Business interruption insurance policy in india information

Home » Trend » Business interruption insurance policy in india informationYour Business interruption insurance policy in india images are available in this site. Business interruption insurance policy in india are a topic that is being searched for and liked by netizens today. You can Find and Download the Business interruption insurance policy in india files here. Find and Download all royalty-free images.

If you’re looking for business interruption insurance policy in india images information connected with to the business interruption insurance policy in india topic, you have visit the right site. Our website frequently gives you hints for downloading the highest quality video and picture content, please kindly hunt and locate more enlightening video content and images that fit your interests.

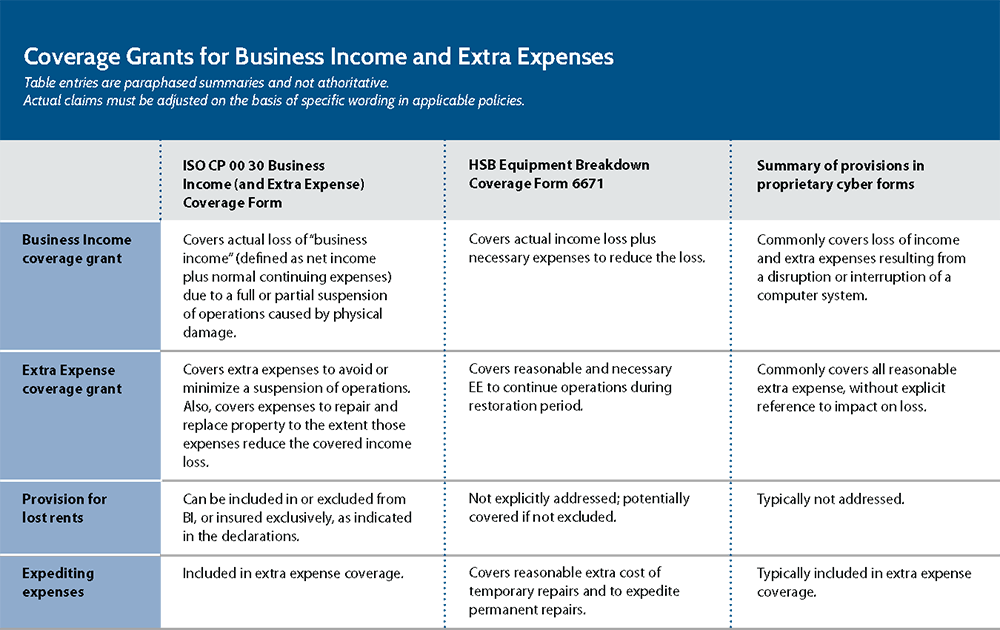

Business Interruption Insurance Policy In India. Let us look at some of the types of commercial insurance available in india that can help minimise and handle various risks related to businesses. These policy provide financial relief only if the. These policies are also called loss of profit insurance or consequential loss policies. Policy the policy form given at annexure i consist of:

business interruption insurance Aaxel Insurance From aaxelinsurance.com

business interruption insurance Aaxel Insurance From aaxelinsurance.com

Repair of minor damage 8 a.5.1.5. India, as a country is in a nascent stage of adoption of insurance. For individuals, their medical insurance policies generally cover all hospitalisations, barring those excluded. It offers protection to the net profit, standing charges, and an increase in the cost of working to maintain normal output or turnover. These policy provide financial relief only if the. Insurers are also likely to face liability due to event cancellations.

Mega risks insurance policy wording general insurance kotak mahindra general insurance company ltd.

India, as a country is in a nascent stage of adoption of insurance. A bi insurance in india can be taken by simultaneously and conjointly subscribing to a fire insurance or a property coverage insurance which will thereby indemnify both the property damage caused due to the fire (or flood or earthquake etc.) and the resultant operational interruption of a business. What is business interruption insurance insurance is a legal arrangement between two parties, namely, the insurer and insuree wherein the former indemnifies the losses incurred to the insuree on a happening of a contingent event. Rights of the insurer in case of a loss 7 a.5.1.4. Business interruption insurance indemnifies the insured for loss arsing out of or connected to trading loss and expenses, normally suffered as a result of physical damage to the insured property and normally forms part of a wider composite insurance such as a property all risks insurance. Business interruption insurance (also known as fire loss of profit or f.l.o.p.) covers the loss of income that a business suffers after a fire or a natural disaster while its facility is either closed or in the process of being rebuilt after it.

