Business laptop insurance cover Idea

Home » Trending » Business laptop insurance cover IdeaYour Business laptop insurance cover images are available. Business laptop insurance cover are a topic that is being searched for and liked by netizens today. You can Download the Business laptop insurance cover files here. Get all royalty-free photos.

If you’re searching for business laptop insurance cover pictures information related to the business laptop insurance cover keyword, you have pay a visit to the ideal blog. Our site always provides you with suggestions for refferencing the highest quality video and image content, please kindly search and locate more enlightening video articles and images that match your interests.

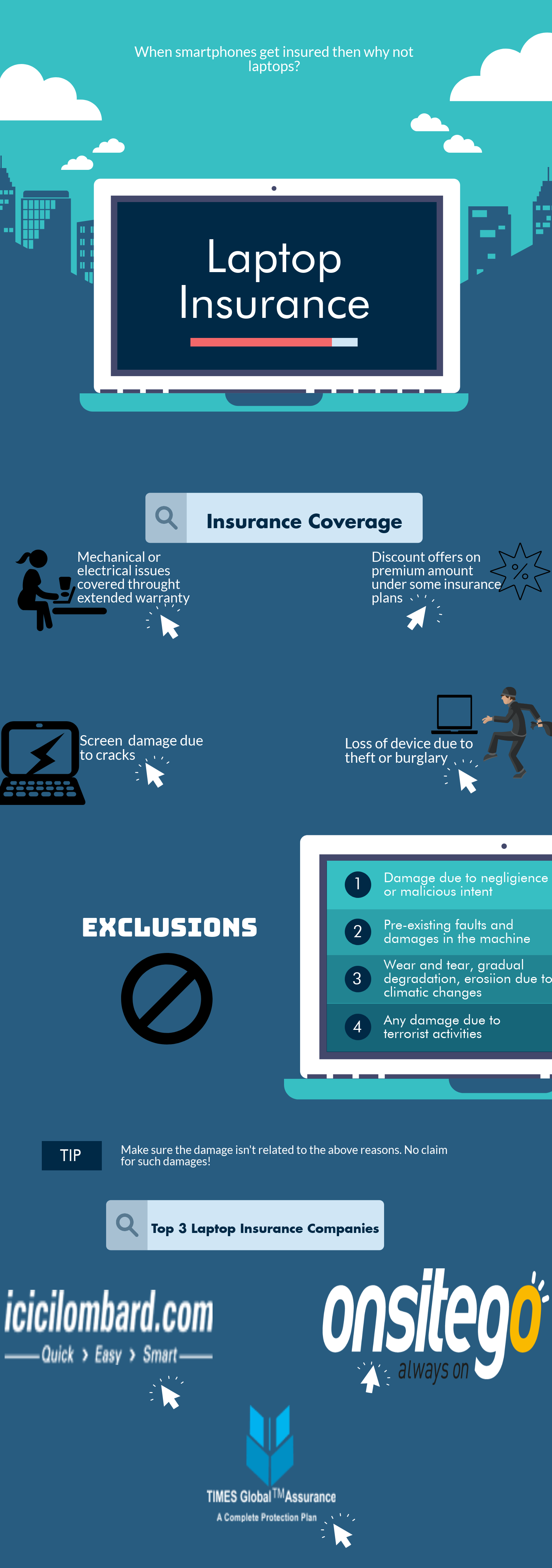

Business Laptop Insurance Cover. Contents insurance will cover your laptop as long as it is inside your home; Fire and lighning, explosions, vandalism, falling objects, freezing, theft, smoke, volcanic eruption, windstorm and hail, damage by aircraft or vehicle, and civil unrest. You can still purchase an insurance2go policy, and we will cover risks such as damage, loss and theft, which are not covered by your manufacturer. Laptop insurance covers common perils that extend beyond standard homeowners insurance and manufacturers’ warranties.

Laptop Business FB Cover Photo ADVERTISEMENT Freelancer From freelancer.com

Laptop Business FB Cover Photo ADVERTISEMENT Freelancer From freelancer.com

Power surges due to lightning. Business income insurance, which helps replace lost income if you can’t run your business because of covered property damage, like. We cover many kinds of business equipment, so for example, if you’re looking for macbook pro insurance, as long as it’s business equipment this is the place to come. Get enough laptop insurance coverage that you will require. Purchase the best laptop insurance and warranty plan for all brands and models of microsoft surface, dell, hp, lenovo, samsung, acer, asus, and other manufacturers including gaming laptops. You are covered for repair (or replacement if we can not repair) of your laptop if a breakdown happens outside of.

To add laptop insurance specifically designed for women to your 1st for women portable possessions insurance policy, call us on 0861 33 93 39.

