Business interruption insurance extra expense Idea

Home » Trending » Business interruption insurance extra expense IdeaYour Business interruption insurance extra expense images are available in this site. Business interruption insurance extra expense are a topic that is being searched for and liked by netizens now. You can Download the Business interruption insurance extra expense files here. Download all free photos.

If you’re looking for business interruption insurance extra expense pictures information related to the business interruption insurance extra expense topic, you have come to the ideal site. Our website always gives you hints for viewing the maximum quality video and picture content, please kindly search and locate more enlightening video articles and images that fit your interests.

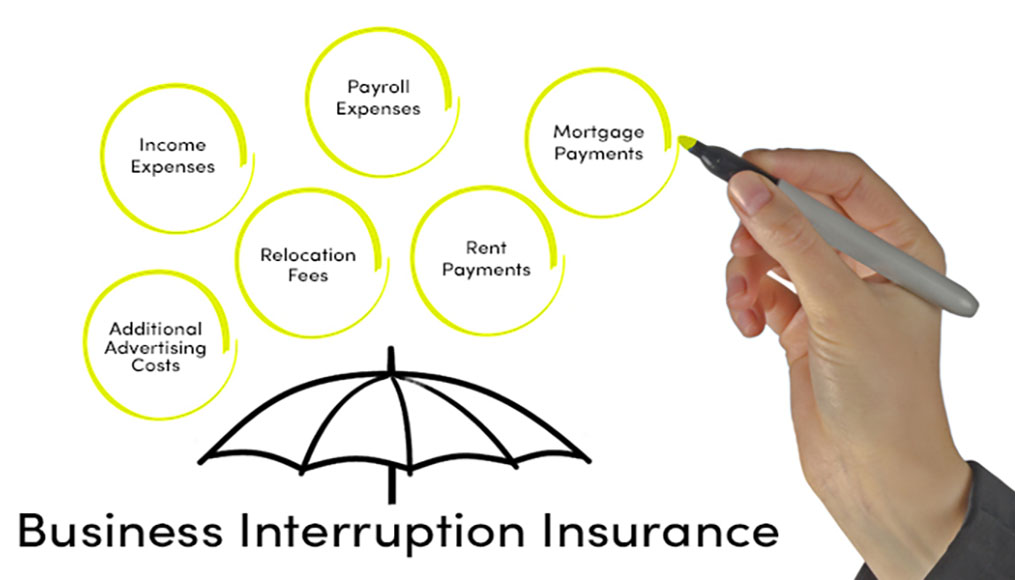

Business Interruption Insurance Extra Expense. The bottom line is that. Business interruption insurance is when your business can’t operate because of some kind of disaster. The period of restoration is a time that begins when a loss occurs and ends when operations are returned to normal and business operations resume. Business interruption & extra expense insurance provides coverage when your business shuts down temporarily due to a covered loss.

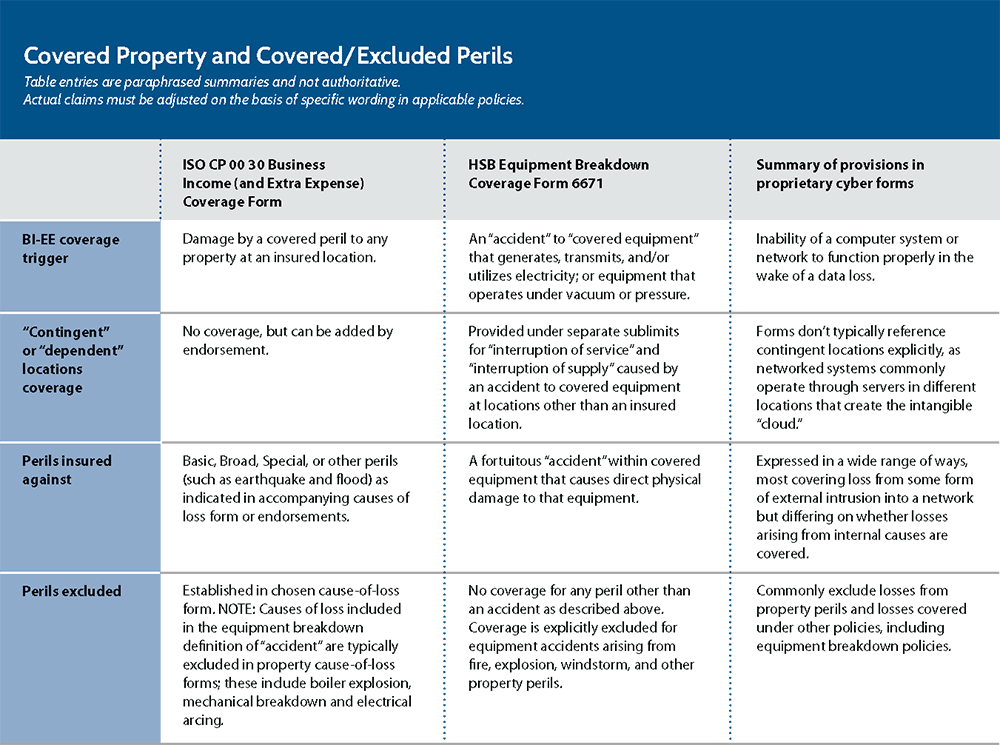

Business Interruption Coverage Times Three Adjusting Today From adjustersinternational.com

