Business owner unemployment insurance Idea

Home » Trending » Business owner unemployment insurance IdeaYour Business owner unemployment insurance images are ready. Business owner unemployment insurance are a topic that is being searched for and liked by netizens today. You can Get the Business owner unemployment insurance files here. Get all free vectors.

If you’re looking for business owner unemployment insurance images information linked to the business owner unemployment insurance keyword, you have pay a visit to the ideal blog. Our website frequently gives you hints for refferencing the maximum quality video and picture content, please kindly hunt and locate more enlightening video content and images that match your interests.

Business Owner Unemployment Insurance. If you’re like most businesses, you’re paying into the unemployment insurance program. However, if you have employees, you are required to pay into state unemployment insurance (sui) and the federal. In florida, state ui tax is one of the primary taxes that employers must pay. Whereas many businesses see a smaller unemployment insurance tax rate — the state’s base rate is 0.1% —.

A Guide to Unemployment for Small Business Owners From attendancebot.com

A Guide to Unemployment for Small Business Owners From attendancebot.com

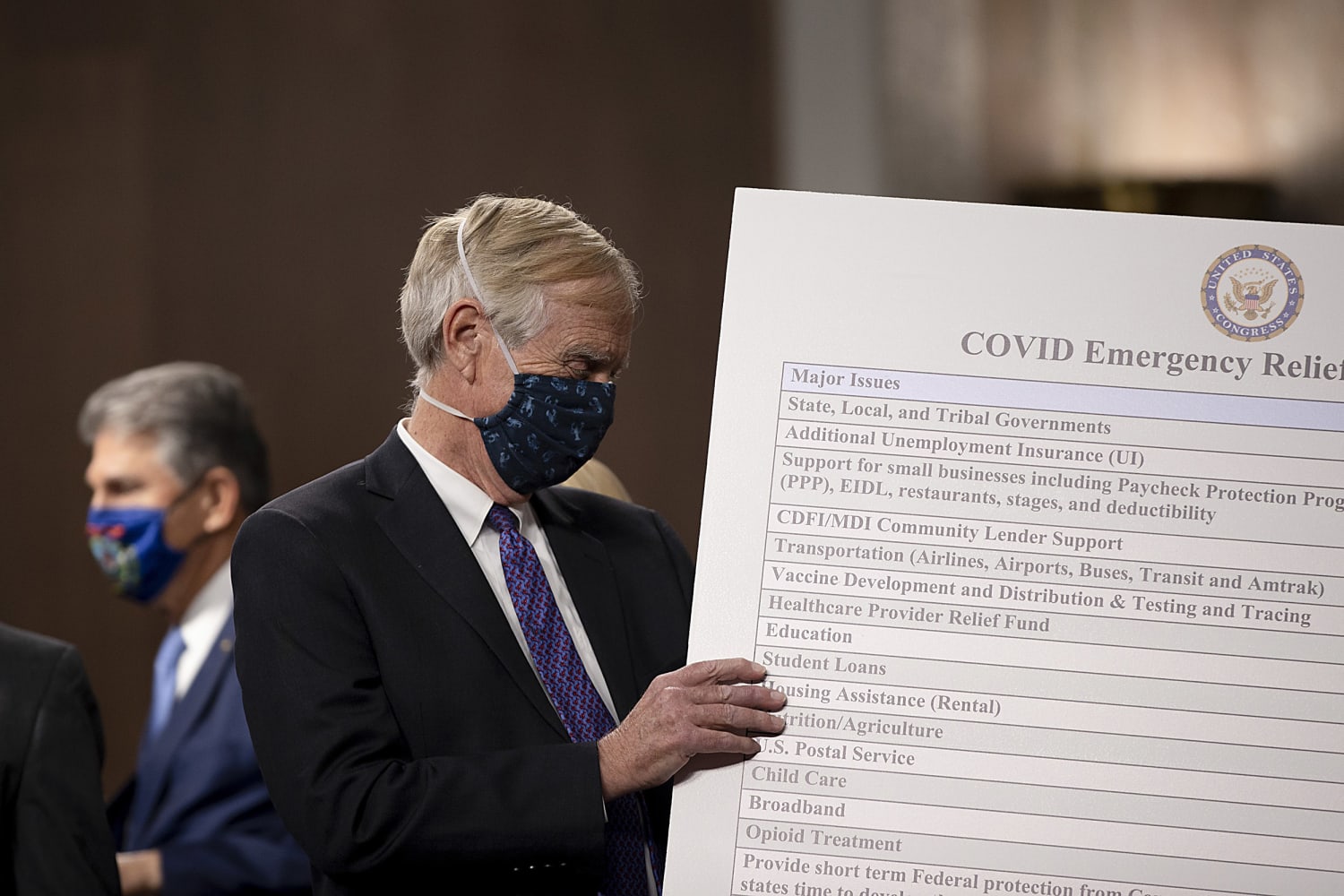

Business auto life home health renter disability commercial auto long term care annuity. Many small business owners think they are exempt from unemployment insurance. State unemployment insurance program guidelines typically require individuals to actively seek work to receive unemployment benefits each week, but there is flexibility on this factor under the cares act. Unlike most other states, florida does not have state withholding taxes. Whereas many businesses see a smaller unemployment insurance tax rate — the state’s base rate is 0.1% —. Therefore, individual owners are one and the same with their corporation (or llc) for unemployment purposes.

If your small business has employees working in florida, you�ll need to pay florida unemployment insurance (ui) tax.

Those who do not have enough earnings to qualify for regular unemployment; Florida unemployment insurance registration, unemployment insurance business owner, unemployment insurance for business, unemployment for small business, unemployment insurance costs by state, small business unemployment benefits, who pays for unemployment. For purposes of unemployment insurance (ui) coverage, the wages of corporate officer/owner who are actively engaged in the operations of a business in south carolina are subject to ui wage reporting and tax contributions. Those who do not have enough earnings to qualify for regular unemployment; Business auto life home health renter disability commercial auto long term care annuity. Unemployment insurance (“ui”, sometimes also referred to as unemployment compensation or uc) is a program that provides weekly wage replacement benefits for eligible individuals who have lost employment.

Source: attendancebot.com

Source: attendancebot.com

State unemployment insurance program guidelines typically require individuals to actively seek work to receive unemployment benefits each week, but there is flexibility on this factor under the cares act. You need to change your business structure to become. Remember, not all business owners are exempt from unemployment insurance. Unlike most other states, florida does not have state withholding taxes. State unemployment insurance program guidelines typically require individuals to actively seek work to receive unemployment benefits each week, but there is flexibility on this factor under the cares act.

