California business insurance cost information

Home » Trend » California business insurance cost informationYour California business insurance cost images are available in this site. California business insurance cost are a topic that is being searched for and liked by netizens today. You can Download the California business insurance cost files here. Get all royalty-free photos.

If you’re searching for california business insurance cost pictures information linked to the california business insurance cost keyword, you have visit the ideal site. Our website always provides you with suggestions for refferencing the highest quality video and image content, please kindly hunt and find more informative video content and graphics that fit your interests.

California Business Insurance Cost. For example, if you add a commercial auto policy to your existing general liability policy, you’ll save 10% right off the bat. Free & fast online or telephone quotes; Request a free online quote! They include the business type, location of your business, the total number of employees in your business, as well as the risk level your business is exposed to.

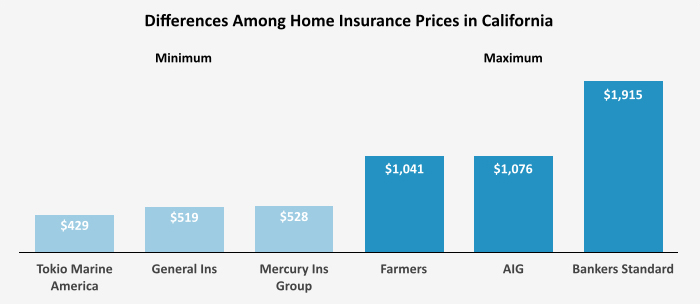

Riverside, California, home insurance rates can be as low From gavop.com

Riverside, California, home insurance rates can be as low From gavop.com

And 5 p.m., excluding holidays. • $500 minimum premium for many business types. That’s why it’s important to understand what impacts the cost of the most common. Business insurance typically costs a general contractor business in los angeles about $62.50 each month. If you qualify, this program could help lower the costs. We’ve been providing business insurance for over 200 years.

In an analysis of 28,000 small business owners� commercial insurance policies purchased through insureon, the median cost of a general liability policy was $42 per month or $500 per year.

$15,000 bodily injury liability per person; A small business insurance policy typically includes a number of different coverages. In an analysis of 28,000 small business owners� commercial insurance policies purchased through insureon, the median cost of a general liability policy was $42 per month or $500 per year. If you wish to get your property & casualty and your life, accident, & health licenses, you will need to apply for each license separately, and pay the $170 fee each time. We can save large premium risks. $15,000 bodily injury liability per person;

Source: picshealth.blogspot.com

Source: picshealth.blogspot.com

California�s minimum requirements for auto insurance are: We can help your business. $15,000 bodily injury liability per person; • access to all major california preferred companies. The fee for an online application is $188 per combined line.

Source: businessinsider.de

Source: businessinsider.de

For example, a business in san francisco can expect to have a different rate than one in los angeles, or a business that has employees might pay. A good rule of thumb for most small businesses is between $500,000 and $1 million. Insureon says the average (mean) cost of their 18,000 policies is about $100 a month, while the median cost is about $50 per month. The cost of business insurance in california depends on a business’s industry, coverage needs, size and location. The fee for an online application is $188 per combined line.

How much you will pay for business insurance in california depends on a variety of factors. In an analysis of 28,000 small business owners� commercial insurance policies purchased through insureon, the median cost of a general liability policy was $42 per month or $500 per year. Business insurance typically costs a general contractor business in los angeles about $62.50 each month. Free & fast online or telephone quotes; Fill out your online application on the nipr california web page.

