Buy sell agreement life insurance Idea

Home » Trend » Buy sell agreement life insurance IdeaYour Buy sell agreement life insurance images are ready. Buy sell agreement life insurance are a topic that is being searched for and liked by netizens today. You can Get the Buy sell agreement life insurance files here. Download all free photos and vectors.

If you’re looking for buy sell agreement life insurance images information connected with to the buy sell agreement life insurance topic, you have come to the ideal blog. Our site always provides you with hints for viewing the maximum quality video and image content, please kindly surf and find more enlightening video articles and images that match your interests.

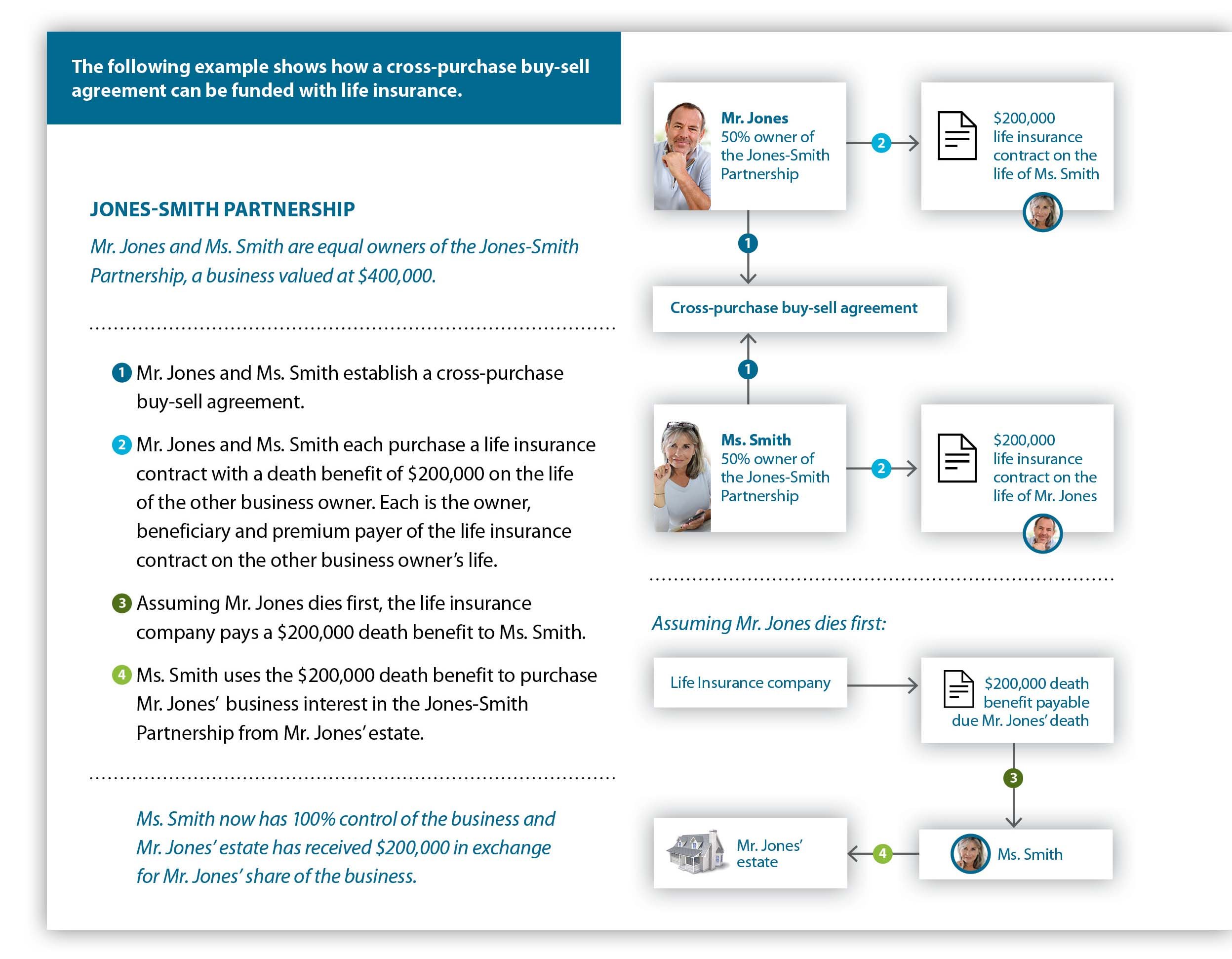

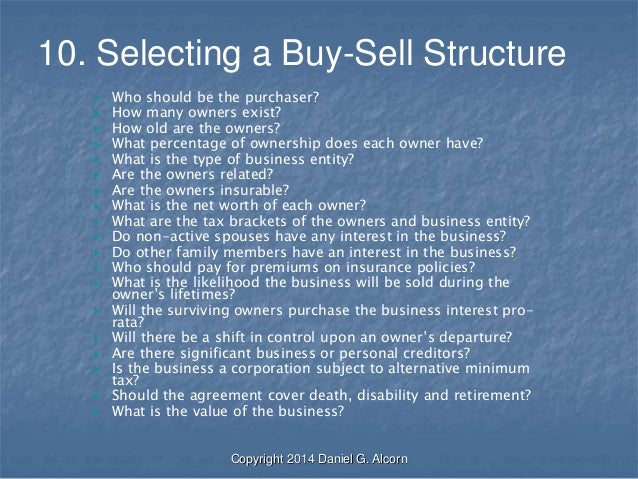

Buy Sell Agreement Life Insurance. These agreements are just as important as a personal liability policy, and are designed to ensure a smooth transition of ownership when business ownership needs to transferred because of the loss of an owner. It is sometimes referred to as a buyout agreement. Agree in writing to be bound by the terms of this agreement before or at the time of the sale or transfer. Buy/sell agreement funded by life insurance:

What Is Buy Sell Agreement Life Insurance Need A Buyout From truebluelifeinsurance.com

What Is Buy Sell Agreement Life Insurance Need A Buyout From truebluelifeinsurance.com

Guarantee to buy the owner’s shares. Suppose something unexpected happens, and one of the business owners passes away. Agree in writing to be bound by the terms of this agreement before or at the time of the sale or transfer. Potential pitfalls some of the pitfalls include matching the life insurance product to the buyout need and timing considerations. These agreements are just as important as a personal liability policy, and are designed to ensure a smooth transition of ownership when business ownership needs to transferred because of the loss of an owner. Buy sell agreements can be.

It is sometimes referred to as a buyout agreement.