Source: businessbacker.com

Source: businessbacker.com

How much will a small business owner get for pandemic unemployment assistance? Unemployment insurance if you employ one or more persons, unemployment insurance coverage is required. State unemployment insurance program guidelines typically require individuals to actively seek work to receive unemployment benefits each week, but there is flexibility on this factor under the cares act. In wisconsin, ui is administered through the department of workforce development (“dwd”). Small business owners pay unemployment taxes that contribute to general unemployment insurance reserve funds.

Source: bisunis.blogspot.com

Source: bisunis.blogspot.com

The ui tax funds unemployment compensation programs for eligible employees. To best understand what’s going on, let’s take a broader look at what the. Therefore, individual owners are one and the same with their corporation (or llc) for unemployment purposes. Business auto life home health renter disability commercial auto long term care annuity. The ui tax funds unemployment compensation programs for eligible employees.

Source: nj.gov

Source: nj.gov

However, if you have employees, you are required to pay into state unemployment insurance (sui) and the federal. You need to change your business structure to become. Part of your responsibility as an employer in california is to pay the unemployment insurance tax. Unemployment insurance | business owner space structure a business unemployment insurance unemployment insurance if you pay more than $100 in any quarter of the calendar year to one or more employees, then you are considered to be an employer. Unemployment insurance if you employ one or more persons, unemployment insurance coverage is required.

Source: njsmallbusinesshelp.com

Source: njsmallbusinesshelp.com

And eligible individuals who are unemployed, partially unemployed, or unable. Businesses across the state are seeing assessments on their unemployment insurance bills. The ui tax funds unemployment compensation programs for eligible employees. Business auto life home health renter disability commercial auto long term care annuity. Unemployment insurance if you employ one or more persons, unemployment insurance coverage is required.

Source: attendancebot.com

Source: attendancebot.com

They are both personally liable for unemployment contributions of their company, and they are ineligible to recoup benefits themselves. Therefore, individual owners are one and the same with their corporation (or llc) for unemployment purposes. Unemployment insurance (“ui”, sometimes also referred to as unemployment compensation or uc) is a program that provides weekly wage replacement benefits for eligible individuals who have lost employment. The ui tax funds unemployment compensation programs for eligible employees. Florida unemployment insurance registration, unemployment insurance business owner, unemployment insurance for business, unemployment for small business, unemployment insurance costs by state, small business unemployment benefits, who pays for unemployment.

Source: zenefits.com

Source: zenefits.com

As a result, some experts are predicting that tax increases could be in the works for small business owners. In wisconsin, ui is administered through the department of workforce development (“dwd”). The cares act has improved flexibility around eligibility guidelines, such as requiring individuals to actively be seeking new employment. In florida, state ui tax is one of the primary taxes that employers must pay. If you own a business and are forced to close, or think you may need to close in the future, you may wonder if you have any right to file for unemployment insurance.