Business Interruption Coverage Times Three Adjusting Today From adjustersinternational.com

Business income and extra expense (biee) insurance helps cover the costs to your business when a covered event, such as a storm or a fire, forces you to temporarily close operations. In fact, “expense to reduce” is not really a separate coverage. This helps replace your income and covered expenses like rent, payroll and other financial responsibilities. What’s the difference between extra expense coverage and business interruption insurance? The period of restoration is a time that begins when a loss occurs and ends when operations are returned to normal and business operations resume. Contingent business interruption and extra expenses insurance could help keep you afloat financially until your partner’s factory is back and running.

Extra expense, however, is an additional coverage that is added to enhance business interruption (bi), just like some of the other additional coverages commonly available (e.g.

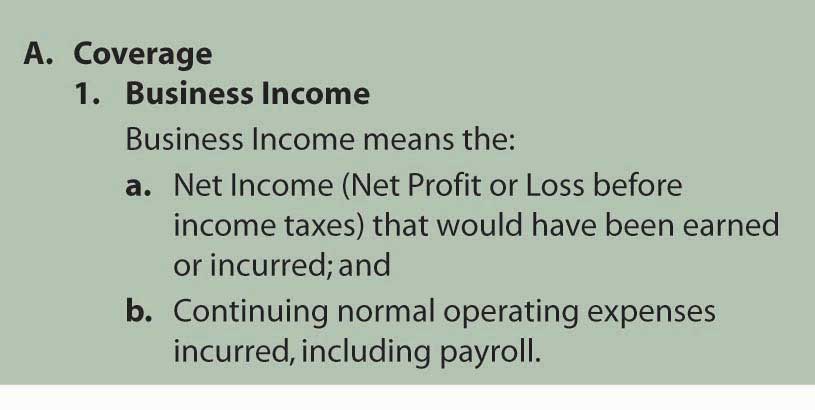

This type of policy provides you with financial support in the event that you lose a manufacturer, supplier, or even a client that your business’s bottom line relies upon heavily. Extra expense insurance is a form of commercial insurance that pays for a policyholder’s additional costs while recovering from a major disruption. Property but entities should also have business interruption coverage to pay for lost profits, operating expenses, and extra expenses while restoring operations. Business income and extra expense coverage www.icwgroup.com www.icwgroup.com || 800.877.1111 800.877.1111 a guide to helping your clients understand business income and extra expense coverage business income coverage overview business income or business interruption coverage can be one of the most misunderstood of all property coverages. What’s the difference between extra expense coverage and business interruption insurance? Business interruption and extra expense worksheet tips to consider when completing the business interruption & extra expense worksheet total salaries and wages of officers, executives and employees whose services would be retained during suspension of business operations compensation insurance premiums, social security, unemployment insurance and.

Source: poolegroup.com.au

Source: poolegroup.com.au

Extra expense, however, is an additional coverage that is added to enhance business interruption (bi), just like some of the other additional coverages commonly available (e.g. It pays for the loss of income during the period your business is shutdown up to the limits of your policy, while your property is being repaired. Business interruption & extra expense insurance provides coverage when your business shuts down temporarily due to a covered loss. Business interruption coverage typically has two different built in coverages: Tenant shall maintain loss of income, business interruption and extra expense insurance in such amounts as.

Source: murraylawgroup.com

Source: murraylawgroup.com

Business interruption lessee shall obtain and maintain loss of income and extra expense insurance in amounts as will reimburse lessee for direct or indirect loss of earnings attributable to all perils commonly insured against by prudent lessees in the business of lessee or attributable to prevention of access to the premises as a result of such perils. Fire or natural disaster) causes your practice’s business operations to slow down or come to a halt entirely. Interruption by order of authorities. This insurance is extended to cover, in accordance with its limits and conditions, the extra expenses necessarily incurred by the insured, without exceeding two consecutive weeks, when as a direct result of a loss caused by the perils insured, Tips to consider when completing the business interruption & extra expense worksheet moving expenses assume that operations will be shut down for at least a year after an earthquake review your business interruption & extra expense insurance every year;

