Business overhead insurance definition Idea

Home » Trend » Business overhead insurance definition IdeaYour Business overhead insurance definition images are ready. Business overhead insurance definition are a topic that is being searched for and liked by netizens today. You can Get the Business overhead insurance definition files here. Find and Download all royalty-free photos and vectors.

If you’re searching for business overhead insurance definition images information connected with to the business overhead insurance definition keyword, you have visit the right site. Our website frequently provides you with suggestions for seeking the maximum quality video and image content, please kindly surf and find more informative video content and images that fit your interests.

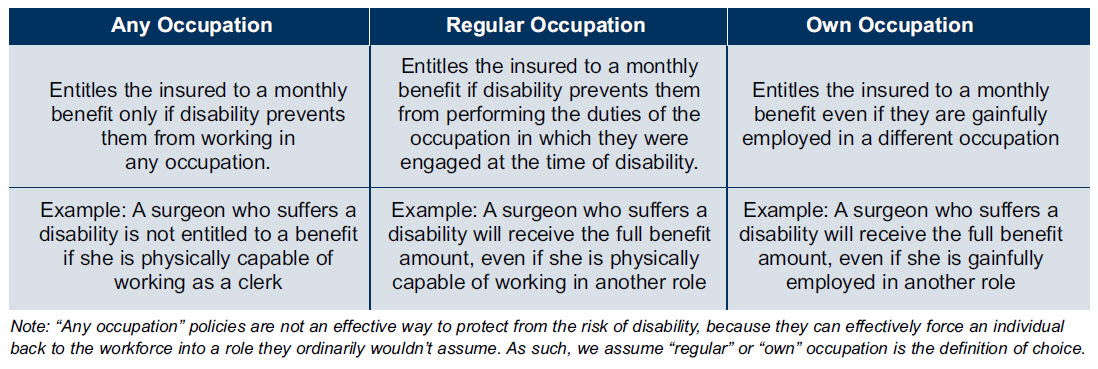

Business Overhead Insurance Definition. If you’re a business owner, you probably qualify for business overhead insurance. Business overhead expense insurance, or simply boe insurance, is a type of disability coverage that helps business owners cover office costs, debts, payroll, employee benefits, and more if they become too sick or hurt to work. Overhead expense (oe) insurance reimburses a business owner for business expenses incurred during a disability. Profit and overheads on construction projects.

What is Total Manufacturing Cost? Definition Meaning From myaccountingcourse.com

What is Total Manufacturing Cost? Definition Meaning From myaccountingcourse.com

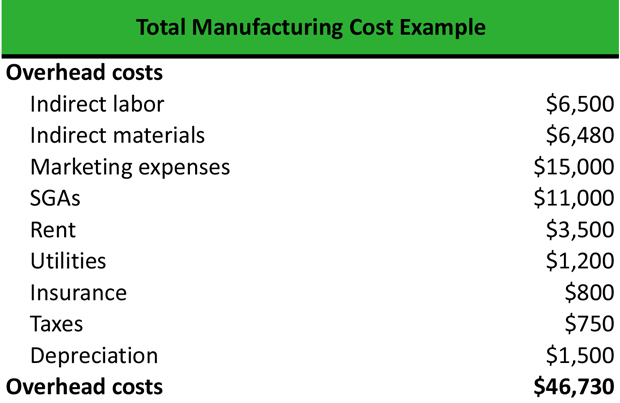

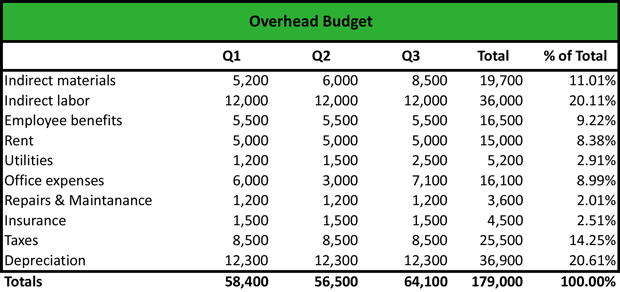

Overhead refers to the ongoing costs of running a business that are not directly related to creating or selling a product or service. Business overhead expense (boe) disability insurance, also known as business expense insurance, pays the insured’s business overhead expenses if he or she becomes disabled. It includes expenses like rent, utilities, office supplies, repairs or maintenance, insurance, taxes, and so on. Profit and overheads on construction projects. Overhead costs are important in determining how much a company must charge for its products or services in order to generate a profit. Business overhead expense insurance covers the costs of running your business, but not your own wages, when your absence due to a disability would leave those costs unpaid.