Source: coastalrealestateguide.com

Source: coastalrealestateguide.com

Get business insurance in california from the hartford. Each variable plays a part in determining your policy premium. Request a free online quote! We can help your business. Some factors that can influence your business insurance costs are:

Source: valchoice.com

Source: valchoice.com

Fill out your online application on the nipr california web page. $5,000 property damage liability per accident; We can start your quote online, or by phone! $30,000 bodily injury liability per accident; Some factors that can influence your business insurance costs are:

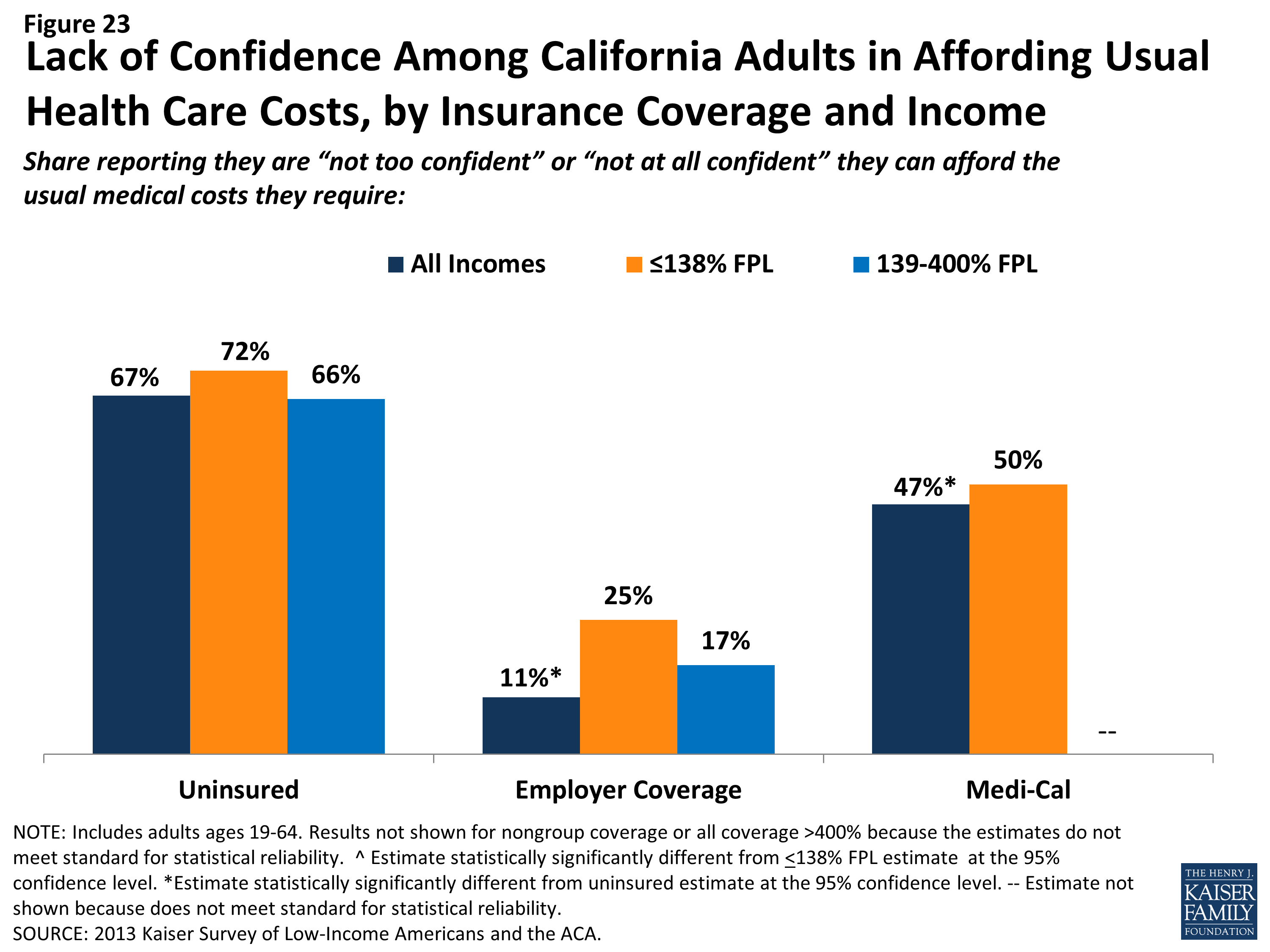

