Buy sell agreement funded by life insurance Idea

Home » Trend » Buy sell agreement funded by life insurance IdeaYour Buy sell agreement funded by life insurance images are ready in this website. Buy sell agreement funded by life insurance are a topic that is being searched for and liked by netizens now. You can Download the Buy sell agreement funded by life insurance files here. Get all free vectors.

If you’re looking for buy sell agreement funded by life insurance pictures information related to the buy sell agreement funded by life insurance interest, you have pay a visit to the right site. Our website always gives you suggestions for downloading the highest quality video and picture content, please kindly search and locate more informative video content and graphics that fit your interests.

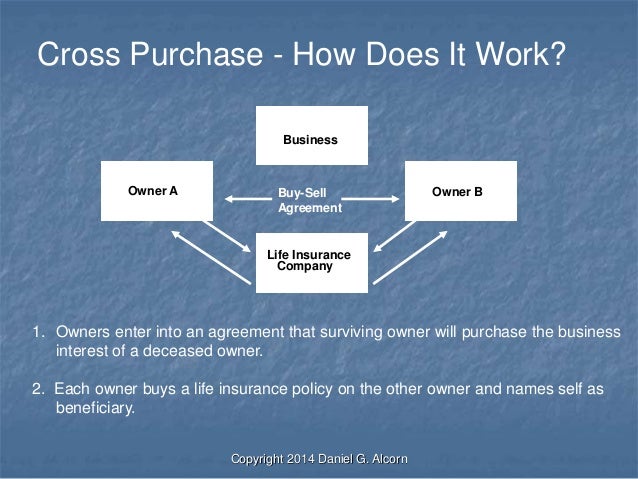

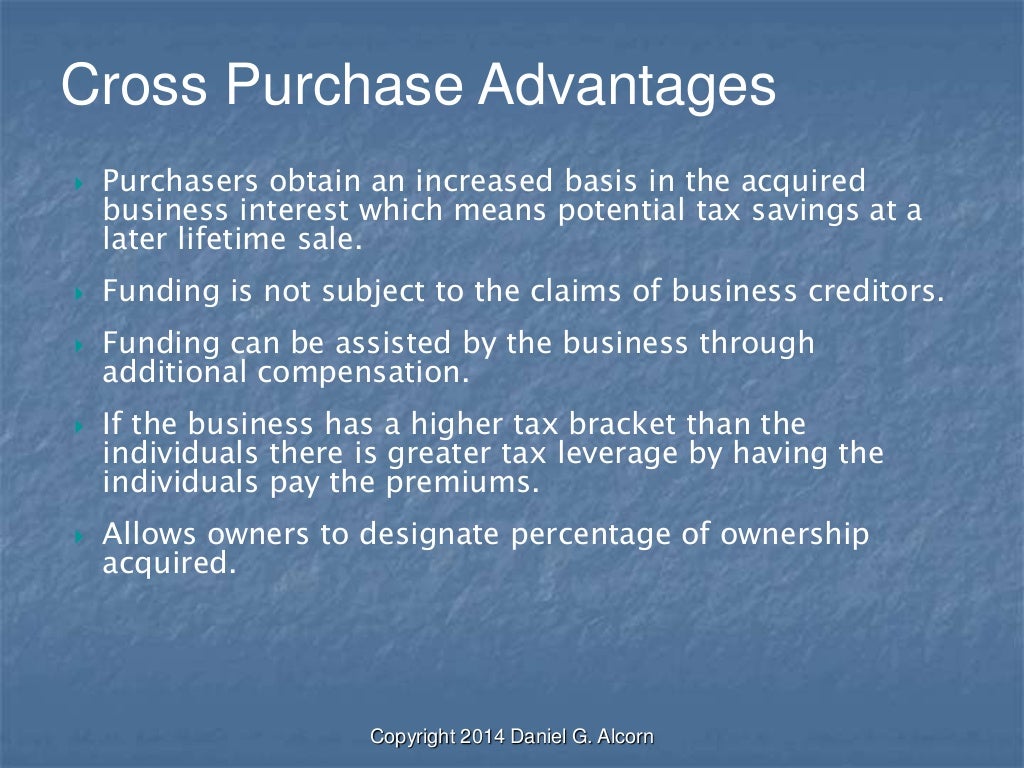

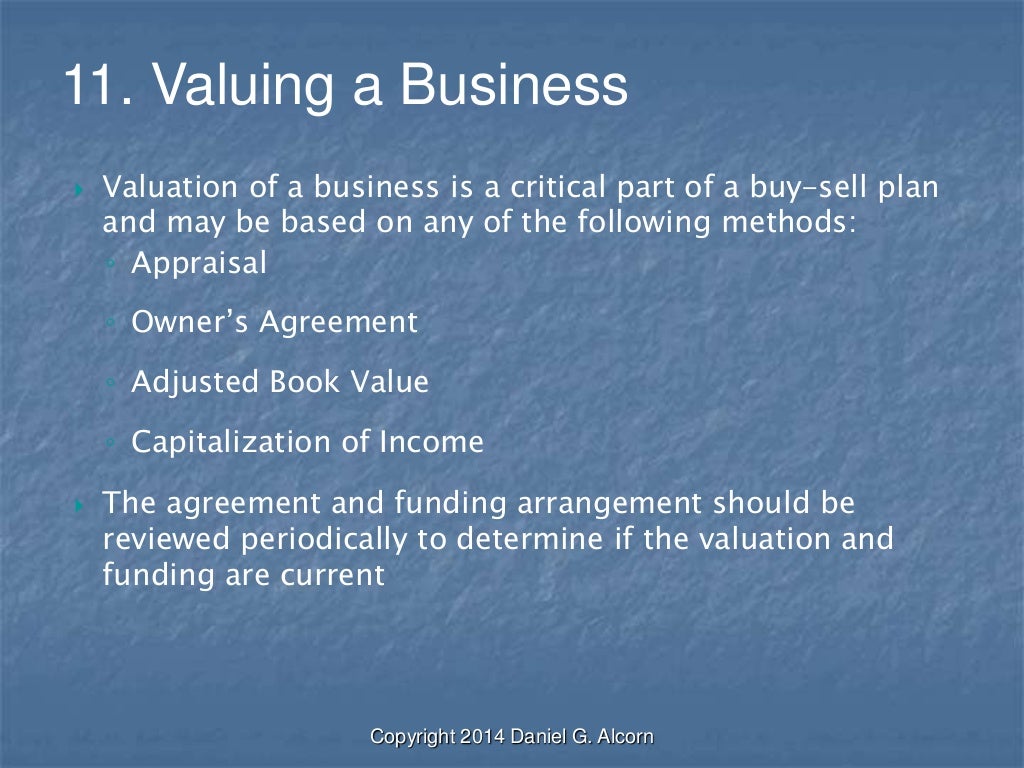

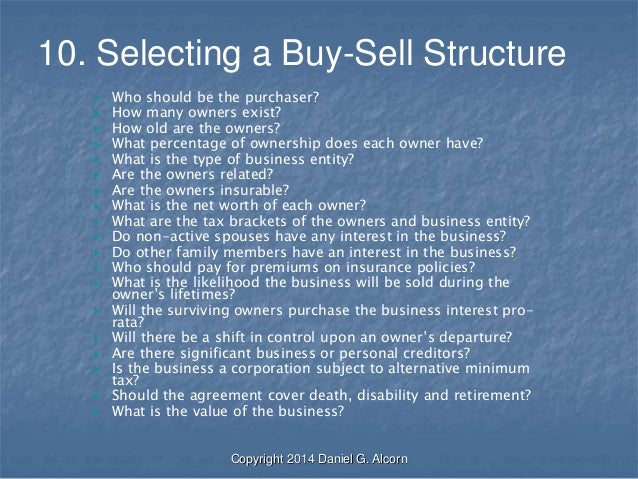

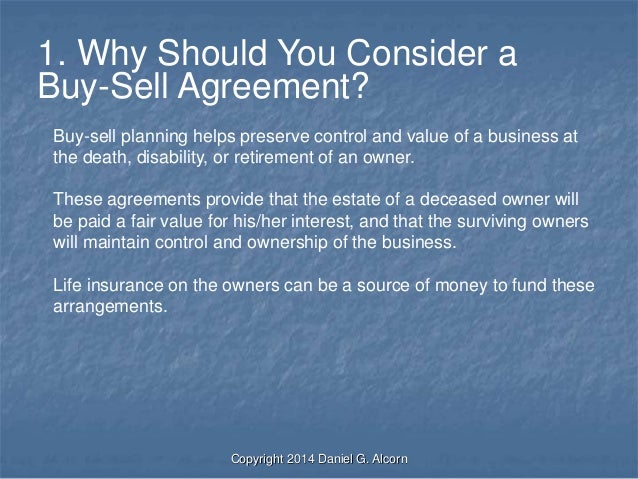

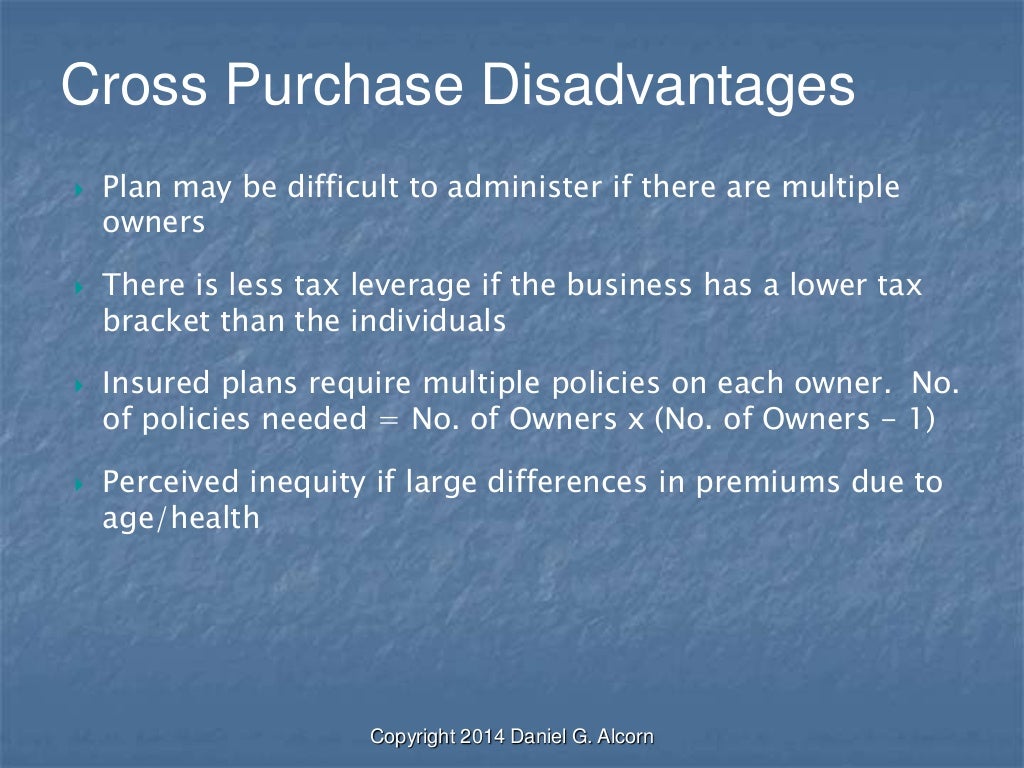

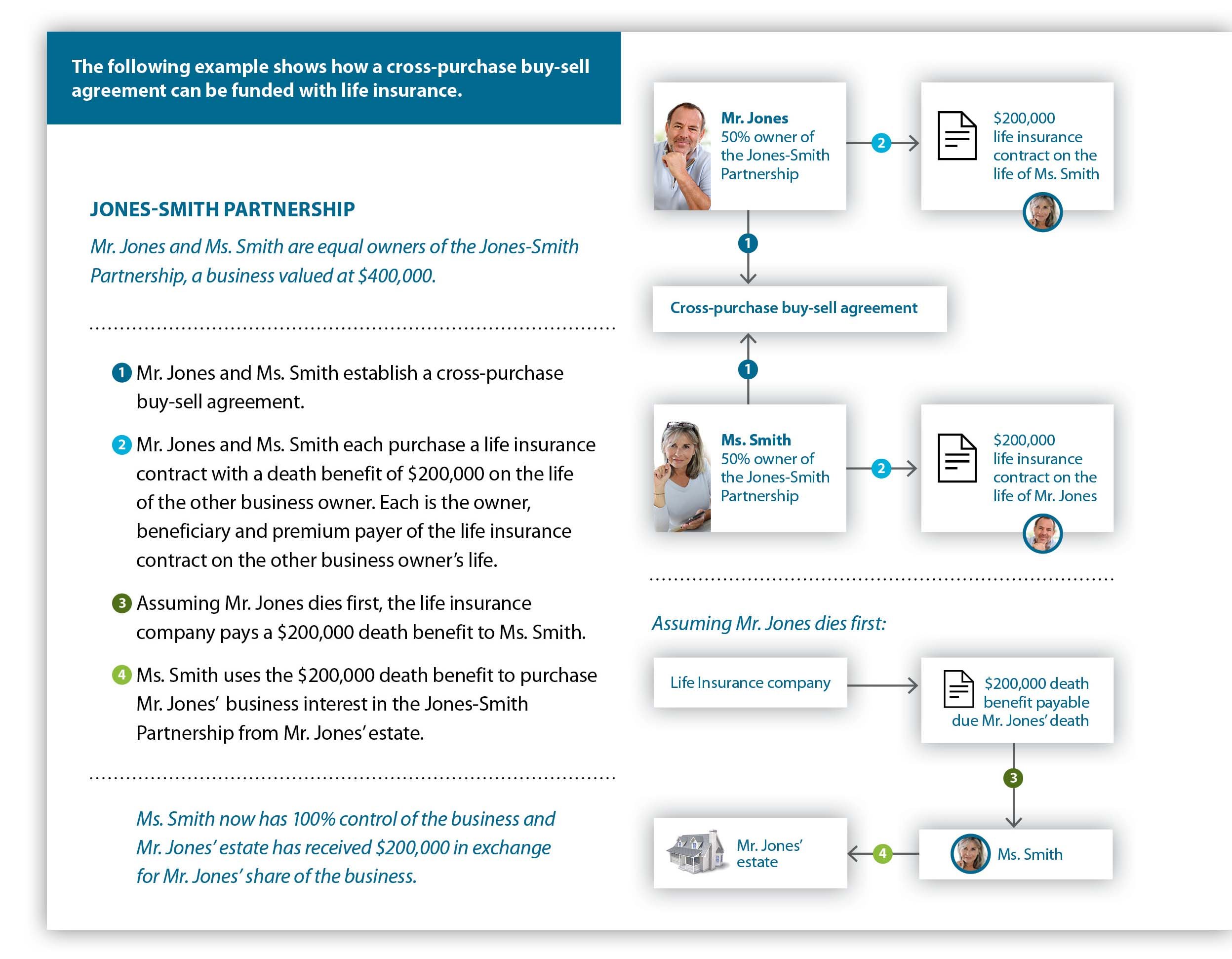

