Business liability insurance colorado Idea

Home » Trending » Business liability insurance colorado IdeaYour Business liability insurance colorado images are available. Business liability insurance colorado are a topic that is being searched for and liked by netizens now. You can Get the Business liability insurance colorado files here. Get all royalty-free photos and vectors.

If you’re looking for business liability insurance colorado images information related to the business liability insurance colorado topic, you have come to the right blog. Our website frequently gives you suggestions for seeing the highest quality video and picture content, please kindly hunt and locate more informative video articles and images that fit your interests.

Business Liability Insurance Colorado. Property or bodily harm caused by your business; For most colorado businesses, a general liability insurance policy is a wise investment, particularly if you work with the public. There are four types that you may fit your needs: This insurance will cover your employees� medical bills and lost wages if they get injured while on the job.

.JPG “General Liability Insurance Colorado Affordable”) General Liability Insurance Colorado Affordable From orcuttgroup.com

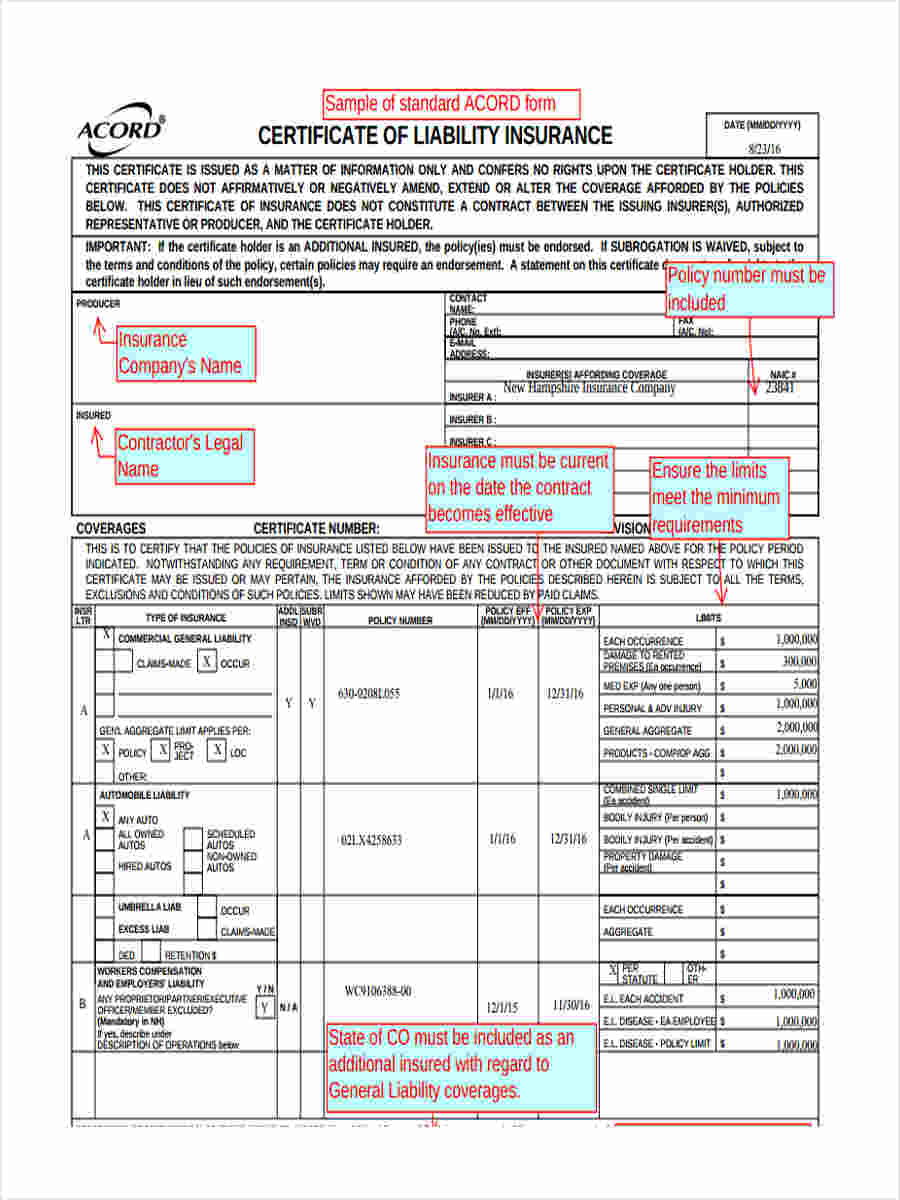

Commercial liability insurance (also called business liability insurance and commercial general liability insurance) protects your colorado business from financial loss resulting from claims of injury or damage cause to others by you or your employees. Get your tailored policy online in 5 min. For most colorado businesses, a general liability insurance policy is a wise investment, particularly if you work with the public. 3 the colorado department of regulatory agencies (dora) strongly. You may also need a certificate of liability insurance if you want to secure large contracts with vendors and clients. General liability insurance, also known as “commercial liability insurance” or business liability insurance is a broad commercial policy that covers general liability exposures of a business.

