Business overhead insurance information

Home » Trend » Business overhead insurance informationYour Business overhead insurance images are ready in this website. Business overhead insurance are a topic that is being searched for and liked by netizens now. You can Get the Business overhead insurance files here. Find and Download all royalty-free vectors.

If you’re searching for business overhead insurance images information related to the business overhead insurance interest, you have pay a visit to the right blog. Our site frequently provides you with hints for refferencing the maximum quality video and picture content, please kindly hunt and locate more enlightening video articles and graphics that fit your interests.

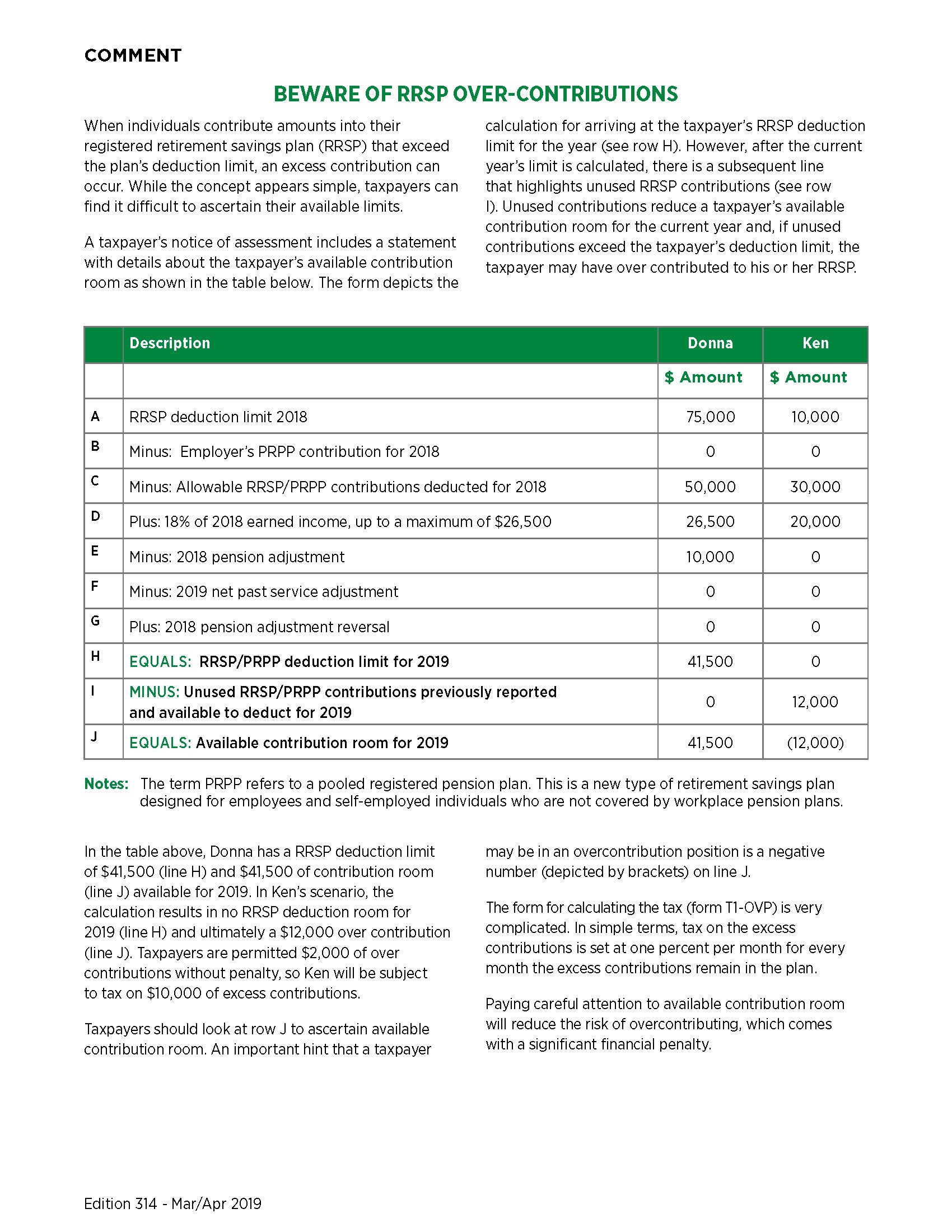

Business Overhead Insurance. If you are unable to produce your portion of revenue due to an illness or injury, this plan can help keep your doors open while you recover. Designed to benefit companies that only have a small number of employees, it helps the. Business overhead expense insurance can also pay to help you recover and rehabilitate. The overhead expenses vary depending on the nature of the business and the industry it operates in.

Why Is Business Overhead Insurance So Important? Malden From maldensolutions.com

Why Is Business Overhead Insurance So Important? Malden From maldensolutions.com

Employee salaries (this does not include your own) legal and accounting services. This insurance covers rent or real estate expenses, wages, utilities, and other operating expenses that still need to be paid to keep the business running, even when the owner is. Monthly benefit ranges from $500 to $20,000 per month. Historically, business owners who work from home have not been found eligible for business overhead. What does business overhead expense insurance pay for and how does it work? Most policies pay for a number of different business aspects, such as the salaries of the employees, rent, and taxes.

Benefits range from $1,000 to $6,000* per month (up to 12 times the monthly benefit) depending on your individual […]

Benefits range from $1,000 to $6,000* per month (up to 12 times the monthly benefit) depending on your individual […] If you become disabled and unable to work at your own occupation, business overhead expense insurance can keep the business up and running until you return to work. Business overhead expense insurance can also pay to help you recover and rehabilitate. Business overhead expense insurance can help keep the business running while you are sick or injured with monthly coverage ranging from $1,000 to $12,000. That means if you’re seriously injured and can’t perform your jobs any longer, you may be able to get this insurance. Business overhead expense insurance helps protect small practices to produce revenue in the case that an individual becomes ill or disabled and the practice becomes economically vulnerable.