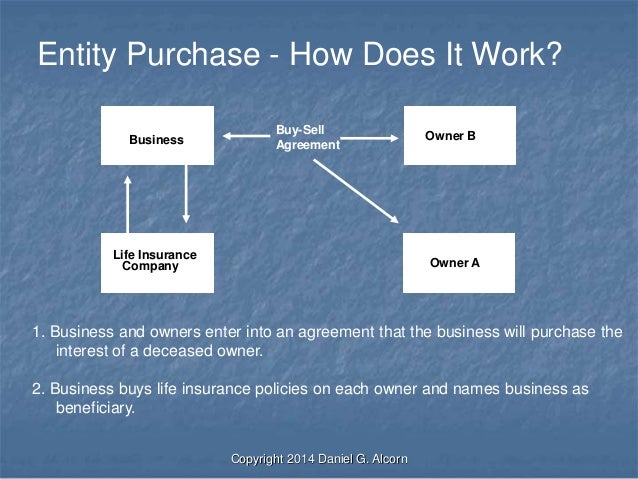

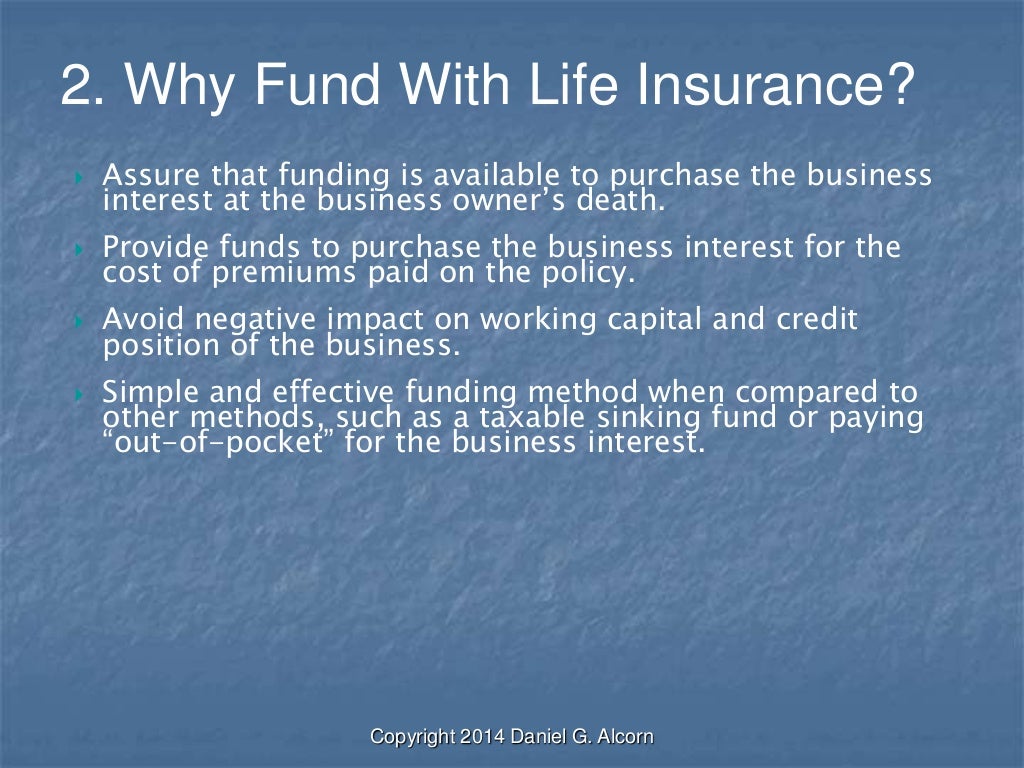

Buy Sell Agreement Funded By Life Insurance. Each has its own benefits, says muth. Advantages to funding with life insurance. Such agreements are often funded by life insurance on the lives of the owners. In the event of their death, the transition is made much smoother by providing.