You may also need a certificate of liability insurance if you want to secure large contracts with vendors and clients.

Protect yourself & your budget. You may also need a certificate of liability insurance if you want to secure large contracts with vendors and clients. The only way to effectively protect the assets of your business is to carry adequate commercial general liability (cgl) insurance coverage. Liability insurance should be a part of every direct market business to help reduce any possible legal and financial burdens that may arise from an injury or other claim brought against your business. Liability insurance for farmers markets and for vendors is important because it: This insurance will cover your employees� medical bills and lost wages if they get injured while on the job.

Source: orcuttgroup.com

Source: orcuttgroup.com

Errors and omissions insurance might be purchased by any number of professions to protect themselves against claims that professional services were not handled properly. Commercial liability insurance (also called business liability insurance and commercial general liability insurance) protects your colorado business from financial loss resulting from claims of injury or damage cause to others by you or your employees. Owning a business is a great accomplishment. Get your tailored policy online in 5 min. Get customized coverage + low monthly payments.

Source: orcuttgroup.com

Source: orcuttgroup.com

Get your tailored policy online in 5 min. Contact us today to find the best liability business insurance for. There are other risks that may be covered, including: Get your tailored policy online in 5 min. Protect your small business with a customized colorado business insurance policy through the progressive advantage® business program.

Source: professionalchoices.blogspot.com

Source: professionalchoices.blogspot.com

Ad get better business insurance policies, 100% online. Orcutt insurance group has been servicing, selling and issuing general liability policies in colorado. There are four types that you may fit your needs: Liability insurance for farmers markets and for vendors is important because it: 3 the colorado department of regulatory agencies (dora) strongly.

Source: orcuttgroup.com

Source: orcuttgroup.com

For most colorado businesses, a general liability insurance policy is a wise investment, particularly if you work with the public. Ad get better business insurance policies, 100% online. Ad get better business insurance policies, 100% online. The state of colorado requires all publically and privately owned businesses to have workers’ compensation insurance for all employees, automobile insurance for vehicles used by the company, and professional liability insurance for select professions (doctors and health professionals). Get your tailored policy online in 5 min.

Source: orcuttgroup.com

Source: orcuttgroup.com

Owning a business is a great accomplishment. Get customized coverage + low monthly payments. Ad get better business insurance policies, 100% online. General liability insurance, also known as “commercial liability insurance” or business liability insurance is a broad commercial policy that covers general liability exposures of a business. Contact us today to find the best liability business insurance for.

.JPG “Colorado Professional Liability Orcutt Insurance Group”) Source: orcuttgroup.com

Since 2004 our agency has been helping various business with general liability and all other insurance needs. Get a quote for a variety of commercial insurance coverages including general liability, professional liability, workers� compensation and more. Property or bodily harm caused by your business; Commercial liability insurance (also called business liability insurance and commercial general liability insurance) protects your colorado business from financial loss resulting from claims of injury or damage cause to others by you or your employees. Southern colorado insurance recommends that all businesses have colorado general liability insurance coverage in place.

.JPG “General Liability Insurance Colorado Affordable”) Source: orcuttgroup.com

There are other risks that may be covered, including: The only way to effectively protect the assets of your business is to carry adequate commercial general liability (cgl) insurance coverage. Get your tailored policy online in 5 min. Ad get better business insurance policies, 100% online. Cgl protects your business from damages caused by bodily injury or property damage for which your business is found to be legally liable.

Source: professionalinforme.blogspot.com

Source: professionalinforme.blogspot.com

According to the u.s small business administration, general liability insurance in colorado protects your business if someone sues you for something that your company caused. General liability insurance in colorado covers: Get customized coverage + low monthly payments. Get your tailored policy online in 5 min. General liability insurance, also known as “commercial liability insurance” or business liability insurance is a broad commercial policy that covers general liability exposures of a business.

