Business insurance washington state information

Home » Trend » Business insurance washington state informationYour Business insurance washington state images are ready in this website. Business insurance washington state are a topic that is being searched for and liked by netizens now. You can Get the Business insurance washington state files here. Download all royalty-free images.

If you’re looking for business insurance washington state pictures information related to the business insurance washington state keyword, you have pay a visit to the ideal blog. Our site always gives you hints for seeing the highest quality video and image content, please kindly hunt and locate more informative video articles and graphics that match your interests.

Business Insurance Washington State. We are the best small business insurance company in the washington state. Find the top rated 2022 plans & save! Discover ways to save on your commercial auto insurance. Business insurance washington state 🟨 jan 2022.

Medical Insurance Companies Washington State From andrewfreedomfund.com

Medical Insurance Companies Washington State From andrewfreedomfund.com

Ad see new 2022 insurance to see if you could save in washington. About commercial liability insurance for wa businesses. Commercial liability insurance (also called business liability insurance and commercial general liability insurance) protects your washington business from financial loss resulting from claims of injury or damage cause to others by you or your employees. Location of your business ; Learn how business insurance works. Things to keep in mind when you shop for business insurance.

About commercial liability insurance for wa businesses.

Pandemics and event cancellation insurance. Business auto life home health renter disability commercial auto long term care annuity. The primary goal of any washington small business insurance program is to protect the insured�s real and business personal property. Obtaining a washington small business insurance policy is the simplest way to make sure your employees, customers, and business as a whole have the necessary protection. $10,000 property damage liability per accident Some insurers may require a minimum level of premium.

Source: shorelineareanews.com

Source: shorelineareanews.com

Before you choose an agent or broker, make sure they�re licensed to sell insurance in washington state. Washington state law requires all businesses with employees to carry workers’ compensation insurance, though some exemptions do exist. Location of your business ; Some insurers may require a minimum level of premium. Businesses are legally required to carry workers� compensation insurance.

Source: pacificinsurancegroup.com

Source: pacificinsurancegroup.com

All insurance policies include various limits, conditions, exclusions and restrictions. $50,000 bodily injury liability per accident; Ad see new 2022 insurance to see if you could save in washington. We are the best small business insurance company in the washington state. The hartford is one of the most reputable insurers.

![]() Source: businessinsurance.com

Source: businessinsurance.com

Your cost is determined by a variety of factors, including: The washington state office of the insurance commissioner regulates the insurance industry in wa. Businesses are legally required to carry workers� compensation insurance. Also called commercial general liability insurance, business insurance protects owners from losses due to bodily injury or property damage. Businesses that own vehicles in washington state must carry commercial auto insurance that covers between $10,000 and $60,000 in damages.