Source: franquiziacomics.blogspot.com

Source: franquiziacomics.blogspot.com

Business income and extra expense coverage www.icwgroup.com www.icwgroup.com || 800.877.1111 800.877.1111 a guide to helping your clients understand business income and extra expense coverage business income coverage overview business income or business interruption coverage can be one of the most misunderstood of all property coverages. This coverage responds in the event an adverse incident (e.g. Business income and extra expense (biee) insurance helps cover the costs to your business when a covered event, such as a storm or a fire, forces you to temporarily close operations. Both are intended to assist businesses in the event a covered peril damages business property and impacts. In fact, “expense to reduce” is not really a separate coverage.

Source: adjustersinternational.com

Source: adjustersinternational.com

Extra expense coverage is usually purchased with a business interruption policy to cover other types of expenses that a business interruption won’t cover. Business interruption coverage typically has two different built in coverages: Finally, extra expense coverage applies as a component of business interruption insurance so that cost incurred to maintain operations can be recovered during the period of restoration. This insurance is extended to cover, in accordance with its limits and conditions, the extra expenses necessarily incurred by the insured, without exceeding two consecutive weeks, when as a direct result of a loss caused by the perils insured, Interruption by order of authorities.

Business interruption insurance & extra expense claim support | rollins accounting & inventory services. Business interruption coverage typically has two different built in coverages: Property but entities should also have business interruption coverage to pay for lost profits, operating expenses, and extra expenses while restoring operations. Both are intended to assist businesses in the event a covered peril damages business property and impacts. This type of policy gives you protection for up to 12 months while business income and extra expense coverage only provides protection for 3 months.

Source: morning-update-suffield-high-schoo611.blogspot.com

Source: morning-update-suffield-high-schoo611.blogspot.com

Both are intended to assist businesses in the event a covered peril damages business property and impacts. Business interruption insurance is when your business can’t operate because of some kind of disaster. Both are intended to assist businesses in the event a covered peril damages business property and impacts. The net result or goal of business interruption coverage is to make the business whole should a covered event occur. The period of restoration is a time that begins when a loss occurs and ends when operations are returned to normal and business operations resume.

Source: slideshare.net

Source: slideshare.net

Business interruption insurance & extra expense claim support | rollins accounting & inventory services. Extra expense coverage pays for expenses that are above and beyond a business’s normal operating costs. Business interruption insurance, also known as business continuation insurance, provides coverage for expenses associated with running a business such as; Contingent business interruption and extra expenses insurance could help keep you afloat financially until your partner’s factory is back and running. Payroll and utility bills, when the business is unable to operate for an extended period of time because of a fire, or other type of loss as specified in the policy.

Source: slideshare.net

Source: slideshare.net

You may need a business interruption insurance policy with an “extra expense” policy to cover the cost of moving to another location, renting equipment or property, and paying employees during the transition. Business interruption coverage typically has two different built in coverages: Interruption by order of authorities. Business interruption & extra expense insurance provides coverage when your business shuts down temporarily due to a covered loss. In most cases, a business interruption insurance policy will not provide coverage for no longer than 12 months.

Source: saylordotorg.github.io

Source: saylordotorg.github.io

For example, if there’s a big power outage on your street, you may be able to get money for that. This coverage responds in the event an adverse incident (e.g. In most cases, a business interruption insurance policy will not provide coverage for no longer than 12 months. Interruption by order of authorities. Cbi, service interruption, epi, etc.).

Source: patriotsoftware.com

Source: patriotsoftware.com

Business interruption lessee shall obtain and maintain loss of income and extra expense insurance in amounts as will reimburse lessee for direct or indirect loss of earnings attributable to all perils commonly insured against by prudent lessees in the business of lessee or attributable to prevention of access to the premises as a result of such perils. Business income and extra expense (biee) insurance helps cover the costs to your business when a covered event, such as a storm or a fire, forces you to temporarily close operations. In fact, “expense to reduce” is not really a separate coverage. Extra expense coverage pays for expenses that are above and beyond a business’s normal operating costs. Extra expense, however, is an additional coverage that is added to enhance business interruption (bi), just like some of the other additional coverages commonly available (e.g.

Source: getglobalpro.com

Source: getglobalpro.com

Payroll and utility bills, when the business is unable to operate for an extended period of time because of a fire, or other type of loss as specified in the policy. This insurance is extended to cover, in accordance with its limits and conditions, the extra expenses necessarily incurred by the insured, without exceeding two consecutive weeks, when as a direct result of a loss caused by the perils insured, In most cases, a business interruption insurance policy will not provide coverage for no longer than 12 months. You may need a business interruption insurance policy with an “extra expense” policy to cover the cost of moving to another location, renting equipment or property, and paying employees during the transition. Business interruption and extra expense insurance definition like poe, business interruption insurance (bii) gives you peace of mind.

