Business liability insurance canada information

Home » Trending » Business liability insurance canada informationYour Business liability insurance canada images are available in this site. Business liability insurance canada are a topic that is being searched for and liked by netizens now. You can Get the Business liability insurance canada files here. Get all royalty-free vectors.

If you’re looking for business liability insurance canada images information connected with to the business liability insurance canada interest, you have visit the right blog. Our site always provides you with suggestions for refferencing the highest quality video and image content, please kindly surf and locate more enlightening video articles and images that match your interests.

Business Liability Insurance Canada. We also offer a few other types of insurance to help protect your business. Is liability insurance a legal requirement in canada? For over 40 years, our business liability insurance brokers have been working with canadian professionals and companies to help them protect their financial security. Business insurance should cost anywhere from $741 a month with a median price of $428 per month.

Liability Insurance Law in Canada, 6th Edition From store.lexisnexis.ca

Liability Insurance Law in Canada, 6th Edition From store.lexisnexis.ca

Legally, you don’t need liability insurance to operate your business in canada. Is liability insurance a legal requirement in canada? General liability insurance is for businesses of all sizes. Directors and officers liability insurance, also known as management liability insurance, covers damages involving wrongful acts committed in the discharge of your duties, including: Business liability insurance broker for canadian businesses click here for a business liability insurance quote today! Negligence, misconduct, errors and omissions, breach of duty, misleading statements or any other act that could be held against you in your capacity as a director or officer.

Is liability insurance a legal requirement in canada?

Directors and officers liability insurance, also known as management liability insurance, covers damages involving wrongful acts committed in the discharge of your duties, including: It pays for legal costs and damages if you�re found to be liable for a person�s injuries and/or damage to their property. For over 40 years, our business liability insurance brokers have been working with canadian professionals and companies to help them protect their financial security. Save up to 35% on your insurance Speak with a broker to find a policy to suit your specific business needs. Join over 100,000 businesses that have trusted us!

Source: indiebusinessnetwork.com

Source: indiebusinessnetwork.com

Legally, you don’t need liability insurance to operate your business in canada. For over 40 years, our business liability insurance brokers have been working with canadian professionals and companies to help them protect their financial security. Liability insurance for an organization, employees and/or volunteers helps protect the organization from financial risk. Is liability insurance a legal requirement in canada? Your business is unique, and coverage requirements will vary.

Source: surveymonkey.com

Source: surveymonkey.com

The cost can vary depending on a variety of factors, including: Our liability insurance protects canadian small businesses if they’re sued for causing an injury or property damage to a third party due to negligent acts. Liability insurance for your business operations is an essential form of coverage. Although, some policies cost over $1,000 a year. For over 40 years, our business liability insurance brokers have been working with canadian professionals and companies to help them protect their financial security.

Source: ajg.com

Source: ajg.com

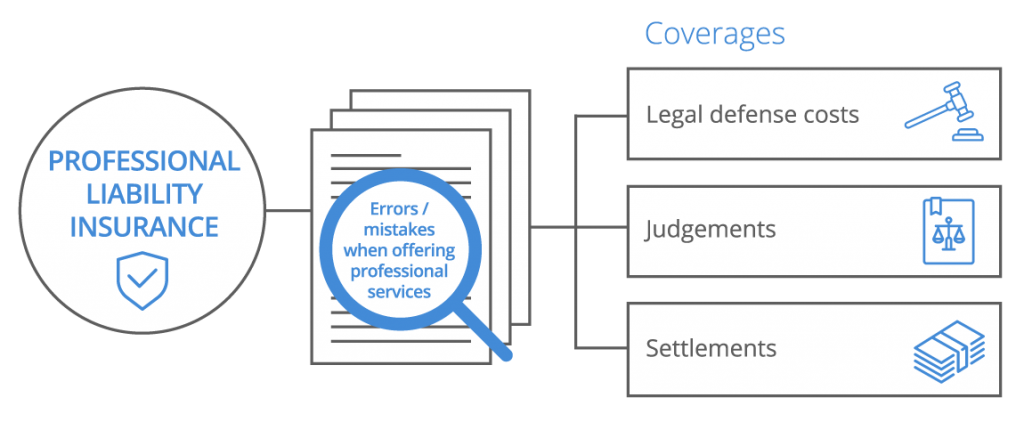

Business liability is ideal for it professionals, electricians, other repair or technical services. However, you’re typically at a higher risk of liability than others as a business owner. Having the right insurance is essential for a business to survive and thrive in a marketplace that is full of both opportunity and risk. Business liability insurance provides coverage for the financial costs associated with unforeseen events such as damage caused to third parties, accusations of professional negligence or defective products. Directors and officers liability insurance, also known as management liability insurance, covers damages involving wrongful acts committed in the discharge of your duties, including:

Source: pinterest.es

Source: pinterest.es

Coverage to protect you in case of lawsuits for bodily or mental injury and property damage, personal and advertising injury liability, tenant’s property damage liability and voluntary medical payments. Since every business has unique needs, every policy will be slightly different. Business liability is ideal for it professionals, electricians, other repair or technical services. Directors and officers liability insurance, also known as management liability insurance, covers damages involving wrongful acts committed in the discharge of your duties, including: Represent your client’s business to other companies.