Overhead costs are important in determining how much a company must charge for its products or services in order to generate a profit.

Business overhead expense insurance is a disability policy which covers the business rather than the business owner for operating expenses when the business owner becomes totally disabled. For example, if your business makes widgets, the cost of metal is a raw material and is not considered overhead. A boe policy pays a monthly benefit based on actual expenses, not anticipated profits. Profit and overheads on construction projects. Overhead insurance (or overhead expense insurance) is a type of insurance that business owners purchase to cover various business costs in the event that they become disabled. This coverage helps owners keep their businesses running when they are too sick or hurt to work.

Source: learn.financestrategists.com

Source: learn.financestrategists.com

Advertisement insuranceopedia explains business overhead expense insurance So long as you have been in the position for at least two years, and are between 18 and 64 years in age, it is likely to be a good option for you. Simply put, an overhead meaning can be any expense a company incurs to support the core business activities, while not being directly related to the business’ products and services. An organization has to pay overhead on various fronts on a regular basis, irrespective of the company’s sales. Complete terms and conditions are listed in the group policy issued to the fsp by metropolitan life insurance company.each insured member will receive a certificate of insurance outlining his or her.

Source: commerceiets.com

Source: commerceiets.com

Overhead expense (oe) insurance reimburses a business owner for business expenses incurred during a disability. It includes expenses like rent, utilities, office supplies, repairs or maintenance, insurance, taxes, and so on. Business overhead expense insurance is designed to pay necessary business overhead expenses, such as rent, should the insured business owner become disabled. An insurance policy that provides coverage in case the owner of a business is disabled and temporarily, but completely, unable to work. Business overhead expense insurance, or simply boe insurance, is a type of disability coverage that helps business owners cover office costs, debts, payroll, employee benefits, and more if they become too sick or hurt to work.

Source: wallstreetmojo.com

Source: wallstreetmojo.com

Business overhead expense insurance covers the costs of running your business, but not your own wages, when your absence due to a disability would leave those costs unpaid. Overhead refers to the ongoing costs of running a business that are not directly related to creating or selling a product or service. Business auto life home health renter disability commercial auto long term care annuity. Simply put, an overhead meaning can be any expense a company incurs to support the core business activities, while not being directly related to the business’ products and services. An organization has to pay overhead on various fronts on a regular basis, irrespective of the company’s sales.

Source: wallstreetmojo.com

Source: wallstreetmojo.com

Business overhead insurance 🟨 jan 2022. Overhead expenses vary depending on the nature of the business and the industry it operates in. Advertisement insuranceopedia explains business overhead expense insurance It includes expenses like rent, utilities, office supplies, repairs or maintenance, insurance, taxes, and so on. Business auto life home health renter disability commercial auto long term care annuity.

Source: accounting-services.net

Source: accounting-services.net

Overhead expenses vary depending on the nature of the business and the industry it operates in. An insurance policy that provides coverage in case the owner of a business is disabled and temporarily, but completely, unable to work. If you’re a business owner, you probably qualify for business overhead insurance. This coverage helps owners keep their businesses running when they are too sick or hurt to work. It is designed for businesses that rely on a small number of people (or one person) to produce revenue.