Source: slideshare.net

Source: slideshare.net

In most cases, a business interruption insurance policy will not provide coverage for no longer than 12 months. You may need a business interruption insurance policy with an “extra expense” policy to cover the cost of moving to another location, renting equipment or property, and paying employees during the transition. What’s the difference between extra expense coverage and business interruption insurance? Both are intended to assist businesses in the event a covered peril damages business property and impacts. Extra expense coverage is a type of insurance that can be added to your commercial property policy for business interruption.

Business interruption and extra expense worksheet tips to consider when completing the business interruption & extra expense worksheet total salaries and wages of officers, executives and employees whose services would be retained during suspension of business operations compensation insurance premiums, social security, unemployment insurance and. Tenant shall maintain loss of income, business interruption and extra expense insurance in such amounts as. The net result or goal of business interruption coverage is to make the business whole should a covered event occur. Extra expense coverage is usually purchased with a business interruption policy to cover other types of expenses that a business interruption won’t cover. Extra expense insurance is a form of commercial insurance that pays for a policyholder’s additional costs while recovering from a major disruption.

Source: thatahdiz.blogspot.com

Source: thatahdiz.blogspot.com

Finally, extra expense coverage applies as a component of business interruption insurance so that cost incurred to maintain operations can be recovered during the period of restoration. Payroll and utility bills, when the business is unable to operate for an extended period of time because of a fire, or other type of loss as specified in the policy. Tips to consider when completing the business interruption & extra expense worksheet moving expenses assume that operations will be shut down for at least a year after an earthquake review your business interruption & extra expense insurance every year; The bottom line is that. Extra expense coverage is a type of insurance that can be added to your commercial property policy for business interruption.

Source: adjustersinternational.com

Source: adjustersinternational.com

Property but entities should also have business interruption coverage to pay for lost profits, operating expenses, and extra expenses while restoring operations. This insurance is extended to cover, in accordance with its limits and conditions, the extra expenses necessarily incurred by the insured, without exceeding two consecutive weeks, when as a direct result of a loss caused by the perils insured, The period of restoration is a time that begins when a loss occurs and ends when operations are returned to normal and business operations resume. Extra expense, however, is an additional coverage that is added to enhance business interruption (bi), just like some of the other additional coverages commonly available (e.g. Business income and extra expense (biee) insurance helps cover the costs to your business when a covered event, such as a storm or a fire, forces you to temporarily close operations.

Source: allanmanning.com

Source: allanmanning.com

This insurance is extended to cover, in accordance with its limits and conditions, the extra expenses necessarily incurred by the insured, without exceeding two consecutive weeks, when as a direct result of a loss caused by the perils insured, Property but entities should also have business interruption coverage to pay for lost profits, operating expenses, and extra expenses while restoring operations. Business interruption lessee shall obtain and maintain loss of income and extra expense insurance in amounts as will reimburse lessee for direct or indirect loss of earnings attributable to all perils commonly insured against by prudent lessees in the business of lessee or attributable to prevention of access to the premises as a result of such perils. Business interruption insurance & extra expense claim support | rollins accounting & inventory services. Interruption by order of authorities.

Source: anchin.com

Source: anchin.com

Business interruption and extra expense insurance definition like poe, business interruption insurance (bii) gives you peace of mind. Cbi, service interruption, epi, etc.). Payroll and utility bills, when the business is unable to operate for an extended period of time because of a fire, or other type of loss as specified in the policy. This helps replace your income and covered expenses like rent, payroll and other financial responsibilities. Extra expense, however, is an additional coverage that is added to enhance business interruption (bi), just like some of the other additional coverages commonly available (e.g.

Source: irmi.com

Source: irmi.com

Business income and extra expense. Finally, extra expense coverage applies as a component of business interruption insurance so that cost incurred to maintain operations can be recovered during the period of restoration. Extra expense coverage pays for expenses that are above and beyond a business’s normal operating costs. This type of policy gives you protection for up to 12 months while business income and extra expense coverage only provides protection for 3 months. In fact, “expense to reduce” is not really a separate coverage.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title business interruption insurance extra expense by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Claims vs occurrence based insurance Idea

- Cheap tablet insurance Idea

- Calling insurance leads Idea

- Disability insurance for postal workers Idea

- Business insurance peoria il information

- Bright health insurance reviews Idea

- Carrier liability vs cargo insurance Idea

- Can you insure a written off car Idea

- Can convicted felons get life insurance information

- Car insurance administrator Idea