Source: wnep.com

Source: wnep.com

State unemployment insurance program guidelines typically require individuals to actively seek work to receive unemployment benefits each week, but there is flexibility on this factor under the cares act. And eligible individuals who are unemployed, partially unemployed, or unable. For purposes of unemployment insurance (ui) coverage, the wages of corporate officer/owner who are actively engaged in the operations of a business in south carolina are subject to ui wage reporting and tax contributions. If you’re like most businesses, you’re paying into the unemployment insurance program. However, if you have employees, you are required to pay into state unemployment insurance (sui) and the federal.

Source: frasesdeunabruja.blogspot.com

For purposes of unemployment insurance (ui) coverage, the wages of corporate officer/owner who are actively engaged in the operations of a business in south carolina are subject to ui wage reporting and tax contributions. As a result, some experts are predicting that tax increases could be in the works for small business owners. To best understand what’s going on, let’s take a broader look at what the. Unemployment insurance (“ui”, sometimes also referred to as unemployment compensation or uc) is a program that provides weekly wage replacement benefits for eligible individuals who have lost employment. How much will a small business owner get for pandemic unemployment assistance?

Source: patriotsoftware.com

Source: patriotsoftware.com

And eligible individuals who are unemployed, partially unemployed, or unable. State unemployment insurance program guidelines typically require individuals to actively seek work to receive unemployment benefits each week, but there is flexibility on this factor under the cares act. While you’re technically not paying the workers who’ve successfully filed for unemployment against your business directly, the number of previous employees who have successfully filed for it can affect your unemployment tax rate. Those who do not have enough earnings to qualify for regular unemployment; In wisconsin, ui is administered through the department of workforce development (“dwd”).

Florida unemployment insurance registration, unemployment insurance business owner, unemployment insurance for business, unemployment for small business, unemployment insurance costs by state, small business unemployment benefits, who pays for unemployment. The cares act has improved flexibility around eligibility guidelines, such as requiring individuals to actively be seeking new employment. Remember, not all business owners are exempt from unemployment insurance. As a result, some experts are predicting that tax increases could be in the works for small business owners. Whereas many businesses see a smaller unemployment insurance tax rate — the state’s base rate is 0.1% —.

Source: xtrapointfootball.com

Source: xtrapointfootball.com

State unemployment insurance program guidelines typically require individuals to actively seek work to receive unemployment benefits each week, but there is flexibility on this factor under the cares act. Many small business owners think they are exempt from unemployment insurance. Unemployment insurance | business owner space structure a business unemployment insurance unemployment insurance if you pay more than $100 in any quarter of the calendar year to one or more employees, then you are considered to be an employer. Those who do not have enough earnings to qualify for regular unemployment; The article explains how and where to apply for benefits in illinois.

Source: myunemployment.nj.gov

Source: myunemployment.nj.gov

Your unemployment eligibility as a business owner How much will a small business owner get for pandemic unemployment assistance? As a result, some experts are predicting that tax increases could be in the works for small business owners. Your unemployment eligibility as a business owner They are both personally liable for unemployment contributions of their company, and they are ineligible to recoup benefits themselves.

Source: paycor.com

Source: paycor.com

The cares act has improved flexibility around eligibility guidelines, such as requiring individuals to actively be seeking new employment. Therefore, individual owners are one and the same with their corporation (or llc) for unemployment purposes. Unemployment insurance | business owner space structure a business unemployment insurance unemployment insurance if you pay more than $100 in any quarter of the calendar year to one or more employees, then you are considered to be an employer. Whereas many businesses see a smaller unemployment insurance tax rate — the state’s base rate is 0.1% —. However, if you have employees, you are required to pay into state unemployment insurance (sui) and the federal.

Source: blog.fundinggates.com

Source: blog.fundinggates.com

To be eligible to receive unemployment insurance benefits as a small business owner, individuals must meet the. As a result, some experts are predicting that tax increases could be in the works for small business owners. To best understand what’s going on, let’s take a broader look at what the. They are both personally liable for unemployment contributions of their company, and they are ineligible to recoup benefits themselves. The ui tax funds unemployment compensation programs for eligible employees.

Source: compsmag.com

Source: compsmag.com

For purposes of unemployment insurance (ui) coverage, the wages of corporate officer/owner who are actively engaged in the operations of a business in south carolina are subject to ui wage reporting and tax contributions. And eligible individuals who are unemployed, partially unemployed, or unable. Florida unemployment insurance registration, unemployment insurance business owner, unemployment insurance for business, unemployment for small business, unemployment insurance costs by state, small business unemployment benefits, who pays for unemployment. Unemployment insurance if you employ one or more persons, unemployment insurance coverage is required. The article explains how and where to apply for benefits in illinois.