Source: pinterest.com

Source: pinterest.com

Speak with a broker to find a policy to suit your specific business needs. The cost can vary depending on a variety of factors, including: Your business is unique, and coverage requirements will vary. General liability insurance is for businesses of all sizes. However, there are certain coverages most small business will need, and liability is one of those coverages.

Source: slideshare.net

Source: slideshare.net

Liability incidents can take a matter of moments to happen and months upon months for you and your business to recover. Join over 100,000 businesses that have trusted us! If you’re shopping around for business liability insurance in canada, look no further than rogers insurance. Business insurance should cost anywhere from $741 a month with a median price of $428 per month. Directors and officers liability insurance, also known as management liability insurance, covers damages involving wrongful acts committed in the discharge of your duties, including:

Source: tcim.ca

Source: tcim.ca

Legally, you don’t need liability insurance to operate your business in canada. Our liability insurance protects canadian small businesses if they’re sued for causing an injury or property damage to a third party due to negligent acts. General liability insurance is for businesses of all sizes. Liability insurance for an organization, employees and/or volunteers helps protect the organization from financial risk. We also offer a few other types of insurance to help protect your business.

Source: slideshare.net

Source: slideshare.net

Since every business has unique needs, every policy will be slightly different. Liability insurance for all types of small businesses in ontario thinkinsure serves a wide range of ontario small businesses from retail to manufacturing to consulting, and more. General liability insurance is for businesses of all sizes. Speak with a broker to find a policy to suit your specific business needs. Should a lawsuit or claim be brought against you or your company, a business liability insurance policy will protect you from losses as a result of litigation costs as well as any applicable payouts that may ensue.