Source: aaxelinsurance.com

Source: aaxelinsurance.com

Mega risks insurance policy wording general insurance kotak mahindra general insurance company ltd. Business interruption insurance (also known as fire loss of profit or f.l.o.p.) covers the loss of income that a business suffers after a fire or a natural disaster while its facility is either closed or in the process of being rebuilt after it. “normal physical damage policies, covering perils like fire and catastrophic or act of god perils like flood and earthquakes, are sold widely.” It offers protection to the net profit, standing charges, and an increase in the cost of working to maintain normal output or turnover. However, most indian corporates do not have.

Source: gafarrell.com

Source: gafarrell.com

Ltd., business interruption policies are not widely sold in india. These policy provide financial relief only if the. Contingent business interruption insurance protects against the loss of prospective earnings because of the interruption of the insured�s business caused by an insured peril to property that the insured does not own, operate, or control. In india, business interruption cover is sold in the form of a ‘loss of profit’ policy, which provides compensation for a shutdown of plant and machinery. Business interruption insurance (also known as fire loss of profit or f.l.o.p.) covers the loss of income that a business suffers after a fire or a natural disaster while its facility is either closed or in the process of being rebuilt after it.

Source: adjustersinternational.com

Source: adjustersinternational.com

Policy the policy form given at annexure i consist of: Let us look at some of the types of commercial insurance available in india that can help minimise and handle various risks related to businesses. Overall sum insured of rs.50 crores and above in one or more locations in india shall be eligible for industrial all risks policy. What is business interruption insurance insurance is a legal arrangement between two parties, namely, the insurer and insuree wherein the former indemnifies the losses incurred to the insuree on a happening of a contingent event. It protects net profits, increase in cost of working and standing charges to sustain a normal turnover.

Source: pscconnect.com.au

Source: pscconnect.com.au

Payroll and utility bills, when the business is unable to operate for an extended period of time because of a fire, or other type of loss as specified in the policy. “normal physical damage policies, covering perils like fire and catastrophic or act of god perils like flood and earthquakes, are sold widely.” This coverage typically pays for lost net profit, standing charges, and an increase in working cost to maintain output during the indemnity (loss) period. In india, business interruption cover is sold in the form of a ‘loss of profit’ policy, which provides compensation for a shutdown of plant and machinery. In india, business interruption insurance is not sold on a standalone basis and is covered as a part of the aforementioned policies.

Source: swoperodante.com

Source: swoperodante.com

As far as ‘business interruption’ insurance is considered, most of the policies in india cover bi triggered by property damage. It protects net profits, increase in cost of working and standing charges to sustain a normal turnover. These policies are also called loss of profit insurance or consequential loss policies. Let us look at some of the types of commercial insurance available in india that can help minimise and handle various risks related to businesses. What is business interruption insurance insurance is a legal arrangement between two parties, namely, the insurer and insuree wherein the former indemnifies the losses incurred to the insuree on a happening of a contingent event.

Source: youtube.com

Source: youtube.com

However, most indian corporates do not have. In india, business interruption cover is sold in the form of a ‘loss of profit’ policy, which provides compensation for a shutdown of plant and machinery. Overall sum insured of rs.50 crores and above in one or more locations in india shall be eligible for industrial all risks policy. These policies are also called loss of profit insurance or consequential loss policies. “fire and special perils policy”, “material damage policy”, “all.

Source: justicecounts.com

Source: justicecounts.com

It is a contract of indemnity which is based on the principle of utmost good faith. Let us look at some of the types of commercial insurance available in india that can help minimise and handle various risks related to businesses. Stempel, stempel on insurance contracts § 24.02 [d] (2007 supp.) (stating that. “normal physical damage policies, covering perils like fire and catastrophic or act of god perils like flood and earthquakes, are sold widely.” A palpable recourse for companies is to rely on business interruption (bi) insurance to recover the losses of business income during this crisis.

