Buy and sell insurance Idea

Home » Trend » Buy and sell insurance IdeaYour Buy and sell insurance images are ready in this website. Buy and sell insurance are a topic that is being searched for and liked by netizens today. You can Get the Buy and sell insurance files here. Get all royalty-free photos.

If you’re searching for buy and sell insurance pictures information related to the buy and sell insurance interest, you have visit the ideal site. Our website frequently gives you hints for refferencing the highest quality video and picture content, please kindly surf and locate more informative video content and graphics that match your interests.

Buy And Sell Insurance. When first deciding if selling your life insurance policy is right for you; Utilizing a life insurance contract to fund the buyout has multiple benefits. Ad find coverage that suites your budget and needs. This is a static report, the data below was valid at the time of the publication, but support and resistance levels for sigi change over time, so the report should.

Quick Guide to Understanding BuySell Agreements (Part 1 of 5) From redbirdagents.com

Quick Guide to Understanding BuySell Agreements (Part 1 of 5) From redbirdagents.com

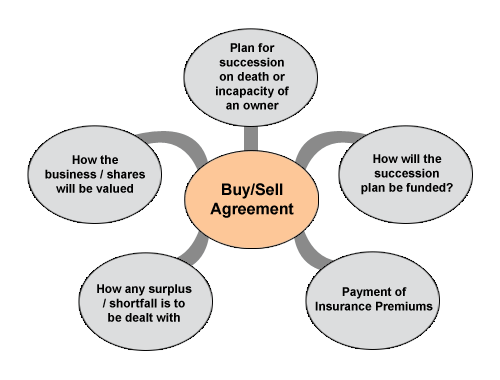

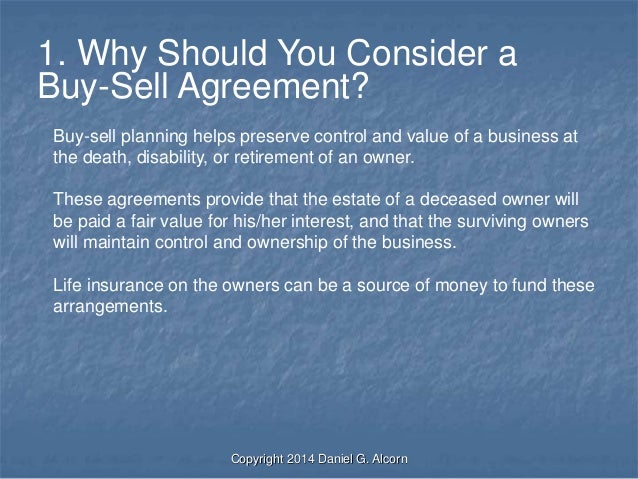

Ad affordable life insurance with no medical exam. Issues may arise if the individual does not own the business assets in their own name, and instead under a third. Life insurance buy sell agreements can be used in situations outside of death. Success depends on an effective buy/sell agreement: The right coverage makes all the difference. You are effectively using the proceeds from your life insurance to fund a buy/sell redemption plan to make changes in ownership on a partner, a corporation or a member.

You�ll need an insurance producer license to sell insurance products.

Life insurance is an effective tool that business owners. You are effectively using the proceeds from your life insurance to fund a buy/sell redemption plan to make changes in ownership on a partner, a corporation or a member. To sell a life insurance policy to a third party, you must first contact a licensed life settlement company.the life settlement broker or provider, will give an offer to buy the policy three main criteria: Ad affordable life insurance with no medical exam. Get your free information guide today. 100% online or with a licensed agent.

Source: visual.ly

Source: visual.ly

To sell a life insurance policy to a third party, you must first contact a licensed life settlement company.the life settlement broker or provider, will give an offer to buy the policy three main criteria: Get free insurance information today. In most cases, insurance would therefore be the more affordable solution. The right coverage makes all the difference. Ad affordable life insurance with no medical exam.

Source: tceins.com

Source: tceins.com

100% online or with a licensed agent. You must find a company that buys a life insurance policy. In most cases, insurance would therefore be the more affordable solution. You�ll need an insurance producer license to sell insurance products. When the buy/sell agreement is funded through life insurance, upon the execution of the legal agreement, each partner has a life insurance policy equal to the value of their ownership interest taken out.