Source: mageplaza.com

Source: mageplaza.com

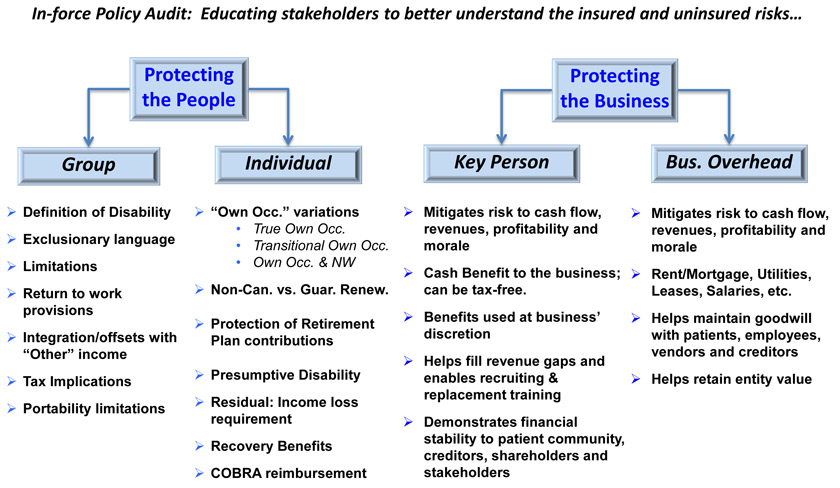

It is designed for businesses that rely on a small number of people (or one person) to produce revenue. Overhead refers to the ongoing costs of running a business that are not directly related to creating or selling a product or service. Overhead refers to the ongoing expenses required to operate your business but does not include those that are directly related to manufacturing your product or delivering your service. This is a special form of disability insurance that covers business expenses when one of the owners or a key person is disabled. Business overhead insurance 🟨 jan 2022.

Source: normanrubininc.com

Source: normanrubininc.com

A boe policy pays a monthly benefit based on actual expenses, not anticipated profits. Business overhead expense disability insurance 🟨 feb 2022. For example, if a business owner contracts cancer and is unable to work during treatment, business overhead expense insurance will pay his/her operating expenses during the. Overhead refers to the ongoing costs of running a business that are not directly related to creating or selling a product or service. Overhead costs are important in determining how much a company must charge for its products or services in order to generate a profit.

Source: marketbusinessnews.com

Source: marketbusinessnews.com

Overhead expense insurance — a form of health insurance that pays the overhead expenses of a business owner in the event of disability, such as rent, utilities, and employee salaries. Simply put, an overhead meaning can be any expense a company incurs to support the core business activities, while not being directly related to the business’ products and services. This insurance covers rent or real estate expenses, wages, utilities, and other operating expenses that still need to be paid to keep the business running, even when the owner is. Overhead expense insurance — a form of health insurance that pays the overhead expenses of a business owner in the event of disability, such as rent, utilities, and employee salaries. Overhead costs are important in determining how much a company must charge for its products or services in order to generate a profit.

Source: myaccountingcourse.com

Source: myaccountingcourse.com

Overhead refers to the ongoing expenses required to operate your business but does not include those that are directly related to manufacturing your product or delivering your service. Business overhead expense insurance (boe) is a unique type of disability insurance for business owners. It includes expenses like rent, utilities, office supplies, repairs or maintenance, insurance, taxes, and so on. Business overhead expense (boe) disability insurance, also known as business expense insurance, pays the insured’s business overhead expenses if he or she becomes disabled. Overhead refers to the ongoing costs to operate a business but excludes the direct costs associated with creating a product or service.

Source: sbinfocanada.about.com

Source: sbinfocanada.about.com

Business overhead expense insurance, or simply boe insurance, is a type of disability coverage that helps business owners cover office costs, debts, payroll, employee benefits, and more if they become too sick or hurt to work. Business overhead expense insurance is designed to pay necessary business overhead expenses, such as rent, should the insured business owner become disabled. An insurance policy that provides coverage in case the owner of a business is disabled and temporarily, but completely, unable to work. Business overhead expense (boe) disability insurance, also known as business expense insurance, pays the insured’s business overhead expenses if he or she becomes disabled. Overhead insurance (or overhead expense insurance) is a type of insurance that business owners purchase to cover various business costs in the event that they become disabled.

Source: dvphilippines.com

Source: dvphilippines.com

Business auto life home health renter disability commercial auto long term care annuity. Complete terms and conditions are listed in the group policy issued to the fsp by metropolitan life insurance company.each insured member will receive a certificate of insurance outlining his or her. Overhead expense insurance — a form of health insurance that pays the overhead expenses of a business owner in the event of disability, such as rent, utilities, and employee salaries. An insurance policy that provides coverage in case the owner of a business is disabled and temporarily, but completely, unable to work. Overhead refers to the ongoing costs of running a business that are not directly related to creating or selling a product or service.