Source: webberinsurance.com.au

Source: webberinsurance.com.au

A palpable recourse for companies is to rely on business interruption (bi) insurance to recover the losses of business income during this crisis. It is a contract of indemnity which is based on the principle of utmost good faith. Repair of minor damage 8 a.5.1.5. Business interruption insurance policy in india.a bi insurance in india can be taken by simultaneously and conjointly subscribing to a fire insurance or a property coverage insurance which will thereby indemnify both the property damage caused due to the fire (or flood or earthquake etc.) and the resultant operational interruption of a business. Contingent business interruption insurance protects against the loss of prospective earnings because of the interruption of the insured�s business caused by an insured peril to property that the insured does not own, operate, or control.

Source: patriotsoftware.com

Source: patriotsoftware.com

Let us look at some of the types of commercial insurance available in india that can help minimise and handle various risks related to businesses. Currently, bi applies only in cases where a company has suffered physical damage to the insured property by perils covered in the policy. Insurers are also likely to face liability due to event cancellations. Mega risks insurance policy wording general insurance kotak mahindra general insurance company ltd. For individuals, their medical insurance policies generally cover all hospitalisations, barring those excluded.

Source: pscconnect.com.au

Source: pscconnect.com.au

Business interruption insurance (also known as fire loss of profit or f.l.o.p.) covers the loss of income that a business suffers after a fire or a natural disaster while its facility is either closed or in the process of being rebuilt after it. It is a contract of indemnity which is based on the principle of utmost good faith. “normal physical damage policies, covering perils like fire and catastrophic or act of god perils like flood and earthquakes, are sold widely.” Business interruption policies cover financial losses due to stoppage of work, which follows a physical damage either due to risks covered under a fire insurance or under a machinery breakdown insurance. Shopkeepers’ insurance policy is an ideal choice for retail.

Source: slideshare.net

Source: slideshare.net

Policy the policy form given at annexure i consist of: These policy provide financial relief only if the. Business interruption insurance indemnifies the insured for loss arsing out of or connected to trading loss and expenses, normally suffered as a result of physical damage to the insured property and normally forms part of a wider composite insurance such as a property all risks insurance. This coverage typically pays for lost net profit, standing charges, and an increase in working cost to maintain output during the indemnity (loss) period. Payroll and utility bills, when the business is unable to operate for an extended period of time because of a fire, or other type of loss as specified in the policy.

Source: slideshare.net

Source: slideshare.net

Property insurance policy, popularly called as fire insurance in india, only covers Contingent business interruption insurance protects against the loss of prospective earnings because of the interruption of the insured�s business caused by an insured peril to property that the insured does not own, operate, or control. Business interruption policies cover financial losses due to stoppage of work, which follows a physical damage either due to risks covered under a fire insurance or under a machinery breakdown insurance. Policy the policy form given at annexure i consist of: It is a contract of indemnity which is based on the principle of utmost good faith.

Source: iii.org

Source: iii.org

Rights of the insurer in case of a loss 7 a.5.1.4. These policies provide a safety net to business owners in case of any problem. Rights of the insurer in case of a loss 7 a.5.1.4. Payroll and utility bills, when the business is unable to operate for an extended period of time because of a fire, or other type of loss as specified in the policy. What is business interruption insurance insurance is a legal arrangement between two parties, namely, the insurer and insuree wherein the former indemnifies the losses incurred to the insuree on a happening of a contingent event.

Source: diamondlaw.ca

Source: diamondlaw.ca

Property insurance policy, popularly called as fire insurance in india, only covers It protects net profits, increase in cost of working and standing charges to sustain a normal turnover. Property insurance policy, popularly called as fire insurance in india, only covers What is business interruption insurance insurance is a legal arrangement between two parties, namely, the insurer and insuree wherein the former indemnifies the losses incurred to the insuree on a happening of a contingent event. Payroll and utility bills, when the business is unable to operate for an extended period of time because of a fire, or other type of loss as specified in the policy.

