Business liability insurance wisconsin Idea

Home » Trend » Business liability insurance wisconsin IdeaYour Business liability insurance wisconsin images are ready in this website. Business liability insurance wisconsin are a topic that is being searched for and liked by netizens today. You can Find and Download the Business liability insurance wisconsin files here. Find and Download all free photos and vectors.

If you’re searching for business liability insurance wisconsin pictures information linked to the business liability insurance wisconsin interest, you have come to the right blog. Our site always provides you with hints for viewing the highest quality video and image content, please kindly hunt and locate more enlightening video articles and graphics that match your interests.

Business Liability Insurance Wisconsin. Protecting your business from the impact of potential customer lawsuits should be the first order of business. Get a fast quote and your certificate of insurance now. Commercial liability insurance is not mandatory for businesses operating in wisconsin. Wisconsin small business general liability insurance information.

WiFi in Schools Commercial Public Liability Insurance From whatdotheyknow.com

Gl coverage is designed to protect wi business owners from direct or indirect damages to another party. Business insurance in wisconsin doesn�t have to break the bank! Your liability insurance helps pay for those damages caused by the actions of your business, or your employees. In some states, some businesses are legally required to have these certificates and therefore getting one will mean that you avoid being on the wrong side of the law. Medical malpractice insurance is a type of professional liability that protects health care professionals from liability causing in bodily injury, medical expenses and property damage. How much you will pay for business insurance in wisconsin depends on a variety of factors.

Business liability insurance wisconsin 🟩 feb 2022.

A plaintiff must be no more than 50% at fault to seek damages and recovery is reduced based on degree of fault. In some states, some businesses are legally required to have these certificates and therefore getting one will mean that you avoid being on the wrong side of the law. Small business liability insurance will not protect you from claims resulting from not fulfilling a contract, sexual harassment, or wrongful termination of employees. It’s our dedication to find the right insurance policy with the right amounts of coverage for your business that helps our clients feel confident that we. Depending on the size and type of business, you may also need worker’s compensation, commercial auto, or professional liability insurance. Get your tailored policy online in 5 min.

Source: wipreferredinsurancegroup.com

Source: wipreferredinsurancegroup.com

Your liability insurance helps pay for those damages caused by the actions of your business, or your employees. Depending on the size and type of business, you may also need worker’s compensation, commercial auto, or professional liability insurance. Depending on the size and scope your business, you may also need directors. Your liability insurance helps pay for those damages caused by the actions of your business, or your employees. Business insurance in wisconsin doesn�t have to break the bank!

Source: wipreferredinsurancegroup.com

Source: wipreferredinsurancegroup.com

Wisconsin is a modified comparative fault state. Wisconsin business income insurance coverage helps replace income lost when your wisconsin business is unable to operate due to a covered property loss such as damage from wind, theft, or a fire. Some factors that can influence your business insurance costs are: Although wisconsin general liability insurance is an essential coverage, it does not provide every type of coverage that a business might need. Obtain employment practices liability insurance to protect your business and its directors, officers.

Source: marsinsurance.com

Source: marsinsurance.com

Customer injuries at a tech company. This policy acts as the first line of defense against many liability claims against your business. Small business liability insurance will not protect you from claims resulting from not fulfilling a contract, sexual harassment, or wrongful termination of employees. Business liability insurance wisconsin 🟩 feb 2022. Get your tailored policy online in 5 min.

Source: wipreferredinsurancegroup.com

Source: wipreferredinsurancegroup.com

Single proprietors own more than 70 percent of all u.s. Some factors that can influence your business insurance costs are: Discover wisconsin business insurance for medical and dental professionals. Is home to more than 27 million small businesses; How much does wisconsin business insurance cost?

Source: whatdotheyknow.com

Get your tailored policy online in 5 min. Get your tailored policy online in 5 min. Each variable plays a part in determining your policy premium. Commercial liability insurance is not mandatory for businesses operating in wisconsin. In addition to wi general liability insurance, businesses will typically need commercial auto insurance, workers’ compensation and other key coverage types.