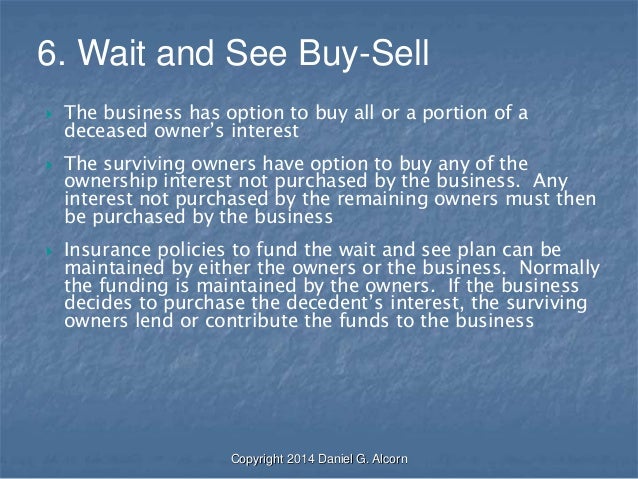

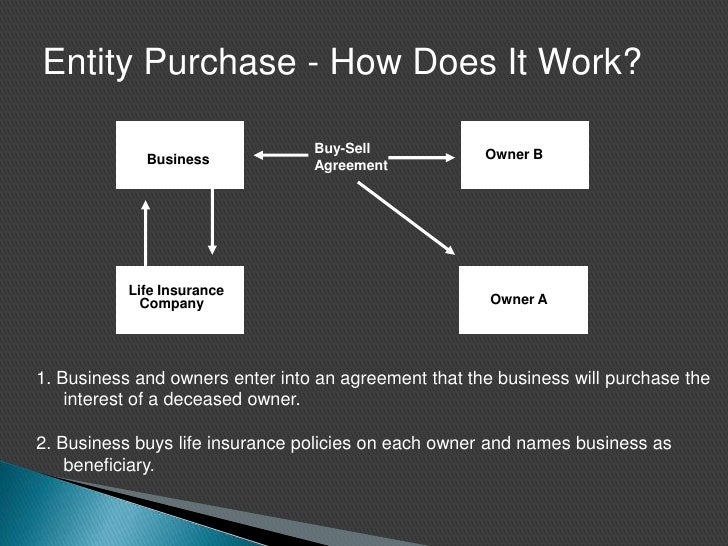

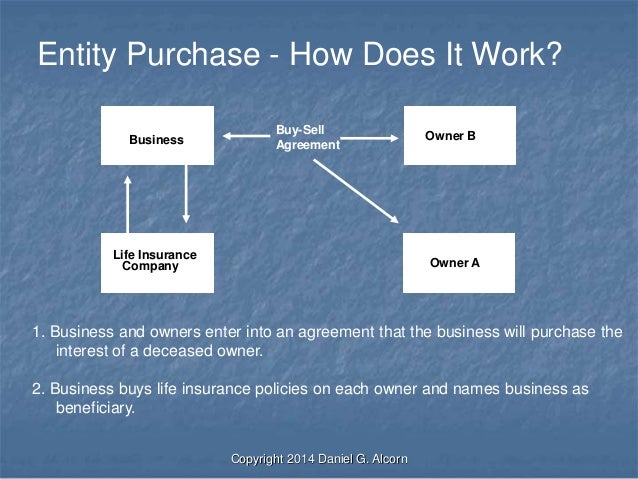

Life insurance proceeds are generally income tax free; Funding a buy sell agreement using life insurance. This type of buy sell agreement is called an entity purchase agreement or stock redemption agreement. For a business that is likely to be sold to a third party within the next decade or so, a term insurance policy is generally. The business will normally have a life insurance policy for every owner. Potential pitfalls some of the pitfalls include matching the life insurance product to the buyout need and timing considerations.

Source: modernwoodmen.org

Source: modernwoodmen.org

That’s why life insurance buy sell agreements are so important. Suppose something unexpected happens, and one of the business owners passes away. Life insurance is the most common source of funding the transaction. A corporate owned life insurance policy. That’s why life insurance buy sell agreements are so important.

Source: truebluelifeinsurance.com

Source: truebluelifeinsurance.com

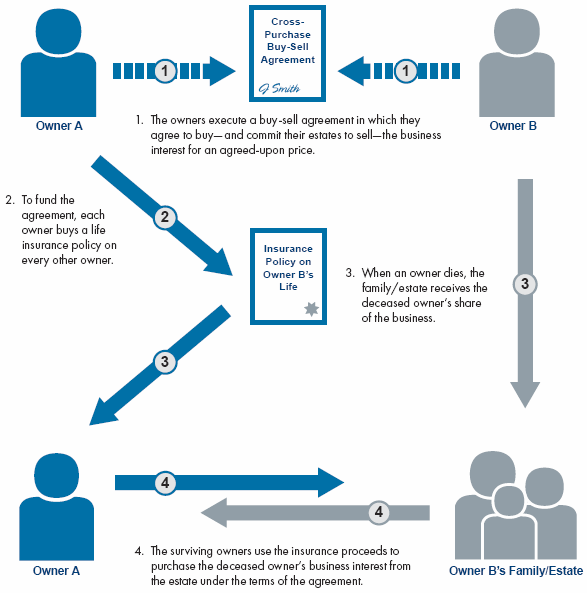

The agreement outlines how each share of the business will be sold to the company or other owners. Drawing up a partnership agreement early on in the business planning stages can provide simple, legal steps in the event that your partner passes away or wants to leave the. A corporate owned life insurance policy. Buy/sell agreement funded by life insurance: Potential pitfalls some of the pitfalls include matching the life insurance product to the buyout need and timing considerations.