Source: iii.org

Source: iii.org

These policies are also called loss of profit insurance or consequential loss policies. However, most indian corporates do not have. Ltd., business interruption policies are not widely sold in india. Mega risks insurance policy wording general insurance kotak mahindra general insurance company ltd. It is a contract of indemnity which is based on the principle of utmost good faith.

Source: einsurance.com

Source: einsurance.com

Overall sum insured of rs.50 crores and above in one or more locations in india shall be eligible for industrial all risks policy. These policy provide financial relief only if the. “normal physical damage policies, covering perils like fire and catastrophic or act of god perils like flood and earthquakes, are sold widely.” Repair of minor damage 8 a.5.1.5. Business interruption policies cover financial losses due to stoppage of work, which follows a physical damage either due to risks covered under a fire insurance or under a machinery breakdown insurance.

Source: lordsinsuranceservices.com.au

Source: lordsinsuranceservices.com.au

Business interruption insurance policy in india.a bi insurance in india can be taken by simultaneously and conjointly subscribing to a fire insurance or a property coverage insurance which will thereby indemnify both the property damage caused due to the fire (or flood or earthquake etc.) and the resultant operational interruption of a business. In india, business interruption cover is sold in the form of a ‘loss of profit’ policy, which provides compensation for a shutdown of plant and machinery. Business interruption insurance (also known as fire loss of profit or f.l.o.p.) covers the loss of income that a business suffers after a fire or a natural disaster while its facility is either closed or in the process of being rebuilt after it. Policy the policy form given at annexure i consist of: Payroll and utility bills, when the business is unable to operate for an extended period of time because of a fire, or other type of loss as specified in the policy.

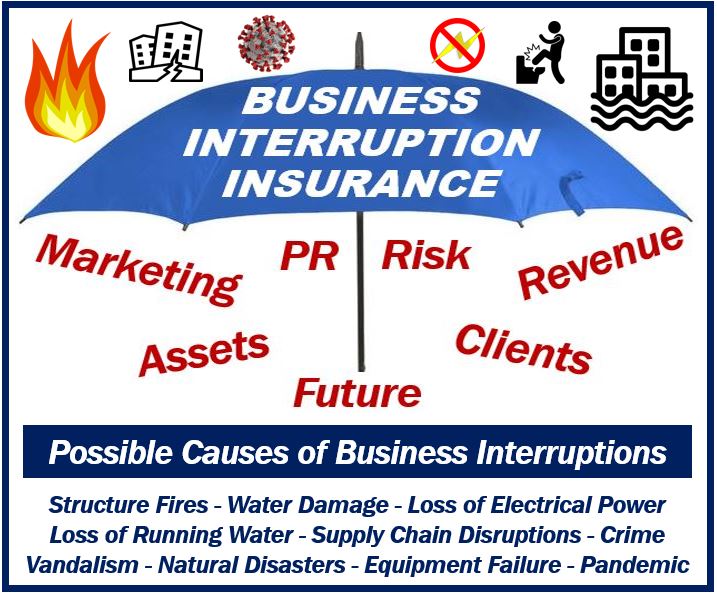

Source: marketbusinessnews.com

Source: marketbusinessnews.com

For individuals, their medical insurance policies generally cover all hospitalisations, barring those excluded. Payroll and utility bills, when the business is unable to operate for an extended period of time because of a fire, or other type of loss as specified in the policy. Let us look at some of the types of commercial insurance available in india that can help minimise and handle various risks related to businesses. Insurers are also likely to face liability due to event cancellations. Stempel, stempel on insurance contracts § 24.02 [d] (2007 supp.) (stating that.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title business interruption insurance policy in india by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Craft insurance arab al Idea

- Colonial life insurance claims Idea

- Business insurance and benefits information

- Deans and homer insurance Idea

- Crown cost without insurance information

- Delmonico insurance syracuse ny Idea

- Department of insurance and financial services michigan duties information

- Cost of eye exam with insurance Idea

- Cashless hospital list under national insurance company Idea

- Crowel insurance agency information