Buying life insurance on a parent information

Home » Trend » Buying life insurance on a parent informationYour Buying life insurance on a parent images are available in this site. Buying life insurance on a parent are a topic that is being searched for and liked by netizens today. You can Get the Buying life insurance on a parent files here. Find and Download all royalty-free vectors.

If you’re searching for buying life insurance on a parent pictures information linked to the buying life insurance on a parent keyword, you have come to the right blog. Our website always gives you suggestions for seeing the highest quality video and image content, please kindly search and find more informative video articles and graphics that match your interests.

Buying Life Insurance On A Parent. It is not always possible to buy life insurance on someone else. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. In order to purchase life insurance on a parent, or on anyone for that matter, you must have consent. They have to pay out benefits upon death and insuring ‘older people’ makes that risk higher, which often means more restrictions.

Should You Buy Life Insurance on Your Parents? From insurechance.com

Should You Buy Life Insurance on Your Parents? From insurechance.com

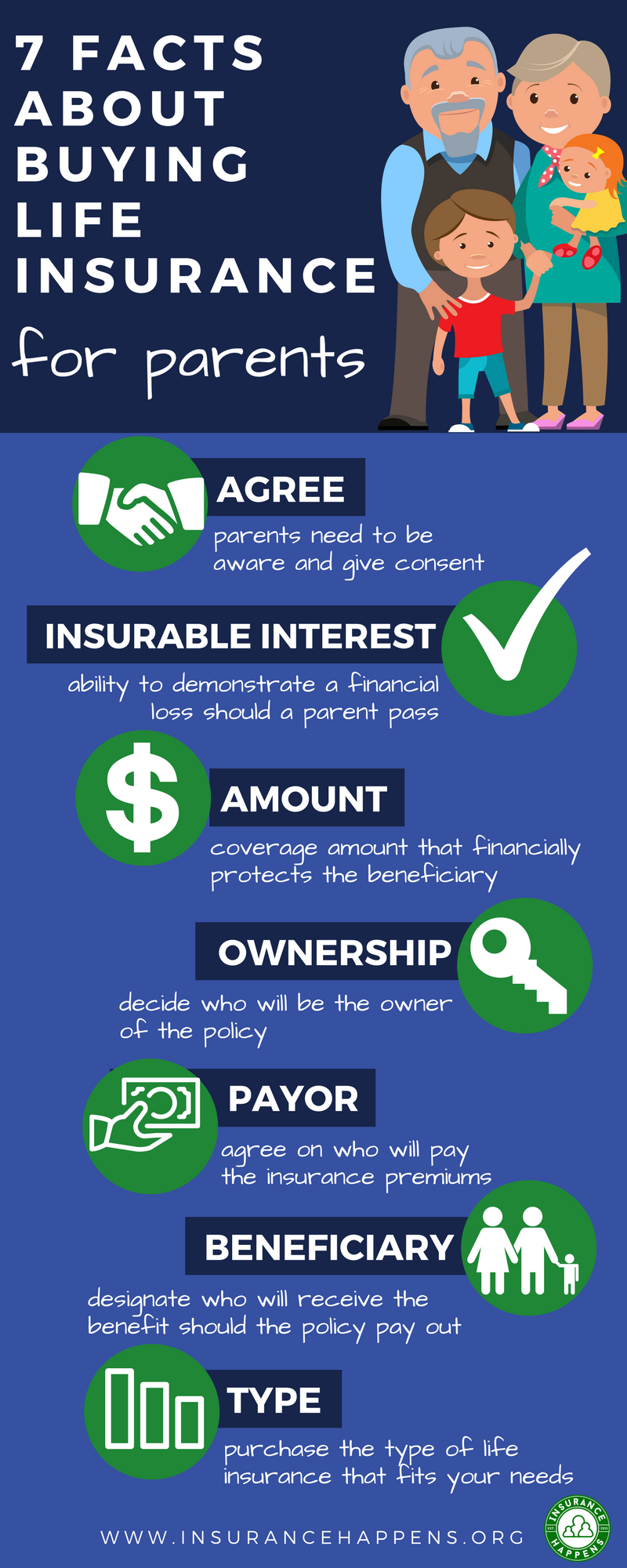

You can buy life insurance on a parent’s behalf, and you can even make yourself the beneficiary. This can give you and your family peace of mind during difficult times. It’s always necessary for your parent to agree to the life insurance policy. They have to pay out benefits upon death and insuring ‘older people’ makes that risk higher, which often means more restrictions. Buying life insurance for parents is very much possible and one of the best ways of preparing for life eventualities. Regardless of your reasons for needing to buy life insurance for your parents, one thing most insurance companies will require before issuing a policy is called “insurable interest.” in the most basic sense, insurable interest is proof, should your parents die, you would suffer some kind of financial loss.

Typical funeral costs can range from $6,000 to $12,000.