Source: commercialinsurance.net

Source: commercialinsurance.net

Ad get better business insurance policies, 100% online. Get your tailored policy online in 5 min. Request a free best business insurance colorado quote in akron, alamosa, arvada, aspen, ault, aurora, avon, basalt, bayfield, bennett, berthoud, boulder, breckenridge, brighton, broomfield, brush, buena vista, burlington, carbondale, castle pines north, castle rock, cañon city, cedaredge, centennial, center, cherry hills village, colorado springs, columbine valley,. Get customized coverage + low monthly payments. General liability insurance, also known as “commercial liability insurance” or business liability insurance is a broad commercial policy that covers general liability exposures of a business.

Source: orcuttgroup.com

Source: orcuttgroup.com

Local independent colorado insurance agency providing commercial general liability insurance quotes, policies, service and advice to any type of business. Southern colorado insurance recommends that all businesses have colorado general liability insurance coverage in place. Please contact us to start the process. Get customized coverage + low monthly payments. Liability insurance provides a business with financial protection in the case of a claim or a lawsuit.

Source: orcuttgroup.com

Source: orcuttgroup.com

Protect your small business with a customized colorado business insurance policy through the progressive advantage® business program. Owning a business is a great accomplishment. Southern colorado insurance recommends that all businesses have colorado general liability insurance coverage in place. Liability insurance for farmers markets and for vendors is important because it: There are other risks that may be covered, including:

Source: orcuttgroup.com

Source: orcuttgroup.com

Get a quote for a variety of commercial insurance coverages including general liability, professional liability, workers� compensation and more. Southern colorado insurance recommends that all businesses have colorado general liability insurance coverage in place. According to the u.s small business administration, general liability insurance in colorado protects your business if someone sues you for something that your company caused. The colorado department of insurance recommends business liability insurance, though they don�t require it. General liability insurance in colorado covers:

Source: orcuttgroup.com

Source: orcuttgroup.com

Since 2004 our agency has been helping various business with general liability and all other insurance needs. Colorado state law requires that all businesses in colorado carry workers� compensation insurance. Get your tailored policy online in 5 min. Cgl protects your business from damages caused by bodily injury or property damage for which your business is found to be legally liable. 3 the colorado department of regulatory agencies (dora) strongly.

Source: orcuttgroup.com

Source: orcuttgroup.com

The state of colorado requires all publically and privately owned businesses to have workers’ compensation insurance for all employees, automobile insurance for vehicles used by the company, and professional liability insurance for select professions (doctors and health professionals). This insurance will cover your employees� medical bills and lost wages if they get injured while on the job. Protect yourself & your budget. According to the u.s small business administration, general liability insurance in colorado protects your business if someone sues you for something that your company caused. Ad get better business insurance policies, 100% online.

.JPG “Professional Liability Colorado Orcutt Insurance Group”) Source: orcuttgroup.com

Liability insurance is appropriate for any business that could face potential lawsuits. General liability coverage, which protects your business if you are accused of injuring another person or damaging their property, is considered essential small business insurance in colorado. Protect yourself & your budget. 3 the colorado department of regulatory agencies (dora) strongly. Get customized coverage + low monthly payments.

Source: altitudeins.com

Source: altitudeins.com

Cgl protects your business from damages caused by bodily injury or property damage for which your business is found to be legally liable. Property or bodily harm caused by your business; Get your tailored policy online in 5 min. The state of colorado requires all publically and privately owned businesses to have workers’ compensation insurance for all employees, automobile insurance for vehicles used by the company, and professional liability insurance for select professions (doctors and health professionals). Even though you may be in and out quickly, work from home remotely, or travel between offices, your business has a liability.

Source: sampleforms.com

Source: sampleforms.com

Protect yourself & your budget. Ad get better business insurance policies, 100% online. Get a quote for a variety of commercial insurance coverages including general liability, professional liability, workers� compensation and more. Errors and omissions insurance might be purchased by any number of professions to protect themselves against claims that professional services were not handled properly. According to the u.s small business administration, general liability insurance in colorado protects your business if someone sues you for something that your company caused.

Source: orcuttgroup.com

Source: orcuttgroup.com

Protect yourself & your budget. Property or bodily harm caused by your business; Contact us today to find the best liability business insurance for. Get customized coverage + low monthly payments. Protect yourself & your budget.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title business liability insurance colorado by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Claims vs occurrence based insurance Idea

- Cheap tablet insurance Idea

- Calling insurance leads Idea

- Disability insurance for postal workers Idea

- Business insurance peoria il information

- Bright health insurance reviews Idea

- Carrier liability vs cargo insurance Idea

- Can you insure a written off car Idea

- Can convicted felons get life insurance information

- Car insurance administrator Idea