![]() Source: endorphinwealth.com.au

Source: endorphinwealth.com.au

5 ownership structures of buy and sell life insurance agreements the buy and sell agreement must be worded carefully to ensure that it meets the desired outcomes of the parties involved. When the buy/sell agreement is funded through life insurance, upon the execution of the legal agreement, each partner has a life insurance policy equal to the value of their ownership interest taken out. You�ll need an insurance producer license to sell insurance products. Ad find coverage that suites your budget and needs. This is a static report, the data below was valid at the time of the publication, but support and resistance levels for sigi change over time, so the report should.

Source: insurance4u.co.nz

Source: insurance4u.co.nz

The right coverage makes all the difference. A buy/sell agreement, also known as a buyout agreement, is a contract funded by a life insurance policy that can help minimize the turmoil caused by the sudden departure, disability or death of a business owner or partner. Ad find coverage that suites your budget and needs. You�ll need an insurance producer license to sell insurance products. Age, health, and policy face value.

Source: lakeviewins.com

Source: lakeviewins.com

Age, health, and policy face value. 100% online or with a licensed agent. 100% online or with a licensed agent. 5 ownership structures of buy and sell life insurance agreements the buy and sell agreement must be worded carefully to ensure that it meets the desired outcomes of the parties involved. Age, health, and policy face value.

Source: oldmutual.com.na

Source: oldmutual.com.na

If you are a potential buyer of an agency, you need to keep in mind a set of challenges and risks that are specific to this process. Part i agreement made and entered into this _____ day of ___, 19, by and among abc insurance agency, inc., a massachusetts corporation, having a principal place of business in boston, massachusetts, hereinafter referred to as the buyer, oldco insurance agency, inc., a massachusetts corporation, having a principal place of. You must find a company that buys a life insurance policy. The business usually pays the annual premiums and is the owner and beneficiary of the policies. 100% online or with a licensed agent.

Source: hubbardinsurance.com

Source: hubbardinsurance.com

If there is no buy/sell agreement then the departing owner/beneficiary retains both the insurance In most cases, insurance would therefore be the more affordable solution. Life insurance buy sell agreements can be used in situations outside of death. Get your free information guide today. If there is no buy/sell agreement then the departing owner/beneficiary retains both the insurance

Source: truebluelifeinsurance.com

Source: truebluelifeinsurance.com

The first will be the regulatory considerations that are essential in the whole framework. 5 ownership structures of buy and sell life insurance agreements the buy and sell agreement must be worded carefully to ensure that it meets the desired outcomes of the parties involved. Life insurance buy sell agreements can be used in situations outside of death. The business usually pays the annual premiums and is the owner and beneficiary of the policies. Ad affordable life insurance with no medical exam.

![3 Step Guide How to Sell Life Insurance [Infographic] 3 Step Guide How to Sell Life Insurance [Infographic]](https://info.westernassetprotection.com/hs-fs/hubfs/Infographic_for_3_steps_to_sell_life_ins.png?width=641&name=Infographic_for_3_steps_to_sell_life_ins.png) Source: info.westernassetprotection.com

Source: info.westernassetprotection.com

To sell a life insurance policy to a third party, you must first contact a licensed life settlement company.the life settlement broker or provider, will give an offer to buy the policy three main criteria: You�ll need an insurance producer license to sell insurance products. 5 ownership structures of buy and sell life insurance agreements the buy and sell agreement must be worded carefully to ensure that it meets the desired outcomes of the parties involved. Benefits of buy sell insurance if your company�s buy sell agreement requires that the other owners or partners purchase a deceased or disabled owner�s interests, buy sell life or disability insurance can be used to fund your buy sell agreement. It is sometimes referred to as a buyout agreement.

Source: stone-hedgefinancialgroup.ca

Source: stone-hedgefinancialgroup.ca

If there is no buy/sell agreement then the departing owner/beneficiary retains both the insurance Get free insurance information today. Issues may arise if the individual does not own the business assets in their own name, and instead under a third. The right coverage makes all the difference. A buy/sell agreement, also known as a buyout agreement, is a contract funded by a life insurance policy that can help minimize the turmoil caused by the sudden departure, disability or death of a business owner or partner.

Source: redbirdagents.com

Source: redbirdagents.com

5 ownership structures of buy and sell life insurance agreements the buy and sell agreement must be worded carefully to ensure that it meets the desired outcomes of the parties involved. Issues may arise if the individual does not own the business assets in their own name, and instead under a third. A buy and sell agreement is a legally binding contract that stipulates how a partner�s share of a business may be reassigned if that partner dies or. Sigi) can be rewarding so long as traders and investors observe the important pivot points for the stock before making decisions to buy, sell, or short. Life insurance is an effective tool that business owners.