Source: slideshare.net

Source: slideshare.net

This type of buy sell agreement is called an entity purchase agreement or stock redemption agreement. By using a fully funded buy sell agreement, it makes sure that your part of the business will be paid for in full. This ensures that funds are immediately available when a death occurs; A corporate owned life insurance policy. Agree in writing to be bound by the terms of this agreement before or at the time of the sale or transfer.

Source: slideshare.net

Source: slideshare.net

That’s why life insurance buy sell agreements are so important. These agreements are just as important as a personal liability policy, and are designed to ensure a smooth transition of ownership when business ownership needs to transferred because of the loss of an owner. Buy/sell agreement and term life insurance: It is sometimes referred to as a buyout agreement. This ensures that funds are immediately available when a death occurs;

Source: slideshare.net

Source: slideshare.net

The agreement outlines how each share of the business will be sold to the company or other owners. Buy sell agreements can be. Potential pitfalls some of the pitfalls include matching the life insurance product to the buyout need and timing considerations. A corporate owned life insurance policy. Funding a buy sell agreement using life insurance.

Source: slideshare.net

Source: slideshare.net

Buy sell agreements can be. Potential pitfalls some of the pitfalls include matching the life insurance product to the buyout need and timing considerations. The agreement outlines how each share of the business will be sold to the company or other owners. Drawing up a partnership agreement early on in the business planning stages can provide simple, legal steps in the event that your partner passes away or wants to leave the. This ensures that funds are immediately available when a death occurs;

Source: slideshare.net

Source: slideshare.net

A c corporation may be subject to the alternative minimum tax (amt) Life insurance proceeds are generally income tax free; A corporate owned life insurance policy. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. This ensures that funds are immediately available when a death occurs;

Source: truebluelifeinsurance.com

Source: truebluelifeinsurance.com

These agreements are just as important as a personal liability policy, and are designed to ensure a smooth transition of ownership when business ownership needs to transferred because of the loss of an owner. Buy sell agreements can be. This type of buy sell agreement is called an entity purchase agreement or stock redemption agreement. The agreement outlines how each share of the business will be sold to the company or other owners. For a business that is likely to be sold to a third party within the next decade or so, a term insurance policy is generally.

Source: yourlifeinsurance101.com

Source: yourlifeinsurance101.com

A corporate owned life insurance policy. Agree in writing to be bound by the terms of this agreement before or at the time of the sale or transfer. Guarantee to buy the owner’s shares. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. Buy sell agreements can be.

Source: slideshare.net

Source: slideshare.net

Life insurance proceeds are generally income tax free; Guarantee to buy the owner’s shares. That’s why life insurance buy sell agreements are so important. Buy/sell agreement and term life insurance: A c corporation may be subject to the alternative minimum tax (amt)

Source: insuranceblogbychris.com

Source: insuranceblogbychris.com

By using a fully funded buy sell agreement, it makes sure that your part of the business will be paid for in full. A c corporation may be subject to the alternative minimum tax (amt) The agreement outlines how each share of the business will be sold to the company or other owners. By using a fully funded buy sell agreement, it makes sure that your part of the business will be paid for in full. Life insurance proceeds are generally income tax free;

Source: ecfofcf.net

Source: ecfofcf.net

It’s likely they would not. Buy/sell agreement and term life insurance: Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. Funding a buy sell agreement using life insurance. The agreement outlines how each share of the business will be sold to the company or other owners.

Source: gtldworldcongress.com

Source: gtldworldcongress.com

Potential pitfalls some of the pitfalls include matching the life insurance product to the buyout need and timing considerations. The business will normally have a life insurance policy for every owner. A buy/sell agreement, also known as a buyout agreement, is a contract funded by a life insurance policy that can help minimize the turmoil caused by the sudden departure, disability or death of a business owner or partner. Buy/sell agreement funded by life insurance: By using a fully funded buy sell agreement, it makes sure that your part of the business will be paid for in full.