However, if you plan to take your laptop other places with you, personal possessions cover could provide cover outside your home. Accidents happen, we get that. Business income insurance, which helps replace lost income if you can’t run your business because of covered property damage, like. A laptop charger insurance policy can only be purchased within 30 days of buying the laptop/laptop charger. Fire and lighning, explosions, vandalism, falling objects, freezing, theft, smoke, volcanic eruption, windstorm and hail, damage by aircraft or vehicle, and civil unrest. This is typically the replacement cost of your laptop at the time you purchased it.

Source: effectivecoverage.com

Source: effectivecoverage.com

An excess fee of r500 is payable for any laptop claim. For example, you will not be covered if your laptop is stolen. The original date of purchase, as mentioned in the invoice, will be considered as the date of purchase. Power surges due to lightning. Companies generally offer a range you may choose from, but a typical deductible is $25.

Source: proinsgrp.com

Source: proinsgrp.com

These include power surges, spills, theft, accidents, vandalism, and damage. Companies generally offer a range you may choose from, but a typical deductible is $25. Business income insurance, which helps replace lost income if you can’t run your business because of covered property damage, like. Almost all small computer programmers business should have enough professional liability insurance to cover an individual claim of $25,000, with annual cover of $50,000. This covers replacing your laptop if you accidentally lose it, although it may cost extra to add this to your policy.

Source: slideshare.net

Source: slideshare.net

The minimum policy term is usually a year. Protection for the whole brood. If the charger is older than 30 days and not insured, then coverage isn’t applicable. Laptop insurance covers common perils that extend beyond standard homeowners insurance and manufacturers’ warranties. The insurance policy broadly covers material damage to electronic equipment (which can include systems software) due to sudden and unforeseen events, cost of external data media, including cost of reconstruction of data, as also increased cost of working.

Source: debenhamsgadgetinsurance.com

Source: debenhamsgadgetinsurance.com

Fire and lighning, explosions, vandalism, falling objects, freezing, theft, smoke, volcanic eruption, windstorm and hail, damage by aircraft or vehicle, and civil unrest. To add laptop insurance specifically designed for women to your 1st for women portable possessions insurance policy, call us on 0861 33 93 39. For example, you will not be covered if your laptop is stolen. Accidents happen, we get that. Business insurance coverage can help protect your electronics business from various risks and damages.

Source: coroflot.com

Source: coroflot.com

Some insurers include extra cover for business gadgets, like commercial use or free data storage. A laptop charger insurance policy can only be purchased within 30 days of buying the laptop/laptop charger. These include power surges, spills, theft, accidents, vandalism, and damage. Contents insurance will cover your laptop as long as it is inside your home; Laptop accidental damage insurance covers things like cracked screens, dropping your laptop or liquid damage caused by spills.

Source: theaccountancy.co.uk

Source: theaccountancy.co.uk

Accidents happen, we get that. If it�s worth more than £1,000 (or thereabouts, it varies between providers) you�ll need to specify it separately to get cover. Contents insurance will cover your laptop as long as it is inside your home; To add laptop insurance specifically designed for women to your 1st for women portable possessions insurance policy, call us on 0861 33 93 39. Almost all small computer programmers business should have enough professional liability insurance to cover an individual claim of $25,000, with annual cover of $50,000.

Source: pinterest.com

Source: pinterest.com

Contents insurance will cover your laptop as long as it is inside your home; We cover many kinds of business equipment, so for example, if you’re looking for macbook pro insurance, as long as it’s business equipment this is the place to come. See the table in the cost of computer programmers insurance section below for average prices of professional liability insurance for your computer programmers operations. With our specialist business gadget insurance cover, you can protect your valuable assets including mobiles, laptops, tablets and even desktop pcs. These include power surges, spills, theft, accidents, vandalism, and damage.

Source: onlineaccountopen.in

Source: onlineaccountopen.in

Water damage (including liquid spills and submersion) damage from dropping or stepping on your laptop. Some insurers include extra cover for business gadgets, like commercial use or free data storage. However, if you plan to take your laptop other places with you, personal possessions cover could provide cover outside your home. Get enough laptop insurance coverage that you will require. It is an all risk policy.

Source: freelancer.com

Source: freelancer.com

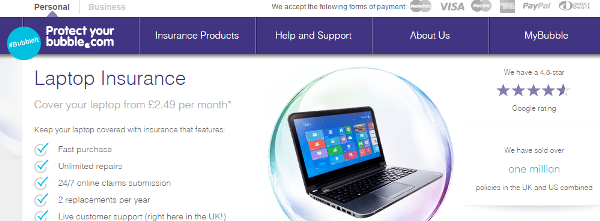

The minimum policy term is usually a year. We cover many kinds of business equipment, so for example, if you’re looking for macbook pro insurance, as long as it’s business equipment this is the place to come. Our insurance covers theft on every policy. The original date of purchase, as mentioned in the invoice, will be considered as the date of purchase. The minimum policy term is usually a year.

