Business insurance vs llc information

Home » Trend » Business insurance vs llc informationYour Business insurance vs llc images are available in this site. Business insurance vs llc are a topic that is being searched for and liked by netizens now. You can Get the Business insurance vs llc files here. Get all free vectors.

If you’re searching for business insurance vs llc pictures information connected with to the business insurance vs llc interest, you have pay a visit to the right site. Our website frequently gives you hints for downloading the highest quality video and picture content, please kindly hunt and locate more enlightening video articles and graphics that match your interests.

Business Insurance Vs Llc. Here are a couple of scenarios to consider: General liability insurance, also known as commercial general liability insurance (cgl) and llc general liability insurance is a basic insurance coverage designed to protect the assets of your small business from a wide spectrum of risks. But once you do, you’ll be able to carry on with business as usual. That means it does not have to pay federal.

General liability insurance for llcs can help protect your business against llc liability claims of bodily injury, property damage, advertising injury and more. General liability insurance, also known as commercial general liability insurance (cgl) and llc general liability insurance is a basic insurance coverage designed to protect the assets of your small business from a wide spectrum of risks. The most obvious bureaucratic difference between a dba and an llc is that the former involves filing renewal paperwork annually or biannually—something that you won’t have to worry about with llcs. What extra insurance should the llc add? Depending on what you do, you might be legally obligated to purchase this insurance. While the llc may not need these additional policies, you should discuss them with a business adviser or attorney:

Ad get general liability insurance for llc.

Depending on what you do, you might be legally obligated to purchase this insurance. An umbrella insurance policy provides coverage above and beyond the typical property insurance. Ad get general liability insurance for llc. If the company is in a business that requires a license or certification then a professional limited liability company (pllc) may be required by your state, otherwise a limited liability cliompany (llc) may be the best option for. In the state of california, we operate under the name simply business insurance agency, inc., license #0m20593. Find out how much general liability insurance for llcs cost, what it covers and more from our experts.

Source: ictaxadvisors.com

Source: ictaxadvisors.com

Deciding whether you want an llc, an umbrella insurance policy, or both will depend on several factors, including the type of property you own and in how many states. But once you do, you’ll be able to carry on with business as usual. For many limited liability companies (llcs), llc insurance is an essential part of running a successful business. An llc (or other corporation), on the other hand, protects you from liabilities that arise in the llc and prevents a plaintiff from being able to go after you personally. The hartford offers many types of business insurance including general liability, bops, commercial auto.

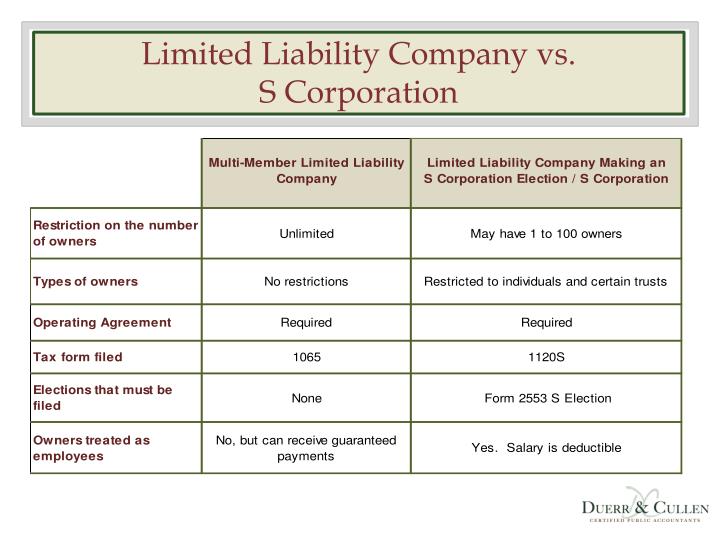

Source: slideserve.com

Source: slideserve.com

A sole proprietorship will typically cease to exist if the owner dies or sells the business. Most llcs and small businesses choose to buy general liability insurance very soon after forming, as this will help to ensure. A landlord owns a triplex worth $700,000. A key difference between an llc and a corporation is the way they�re treated at tax time. Ad get general liability insurance for llc.

