California car insurance tips information

Home » Trending » California car insurance tips informationYour California car insurance tips images are available. California car insurance tips are a topic that is being searched for and liked by netizens now. You can Get the California car insurance tips files here. Get all free photos.

If you’re looking for california car insurance tips pictures information connected with to the california car insurance tips keyword, you have come to the right blog. Our site always gives you hints for seeking the maximum quality video and image content, please kindly search and locate more informative video articles and graphics that fit your interests.

California Car Insurance Tips. Your monthly bill will depend on how much you drive. Ca car insurance in order to register your car in california, you must hold valid car insurance. Your browser does not support the video tag. Crashes generally cost more than the minimum limits, according to the insurance information institute, so it’s a good idea to get more liability insurance than required.

Cheap Car Insurance, Buying Car Insurance, California From pinterest.com

Cheap Car Insurance, Buying Car Insurance, California From pinterest.com

Check out our resource center to make sure you�re staying in the right lane. Schedule to have your fingerprint impressions taken before the license examination. Filing a claim will increase car insurance premiums from 3% to 32% on average for three to five years in almost all cases. California requires that all insurance license applicants provide fingerprints prior to licensing. Tips and ideas to reduce car insurance costs the main factors that can help reduce car insurance include: Your browser does not support the video tag.

Surety bond for $35,000 from a company licensed to do business in california.

For example, geico offers the cheapest rates in. Whether you�re a vehicle owner, a licensed driver or just a passenger, these tips will help keep you and others safe. Your monthly bill will depend on how much you drive. How much your rate goes up depends on several factors, like the claim type and amount, your insurance company, your claims history, your location, and whether or not you have accident forgiveness. In general, here’s how it works: For example, if you drive 600 miles in a month.

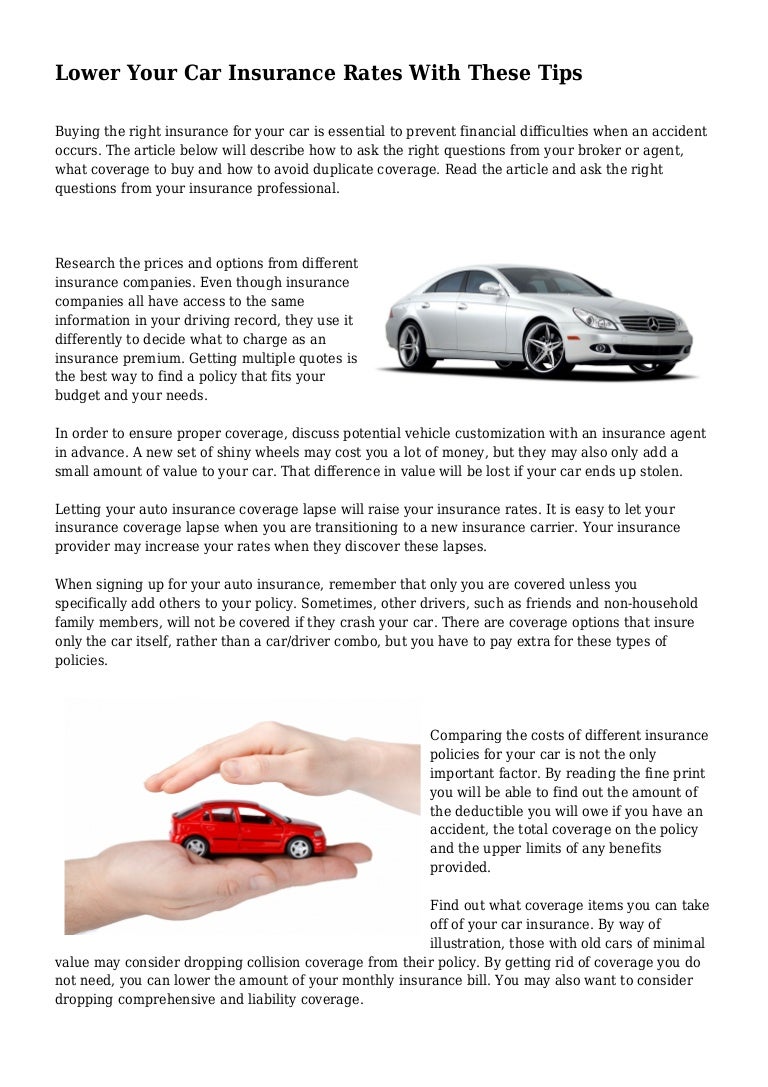

Source: slideshare.net

Source: slideshare.net

In general, here’s how it works: This score comes from their consistent showing with 3.5 stars across the board in claims, price, customer service and website & apps. Check out our resource center to make sure you�re staying in the right lane. Ways to keep calm on the road. Auto club of southern california auto insurance earned a score of 3.5 out of five stars in our annual best car insurance companies review.

