Business insurance new york state information

Home » Trending » Business insurance new york state informationYour Business insurance new york state images are ready. Business insurance new york state are a topic that is being searched for and liked by netizens now. You can Get the Business insurance new york state files here. Get all royalty-free vectors.

If you’re looking for business insurance new york state images information connected with to the business insurance new york state topic, you have come to the right blog. Our site always gives you suggestions for downloading the maximum quality video and image content, please kindly hunt and locate more informative video content and images that match your interests.

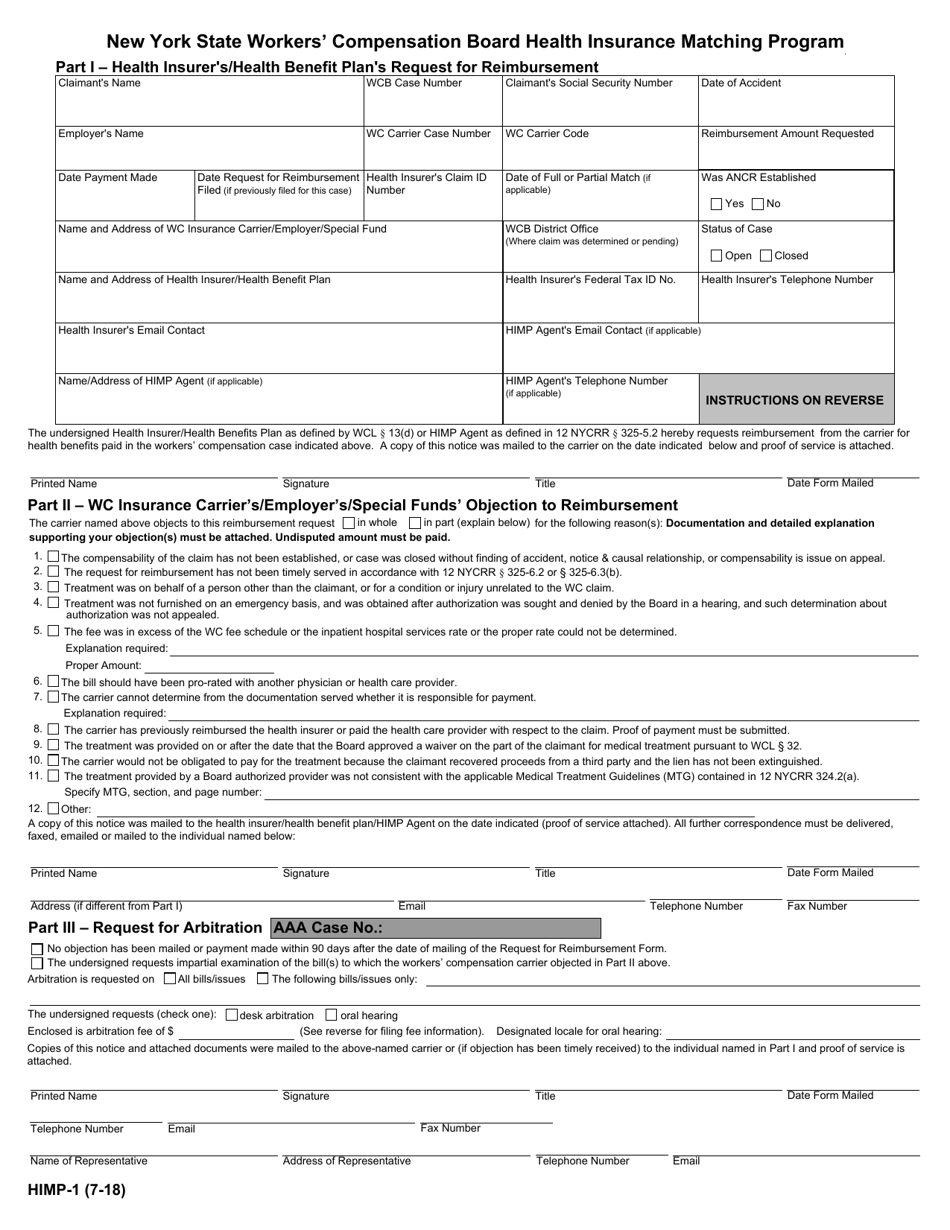

Business Insurance New York State. Nysif provides workers’ compensation benefit payments, both indemnity and medical costs, for covered workers’ compensation claimants; The purpose of the safety group is to provide premium savings to policyholders and to promote a safe work environment. Limit the number of years that permanent partial disability claimants can receive indemnity benefits. Allow the compensation insurance rating board to sunset early in 2008 with the superintendent of insurance recommending how to replace it.