Source: slideshare.net

Source: slideshare.net

Put simply, a buy sell life insurance agreement covers the risk of significant financial loss to you and your partners in the event one of you suddenly dies or become disabled. Suppose something unexpected happens, and one of the business owners passes away. Buy/sell agreement funded by life insurance: These agreements are just as important as a personal liability policy, and are designed to ensure a smooth transition of ownership when business ownership needs to transferred because of the loss of an owner. A buy/sell agreement, also known as a buyout agreement, is a contract funded by a life insurance policy that can help minimize the turmoil caused by the sudden departure, disability or death of a business owner or partner.

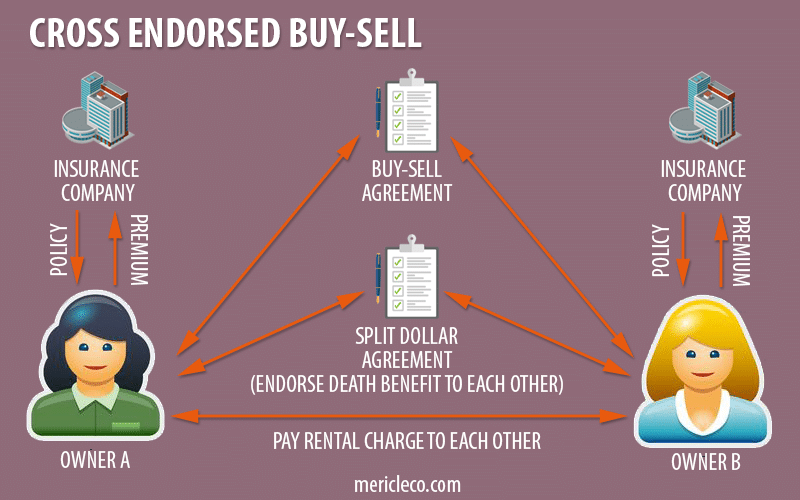

Source: mericleco.com

Source: mericleco.com

Life insurance is the most common source of funding the transaction. A corporate owned life insurance policy. Sometimes the only way to fully fund an agreement is using a life insurance policy. The agreement outlines how each share of the business will be sold to the company or other owners. It’s likely they would not.

Source: image.frompo.com

Source: image.frompo.com

Potential pitfalls some of the pitfalls include matching the life insurance product to the buyout need and timing considerations. These agreements are just as important as a personal liability policy, and are designed to ensure a smooth transition of ownership when business ownership needs to transferred because of the loss of an owner. By using a fully funded buy sell agreement, it makes sure that your part of the business will be paid for in full. For a business that is likely to be sold to a third party within the next decade or so, a term insurance policy is generally. The agreement outlines how each share of the business will be sold to the company or other owners.

Source: truebluelifeinsurance.com

Source: truebluelifeinsurance.com

Funding a buy sell agreement using life insurance. Life insurance is the most common source of funding the transaction. It is sometimes referred to as a buyout agreement. A corporate owned life insurance policy. The business will normally have a life insurance policy for every owner.

Source: redbirdagents.com

Source: redbirdagents.com

Buy sell agreements can be. Buy/sell agreement funded by life insurance: Buy/sell agreement and term life insurance: Potential pitfalls some of the pitfalls include matching the life insurance product to the buyout need and timing considerations. A c corporation may be subject to the alternative minimum tax (amt)

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title buy sell agreement life insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Craft insurance arab al Idea

- Colonial life insurance claims Idea

- Business insurance and benefits information

- Deans and homer insurance Idea

- Crown cost without insurance information

- Delmonico insurance syracuse ny Idea

- Department of insurance and financial services michigan duties information

- Cost of eye exam with insurance Idea

- Cashless hospital list under national insurance company Idea

- Crowel insurance agency information