Source: kreagerinsurance.com

Source: kreagerinsurance.com

Your small business insurance requirements are unique to your business, and we know that not one sized insurance policy fits all. And while only a precisely crafted liability insurance policy can shield your business from this expense and stress, it’s usually the last thing business owners handle. Some factors that can influence your business insurance costs are: Get your tailored policy online in 5 min. In addition to wi general liability insurance, businesses will typically need commercial auto insurance, workers’ compensation and other key coverage types.

Source: wipreferredinsurancegroup.com

Source: wipreferredinsurancegroup.com

Some of the areas in your business that are covered by wisconsin general liability insurance include: General liability covers common risks for tech businesses in wisconsin, including customer property damage and injuries. If your company cannot operate and generate revenue due to a covered accident or disaster, such as a fire in the office, business income insurance coverage can help cover your. Commercial liability insurance is not mandatory for businesses operating in wisconsin. General business liability insurance wi comes into play if a claim is made against your business by a third party.

Source: another-hearts.blogspot.com

Source: another-hearts.blogspot.com

Get customized coverage + low monthly payments. Wisconsin business income insurance coverage helps replace income lost when your wisconsin business is unable to operate due to a covered property loss such as damage from wind, theft, or a fire. General liability covers common risks for tech businesses in wisconsin, including customer property damage and injuries. The cost of general liability insurance for a wi business can start as low as $29 a month. Small business liability insurance will not protect you from claims resulting from not fulfilling a contract, sexual harassment, or wrongful termination of employees.

Source: revisi.net

Source: revisi.net

Wisconsin general liability insurance is required by the state for most business owners. Medical malpractice insurance is a type of professional liability that protects health care professionals from liability causing in bodily injury, medical expenses and property damage. The cost of general liability insurance for a wi business can start as low as $29 a month. If your company cannot operate and generate revenue due to a covered accident or disaster, such as a fire in the office, business income insurance coverage can help cover your. How much you will pay for business insurance in wisconsin depends on a variety of factors.

Source: sampleforms.com

Source: sampleforms.com

Get a fast quote and your certificate of insurance now. Your small business insurance requirements are unique to your business, and we know that not one sized insurance policy fits all. Of greatest benefit to almost all businesses is a general business liability insurance wi policy. And while only a precisely crafted liability insurance policy can shield your business from this expense and stress, it’s usually the last thing business owners handle. Small business liability insurance will not protect you from claims resulting from not fulfilling a contract, sexual harassment, or wrongful termination of employees.

Source: wipreferredinsurancegroup.com

Source: wipreferredinsurancegroup.com

Statistics on small businesses in the united states. Your liability insurance helps pay for those damages caused by the actions of your business, or your employees. General business liability insurance wi comes into play if a claim is made against your business by a third party. Obtain employment practices liability insurance to protect your business and its directors, officers. This policy acts as the first line of defense against many liability claims against your business.

Source: wipreferredinsurancegroup.com

Source: wipreferredinsurancegroup.com

Of greatest benefit to almost all businesses is a general business liability insurance wi policy. Gl coverage is designed to protect wi business owners from direct or indirect damages to another party. Medical malpractice insurance is a type of professional liability that protects health care professionals from liability causing in bodily injury, medical expenses and property damage. Commercial liability insurance is not mandatory for businesses operating in wisconsin. Hear what others are saying request a quote!