Source: physiciansplanning.com

Source: physiciansplanning.com

For example, if you’re in a car accident and are seriously injured, or you’re diagnosed with a serious illness, your policy’s benefits could kick in to provide the business with cash flow while you recover. If you are a doctor, dentist, attorney, cpa, realtor, or other professional or small business owner that plays a vital role in generating revenue, you should consider business overhead expense. Overhead insurance (or overhead expense insurance) is a type of insurance that business owners purchase to cover various business costs in the event that they become disabled. For example, if you’re in a car accident and are seriously injured, or you’re diagnosed with a serious illness, your policy’s benefits could kick in to provide the business with cash flow while you recover. Business overhead expense insurance can provide financial protection for the business you have worked so hard to build.

Source: stone-hedgefinancialgroup.ca

Source: stone-hedgefinancialgroup.ca

Business overhead insurance plans cover the overhead expenses that you incur while running your business. Business overhead expense insurance can help keep the business running while you are sick or injured with monthly coverage ranging from $1,000 to $12,000. There are three main types of overhead that businesses incur. Insuranceintel , a sister publication of insurance portal , sizes up and compares five products. Monthly benefit ranges from $500 to $20,000 per month.

![Business Overhead Expense [BOE] Insurance Business Overhead Expense [BOE] Insurance](https://www.treloaronline.com/hs-fs/hubfs/Dental-practice-business-overhead-insurance.jpg?width=4750&name=Dental-practice-business-overhead-insurance.jpg) Source: treloaronline.com

Source: treloaronline.com

Business overhead insurance is a type of specialty insurance that pays money to cover your businesses operating costs if you are injured or not be able to work in your business like normal. Business overhead insurance helps to preserve your practice it reassures a business owner to know that their business can stay afloat even during challenging times. This is a special form of disability insurance that covers business expenses when one of the owners or a key person is disabled. While it does not cover every business expense, it will cover and pay for the following: If you are a doctor, dentist, attorney, cpa, realtor, or other professional or small business owner that plays a vital role in generating revenue, you should consider business overhead expense.