Buy Sell Agreements Funded with Life Insurance From slideshare.net

Buy Sell Agreements Funded with Life Insurance From slideshare.net

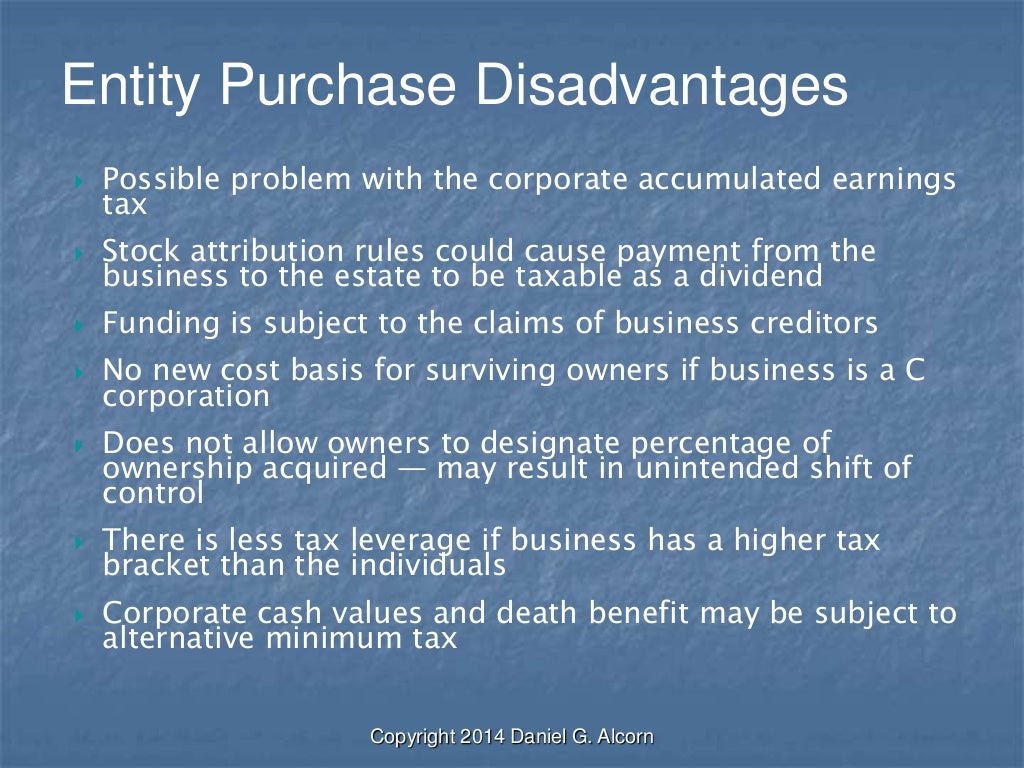

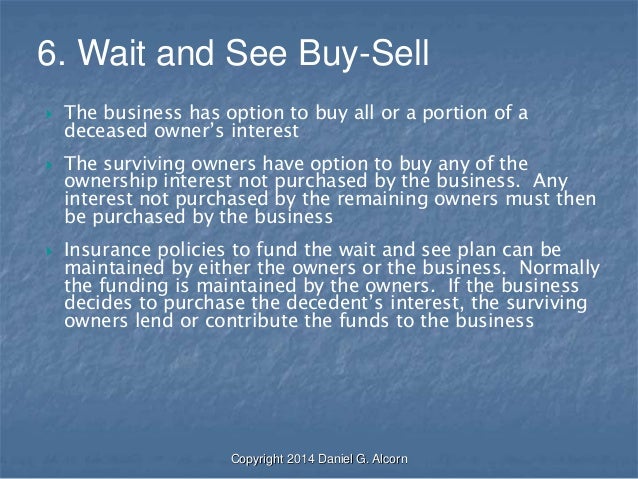

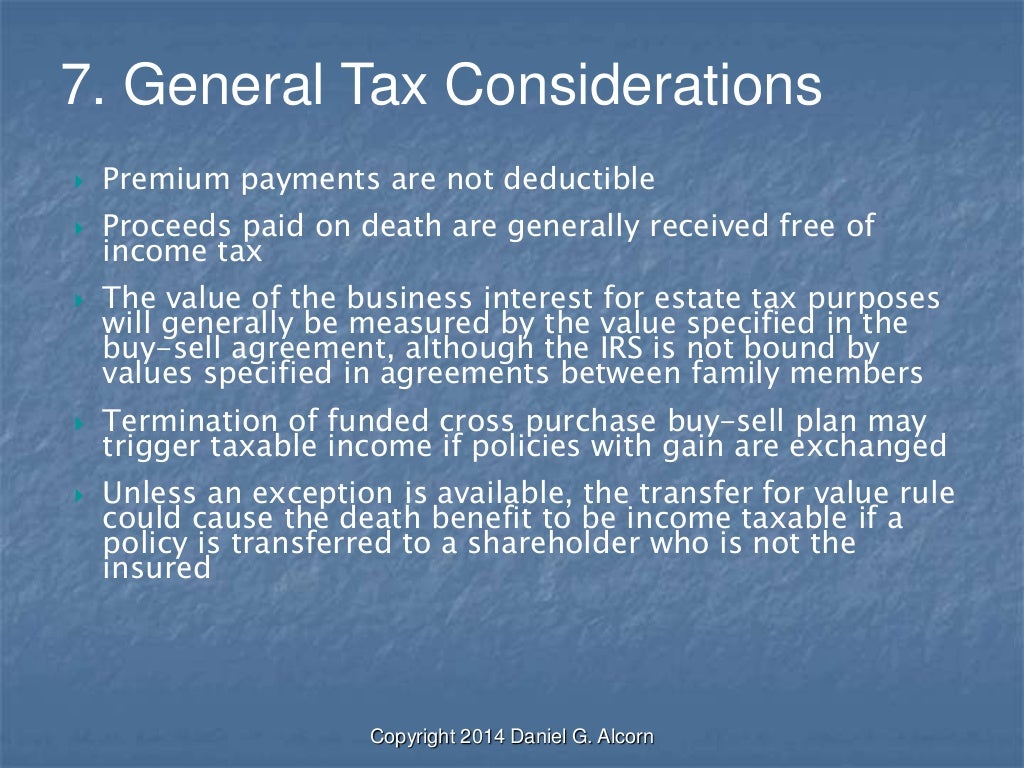

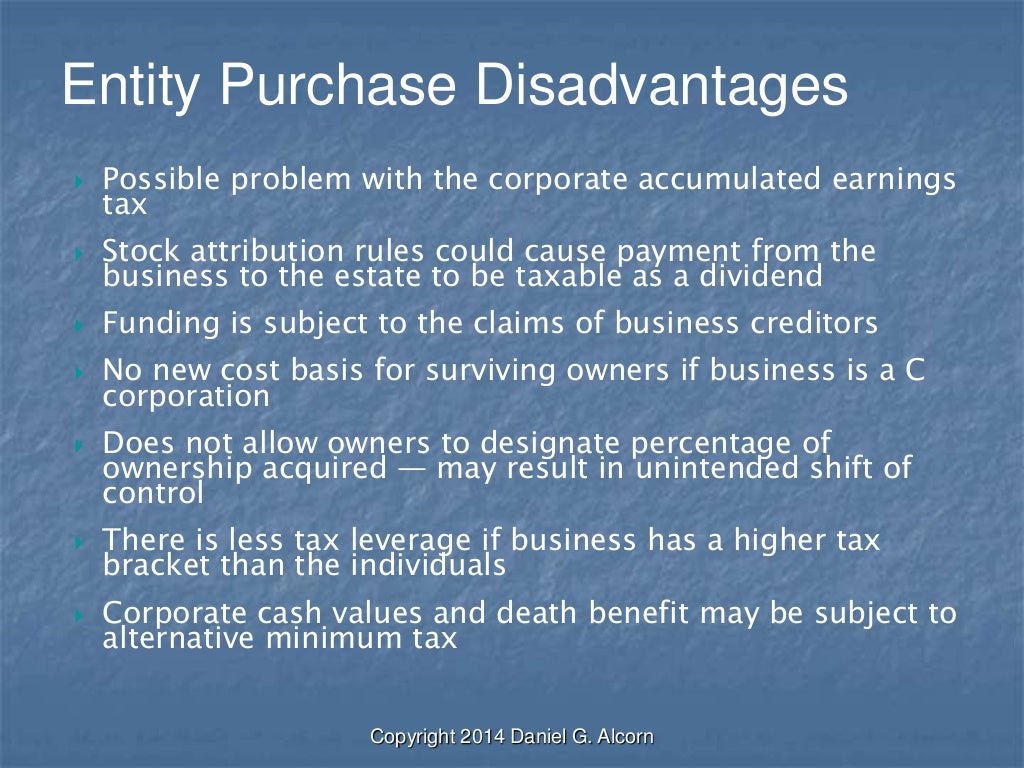

To ensure that the cash is available for this buyout, it is often funded through life insurance purchased by the company. A c corporation may be subject to the alternative minimum tax (amt) It is recommended that an experienced tax and legal advisor be consulted in the drafting of such agreements. In addition, the funds used to buy the deceased’s share are purchased for. This insurance can offset lost revenue, increased expenses, and other needs related to the loss of an active owner. When the buy/sell agreement is funded through life insurance, upon the execution of the legal agreement, each partner has a life insurance policy equal to the value of their ownership interest taken out.

