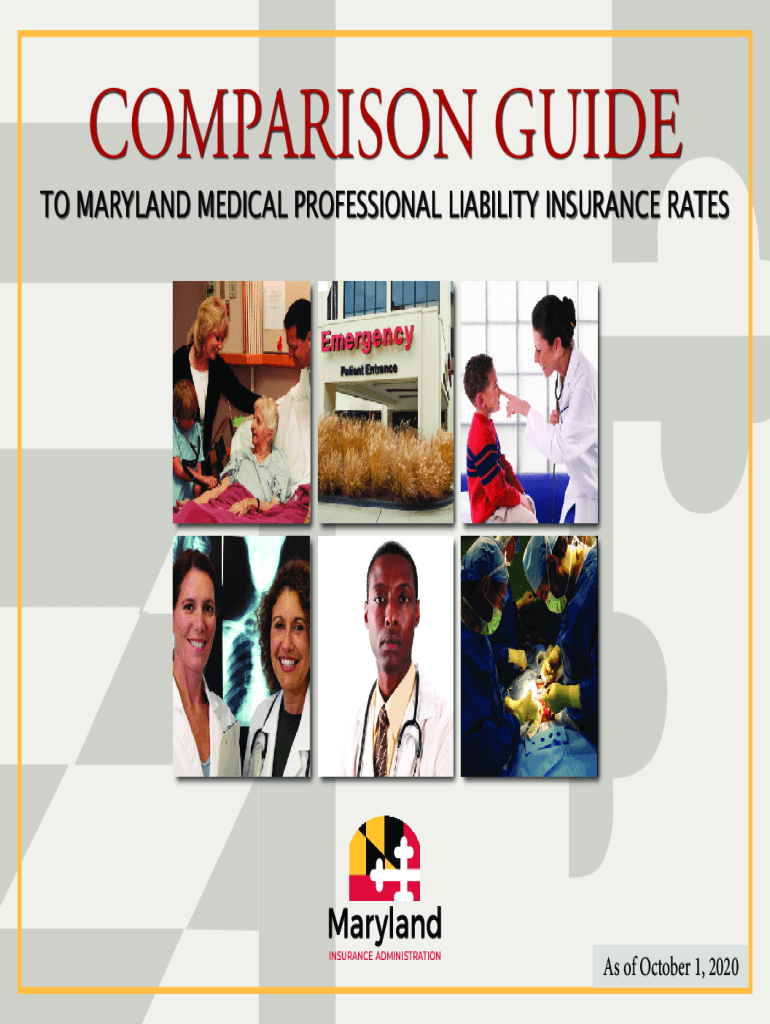

Business liability insurance in md information

Home » Trending » Business liability insurance in md informationYour Business liability insurance in md images are ready in this website. Business liability insurance in md are a topic that is being searched for and liked by netizens now. You can Download the Business liability insurance in md files here. Download all royalty-free photos.

If you’re searching for business liability insurance in md pictures information connected with to the business liability insurance in md interest, you have visit the ideal blog. Our site always provides you with suggestions for seeing the maximum quality video and picture content, please kindly hunt and find more informative video articles and graphics that match your interests.

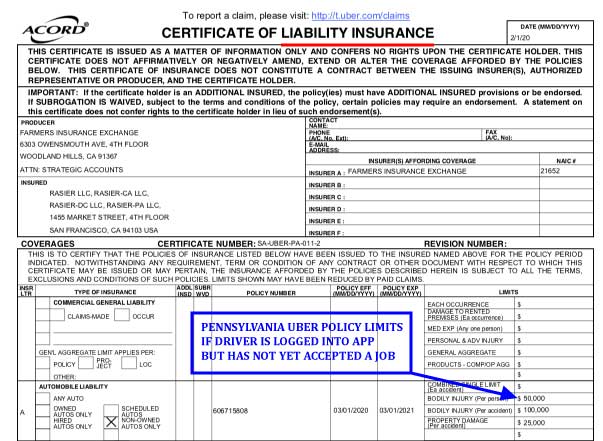

Business Liability Insurance In Md. Typically, general contractors, entrepreneurs, managers and business owners purchase a general liability insurance policy for their businesses. Business liability insurance covers legal fees, court costs and the subsequent award, if any is made. Bodily injury) and damages to the property of other individuals as a result of a motor vehicle. A good rule of thumb for most small businesses is.