Source: business.laws.com

Source: business.laws.com

This coverage protects your business against malpractice, errors, negligence and omissions. If the llc has manufactured a defective product, you can insure against property damage and personal injury to others. Ad get general liability insurance for llc. Without it, you’d have to pay out of pocket to cover these claims, which can be very expensive. A landlord owns a triplex worth $700,000.

Source: findsig.com

Source: findsig.com

A landlord owns a triplex worth $700,000. An umbrella insurance policy provides coverage above and beyond the typical property insurance. It will favor one or the other. Insure your business online in 5 mins! A key difference between an llc and a corporation is the way they�re treated at tax time.

Source: icaagencyalliance.com

Source: icaagencyalliance.com

What extra insurance should the llc add? Get a free online quote today. But once you do, you’ll be able to carry on with business as usual. Most small business owners pay between $500 and $1,500 a year for umbrella liability insurance. Insure your business online in 5 mins!

Source: thebalance.com

Source: thebalance.com

A sole proprietorship will typically cease to exist if the owner dies or sells the business. A sole proprietorship is owned by one person by definition. General liability insurance, also known as commercial general liability insurance (cgl) and llc general liability insurance is a basic insurance coverage designed to protect the assets of your small business from a wide spectrum of risks. And in the match of llc vs inc, taxation is almost never a draw. A sole proprietorship will typically cease to exist if the owner dies or sells the business.

Source: companiesinc.com

Source: companiesinc.com

Ad get general liability insurance for llc. In the state of california, we operate under the name simply business insurance agency, inc., license #0m20593. Forming a pllc vs llc is an easy decision once the requirements and restrictions for each are understood. Find out how much general liability insurance for llcs cost, what it covers and more from our experts. The most obvious bureaucratic difference between a dba and an llc is that the former involves filing renewal paperwork annually or biannually—something that you won’t have to worry about with llcs.

Source: fitsmallbusiness.com

Source: fitsmallbusiness.com

What is at risk in a lawsuit against the business entity (llc or corporation) however, is the assets of that business itself. If you provide business services of any kind, you should probably get professional liability insurance. In the state of california, we operate under the name simply business insurance agency, inc., license #0m20593. But once you do, you’ll be able to carry on with business as usual. For many limited liability companies (llcs), llc insurance is an essential part of running a successful business.

Source: firstlightlaw.com

Source: firstlightlaw.com

The hartford offers many types of business insurance including general liability, bops, commercial auto. In the state of california, we operate under the name simply business insurance agency, inc., license #0m20593. Most llcs and small businesses choose to buy general liability insurance very soon after forming, as this will help to ensure. Forgetting to renew your paperwork will leave your company name up for grabs. Insure your business online in 5 mins!

Source: ceotruckergroup.com

Source: ceotruckergroup.com

This coverage protects your business against malpractice, errors, negligence and omissions. A sole proprietorship will typically cease to exist if the owner dies or sells the business. General liability insurance for llcs can help protect your business against llc liability claims of bodily injury, property damage, advertising injury and more. If you provide business services of any kind, you should probably get professional liability insurance. Forgetting to renew your paperwork will leave your company name up for grabs.