Business Insurance Hudson Valley Orange County NY From joyinsurance.com

Business Insurance Hudson Valley Orange County NY From joyinsurance.com

Corporate wellness insurance new york protects your business from lawsuits with rates as low as $37/mo. Business insurance new york state 🟨 oct 2021. We’ll work with you to design coverage that protects your business from a variety of risks, unique to you. Learn about general liability, commercial auto and other coverages that ny businesses need. Allow the compensation insurance rating board to sunset early in 2008 with the superintendent of insurance recommending how to replace it. Safety group 505 paid members a 25% dividend for 2020.

New york (ny) business insurance can help protect your small business, assets and employees no matter where you are in the state.

Its mission is to guard against financial crises and to protect consumers and markets from fraud. Commercial liability insurance (also called business liability insurance and commercial general liability insurance) protects your new york business from financial loss resulting from claims of injury or damage cause to others by you or your employees. Safety group 505 paid members a 25% dividend for 2020. Insurance requirements for business owners in ny. List of insurance companies in new york state. In 2018, private sector businesses accounted for about.

Source: commercialcafe.com

Source: commercialcafe.com

In new york state, if you have any employees, you are required to carry workers� compensation and disability benefits insurance. 129 w 27th st, new york, ny 10001, usa phone: This policy covers the cost of accidents involving work vehicles. Business auto insurance in the syracuse, ny area, throughout central new york and beyond. If you�re living in new york state and think your health insurance is too high, here�s a new bill that could save you money.

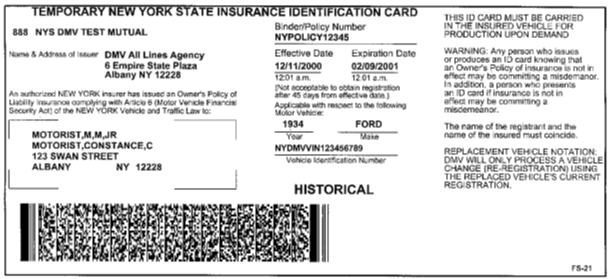

Source: dmv.ny.gov

Source: dmv.ny.gov

Your business pays an average annual salary or wage of less than $53,000 a year per worker (this amount is indexed annually for inflation). Its mission is to guard against financial crises and to protect consumers and markets from fraud. From brooklyn to buffalo, the hartford has your back. List of insurance companies in new york state. Business income means the net income (net profit or loss before income taxes) that would have been earned or incurred, as well as continuing normal operating expenses.

Source: adirondackdailyenterprise.com

Source: adirondackdailyenterprise.com

$25,000 for bodily injury and $50,000 for death of one person Insurance requirements for business owners in ny. Your liability insurance helps pay for those damages caused by the actions of your business, or your employees. Learn about general liability, commercial auto and other coverages that ny businesses need. In 2018, private sector businesses accounted for about.

Source: dmv.ny.gov

Source: dmv.ny.gov

Business corporations file a certificate of incorporation with the department of state. Business income means the net income (net profit or loss before income taxes) that would have been earned or incurred, as well as continuing normal operating expenses. Nysid is liable for regulating and supervising all insurance business in new york state. $25,000 for bodily injury and $50,000 for death of one person Business auto insurance in the syracuse, ny area, throughout central new york and beyond.

Source: dmv.ny.gov

Source: dmv.ny.gov

In new york state, if you have any employees, you are required to carry workers� compensation and disability benefits insurance. If you�re living in new york state and think your health insurance is too high, here�s a new bill that could save you money. This policy covers the cost of accidents involving work vehicles. Nysid is liable for regulating and supervising all insurance business in new york state. If you own a car or truck for business you need auto insurance.

Source: dmv.ny.gov

Source: dmv.ny.gov

Gl coverage is designed to protect ny business owners from direct or indirect damages to another party. Safety group 505 paid members a 25% dividend for 2020. Commercial liability insurance (also called business liability insurance and commercial general liability insurance) protects your new york business from financial loss resulting from claims of injury or damage cause to others by you or your employees. In new york state, if you have any employees, you are required to carry workers� compensation and disability benefits insurance. A business owners policy (bop) combines business property and business liability insurance into one convenient policy.

Source: enriquecimientodelosmasjovenes.blogspot.com

Source: enriquecimientodelosmasjovenes.blogspot.com

How much you will pay for business insurance in new york depends on a variety of factors. How much you will pay for business insurance in new york depends on a variety of factors. Business insurance new york state 🟨 oct 2021. Gl coverage is designed to protect ny business owners from direct or indirect damages to another party. In new york state, if you have any employees, you are required to carry workers� compensation and disability benefits insurance.

Source: insurancewholesaler.net

Source: insurancewholesaler.net

Safety group 505 was created by nysra members in conjunction with the new york state insurance fund (nysif). Allow the compensation insurance rating board to sunset early in 2008 with the superintendent of insurance recommending how to replace it. In death cases, it provides survivor. Business insurance new york state 🟨 oct 2021. Often a landlord will require you to maintain a certain level of liability coverage as a condition of your lease.