Business Liability Insurance in PA & MD Business From mutualbenefitgroup.com

Business Liability Insurance in PA & MD Business From mutualbenefitgroup.com

Agricultural businesses with less than three employees and businesses with an annual income of less than $15,000 per year are exempt. All motorized vehicles registered in maryland, whether used for personal or business purposes, are required to carry automobile liability insurance. Bodily injury) and damages to the property of other individuals as a result of a motor vehicle. On average, a small business in maryland pays $1,400 for a general liability insurance policy. Some of the areas in your business that are covered by maryland general liability insurance include: Businessowners providing services should consider having professional liability insurance (also known as errors and omissions insurance).

Businessowners providing services should consider having professional liability insurance (also known as errors and omissions insurance).

Business liability insurance in md can help protect your business from common situations, like if your: Your liability insurance helps pay for those damages caused by the actions of your business, or your employees. With court awards and legal fees getting more and more expensive, it is vital for everyone to get liability coverage. This requirement applies to nearly all businesses, however, there are a few exceptions. Agricultural businesses with less than three employees and businesses with an annual income of less than $15,000 per year are exempt. How insurance brokers of maryland can help

Source: huffinsurance.com

Source: huffinsurance.com

This type of liability coverage protects a business against malpractice, errors, and negligence in provision of services to customers. Business liability insurance in md can help protect your business from common situations, like if your: Carrying business liability insurance can protect against unforeseen events and circumstances. How insurance brokers of maryland can help Depending on the size and scope your business, you may also need directors.

Source: crawfordyinglinginsurance.com

Source: crawfordyinglinginsurance.com

This policy, also called errors and omissions insurance (e&o), protects maryland businesses that provide professional services. 20 crossroads drive suite 215 owings mills, md 21117 There are other risks that may be covered, including: It covers lawsuits related to work performance. Customer claims your business caused damage to their property.

Source: revisi.net

Source: revisi.net

Agricultural businesses with less than three employees and businesses with an annual income of less than $15,000 per year are exempt. Without adequate liability insurance maryland coverage, they can cause devastating effects to your business or career. Automobile liability insurance coverage includes payment for medical expenses and damages sustained by other injured people (i.e. Businessowners providing services should consider having professional liability insurance (also known as errors and omissions insurance). Gl coverage is designed to protect md business owners from direct or indirect damages to another party.

Source: freshsince87.blogspot.com

Source: freshsince87.blogspot.com

This policy, also called errors and omissions insurance (e&o), protects maryland businesses that provide professional services. On average, a small business in maryland pays $1,400 for a general liability insurance policy. Businessowners providing services should consider having professional liability insurance (also known as errors and omissions insurance). Some of the areas in your business that are covered by maryland general liability insurance include: Maryland law requires businesses with employees to carry workers’ compensation insurance.

Source: lmtsuccessgroup.com

Source: lmtsuccessgroup.com

Maryland law requires businesses with employees to carry workers’ compensation insurance. This type of coverage is necessary for any business that could encounter a lawsuit. Without adequate liability insurance maryland coverage, they can cause devastating effects to your business or career. There are other risks that may be covered, including: 20 crossroads drive suite 215 owings mills, md 21117

Source: revisi.net

Source: revisi.net

This policy, also called errors and omissions insurance (e&o), protects maryland businesses that provide professional services. 133 defense highway suite 214 annapolis, md 21401 Some of the areas in your business that are covered by maryland general liability insurance include: Get customized coverage + low monthly payments. This type of liability coverage protects a business against malpractice, errors, and negligence in provision of services to customers.

Source: carcheapinsurance2019.blogspot.com

Source: carcheapinsurance2019.blogspot.com

Agricultural businesses with less than three employees and businesses with an annual income of less than $15,000 per year are exempt. If you are contractually obligated to have a general liability insurance policy; Business liability insurance in md 🟨 feb 2022. Business liability insurance covers legal fees, court costs and the subsequent award, if any is made. Business liability insurance in md can help protect your business from common situations, like if your:

Source: bouncy-rentals.com

133 defense highway suite 214 annapolis, md 21401 Simply business builds customized coverage for your business. Our firm specializes in covering local businesses, we have ways to make the cost of your liability insurance easier to handle. There are four types that you may fit your needs: Employee is accused of violating a customer’s right to privacy and you’re liable in a $200,000 lawsuit.