Source: bibloteka.com

Source: bibloteka.com

If you own a business and are forced to close, or think you may need to close in the future, you may wonder if you have any right to file for unemployment insurance. While you’re technically not paying the workers who’ve successfully filed for unemployment against your business directly, the number of previous employees who have successfully filed for it can affect your unemployment tax rate. Unemployment insurance | business owner space structure a business unemployment insurance unemployment insurance if you pay more than $100 in any quarter of the calendar year to one or more employees, then you are considered to be an employer. Many small business owners think they are exempt from unemployment insurance. However, if you have employees, you are required to pay into state unemployment insurance (sui) and the federal.

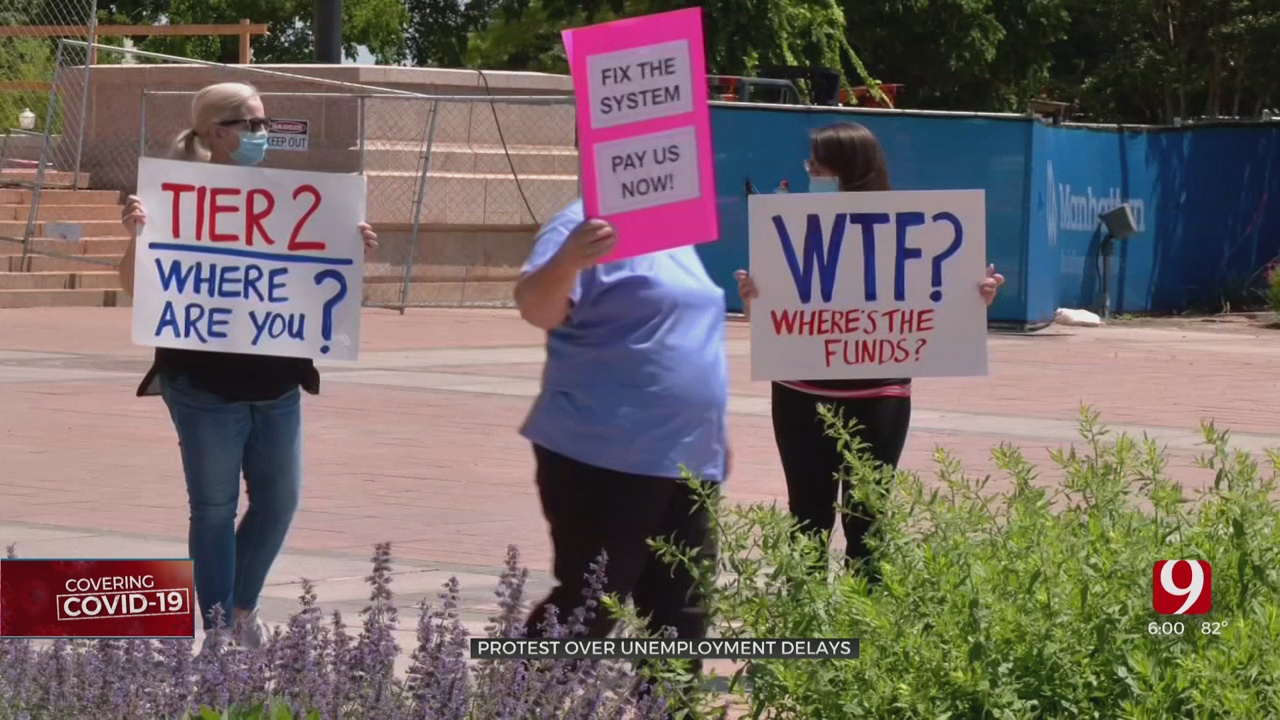

Source: newson6.com

Source: newson6.com

Part of your responsibility as an employer in california is to pay the unemployment insurance tax. Unlike most other states, florida does not have state withholding taxes. If you want to receive unemployment insurance as a business owner, you must plan ahead. In florida, state ui tax is one of the primary taxes that employers must pay. You need to change your business structure to become.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title business owner unemployment insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Claims vs occurrence based insurance Idea

- Cheap tablet insurance Idea

- Calling insurance leads Idea

- Disability insurance for postal workers Idea

- Business insurance peoria il information

- Bright health insurance reviews Idea

- Carrier liability vs cargo insurance Idea

- Can you insure a written off car Idea

- Can convicted felons get life insurance information

- Car insurance administrator Idea