Source: pinterest.com

Source: pinterest.com

This score comes from their consistent showing with 3.5 stars across the board in claims, price, customer service and website & apps. For example, if you drive 600 miles in a month. This score comes from their consistent showing with 3.5 stars across the board in claims, price, customer service and website & apps. For example, geico offers the cheapest rates in. Get competing quotes from insurance websites and individual companies of interest to you.

Source: simplyinsurance.com

Source: simplyinsurance.com

A car insurance premium is simply the dollar amount you pay for your coverage. Crashes generally cost more than the minimum limits, according to the insurance information institute, so it’s a good idea to get more liability insurance than required. A car insurance premium is simply the dollar amount you pay for your coverage. Get competing quotes from insurance websites and individual companies of interest to you. Check your current coverage to find out how much you are paying.

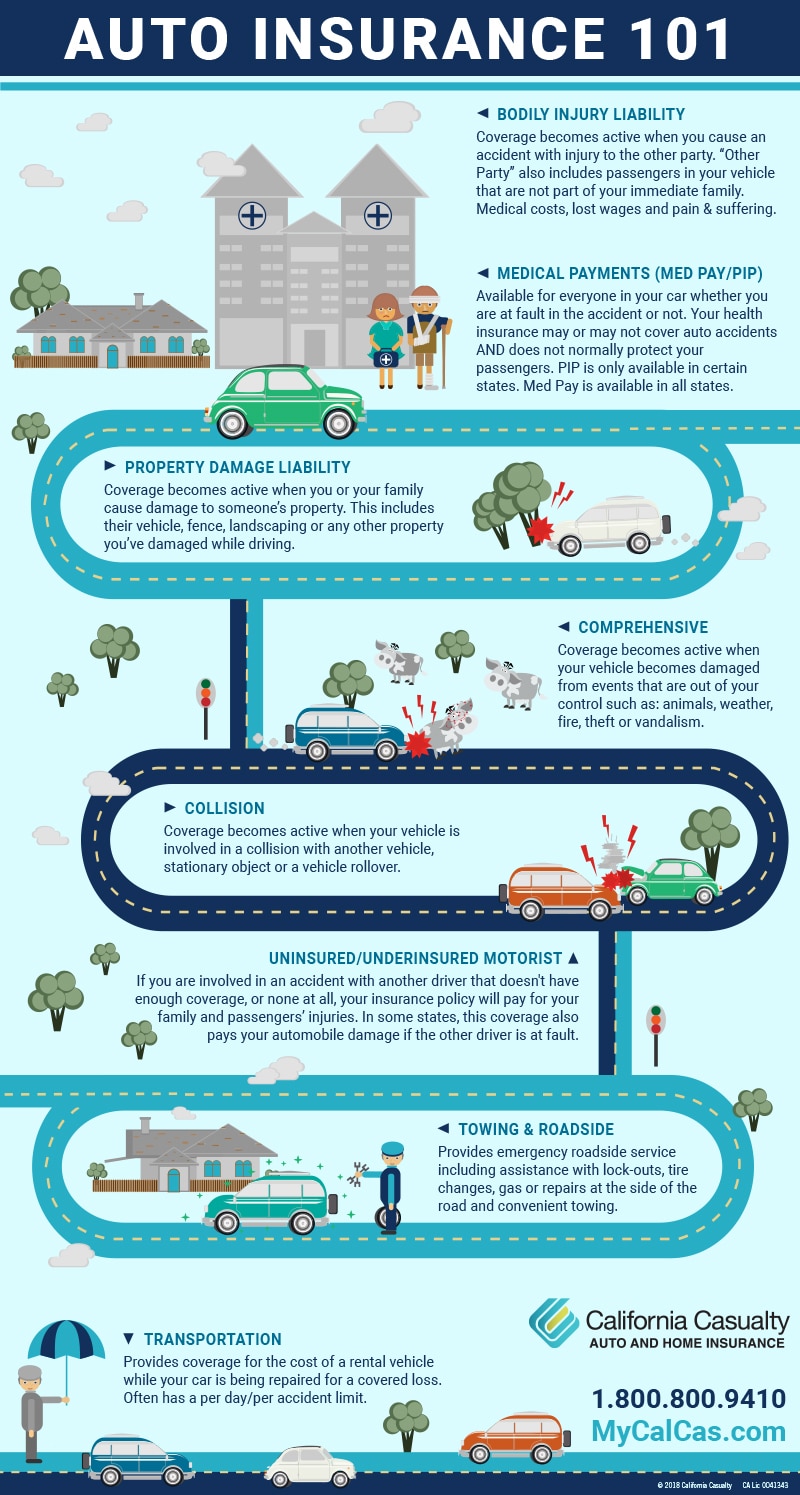

Source: mycalcas.com

Source: mycalcas.com

Surety bond for $35,000 from a company licensed to do business in california. Crashes generally cost more than the minimum limits, according to the insurance information institute, so it’s a good idea to get more liability insurance than required. Car insurance can be broken down into components, each of which protects you from specific types of events. If you have any prior misdemeanors or felonies, this may affect the outcome of your licensing efforts. Whether you�re a vehicle owner, a licensed driver or just a passenger, these tips will help keep you and others safe.

Source: slideshare.net

Source: slideshare.net

For example, geico offers the cheapest rates in. Giving your fingerprints will initiate a background check. Car insurance can be broken down into components, each of which protects you from specific types of events. Depending on your insurance company, you may pay monthly, quarterly, semiannually or even annually. California requires that all insurance license applicants provide fingerprints prior to licensing.