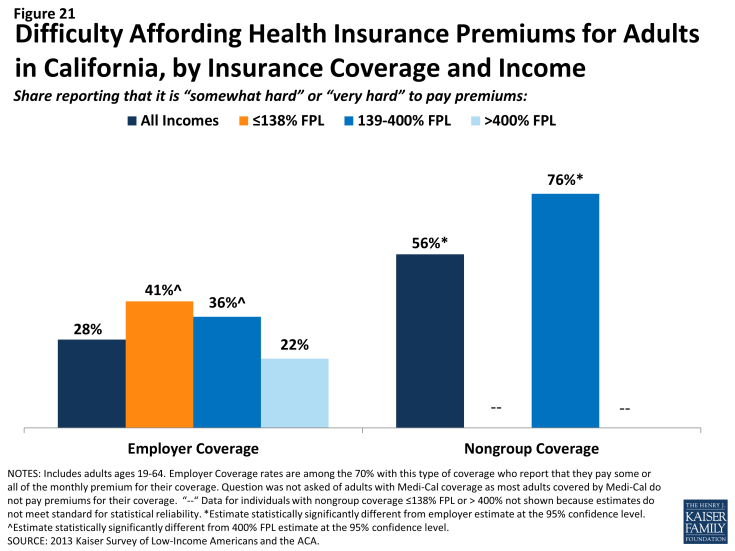

Source: kff.org

Source: kff.org

The median cost of a business owner�s policy (bop), which bundles general liability insurance with business property coverage at a discount, was $53 per month or $636 annually. And 5 p.m., excluding holidays. That means if a customer were to accuse one of your employees of spreading misinformation about them or sues you for slander, your business could be put in a serious financial hole. A small business insurance policy typically includes a number of different coverages. In fact, many factors help decide the amount you’ll spend on small business insurance, including your:

Source: insuremekevin.com

Source: insuremekevin.com

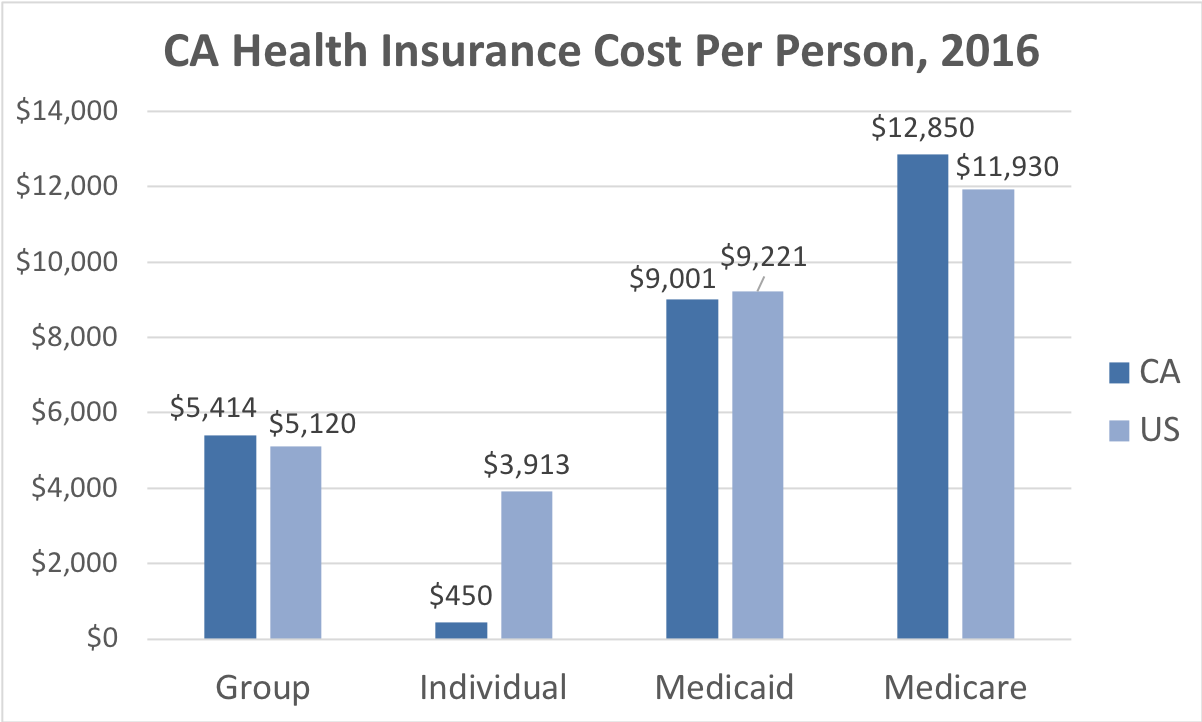

Trucking companies may need additional coverage to comply with regulations. In an analysis of 28,000 small business owners� commercial insurance policies purchased through insureon, the median cost of a general liability policy was $42 per month or $500 per year. $5,000 property damage liability per accident; We can save large premium risks. In california, small business health insurance premiums are typically less expensive than individual health insurance premiums.

We can start your quote online, or by phone! Fill out your online application on the nipr california web page. Each variable plays a part in determining your policy premium. Ricardo lara said the new rules will require insurance companies to factor property owners� improvements into the pricing of residential and commercial coverage. In california, drivers need $15,000 of bodily injury liability insurance per person, up to $30,000 per accident, and $5,000 of property damage liability insurance.

Source: californiainform.com

Source: californiainform.com

Each variable plays a part in determining your policy premium. You automatically save 10% if you combine more than one type of policy together. We can save large premium risks. We’ve been providing business insurance for over 200 years. In an analysis of 28,000 small business owners� commercial insurance policies purchased through insureon, the median cost of a general liability policy was $42 per month or $500 per year.

![California Auto Insurance Basics [Rates + Coverages] California Auto Insurance Basics [Rates + Coverages]](https://www.carinsurance101.com/wp-content/uploads/dw/california-car-insurers-by-market-share--6SARy.png) Source: carinsurance101.com

Source: carinsurance101.com

Ricardo lara said the new rules will require insurance companies to factor property owners� improvements into the pricing of residential and commercial coverage. Learn what factors affect your cost and get a free quote today. $15,000 bodily injury liability per person; In an analysis of 28,000 small business owners� commercial insurance policies purchased through insureon, the median cost of a general liability policy was $42 per month or $500 per year. We can save large premium risks.

Source: huffingtonpost.co.uk

Source: huffingtonpost.co.uk

The median cost of a business owner�s policy (bop), which bundles general liability insurance with business property coverage at a discount, was $53 per month or $636 annually. We’ve been providing business insurance for over 200 years. That means if a customer were to accuse one of your employees of spreading misinformation about them or sues you for slander, your business could be put in a serious financial hole. The cost of business insurance in california depends on a business’s industry, coverage needs, size and location. Trucking companies may need additional coverage to comply with regulations.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

The most expensive claim is reputational damage, which could cost your business an average of $50,000 if you don’t have insurance coverage. In fact, many factors help decide the amount you’ll spend on small business insurance, including your: • access to all major california preferred companies. That means if a customer were to accuse one of your employees of spreading misinformation about them or sues you for slander, your business could be put in a serious financial hole. A good rule of thumb for most small businesses is between $500,000 and $1 million.

We can start your quote online, or by phone! Receive a quote for california business insurance today. They include the business type, location of your business, the total number of employees in your business, as well as the risk level your business is exposed to. In an analysis of 28,000 small business owners� commercial insurance policies purchased through insureon, the median cost of a general liability policy was $42 per month or $500 per year. The most expensive claim is reputational damage, which could cost your business an average of $50,000 if you don’t have insurance coverage.

Each variable plays a part in determining your policy premium. • $500 minimum premium for many business types. In california, drivers need $15,000 of bodily injury liability insurance per person, up to $30,000 per accident, and $5,000 of property damage liability insurance. The cost of your california general liability insurance coverage is determined by various factors. We can help your business.