Such agreements are often funded by life insurance on the lives of the owners.

A buy sell agreement states that on the death of one owner, the other (s) will buy out that partner’s successor. They can also go into effect if an owner retires or doesn’t want the company anymore. Utilizing a life insurance contract to fund the buyout has multiple benefits. This ensures that funds are immediately available when a death occurs; A c corporation may be subject to the alternative minimum tax (amt) In the event of their death, the transition is made much smoother by providing.

Source: truebluelifeinsurance.com

Source: truebluelifeinsurance.com

This ensures that funds are immediately available when a death occurs; In addition, the funds used to buy the deceased’s share are purchased for. This insurance can offset lost revenue, increased expenses, and other needs related to the loss of an active owner. Each has its own benefits, says muth. When the buy/sell agreement is funded through life insurance, upon the execution of the legal agreement, each partner has a life insurance policy equal to the value of their ownership interest taken out.

Source: truebluelifeinsurance.com

Source: truebluelifeinsurance.com

Term insurance provides temporary coverage for a specific window of time and has no cash value component. The family doesn’t have to worry about managing part of a business. Buy sell agreement funded with life insurance “if you retire, you may be able to transfer ownership of the policy to your life and take away the policy. This would allow you to designate your own beneficiary for the death benefit and use each cumulative current value to supplement your retirement income, finance a new activity or do what you. The entity and its owners may have sufficient resources to pay for any interests that may be bought pursuant to the terms of the agreement.

Source: de.slideshare.net

Source: de.slideshare.net

Utilizing a life insurance contract to fund the buyout has multiple benefits. The entity and its owners may have sufficient resources to pay for any interests that may be bought pursuant to the terms of the agreement. In the event of their death, the transition is made much smoother by providing. This would allow you to designate your own beneficiary for the death benefit and use each cumulative current value to supplement your retirement income, finance a new activity or do what you. In addition, the funds used to buy the deceased’s share are purchased for.

Source: slideshare.net

Source: slideshare.net

This would allow you to designate your own beneficiary for the death benefit and use each cumulative current value to supplement your retirement income, finance a new activity or do what you. This ensures that funds are immediately available when a death occurs; For the most part, life insurance rates are fairly low; Such agreements are often funded by life insurance on the lives of the owners. Buy sell agreements funded with life insurance when a buy sell agreement is funded with life insurance, the policy owner uses the insurance proceeds to purchase the.

Source: slideshare.net

Source: slideshare.net

Unlike purchasing a life insurance policy for a key man, or using it for a deferred compensation plan, it is used for the interests of the partners. This is one of the reasons it’s so popular. While in the act of purchasing buy sell life insurance, a business may want to also obtain key man life insurance, which provides capital to the business above and beyond the needs of the buy sell agreement. In the event of their death, the transition is made much smoother by providing. A c corporation may be subject to the alternative minimum tax (amt)

Source: slideshare.net

Source: slideshare.net

A c corporation may be subject to the alternative minimum tax (amt) The entity and its owners may have sufficient resources to pay for any interests that may be bought pursuant to the terms of the agreement. To ensure that the cash is available for this buyout, it is often funded through life insurance purchased by the company. Buy sell agreements funded with life insurance when a buy sell agreement is funded with life insurance, the policy owner uses the insurance proceeds to purchase the. However, the initial premiums may be lower than they’d be for a comparable amount of permanent life coverage.

Source: truebluelifeinsurance.com

Source: truebluelifeinsurance.com

While in the act of purchasing buy sell life insurance, a business may want to also obtain key man life insurance, which provides capital to the business above and beyond the needs of the buy sell agreement. While in the act of purchasing buy sell life insurance, a business may want to also obtain key man life insurance, which provides capital to the business above and beyond the needs of the buy sell agreement. Buy sell agreements funded with life insurance when a buy sell agreement is funded with life insurance, the policy owner uses the insurance proceeds to purchase the. A buy sell agreement states that on the death of one owner, the other (s) will buy out that partner’s successor. It is recommended that an experienced tax and legal advisor be consulted in the drafting of such agreements.

Source: slideshare.net

Source: slideshare.net

Advantages to funding with life insurance. The family doesn’t have to worry about managing part of a business. Buy sell agreements can be used in other scenarios other than death. Advantages to funding with life insurance. While in the act of purchasing buy sell life insurance, a business may want to also obtain key man life insurance, which provides capital to the business above and beyond the needs of the buy sell agreement.