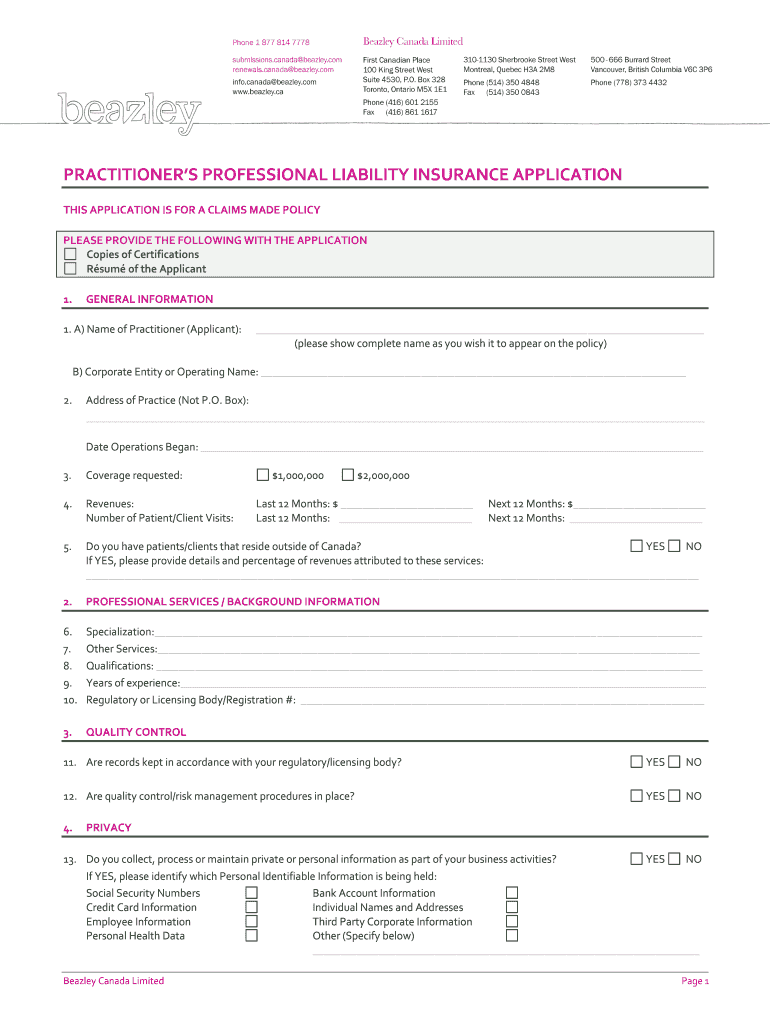

Source: uslegalforms.com

Source: uslegalforms.com

The median cost of general liability insurance (commercial general liability or cgl) ranges from $425 to $921, and the annual average cost ranges from $483 to $2,758. Small business liability insurance canada has grown rapidly in popularity within the country as a part of general insurance being provided by many leading insurance companies. Liability insurance for all types of small businesses in ontario thinkinsure serves a wide range of ontario small businesses from retail to manufacturing to consulting, and more. General liability insurance policies can be tailored to businesses of all sizes. Coverage to protect you in case of lawsuits for bodily or mental injury and property damage, personal and advertising injury liability, tenant’s property damage liability and voluntary medical payments.

Source: professionalscoverage.ca

Source: professionalscoverage.ca

We also offer a few other types of insurance to help protect your business. However, there are certain coverages most small business will need, and liability is one of those coverages. Join over 100,000 businesses that have trusted us! Should a lawsuit or claim be brought against you or your company, a business liability insurance policy will protect you from losses as a result of litigation costs as well as any applicable payouts that may ensue. It pays for legal costs and damages if you�re found to be liable for a person�s injuries and/or damage to their property.

Source: store.lexisnexis.ca

Source: store.lexisnexis.ca

Business liability can cover architects, designers, wedding planners, etc. Keep reading to learn more about small business liability insurance and how it will protect you. Some businesses have higher liability risks than others. General liability insurance policies can be tailored to businesses of all sizes. Liability insurance for an organization, employees and/or volunteers helps protect the organization from financial risk.

Source: slideshare.net

Source: slideshare.net

Speak with a broker to find a policy to suit your specific business needs. It provides legal security to the owners of small businesses from the risk. Directors and officers liability insurance, also known as management liability insurance, covers damages involving wrongful acts committed in the discharge of your duties, including: It pays for legal costs and damages if you�re found to be liable for a person�s injuries and/or damage to their property. Comparing rates from canada’s leading business liability insurance companies commercial general liability insurance we provide property damage liability coverage if your product or an employee causes damage to someone else’s property.