Buying life insurance for a parent can provide financial protection in case of unpaid expenses after the parent passes away. Whenever a parent dies, survived ones are usually left with unexpected bills that can pose significant challenges. In some cases, it may be easier to help your parents take out a life insurance policy and list you as a. Yes, you can buy life insurance for your parents. In order to buy a policy on a parent, you will need their consent along with proof of insurable interest. However, it is possible that an adult child can purchase a life insurance policy on their parent provided that they would be able to “justify” the need for such a policy to a life insurance company.

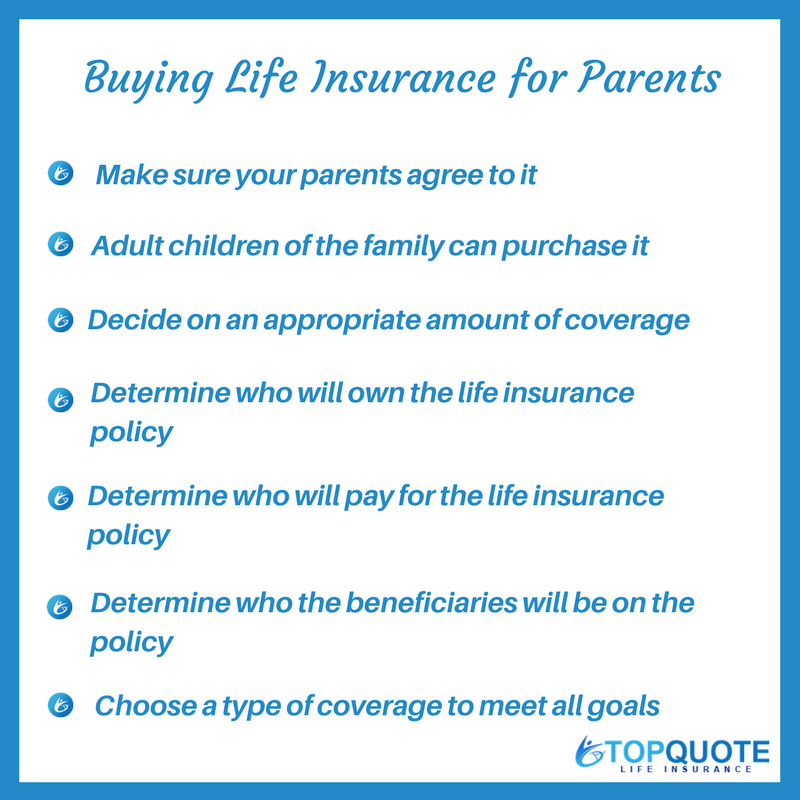

Source: topquotelifeinsurance.com

Source: topquotelifeinsurance.com

Think of consent as a way for life insurance carriers to. Buying life insurance for a parent can provide financial protection in case of unpaid expenses after the parent passes away. Insurable interest to buy life insurance for someone else, you need to have an insurable interest. The process is similar to purchasing a policy for yourself — but you’ll need to prove insurable interest and get your parents’ consent. Can an individual purchase a life insurance policy on their mother or father?

Yes, you can purchase life insurance for your parents, but it can be difficult to take out a life insurance policy on someone other than yourself, even if that person is related to you. Remember that life insurance companies take on risks. Like many other activities we all experienced while growing up, you’ll need your parents’ permission to buy a life insurance policy for your parents. Regardless of your reasons for needing to buy life insurance for your parents, one thing most insurance companies will require before issuing a policy is called “insurable interest.” in the most basic sense, insurable interest is proof, should your parents die, you would suffer some kind of financial loss. When buying life insurance on your parents, you will typically need to have their knowledge and their approval first and foremost.