Source: pinterest.com

Source: pinterest.com

If you have any prior misdemeanors or felonies, this may affect the outcome of your licensing efforts. The amount you pay for your auto insurance policy can vary greatly based on the state�s required amounts and other additional protection you may wish to obtain. Ca car insurance in order to register your car in california, you must hold valid car insurance. Your monthly bill will depend on how much you drive. If you have any prior misdemeanors or felonies, this may affect the outcome of your licensing efforts.

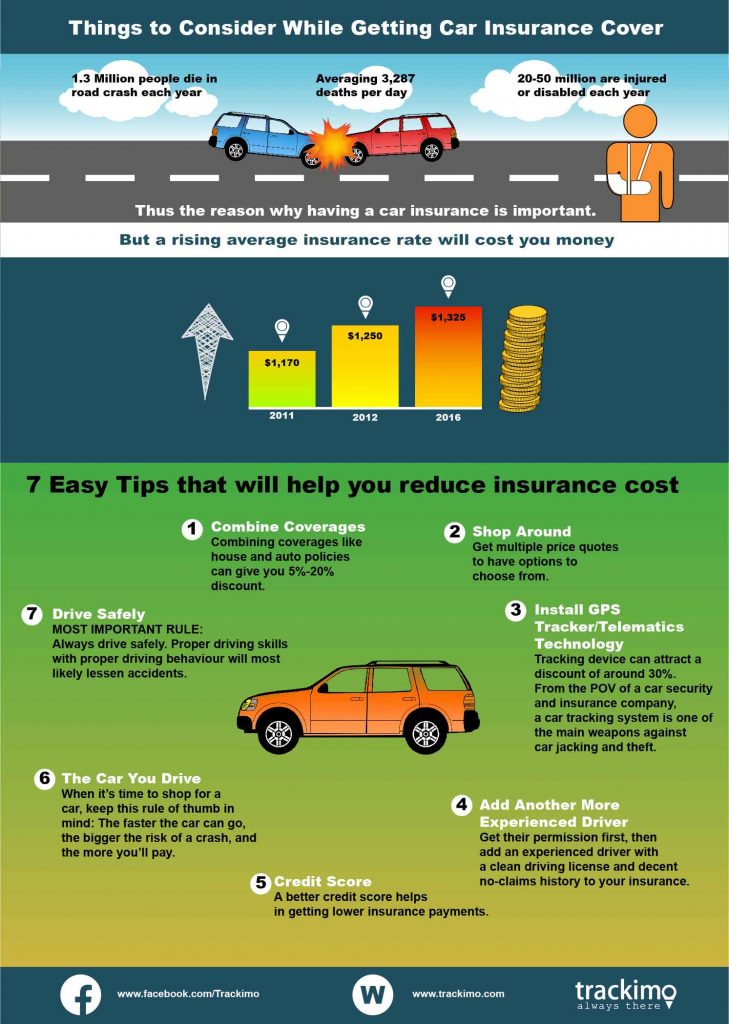

Source: infographicas.com

Source: infographicas.com

For example, geico offers the cheapest rates in. Vehicles provide flexibility and freedom, but there are risks associated with hitting the road. Multiple cars and/or multiple drivers practicing safe driving compare insurance premiums. Tips and ideas to reduce car insurance costs the main factors that can help reduce car insurance include: In general, here’s how it works:

Source: pinterest.com

Source: pinterest.com

Surety bond for $35,000 from a company licensed to do business in california. Your browser does not support the video tag. Ways to keep calm on the road. Your monthly bill will depend on how much you drive. Ask your agent about the market value of your car before deciding how much you need;

Source: pinterest.com

Source: pinterest.com

Ca car insurance in order to register your car in california, you must hold valid car insurance. Ask your agent about the market value of your car before deciding how much you need; Whether you�re a vehicle owner, a licensed driver or just a passenger, these tips will help keep you and others safe. Motor vehicle liability insurance policy. Multiple cars and/or multiple drivers practicing safe driving compare insurance premiums.