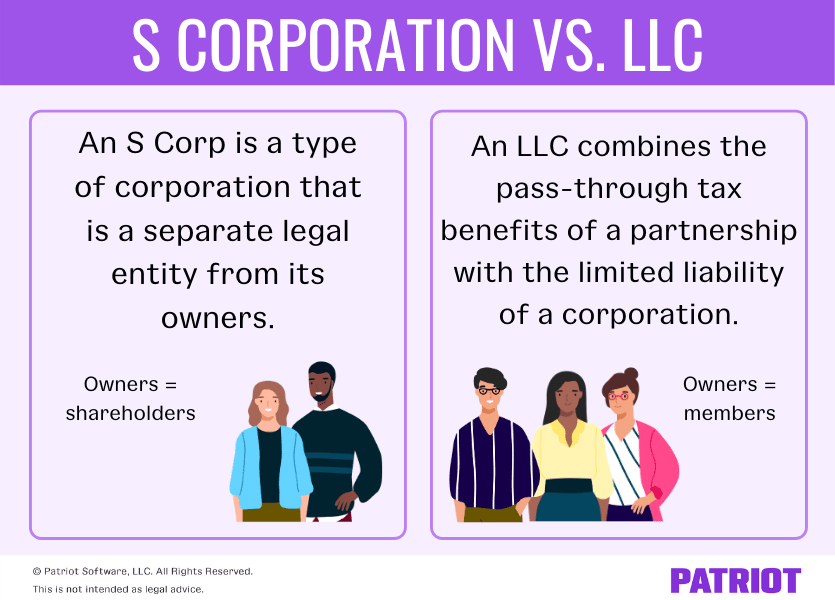

Source: patriotsoftware.com

Source: patriotsoftware.com

Find out how much general liability insurance for llcs cost, what it covers and more from our experts. If the llc has manufactured a defective product, you can insure against property damage and personal injury to others. Find out how much general liability insurance for llcs cost, what it covers and more from our experts. If the company is in a business that requires a license or certification then a professional limited liability company (pllc) may be required by your state, otherwise a limited liability cliompany (llc) may be the best option for. If you provide business services of any kind, you should probably get professional liability insurance.

Source: apkpure.com

Source: apkpure.com

Here are the median costs for the most common llc insurance policies, based on our own customer data: That means it does not have to pay federal. If the company is in a business that requires a license or certification then a professional limited liability company (pllc) may be required by your state, otherwise a limited liability cliompany (llc) may be the best option for. It will favor one or the other. If you have llc status, you’re able to include additional owners that are people, corporations, other llcs, partnerships, trusts, or estates.

Source: pinterest.com

Source: pinterest.com

Forming a pllc vs llc is an easy decision once the requirements and restrictions for each are understood. Most small business owners pay between $500 and $1,500 a year for umbrella liability insurance. A key difference between an llc and a corporation is the way they�re treated at tax time. An llc (or other corporation), on the other hand, protects you from liabilities that arise in the llc and prevents a plaintiff from being able to go after you personally. $636 annually, or $53 per month.

Source: nextinsurance.com

Source: nextinsurance.com

Forgetting to renew your paperwork will leave your company name up for grabs. Ad get general liability insurance for llc. A sole proprietorship is owned by one person by definition. Here are the median costs for the most common llc insurance policies, based on our own customer data: An umbrella insurance policy provides coverage above and beyond the typical property insurance.

Source: fortunebuilders.com

Source: fortunebuilders.com

Ad get general liability insurance for llc. If you provide business services of any kind, you should probably get professional liability insurance. Any vehicles used for business should be fully insured. Here are the median costs for the most common llc insurance policies, based on our own customer data: Insure your business online in 5 mins!

Source: pinterest.com

Source: pinterest.com

A sole proprietorship is owned by one person by definition. Ad get general liability insurance for llc. Get a free online quote today. Any vehicles used for business should be fully insured. A sole proprietorship is owned by one person by definition.

Source: mainstreetfinancial.services

Source: mainstreetfinancial.services

Deciding whether you want an llc, an umbrella insurance policy, or both will depend on several factors, including the type of property you own and in how many states. It can help you cover the cost of substantial claims. States and the district of columbia. Business insurance for llcs helps protect your company from claims that can come up during normal operations. Most small business owners pay between $500 and $1,500 a year for umbrella liability insurance.

A sole proprietorship will typically cease to exist if the owner dies or sells the business. While the llc may not need these additional policies, you should discuss them with a business adviser or attorney: That means it does not have to pay federal. $560 annually, or about $47 per month. Here are the median costs for the most common llc insurance policies, based on our own customer data:

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title business insurance vs llc by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Craft insurance arab al Idea

- Colonial life insurance claims Idea

- Business insurance and benefits information

- Deans and homer insurance Idea

- Crown cost without insurance information

- Delmonico insurance syracuse ny Idea

- Department of insurance and financial services michigan duties information

- Cost of eye exam with insurance Idea

- Cashless hospital list under national insurance company Idea

- Crowel insurance agency information