Source: forbes.com

Source: forbes.com

The insured (your parent) the policyholder (can be you, can be your parent) the beneficiary (can be anyone or a charity) if the three parties are three different people, you create what is called the goodman triangle. Think of consent as a way for life insurance carriers to. You’ll also need to prove insurable interest, which means showing that their death will have a financial impact on you. Buying life insurance for a parent can provide financial protection in case of unpaid expenses after the parent passes away. Universal life insurance and whole life insurance are options for a parent who wants life insurance in place no matter when they pass away.

Source: everquote.com

Source: everquote.com

Yes, you can purchase life insurance for your parents to help cover the final expenses they leave behind. It’s always necessary for your parent to agree to the life insurance policy. To take out a policy on someone’s life, you need their consent. Can you get life insurance for your parents? It is not always possible to buy life insurance on someone else.

Source: buylifeinsuranceforburial.com

Source: buylifeinsuranceforburial.com

Buying life insurance for parents is very much possible and one of the best ways of preparing for life eventualities. Such final expenses can include: When buying life insurance on your parents, you will typically need to have their knowledge and their approval first and foremost. It is not always possible to buy life insurance on someone else. Can you buy life insurance for your parents?

Source: insurechance.com

Source: insurechance.com

You will need to get their permission and proof of insurable interests before you can purchase a policy for a parent. In this case, you are the owner of the policy and responsible to make premium payments. Typical funeral costs can range from $6,000 to $12,000. Remember that life insurance companies take on risks. Universal life insurance and whole life insurance are options for a parent who wants life insurance in place no matter when they pass away.

Source: quotacy.com

Source: quotacy.com

When you buy life insurance for yourself, you are both the policyholder and the person whose life is insured by the policy. You can buy life insurance on a parent’s behalf, and you can even make yourself the beneficiary. To buy life insurance on somebody else, you need to have an insurable interest. You’ll also need to prove that you have insurable interest. Yes, you can purchase life insurance for your parents to help cover the final expenses they leave behind.

Source: blog.massmutual.com

Source: blog.massmutual.com

Typical funeral costs can range from $6,000 to $12,000. Regardless of your reasons for needing to buy life insurance for your parents, one thing most insurance companies will require before issuing a policy is called “insurable interest.” in the most basic sense, insurable interest is proof, should your parents die, you would suffer some kind of financial loss. When you buy life insurance for yourself, you are both the policyholder and the person whose life is insured by the policy. Such final expenses can include: In order to purchase life insurance on a parent, or on anyone for that matter, you must have consent.

Source: sg.thefinder.life

Source: sg.thefinder.life

Can you get life insurance for your parents? Whenever a parent dies, survived ones are usually left with unexpected bills that can pose significant challenges. The insured (your parent) the policyholder (can be you, can be your parent) the beneficiary (can be anyone or a charity) if the three parties are three different people, you create what is called the goodman triangle. Doing so can provide peace of mind for you and your family during this difficult time. However, you need to satisfy certain requirements to do so.

Source: pinterest.com

Source: pinterest.com

When buying life insurance on your parents, you will typically need to have their knowledge and their approval first and foremost. In this case, you are the owner of the policy and responsible to make premium payments. When buying life insurance for parents, you have fewer options than you might when buying life insurance for yourself at a much younger age. Yes, you can buy life insurance for your parents. However, you need to satisfy certain requirements to do so.

Source: insurancebrokersusa.com

Source: insurancebrokersusa.com

In this case, you are the owner of the policy and responsible to make premium payments. In order to purchase life insurance on a parent, or on anyone for that matter, you must have consent. The process is similar to purchasing a policy for yourself — but you’ll need to prove insurable interest and get your parents’ consent. In most cases, prior to age 85, buying life insurance for elderly parents can be relatively affordable, depending on the type and amount of coverage, and the carrier you choose to purchase the coverage through. Therefore life insurance might be the ultimate savior when one is most vulnerable, both financially and mentally.