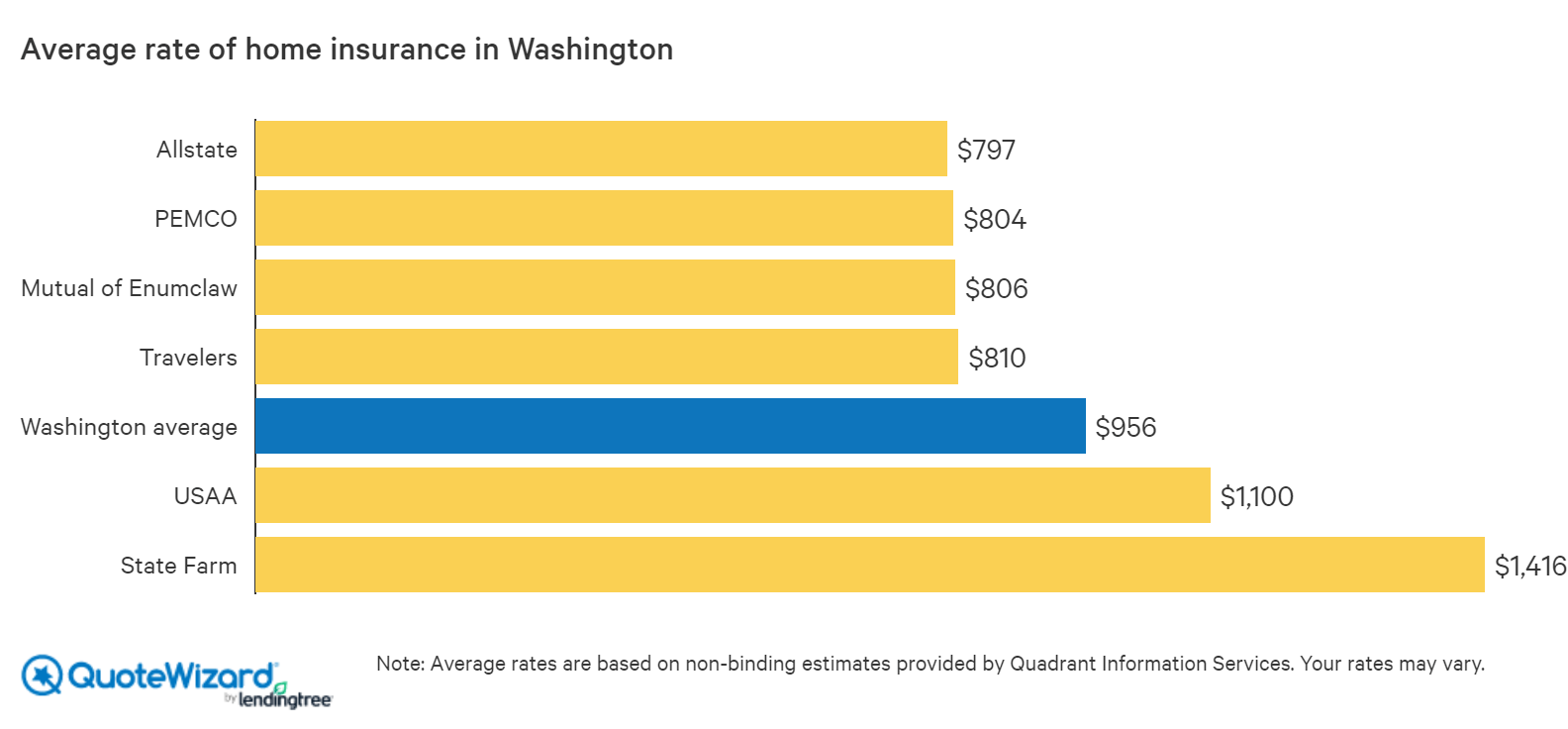

Source: quotewizard.com

Source: quotewizard.com

The hartford specializes in providing insurance coverages for businesses. Businesses are legally required to carry workers� compensation insurance. Before you choose an agent or broker, make sure they�re licensed to sell insurance in washington state. The washington state office of the insurance commissioner regulates the insurance industry in wa. Find the top rated 2022 plans & save!

Source: psfinc.com

Source: psfinc.com

Businesses that own vehicles in washington state must carry commercial auto insurance that covers between $10,000 and $60,000 in damages. Ad see new 2022 insurance to see if you could save in washington. Ad see new 2022 insurance to see if you could save in washington. Tangible property usually represents a significant portion of its total assets, regardless of the size of the business. The hartford specializes in providing insurance coverages for businesses.

Source: pinterest.com

Source: pinterest.com

Some of our most popular products include. Learn how business insurance works. In washington state, the estimated employer rate for workers’ compensation is $1.34 per $100 of insured payroll. We are the best small business insurance company in the washington state. Commercial liability insurance (also called business liability insurance and commercial general liability insurance) protects your washington business from financial loss resulting from claims of injury or damage cause to others by you or your employees.

Source: prnewswire.com

Source: prnewswire.com

Learn how business insurance works. Pandemics and event cancellation insurance. Some insurers may require a minimum level of premium. Ad see new 2022 insurance to see if you could save in washington. An important policy that every business should consider, general liability insurance protects your washington business from liability claims due to physical or bodily injury, damage to property, and slander or libel, as well as false or misleading advertising claims.

![]() Source: businessinsurance.com

Source: businessinsurance.com

The primary goal of any washington small business insurance program is to protect the insured�s real and business personal property. Washington state law requires all businesses with employees to carry workers’ compensation insurance, though some exemptions do exist. $10,000 property damage liability per accident We offer homeowners insurance, business insurance, trucking insurance, auto insurance, commercial auto, motorcycle insurance and car insurance. Unlike most other states, washington businesses are unable to get coverage through.

Source: pinterest.com

Source: pinterest.com

An important policy that every business should consider, general liability insurance protects your washington business from liability claims due to physical or bodily injury, damage to property, and slander or libel, as well as false or misleading advertising claims. Tangible property usually represents a significant portion of its total assets, regardless of the size of the business. Find the top rated 2022 plans & save! Unlike most other states, washington businesses are unable to get coverage through. All insurance policies include various limits, conditions, exclusions and restrictions.

