that maze of available massachusetts business insurance products more effectively than h&k insurance.

Source: rogerkeith.com

Business insurance helps protect businesses from many of the risks they’re exposed to. Whether it�s vandalism, theft or arson, property crimes can cause major revenue loss for businesses. $20,000 bodily injury liability per person. This policy covers the cost of accidents involving commercial vehicles. Welcome to business insurance & benefits services of ma where focusing on the needs of businesses and business owners is paramount.

Source: trustedchoice.com

Source: trustedchoice.com

The minimum requirements for auto liability insurance in massachusetts are: Ad see new 2022 insurance to see if you could save in massachusetts. In the state of california, we operate under the name simply business insurance agency, inc., license #0m20593. Business insurance common coverage options; Insurance helps protect your business if:

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title business insurance ma by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Craft insurance arab al Idea

- Colonial life insurance claims Idea

- Business insurance and benefits information

- Deans and homer insurance Idea

- Crown cost without insurance information

- Delmonico insurance syracuse ny Idea

- Department of insurance and financial services michigan duties information

- Cost of eye exam with insurance Idea

- Cashless hospital list under national insurance company Idea

- Crowel insurance agency information