Source: glistrategies.com

Source: glistrategies.com

In order to buy a policy on a parent, you will need their consent along with proof of insurable interest. In most cases, prior to age 85, buying life insurance for elderly parents can be relatively affordable, depending on the type and amount of coverage, and the carrier you choose to purchase the coverage through. This can give you and your family peace of mind during difficult times. To buy life insurance for a parent, they need to provide consent and be legally competent to sign the paperwork. Yes, you can buy life insurance for your parents.

Source: theinsuranceproblog.com

Source: theinsuranceproblog.com

In order to buy a policy on a parent, you will need their consent along with proof of insurable interest. When you buy life insurance for yourself, you are both the policyholder and the person whose life is insured by the policy. In order to buy a policy on a parent, you will need their consent along with proof of insurable interest. You’ll also need to prove insurable interest, which means showing that their death will have a financial impact on you. In most cases, prior to age 85, buying life insurance for elderly parents can be relatively affordable, depending on the type and amount of coverage, and the carrier you choose to purchase the coverage through.

Source: topquotelifeinsurance.com

Source: topquotelifeinsurance.com

Buying life insurance for a parent can provide financial protection in case of unpaid expenses after the parent passes away. Such final expenses can include: However, it is possible that an adult child can purchase a life insurance policy on their parent provided that they would be able to “justify” the need for such a policy to a life insurance company. You’ll also need to prove that you have insurable interest. Buying life insurance for a parent can provide financial protection in case of unpaid expenses after the parent passes away.

![Buy No Exam Life Insurance for Parents [Quick Approval] Buy No Exam Life Insurance for Parents [Quick Approval]](https://nophysicaltermlife.com/wp-content/uploads/2019/05/Life-insurance-for-a-parent.jpg) Source: nophysicaltermlife.com

Source: nophysicaltermlife.com

However, you need to satisfy certain requirements to do so. Can an individual purchase a life insurance policy on their mother or father? To make sure you”re getting your parents the best possible protection, compare life insurance companies. Buying your parents life insurance isn’t like getting them a surprise birthday gift. Buying life insurance for parents is very much possible and one of the best ways of preparing for life eventualities.

Source: choicemutual.com

Source: choicemutual.com

Whenever a parent dies, survived ones are usually left with unexpected bills that can pose significant challenges. You’ll also need to prove that you have insurable interest. Doing so can provide peace of mind for you and your family during this difficult time. Can an individual purchase a life insurance policy on their mother or father? In order to buy a policy on a parent, you will need their consent along with proof of insurable interest.

Source: lhlic.com

Source: lhlic.com

In order to buy a policy on a parent, you will need their consent along with proof of insurable interest. Yes, you can purchase life insurance for your parents to help cover the final expenses they leave behind. It’s always necessary for your parent to agree to the life insurance policy. However, it is possible that an adult child can purchase a life insurance policy on their parent provided that they would be able to “justify” the need for such a policy to a life insurance company. They have to pay out benefits upon death and insuring ‘older people’ makes that risk higher, which often means more restrictions.

Source: lifeinsurancepost.com

Source: lifeinsurancepost.com

Regardless of your reasons for needing to buy life insurance for your parents, one thing most insurance companies will require before issuing a policy is called “insurable interest.” in the most basic sense, insurable interest is proof, should your parents die, you would suffer some kind of financial loss. Therefore life insurance might be the ultimate savior when one is most vulnerable, both financially and mentally. This can give you and your family peace of mind during difficult times. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. However, it is possible that an adult child can purchase a life insurance policy on their parent provided that they would be able to “justify” the need for such a policy to a life insurance company.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title buying life insurance on a parent by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Craft insurance arab al Idea

- Colonial life insurance claims Idea

- Business insurance and benefits information

- Deans and homer insurance Idea

- Crown cost without insurance information

- Delmonico insurance syracuse ny Idea

- Department of insurance and financial services michigan duties information

- Cost of eye exam with insurance Idea

- Cashless hospital list under national insurance company Idea

- Crowel insurance agency information