Source: youtube.com

Source: youtube.com

Check your current coverage to find out how much you are paying. Your monthly bill will depend on how much you drive. Crashes generally cost more than the minimum limits, according to the insurance information institute, so it’s a good idea to get more liability insurance than required. Ways to keep calm on the road. California laws, driving regulations and traffic patterns are always changing.

Source: pinterest.com

Source: pinterest.com

For example, geico offers the cheapest rates in. Cash deposit of $35,000 with dmv. Whether you�re a vehicle owner, a licensed driver or just a passenger, these tips will help keep you and others safe. California requires that all insurance license applicants provide fingerprints prior to licensing. Your browser does not support the video tag.

Source: goodtogoinsurance.org

Source: goodtogoinsurance.org

California laws, driving regulations and traffic patterns are always changing. Your monthly bill will depend on how much you drive. California laws, driving regulations and traffic patterns are always changing. A car insurance premium is simply the dollar amount you pay for your coverage. Filing a claim will increase car insurance premiums from 3% to 32% on average for three to five years in almost all cases.

Source: newsamt.com

Source: newsamt.com

How much your rate goes up depends on several factors, like the claim type and amount, your insurance company, your claims history, your location, and whether or not you have accident forgiveness. Ask your agent about the market value of your car before deciding how much you need; Check your current coverage to find out how much you are paying. Cash deposit of $35,000 with dmv. California requires that all insurance license applicants provide fingerprints prior to licensing.

Source: varsitydrivingacademy.com

Source: varsitydrivingacademy.com

Motor vehicle liability insurance policy. A car insurance premium is simply the dollar amount you pay for your coverage. Car insurance can be broken down into components, each of which protects you from specific types of events. Whether you�re a vehicle owner, a licensed driver or just a passenger, these tips will help keep you and others safe. Minimum coverage in california is $629 per year on average, but we found you can likely get a cheaper policy.

Source: slideserve.com

Source: slideserve.com

Minimum coverage in california is $629 per year on average, but we found you can likely get a cheaper policy. Ask your agent about the market value of your car before deciding how much you need; Your browser does not support the video tag. If you have any prior misdemeanors or felonies, this may affect the outcome of your licensing efforts. Crashes generally cost more than the minimum limits, according to the insurance information institute, so it’s a good idea to get more liability insurance than required.

Source: youtube.com

Source: youtube.com

In 2019, the average collision claim filed was $3,750 while the average comprehensive claim was $1,780. Get competing quotes from insurance websites and individual companies of interest to you. For example, if you drive 600 miles in a month. For example, geico offers the cheapest rates in. Minimum coverage in california is $629 per year on average, but we found you can likely get a cheaper policy.

Source: pinterest.com

Source: pinterest.com

Surety bond for $35,000 from a company licensed to do business in california. California laws, driving regulations and traffic patterns are always changing. Tips and ideas to reduce car insurance costs the main factors that can help reduce car insurance include: Vehicles provide flexibility and freedom, but there are risks associated with hitting the road. A car insurance premium is simply the dollar amount you pay for your coverage.

Source: slideshare.net

Source: slideshare.net

How much your rate goes up depends on several factors, like the claim type and amount, your insurance company, your claims history, your location, and whether or not you have accident forgiveness. If you have any prior misdemeanors or felonies, this may affect the outcome of your licensing efforts. Your browser does not support the video tag. Whether you�re a vehicle owner, a licensed driver or just a passenger, these tips will help keep you and others safe. For example, if you drive 600 miles in a month.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title california car insurance tips by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Claims vs occurrence based insurance Idea

- Cheap tablet insurance Idea

- Calling insurance leads Idea

- Disability insurance for postal workers Idea

- Business insurance peoria il information

- Bright health insurance reviews Idea

- Carrier liability vs cargo insurance Idea

- Can you insure a written off car Idea

- Can convicted felons get life insurance information

- Car insurance administrator Idea