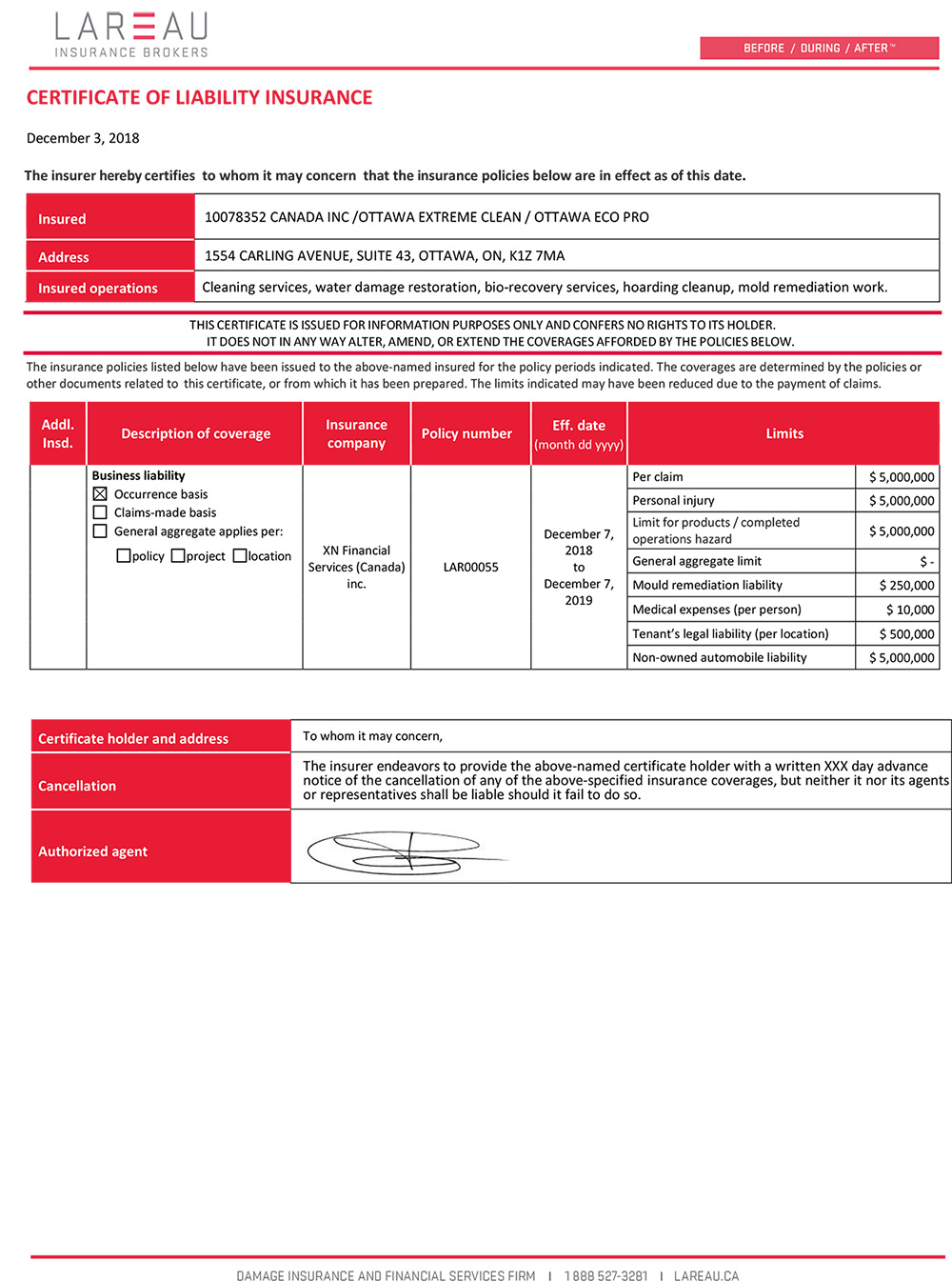

Source: ottawaextremeclean.com

Source: ottawaextremeclean.com

For example, someone slips and falls on your premises and decides to sue your business. Business insurance should cost anywhere from $741 a month with a median price of $428 per month. Liability incidents can take a matter of moments to happen and months upon months for you and your business to recover. Since every business has unique needs, every policy will be slightly different. Represent your client’s business to other companies.

Source: noclutter.cloud

Source: noclutter.cloud

We’re one of the largest and most trusted independent insurance brokerages in canada. An injury to a visitor in your home office or to a delivery person at. The cost can vary depending on a variety of factors, including: Liability incidents can take a matter of moments to happen and months upon months for you and your business to recover. Business insurance should cost anywhere from $741 a month with a median price of $428 per month.

Source: professionalscoverage.ca

Source: professionalscoverage.ca

Our liability insurance protects canadian small businesses if they’re sued for causing an injury or property damage to a third party due to negligent acts. We also offer a few other types of insurance to help protect your business. Business liability can cover architects, designers, wedding planners, etc. Business liability is ideal for it professionals, electricians, other repair or technical services. Should a lawsuit or claim be brought against you or your company, a business liability insurance policy will protect you from losses as a result of litigation costs as well as any applicable payouts that may ensue.

The cost can vary depending on a variety of factors, including: Your business is unique, and coverage requirements will vary. For over 40 years, our business liability insurance brokers have been working with canadian professionals and companies to help them protect their financial security. Join over 100,000 businesses that have trusted us! For example, someone slips and falls on your premises and decides to sue your business.

Source: slideshare.net

Source: slideshare.net

However, there are certain coverages most small business will need, and liability is one of those coverages. Bodily injury protection if your product or service causes damage to another person. Represent your client’s business to other companies. Business liability can cover architects, designers, wedding planners, etc. Should a lawsuit or claim be brought against you or your company, a business liability insurance policy will protect you from losses as a result of litigation costs as well as any applicable payouts that may ensue.

Source: youtube.com

Source: youtube.com

Should a lawsuit or claim be brought against you or your company, a business liability insurance policy will protect you from losses as a result of litigation costs as well as any applicable payouts that may ensue. It provides legal security to the owners of small businesses from the risk. The median cost of general liability insurance (commercial general liability or cgl) ranges from $425 to $921, and the annual average cost ranges from $483 to $2,758. Represent your client’s business to other companies. Save up to 35% on your insurance

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title business liability insurance canada by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Claims vs occurrence based insurance Idea

- Cheap tablet insurance Idea

- Calling insurance leads Idea

- Disability insurance for postal workers Idea

- Business insurance peoria il information

- Bright health insurance reviews Idea

- Carrier liability vs cargo insurance Idea

- Can you insure a written off car Idea

- Can convicted felons get life insurance information

- Car insurance administrator Idea