Source: freshsince87.blogspot.com

Source: freshsince87.blogspot.com

Without adequate liability insurance maryland coverage, they can cause devastating effects to your business or career. In addition to md general liability insurance, businesses will typically need commercial auto insurance, workers’ compensation and other key coverage types. Although maryland general liability insurance is an essential coverage, it does not provide every type of coverage that a business might need. Agricultural businesses with less than three employees and businesses with an annual income of less than $15,000 per year are exempt. On average, a small business in maryland pays $1,400 for a general liability insurance policy.

Source: mutualbenefitgroup.com

Source: mutualbenefitgroup.com

Get customized coverage + low monthly payments. Maryland general liability insurance is required by the state for most business owners. Business liability insurance in md 🟨 feb 2022. The property damage and bodily injury helps to protect your business against various business claims as well as claims alleging financial loss as a result of bodily injury or property damage, occurring out of your products or business. There are other risks that may be covered, including:

Source: wsparks.com

Source: wsparks.com

The majority of small business owners in maryland can expect to pay between $200 and $5,000 a year for a general liability insurance policy. If you are contractually obligated to have a general liability insurance policy; Get your tailored policy online in 5 min. Ad protect yourself & your budget. Without adequate liability insurance maryland coverage, they can cause devastating effects to your business or career.

Source: guaranteedrateinsurance.com

Source: guaranteedrateinsurance.com

Your liability insurance helps pay for those damages caused by the actions of your business, or your employees. There are other risks that may be covered, including: Get customized coverage + low monthly payments. If you are contractually obligated to have a general liability insurance policy; Maryland law requires businesses with employees to carry workers’ compensation insurance.

Source: freshsince87.blogspot.com

Source: freshsince87.blogspot.com

Business auto life home health renter disability commercial auto long term care annuity. Your liability insurance helps pay for those damages caused by the actions of your business, or your employees. Each situation is unique, but as a general guideline, the type of maryland business you operate or products you manufacture should determine how much maryland commercial general liability insurance you need. This requirement applies to nearly all businesses, however, there are a few exceptions. Businessowners providing services should consider having professional liability insurance (also known as errors and omissions insurance).

Source: meckinsurance.com

Source: meckinsurance.com

Maryland general liability insurance is required by the state for most business owners. Get a fast quote and your certificate of insurance now. How much does general liability insurance cost in maryland? Maryland general liability insurance is required by the state for most business owners. Let�s get you covered today.

Source: geretyinsurance.com

Source: geretyinsurance.com

Ad protect yourself & your budget. Typically, general contractors, entrepreneurs, managers and business owners purchase a general liability insurance policy for their businesses. This type of liability coverage protects a business against malpractice, errors, and negligence in provision of services to customers. Without adequate liability insurance maryland coverage, they can cause devastating effects to your business or career. How insurance brokers of maryland can help

Source: uslegalforms.com

Source: uslegalforms.com

Get your tailored policy online in 5 min. The majority of small business owners in maryland can expect to pay between $200 and $5,000 a year for a general liability insurance policy. In addition to md general liability insurance, businesses will typically need commercial auto insurance, workers’ compensation and other key coverage types. 133 defense highway suite 214 annapolis, md 21401 Ad protect yourself & your budget.

Source: wsmt.com

Source: wsmt.com

On average, a small business in maryland pays $1,400 for a general liability insurance policy. We provide the following, based on your needs: Your liability insurance helps pay for those damages caused by the actions of your business, or your employees. Let�s get you covered today. Although maryland general liability insurance is an essential coverage, it does not provide every type of coverage that a business might need.

Source: revisi.net

Source: revisi.net

Liability insurance is appropriate for any business that could face potential lawsuits. This requirement applies to nearly all businesses, however, there are a few exceptions. There are four types that you may fit your needs: Get customized coverage + low monthly payments. Automobile liability insurance coverage includes payment for medical expenses and damages sustained by other injured people (i.e.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title business liability insurance in md by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Claims vs occurrence based insurance Idea

- Cheap tablet insurance Idea

- Calling insurance leads Idea

- Disability insurance for postal workers Idea

- Business insurance peoria il information

- Bright health insurance reviews Idea

- Carrier liability vs cargo insurance Idea

- Can you insure a written off car Idea

- Can convicted felons get life insurance information

- Car insurance administrator Idea