Source: youtube.com

Source: youtube.com

This is called recovery benefits. Business overhead insurance plans cover the overhead expenses that you incur while running your business. That means if you’re seriously injured and can’t perform your jobs any longer, you may be able to get this insurance. Designed to benefit companies that only have a small number of employees, it helps the. Overhead insurance (or overhead expense insurance) is a type of insurance that business owners purchase to cover various business costs in the event that they become disabled.

Source: kaseinsurance.com

Source: kaseinsurance.com

Business overhead expense insurance (boe) is a type of insurance that pays benefits to your business if you’re unable to work. Business overhead insurance helps to preserve your practice it reassures a business owner to know that their business can stay afloat even during challenging times. While it does not cover every business expense, it will cover and pay for the following: Coverage is available from $500 to $8,000 in monthly benefits, in increments of $100. You can continue to afford to run your business, even if you’re not there, until you are able to return to work or figure out what decisions to make regarding the future of your business.

Source: oppinsurance.com

Source: oppinsurance.com

But if you suffer a disability from which it�s immediately evident that you won�t recover — such as losing limbs, going blind or deaf, or losing your ability to speak — then you could qualify for your boe coverage�s presumptive disability. The overhead expenses vary depending on the nature of the business and the industry it operates in. This is a special form of disability insurance that covers business expenses when one of the owners or a key person is disabled. Business overhead insurance plans cover the overhead expenses that you incur while running your business. Insuranceintel , a sister publication of insurance portal , sizes up and compares five products.

Source: plusgroupus.com

Source: plusgroupus.com

There are three main types of overhead that businesses incur. This is a special form of disability insurance that covers business expenses when one of the owners or a key person is disabled. Business overhead insurance plans cover the overhead expenses that you incur while running your business. Business overhead insurance is vital to the security and protection of your business or practice. Business overhead insurance for physicians can help pay for the following expenses:

Source: maldensolutions.com

Source: maldensolutions.com

If you’re a business owner, you probably qualify for business overhead insurance. This is called recovery benefits. For example, if you’re in a car accident and are seriously injured, or you’re diagnosed with a serious illness, your policy’s benefits could kick in to provide the business with cash flow while you recover. Business overhead expense insurance is designed for principals of closely held businesses or practices and owners of small businesses. Business overhead insurance is a type of specialty insurance that pays money to cover your businesses operating costs if you are injured or not be able to work in your business like normal.

Source: tmait.org

Source: tmait.org

Most policies pay for a number of different business aspects, such as the salaries of the employees, rent, and taxes. But if you suffer a disability from which it�s immediately evident that you won�t recover — such as losing limbs, going blind or deaf, or losing your ability to speak — then you could qualify for your boe coverage�s presumptive disability. If you’re a business owner, you probably qualify for business overhead insurance. Benefits range from $1,000 to $6,000* per month (up to 12 times the monthly benefit) depending on your individual […] The table below presents some boe product features.

Source: wareinsurance.com

Source: wareinsurance.com

There are three main types of overhead that businesses incur. Insuranceintel , a sister publication of insurance portal , sizes up and compares five products. This is a special form of disability insurance that covers business expenses when one of the owners or a key person is disabled. Business overhead expense insurance, or simply boe insurance, is a type of disability coverage that helps business owners cover office costs, debts, payroll, employee benefits, and more if they become too sick or hurt to work. Business overhead expense insurance is a type of disability insurance policy that covers your business expenses upon your disability.

Source: financialtechtools.ca

Source: financialtechtools.ca

Coverage is available from $500 to $8,000 in monthly benefits, in increments of $100. Historically, business owners who work from home have not been found eligible for business overhead. Benefits range from $1,000 to $6,000* per month (up to 12 times the monthly benefit) depending on your individual […] What does business overhead expense insurance pay for and how does it work? If you are a doctor, dentist, attorney, cpa, realtor, or other professional or small business owner that plays a vital role in generating revenue, you should consider business overhead expense.