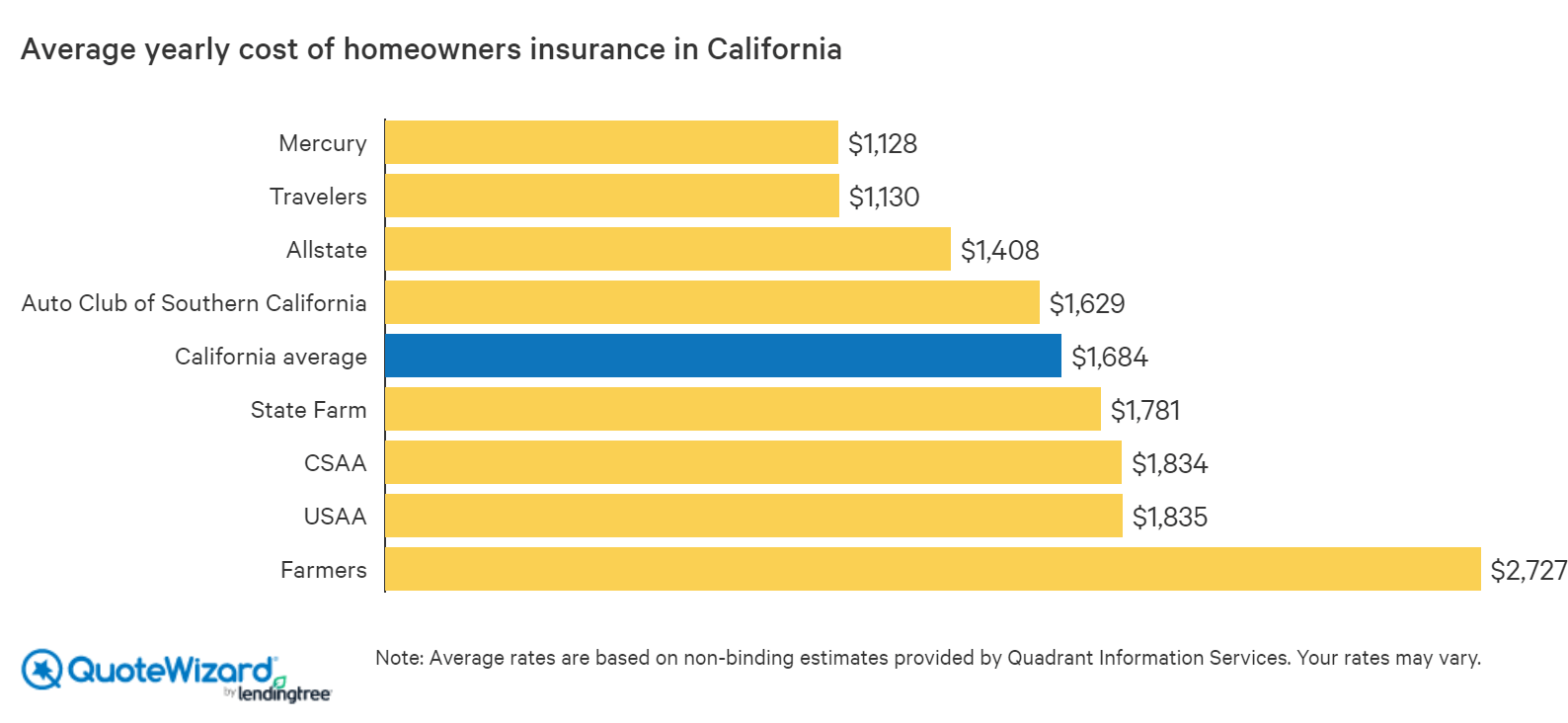

Source: quotewizard.com

Source: quotewizard.com

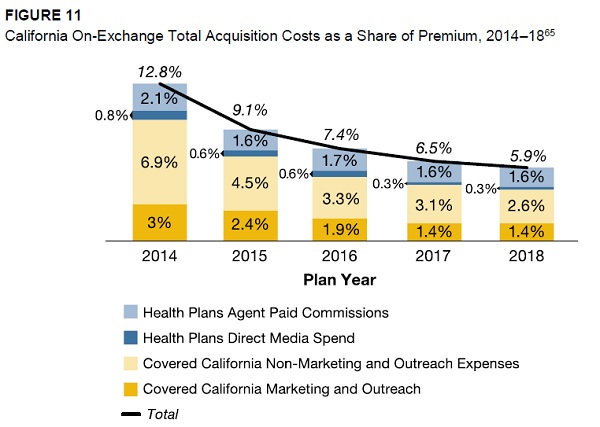

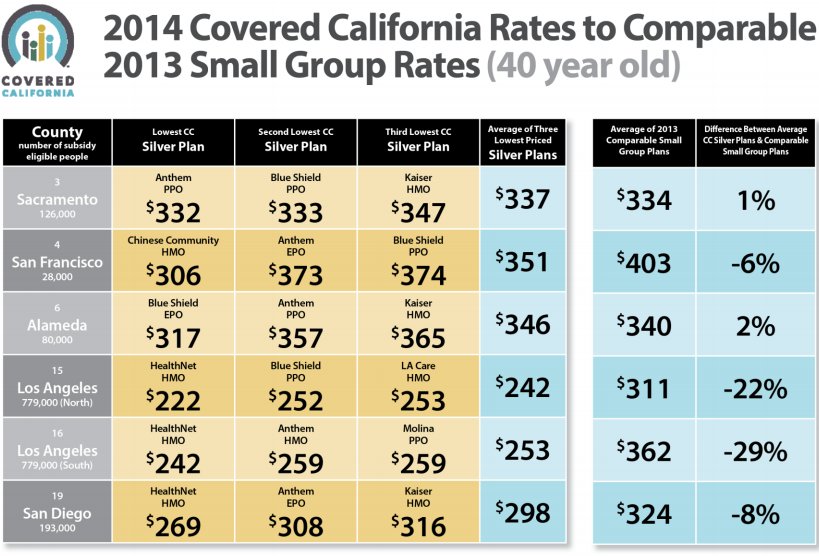

We can save large premium risks. $30,000 bodily injury liability per accident; California�s insurance commissioner announced new rules on friday aimed at lowering premiums for people who make improvements to their property to resist wildfires. Comparing the lowest cost ppo and hmo plans in san francisco, los angeles, and san diego: We can start your quote online, or by phone!

Source: gavop.com

Source: gavop.com

Request a free online quote! Insureon says the average (mean) cost of their 18,000 policies is about $100 a month, while the median cost is about $50 per month. Request a free online quote! That means if a customer were to accuse one of your employees of spreading misinformation about them or sues you for slander, your business could be put in a serious financial hole. In california, small business health insurance premiums are typically less expensive than individual health insurance premiums.

Source: findtwentynine.com

Source: findtwentynine.com

We can start your quote online, or by phone! How much you will pay for business insurance in california depends on a variety of factors. In california, small business health insurance premiums are typically less expensive than individual health insurance premiums. • access to all major california preferred companies. You automatically save 10% if you combine more than one type of policy together.

Source: kff.org

Source: kff.org

We can help your business. The small business association says the cost for a small business general liability policy usually ranges from $750 to $2,000 annually or approximately $60 to $170 per month. Learn what factors affect your cost and get a free quote today. That’s why it’s important to understand what impacts the cost of the most common. $15,000 bodily injury liability per person;

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title california business insurance cost by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Craft insurance arab al Idea

- Colonial life insurance claims Idea

- Business insurance and benefits information

- Deans and homer insurance Idea

- Crown cost without insurance information

- Delmonico insurance syracuse ny Idea

- Department of insurance and financial services michigan duties information

- Cost of eye exam with insurance Idea

- Cashless hospital list under national insurance company Idea

- Crowel insurance agency information