Source: joyinsurance.com

Source: joyinsurance.com

Whether you have one vehicle or a whole fleet, we can help you implement custom coverage that will protect your business and personal assets from the additional exposure that commercial vehicles bring with them. Corporate wellness insurance new york protects your business from lawsuits with rates as low as $37/mo. Nysid is liable for regulating and supervising all insurance business in new york state. Typically, the requirements to qualify for a small business health insurance tax credit in new york are: Insurance requirements for business owners in ny.

Source: ticketgalaxy.com

Source: ticketgalaxy.com

Learn about general liability, commercial auto and other coverages that ny businesses need. Business corporations file a certificate of incorporation with the department of state. Gl coverage is designed to protect ny business owners from direct or indirect damages to another party. Your business pays an average annual salary or wage of less than $53,000 a year per worker (this amount is indexed annually for inflation). Nysif provides workers’ compensation benefit payments, both indemnity and medical costs, for covered workers’ compensation claimants;

![]() Source: businessinsurance.com

Source: businessinsurance.com

New york�s minimum requirements for auto liability insurance are: New york (ny) business insurance can help protect your small business, assets and employees no matter where you are in the state. In death cases, it provides survivor. Limit the number of years that permanent partial disability claimants can receive indemnity benefits. A business owners policy (bop) combines business property and business liability insurance into one convenient policy.

Source: bsc.ogs.ny.gov

Source: bsc.ogs.ny.gov

This includes vehicles owned by a business. New york (ny) business insurance can help protect your small business, assets and employees no matter where you are in the state. How much you will pay for business insurance in new york depends on a variety of factors. Business insurance new york state 🟨 oct 2021. Limit the number of years that permanent partial disability claimants can receive indemnity benefits.

Source: blog.nycm.com

Source: blog.nycm.com

In new york state, if you have any employees, you are required to carry workers� compensation and disability benefits insurance. With corporate wellness insurance new york, you can cover professional liability and other business risks as you provide your services. New york�s minimum requirements for auto liability insurance are: Business corporations file a certificate of incorporation with the department of state. The new york state department of financial services regulates insurance in the empire state.

Source: commercialcafe.com

Source: commercialcafe.com

In death cases, it provides survivor. Whether you have one vehicle or a whole fleet, we can help you implement custom coverage that will protect your business and personal assets from the additional exposure that commercial vehicles bring with them. The article discusses the upcoming if you�re living in new york state and think your health insurance is too high, here�s a new bill that $25,000 bodily injury liability per. Learn about general liability, commercial auto and other coverages that ny businesses need.

Business owners insurance in the syracuse, ny area, throughout central new york and beyond. Your business pays an average annual salary or wage of less than $53,000 a year per worker (this amount is indexed annually for inflation). How much you will pay for business insurance in new york depends on a variety of factors. Nysif provides workers’ compensation benefit payments, both indemnity and medical costs, for covered workers’ compensation claimants; The purpose of the safety group is to provide premium savings to policyholders and to promote a safe work environment.

Source: joyinsurance.com

Source: joyinsurance.com

$25,000 bodily injury liability per. $25,000 bodily injury liability per. The purpose of the safety group is to provide premium savings to policyholders and to promote a safe work environment. In new york state, if you have any employees, you are required to carry workers� compensation and disability benefits insurance. With corporate wellness insurance new york, you can cover professional liability and other business risks as you provide your services.

Source: simplyinsured.com

Source: simplyinsured.com

This policy covers the cost of accidents involving work vehicles. If you own a car or truck for business you need auto insurance. Business income means the net income (net profit or loss before income taxes) that would have been earned or incurred, as well as continuing normal operating expenses. All registered vehicles in new york must be covered by auto liability insurance. Business owners insurance in the syracuse, ny area, throughout central new york and beyond.

Source: coastalinsurancesolution.com

Source: coastalinsurancesolution.com

Nysif provides workers’ compensation benefit payments, both indemnity and medical costs, for covered workers’ compensation claimants; Business interruption (or business income) insurance can provide sufficient funds to pay your fixed expenses and lost business income during a period of time when your business is not operational. Allow the compensation insurance rating board to sunset early in 2008 with the superintendent of insurance recommending how to replace it. The article discusses the upcoming if you�re living in new york state and think your health insurance is too high, here�s a new bill that With corporate wellness insurance new york, you can cover professional liability and other business risks as you provide your services.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title business insurance new york state by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Claims vs occurrence based insurance Idea

- Cheap tablet insurance Idea

- Calling insurance leads Idea

- Disability insurance for postal workers Idea

- Business insurance peoria il information

- Bright health insurance reviews Idea

- Carrier liability vs cargo insurance Idea

- Can you insure a written off car Idea

- Can convicted felons get life insurance information

- Car insurance administrator Idea