Source: turtlemint.com

Source: turtlemint.com

You can usually cover your laptop as part of your home insurance. Our insurance covers theft on every policy. It covers mostly all models of laptop manufacturers like apple, hp, dell, lenovo, acer, sony, samsung, and toshiba, etc. Business policies only cover loss or damage to gadgets used by you or your employees for work. Covered against theft, and damage caused by lightning and flood under your house contents.

Source: paisabazaar.com

Source: paisabazaar.com

Personal possessions cover will cover your laptop when it is, outside the home up to a value of £1,500. Laptop insurance covers common perils that extend beyond standard homeowners insurance and manufacturers’ warranties. A contents or single item insurance policy can cover your laptop for loss or damage as a result of the following: You can still purchase an insurance2go policy, and we will cover risks such as damage, loss and theft, which are not covered by your manufacturer. Electrical and mechanical breakdowns are also covered;

Source: bizcover.com.au

Source: bizcover.com.au

Our laptop insurance quotes are based on the value of your laptop. The minimum policy term is usually a year. Commercial property insurance, which covers the place where you do business and the tools you use, like computer equipment and office furniture. See the table in the cost of computer programmers insurance section below for average prices of professional liability insurance for your computer programmers operations. These include power surges, spills, theft, accidents, vandalism, and damage.

Source: insurancebee.com

Source: insurancebee.com

The minimum policy term is usually a year. They do not cover stock, for example if you own a shop selling electronics. You are covered for repair (or replacement if we can not repair) of your laptop if a breakdown happens outside of. Some insurers include extra cover for business gadgets, like commercial use or free data storage. However, if you plan to take your laptop other places with you, personal possessions cover could provide cover outside your home.

Source: lflinsurance.com

Source: lflinsurance.com

Electrical and mechanical breakdowns are also covered; If it�s worth more than £1,000 (or thereabouts, it varies between providers) you�ll need to specify it separately to get cover. We can cover you for: You are covered for repair (or replacement if we can not repair) of your laptop if a breakdown happens outside of. Get enough laptop insurance coverage that you will require.

Source: techradar.com

Source: techradar.com

You can still purchase an insurance2go policy, and we will cover risks such as damage, loss and theft, which are not covered by your manufacturer. Almost all small computer programmers business should have enough professional liability insurance to cover an individual claim of $25,000, with annual cover of $50,000. These include power surges, spills, theft, accidents, vandalism, and damage. Laptop accidental damage insurance covers things like cracked screens, dropping your laptop or liquid damage caused by spills. We can cover you for:

Source: ampercent.com

Source: ampercent.com

We cover your laptop outside of your home and whilst abroad, whether on holiday or with you on your studies. You should determine how much coverage you require for your home laptop or pc, as well as. Purchase the best laptop insurance and warranty plan for all brands and models of microsoft surface, dell, hp, lenovo, samsung, acer, asus, and other manufacturers including gaming laptops. Protection for the whole brood. Laptop insurance covers common perils that extend beyond standard homeowners insurance and manufacturers’ warranties.

Source: squaretrade.com

Source: squaretrade.com

See the table in the cost of computer programmers insurance section below for average prices of professional liability insurance for your computer programmers operations. For example, you will not be covered if your laptop is stolen. At a basic level, it�ll only cover your laptop in your home. You can usually cover your laptop as part of your home insurance. The original date of purchase, as mentioned in the invoice, will be considered as the date of purchase.

Source: e-michiganinsurance.com

Source: e-michiganinsurance.com

Power surges due to lightning. Laptop accidental damage insurance covers things like cracked screens, dropping your laptop or liquid damage caused by spills. Covered against theft, and damage caused by lightning and flood under your house contents. The minimum policy term is usually a year. It covers mostly all models of laptop manufacturers like apple, hp, dell, lenovo, acer, sony, samsung, and toshiba, etc.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title business laptop insurance cover by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Claims vs occurrence based insurance Idea

- Cheap tablet insurance Idea

- Calling insurance leads Idea

- Disability insurance for postal workers Idea

- Business insurance peoria il information

- Bright health insurance reviews Idea

- Carrier liability vs cargo insurance Idea

- Can you insure a written off car Idea

- Can convicted felons get life insurance information

- Car insurance administrator Idea