Source: slideshare.net

Source: slideshare.net

The entity and its owners may have sufficient resources to pay for any interests that may be bought pursuant to the terms of the agreement. In addition, the funds used to buy the deceased’s share are purchased for. Term insurance provides temporary coverage for a specific window of time and has no cash value component. Buy sell agreements can be used in other scenarios other than death. Unlike purchasing a life insurance policy for a key man, or using it for a deferred compensation plan, it is used for the interests of the partners.

Source: slideshare.net

Source: slideshare.net

In addition, the funds used to buy the deceased’s share are purchased for. Term insurance provides temporary coverage for a specific window of time and has no cash value component. The family doesn’t have to worry about managing part of a business. For the most part, life insurance rates are fairly low; This while also grieving and planning a funeral, which is often a relief.

Source: slideshare.net

Source: slideshare.net

Such agreements are often funded by life insurance on the lives of the owners. To ensure that the cash is available for this buyout, it is often funded through life insurance purchased by the company. A c corporation may be subject to the alternative minimum tax (amt) A buy sell agreement states that on the death of one owner, the other (s) will buy out that partner’s successor. Utilizing a life insurance contract to fund the buyout has multiple benefits.

Source: modernwoodmen.org

Source: modernwoodmen.org

Buy sell agreements can be used in other scenarios other than death. The entity and its owners may have sufficient resources to pay for any interests that may be bought pursuant to the terms of the agreement. Advantages to funding with life insurance. In the event of their death, the transition is made much smoother by providing. Buy sell agreement funded with life insurance “if you retire, you may be able to transfer ownership of the policy to your life and take away the policy.

Source: slideshare.net

Source: slideshare.net

Each has its own benefits, says muth. Unlike purchasing a life insurance policy for a key man, or using it for a deferred compensation plan, it is used for the interests of the partners. Term insurance provides temporary coverage for a specific window of time and has no cash value component. While in the act of purchasing buy sell life insurance, a business may want to also obtain key man life insurance, which provides capital to the business above and beyond the needs of the buy sell agreement. In the event of their death, the transition is made much smoother by providing.

Source: slideshare.net

Source: slideshare.net

Each has its own benefits, says muth. Buy sell agreements can be used in other scenarios other than death. A buy/sell agreement funded with life insurance is legal agreement between the current generation owner and the next generation that will be taking over the operation. Buy sell agreements funded with life insurance when a buy sell agreement is funded with life insurance, the policy owner uses the insurance proceeds to purchase the. Utilizing a life insurance contract to fund the buyout has multiple benefits.

Source: ecfofcf.net

Source: ecfofcf.net

However, the initial premiums may be lower than they’d be for a comparable amount of permanent life coverage. This would allow you to designate your own beneficiary for the death benefit and use each cumulative current value to supplement your retirement income, finance a new activity or do what you. This ensures that funds are immediately available when a death occurs; To ensure that the cash is available for this buyout, it is often funded through life insurance purchased by the company. Each has its own benefits, says muth.

Source: slideshare.net

Source: slideshare.net

In addition, the funds used to buy the deceased’s share are purchased for. Under this option, when a partner dies, the life insurance of the existing partner is automatically used to purchase the dead partner’s stake, and compensate their family. In the event of their death, the transition is made much smoother by providing. They can also go into effect if an owner retires or doesn’t want the company anymore. Each has its own benefits, says muth.

Source: slideshare.net

Source: slideshare.net

Unlike purchasing a life insurance policy for a key man, or using it for a deferred compensation plan, it is used for the interests of the partners. Term insurance provides temporary coverage for a specific window of time and has no cash value component. Under this option, when a partner dies, the life insurance of the existing partner is automatically used to purchase the dead partner’s stake, and compensate their family. This is one of the reasons it’s so popular. While in the act of purchasing buy sell life insurance, a business may want to also obtain key man life insurance, which provides capital to the business above and beyond the needs of the buy sell agreement.

Source: slideshare.net

Source: slideshare.net

This insurance can offset lost revenue, increased expenses, and other needs related to the loss of an active owner. Such agreements are often funded by life insurance on the lives of the owners. This insurance can offset lost revenue, increased expenses, and other needs related to the loss of an active owner. Buy sell agreements can be used in other scenarios other than death. This ensures that funds are immediately available when a death occurs;

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title buy sell agreement funded by life insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Craft insurance arab al Idea

- Colonial life insurance claims Idea

- Business insurance and benefits information

- Deans and homer insurance Idea

- Crown cost without insurance information

- Delmonico insurance syracuse ny Idea

- Department of insurance and financial services michigan duties information

- Cost of eye exam with insurance Idea

- Cashless hospital list under national insurance company Idea

- Crowel insurance agency information