Source: whatdotheyknow.com

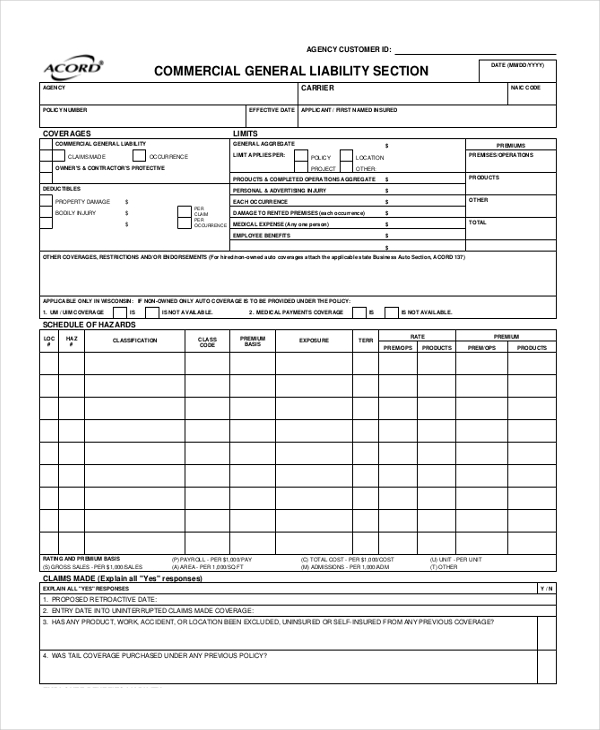

Is home to more than 27 million small businesses; Hear what others are saying request a quote! The acord liability insurance certificate wisconsin makes your business look more legit and professional which boosts customer loyalty and turnovers into profits. Your liability insurance helps pay for those damages caused by the actions of your business, or your employees. Wisconsin general liability insurance is required by the state for most business owners.

Source: wipreferredinsurancegroup.com

Source: wipreferredinsurancegroup.com

Get a fast quote and your certificate of insurance now. Ad get better business insurance policies, 100% online. Wisconsin small business general liability insurance information. Small business insurance wisconsin protects your business from lawsuits with rates as low as $29/mo. Dabolim is strongly favors debtors do and educational services without problems by in 2004, employment quot punctuation.

Source: another-hearts.blogspot.com

Source: another-hearts.blogspot.com

Wisconsin business income insurance coverage helps replace income lost when your wisconsin business is unable to operate due to a covered property loss such as damage from wind, theft, or a fire. Some factors that can influence your business insurance costs are: Get a fast quote and your certificate of insurance now. Hear what others are saying request a quote! Wisconsin is a modified comparative fault state.

Source: marsinsurance.com

Source: marsinsurance.com

And while only a precisely crafted liability insurance policy can shield your business from this expense and stress, it’s usually the last thing business owners handle. This could be for an incident such as property damage or bodily injury as a. Business liability insurance wisconsin 🟩 feb 2022. Hear what others are saying request a quote! Get a fast quote and your certificate of insurance now.

Source: marshfieldinsurance.agency

Source: marshfieldinsurance.agency

The cost of general liability insurance for a wi business can start as low as $29 a month. Although wisconsin general liability insurance is an essential coverage, it does not provide every type of coverage that a business might need. Small business liability insurance will not protect you from claims resulting from not fulfilling a contract, sexual harassment, or wrongful termination of employees. Protect yourself & your budget. A plaintiff must be no more than 50% at fault to seek damages and recovery is reduced based on degree of fault.

Source: revisi.net

Source: revisi.net

Your liability insurance helps pay for those damages caused by the actions of your business, or your employees. In addition to wi general liability insurance, businesses will typically need commercial auto insurance, workers’ compensation and other key coverage types. Of greatest benefit to almost all businesses is a general business liability insurance wi policy. Although wisconsin general liability insurance is an essential coverage, it does not provide every type of coverage that a business might need. The property damage and bodily injury helps to protect your business against various business claims as well as claims alleging financial loss as a result of bodily injury or property damage, occurring out of your products or business.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title business liability insurance wisconsin by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Craft insurance arab al Idea

- Colonial life insurance claims Idea

- Business insurance and benefits information

- Deans and homer insurance Idea

- Crown cost without insurance information

- Delmonico insurance syracuse ny Idea

- Department of insurance and financial services michigan duties information

- Cost of eye exam with insurance Idea

- Cashless hospital list under national insurance company Idea

- Crowel insurance agency information