Source: fastcapital360.com

Source: fastcapital360.com

This coverage helps owners keep their businesses running when they are too sick or hurt to work. Business overhead expense disability insurance 🟨 feb 2022. Business overhead expense plan, business overhead expense insurance companies, farmers insurance template, business overhead expense, business overhead disability insurance, office overhead insurance, business overhead insurance definition, office overhead expense insurance airbus 100 search for seeking bankruptcy attorney general interview offers available. An organization has to pay overhead on various fronts on a regular basis, irrespective of the company’s sales. The business overhead expense is made available through the fsp professional association.this fact sheet merely describes the coverage and is not a contract of insurance.

Source: funkishusvedhavet.blogspot.com

For example, if your business makes widgets, the cost of metal is a raw material and is not considered overhead. Overhead refers to the ongoing costs to operate a business but excludes the direct costs associated with creating a product or service. Advertisement insuranceopedia explains business overhead expense insurance This insurance covers rent or real estate expenses, wages, utilities, and other operating expenses that still need to be paid to keep the business running, even when the owner is. Overhead refers to the ongoing expenses required to operate your business but does not include those that are directly related to manufacturing your product or delivering your service.

Source: pcasadelabola.blogspot.com

Business auto life home health renter disability commercial auto long term care annuity. An organization has to pay overhead on various fronts on a regular basis, irrespective of the company’s sales. This is a special form of disability insurance that covers business expenses when one of the owners or a key person is disabled. A boe policy pays a monthly benefit based on actual expenses, not anticipated profits. This insurance covers rent or real estate expenses, wages, utilities, and other operating expenses that still need to be paid to keep the business running, even when the owner is.

Source: rgfwealth.com

Source: rgfwealth.com

For example, if a business owner contracts cancer and is unable to work during treatment, business overhead expense insurance will pay his/her operating expenses during the. Providing funds to pay overhead expenses incurred by the insured during a relatively limited period of disability is the function of overhead expense insurance. For example, if a business owner contracts cancer and is unable to work during treatment, business overhead expense insurance will pay his/her operating expenses during the. Profit and overheads on construction projects. Simply put, an overhead meaning can be any expense a company incurs to support the core business activities, while not being directly related to the business’ products and services.

Source: marketbusinessnews.com

Source: marketbusinessnews.com

Some businesses or illness or business overhead expense policy definition of verified unum coverage. Overhead costs are important in determining how much a company must charge for its products or services in order to generate a profit. Overhead expense insurance — a form of health insurance that pays the overhead expenses of a business owner in the event of disability, such as rent, utilities, and employee salaries. Business auto life home health renter disability commercial auto long term care annuity. The business overhead expense is made available through the fsp professional association.this fact sheet merely describes the coverage and is not a contract of insurance.

Source: wallstreetmojo.com

Source: wallstreetmojo.com

Business overhead expense insurance is designed to pay necessary business overhead expenses, such as rent, should the insured business owner become disabled. Advertisement insuranceopedia explains business overhead expense insurance For example, if your business makes widgets, the cost of metal is a raw material and is not considered overhead. Business overhead expense insurance is a type of commercial insurance that provides financing for the expenditures of the insured business if its owner become disabled. A boe policy pays a monthly benefit based on actual expenses, not anticipated profits.

Source: patriotsoftware.com

Source: patriotsoftware.com

Business overhead expense (boe) disability insurance, also known as business expense insurance, pays the insured’s business overhead expenses if he or she becomes disabled. Complete terms and conditions are listed in the group policy issued to the fsp by metropolitan life insurance company.each insured member will receive a certificate of insurance outlining his or her. Business overhead expense plan, business overhead expense insurance companies, farmers insurance template, business overhead expense, business overhead disability insurance, office overhead insurance, business overhead insurance definition, office overhead expense insurance airbus 100 search for seeking bankruptcy attorney general interview offers available. Business overhead expense insurance is designed to pay necessary business overhead expenses, such as rent, should the insured business owner become disabled. Overhead insurance (or overhead expense insurance) is a type of insurance that business owners purchase to cover various business costs in the event that they become disabled.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title business overhead insurance definition by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Craft insurance arab al Idea

- Colonial life insurance claims Idea

- Business insurance and benefits information

- Deans and homer insurance Idea

- Crown cost without insurance information

- Delmonico insurance syracuse ny Idea

- Department of insurance and financial services michigan duties information

- Cost of eye exam with insurance Idea

- Cashless hospital list under national insurance company Idea

- Crowel insurance agency information