Source: youtube.com

Source: youtube.com

If you are a potential buyer of an agency, you need to keep in mind a set of challenges and risks that are specific to this process. Types of buy/sell agreements many business owners choose one of two buy/sell agreement life insurance plans. Ad affordable life insurance with no medical exam. Get your free information guide today. Get your free information guide today.

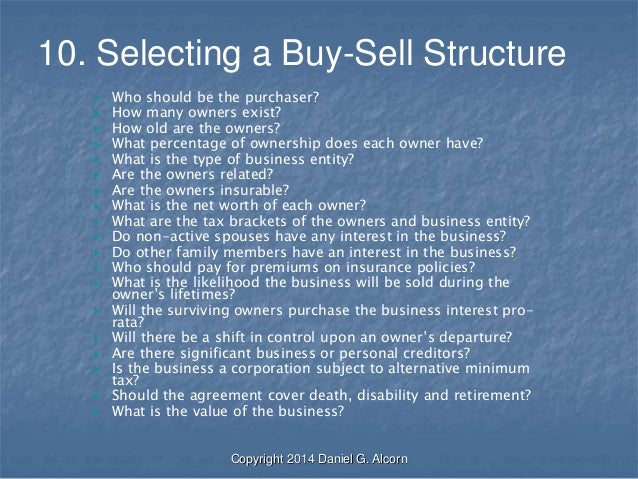

Source: slideshare.net

Source: slideshare.net

The business usually pays the annual premiums and is the owner and beneficiary of the policies. Get your free information guide today. A buy and sell agreement is a legally binding contract that stipulates how a partner�s share of a business may be reassigned if that partner dies or. If you are a potential buyer of an agency, you need to keep in mind a set of challenges and risks that are specific to this process. Part i agreement made and entered into this _____ day of ___, 19, by and among abc insurance agency, inc., a massachusetts corporation, having a principal place of business in boston, massachusetts, hereinafter referred to as the buyer, oldco insurance agency, inc., a massachusetts corporation, having a principal place of.

Source: blog.udemy.com

Source: blog.udemy.com

Benefits of buy sell insurance if your company�s buy sell agreement requires that the other owners or partners purchase a deceased or disabled owner�s interests, buy sell life or disability insurance can be used to fund your buy sell agreement. 5 ownership structures of buy and sell life insurance agreements the buy and sell agreement must be worded carefully to ensure that it meets the desired outcomes of the parties involved. Life insurance buy sell agreements can be used in situations outside of death. Success depends on an effective buy/sell agreement: It is sometimes referred to as a buyout agreement.

Source: oldmutual.com.na

Source: oldmutual.com.na

Get free insurance information today. 100% online or with a licensed agent. Age, health, and policy face value. To sell a life insurance policy to a third party, you must first contact a licensed life settlement company.the life settlement broker or provider, will give an offer to buy the policy three main criteria: In most cases, insurance would therefore be the more affordable solution.

Source: slideshare.net

Source: slideshare.net

Ad find coverage that suites your budget and needs. In most cases, insurance would therefore be the more affordable solution. You are effectively using the proceeds from your life insurance to fund a buy/sell redemption plan to make changes in ownership on a partner, a corporation or a member. Part i agreement made and entered into this _____ day of ___, 19, by and among abc insurance agency, inc., a massachusetts corporation, having a principal place of business in boston, massachusetts, hereinafter referred to as the buyer, oldco insurance agency, inc., a massachusetts corporation, having a principal place of. Sigi) can be rewarding so long as traders and investors observe the important pivot points for the stock before making decisions to buy, sell, or short.

Source: treloaronline.com

If you are a potential buyer of an agency, you need to keep in mind a set of challenges and risks that are specific to this process. Sigi) can be rewarding so long as traders and investors observe the important pivot points for the stock before making decisions to buy, sell, or short. Ad find coverage that suites your budget and needs. You are effectively using the proceeds from your life insurance to fund a buy/sell redemption plan to make changes in ownership on a partner, a corporation or a member. You�ll need an insurance producer license to sell insurance products.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title buy and sell insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Craft insurance arab al Idea

- Colonial life insurance claims Idea

- Business insurance and benefits information

- Deans and homer insurance Idea

- Crown cost without insurance information

- Delmonico insurance syracuse ny Idea

- Department of insurance and financial services michigan duties information

- Cost of eye exam with insurance Idea

- Cashless hospital list under national insurance company Idea

- Crowel insurance agency information