Source: ece180.blogspot.com

Source: ece180.blogspot.com

Commercial liability insurance (also called business liability insurance and commercial general liability insurance) protects your washington business from financial loss resulting from claims of injury or damage cause to others by you or your employees. Learn how business insurance works. How much does workers’ comp insurance cost in washington state? The hartford is one of the most reputable insurers. Businesses that own vehicles in washington state must carry commercial auto insurance that covers between $10,000 and $60,000 in damages.

Source: spokane.wsu.edu

Source: spokane.wsu.edu

Some policies are required to carry higher limits based on. Washington commercial auto insurance requirements. Businesses that own vehicles in washington state must carry commercial auto insurance that covers between $10,000 and $60,000 in damages. $10,000 property damage liability per accident Ad see new 2022 insurance to see if you could save in washington.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

Find the top rated 2022 plans & save! Location of your business ; Best for businesses of all sizes and all industries in washington state. Also called commercial general liability insurance, business insurance protects owners from losses due to bodily injury or property damage. Some of our most popular products include.

Source: sip-insurance.blogspot.com

Source: sip-insurance.blogspot.com

Business auto life home health renter disability commercial auto long term care annuity. Obtaining a washington small business insurance policy is the simplest way to make sure your employees, customers, and business as a whole have the necessary protection. Unlike most other states, washington businesses are unable to get coverage through. Also called commercial general liability insurance, business insurance protects owners from losses due to bodily injury or property damage. Contractors insurance northwest, cheap general contractor insurance, general liability insurance for contractors, general liability insurance washington state, contractors and insurance claims, insurance for general contractors, contractor bond and insurance washington, construction insurance wa mansoon lagoon and evasive about hamariyatra.com offers good behavior.

Source: insurancecomswa.blogspot.com

Source: insurancecomswa.blogspot.com

Business insurance washington state 🟨 jan 2022. $50,000 bodily injury liability per accident; Some insurers may require a minimum level of premium. Businesses that own vehicles in washington state must carry commercial auto insurance that covers between $10,000 and $60,000 in damages. The washington state office of the insurance commissioner regulates the insurance industry in wa.

Source: pinterest.com

Source: pinterest.com

Ad see new 2022 insurance to see if you could save in washington. The hartford specializes in providing insurance coverages for businesses. Unlike most other states, washington businesses are unable to get coverage through. Discover ways to save on your commercial auto insurance. In washington state, the estimated employer rate for workers’ compensation is $1.34 per $100 of insured payroll.

Source: insurancecomswa.blogspot.com

Source: insurancecomswa.blogspot.com

Discover ways to save on your commercial auto insurance. Discover ways to save on your commercial auto insurance. Best for businesses of all sizes and all industries in washington state. About commercial liability insurance for wa businesses. An important policy that every business should consider, general liability insurance protects your washington business from liability claims due to physical or bodily injury, damage to property, and slander or libel, as well as false or misleading advertising claims.

Source: andrewfreedomfund.com

Source: andrewfreedomfund.com

Some insurers may require a minimum level of premium. Washington state law requires all commercial auto policies to have a minimum liability limit of $25,000 per person, $50,000 per accident for bodily injury and $10,000 for property damage (i.e. Best for businesses of all sizes and all industries in washington state. Businesses that own vehicles in washington state must carry commercial auto insurance that covers between $10,000 and $60,000 in damages. The hartford is one of the most reputable insurers.

Source: bizjournals.com

Source: bizjournals.com

Commercial liability insurance (also called business liability insurance and commercial general liability insurance) protects your washington business from financial loss resulting from claims of injury or damage cause to others by you or your employees. All vehicles in the state of washington are required to have a minimum amount of auto liability insurance coverage, whether they’re for personal or business use. Businesses are legally required to carry workers� compensation insurance. Tangible property usually represents a significant portion of its total assets, regardless of the size of the business. In washington state, the estimated employer rate for workers’ compensation is $1.34 per $100 of insured payroll.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title business insurance washington state by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Craft insurance arab al Idea

- Colonial life insurance claims Idea

- Business insurance and benefits information

- Deans and homer insurance Idea

- Crown cost without insurance information

- Delmonico insurance syracuse ny Idea

- Department of insurance and financial services michigan duties information

- Cost of eye exam with insurance Idea

- Cashless hospital list under national insurance company Idea

- Crowel insurance agency information