Source: youtube.com

Source: youtube.com

Business overhead expense insurance covers business expenses that continue when your business revenue slows or stops because you are disabled due to illness or accident. There are three main types of overhead that businesses incur. That means if you’re seriously injured and can’t perform your jobs any longer, you may be able to get this insurance. While it does not cover every business expense, it will cover and pay for the following: Business overhead insurance plans cover the overhead expenses that you incur while running your business.

Source: accesspluscapital.com

Source: accesspluscapital.com

If you are a doctor, dentist, attorney, cpa, realtor, or other professional or small business owner that plays a vital role in generating revenue, you should consider business overhead expense. Business overhead insurance plans cover the overhead expenses that you incur while running your business. Business overhead insurance is a type of specialty insurance that pays money to cover your businesses operating costs if you are injured or not be able to work in your business like normal. But if you suffer a disability from which it�s immediately evident that you won�t recover — such as losing limbs, going blind or deaf, or losing your ability to speak — then you could qualify for your boe coverage�s presumptive disability. It will reimburse most business expenses, and these often include:

Source: approvedfp.com.au

Source: approvedfp.com.au

Benefits range from $1,000 to $6,000* per month (up to 12 times the monthly benefit) depending on your individual […] Overhead insurance (or overhead expense insurance) is a type of insurance that business owners purchase to cover various business costs in the event that they become disabled. Fixed overheads are costs that remain constant every month and do not change with changes in business activity levels. Monthly benefit ranges from $500 to $20,000 per month. Business overhead expense insurance helps protect small practices to produce revenue in the case that an individual becomes ill or disabled and the practice becomes economically vulnerable.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

Business overhead insurance plans cover the overhead expenses that you incur while running your business. It will reimburse most business expenses, and these often include: You can continue to afford to run your business, even if you’re not there, until you are able to return to work or figure out what decisions to make regarding the future of your business. While it does not cover every business expense, it will cover and pay for the following: Employee salaries (this does not include your own) legal and accounting services.

Source: financialtechtools.ca

Source: financialtechtools.ca

In 2019, metro commercial plumbing had its best financial year ever. Fixed overheads are costs that remain constant every month and do not change with changes in business activity levels. That means if you’re seriously injured and can’t perform your jobs any longer, you may be able to get this insurance. You can continue to afford to run your business, even if you’re not there, until you are able to return to work or figure out what decisions to make regarding the future of your business. Business overhead insurance is vital to the security and protection of your business or practice.

Source: hisnv.com

Source: hisnv.com

If you’re a business owner, you probably qualify for business overhead insurance. Business overhead insurance helps to preserve your practice it reassures a business owner to know that their business can stay afloat even during challenging times. Fixed overheads are costs that remain constant every month and do not change with changes in business activity levels. Business overhead insurance is vital to the security and protection of your business or practice. What does business overhead expense insurance pay for and how does it work?

Source: maldensolutions.com

Source: maldensolutions.com

While it does not cover every business expense, it will cover and pay for the following: This is a special form of disability insurance that covers business expenses when one of the owners or a key person is disabled. Business overhead expense insurance can provide financial protection for the business you have worked so hard to build. Coverage is available from $500 to $8,000 in monthly benefits, in increments of $100. Business overhead expense insurance helps protect small practices to produce revenue in the case that an individual becomes ill or disabled and the practice becomes economically vulnerable.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title business overhead insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Craft insurance arab al Idea

- Colonial life insurance claims Idea

- Business insurance and benefits information

- Deans and homer insurance Idea

- Crown cost without insurance information

- Delmonico insurance syracuse ny Idea

- Department of insurance and financial services michigan duties information

- Cost of eye exam with insurance Idea

- Cashless hospital list under national insurance company Idea

- Crowel insurance agency information