California insurance fair claims practices act Idea

Home » Trending » California insurance fair claims practices act IdeaYour California insurance fair claims practices act images are available in this site. California insurance fair claims practices act are a topic that is being searched for and liked by netizens today. You can Download the California insurance fair claims practices act files here. Download all free vectors.

If you’re looking for california insurance fair claims practices act pictures information connected with to the california insurance fair claims practices act interest, you have pay a visit to the right site. Our website always gives you hints for seeing the maximum quality video and image content, please kindly search and find more informative video articles and graphics that fit your interests.

California Insurance Fair Claims Practices Act. In addition to section 790.03 of the insurance. We would like to show you a description here but the site won’t allow us. California insurance code section 790.03 (h) requires all persons engaged in the business of insurance to effectuate prompt, fair and equitable settlements of claims and to otherwise process claims in a fair and reasonable manner. Get free online courses from famous schools

Free Privacy Policy Templates Website, Mobile, FB App From termly.io

Free Privacy Policy Templates Website, Mobile, FB App From termly.io

Get free online courses from famous schools Unfair claims settlement practice is the improper avoidance, or reduction of a claim by an insurance company. Identifying prohibited insurer conduct and effectively communicating to a carrier it committed prohibited acts will lead to better claim results. The insurer cited to section 2695.7 (f) of the fair claims settlement regulations, which states: The purpose of this act is to set forth standards for the investigation and disposition of claims arising under policies or certificates of insurance issued to residents of [insert state]. Unfair claims practices, this separation of unfair claims from unfair trade practices is recommended.

It may not attempt to enforce policy provisions that were altered by the company without notice to you or without your knowledge or consent.

There are many methods or tactics that insurance companies might use to unfairly handle the settlement of claims, and it unfortunately happens quite often. California insurance code section 790.03 (h) requires all persons engaged in the business of insurance to effectuate prompt, fair and equitable settlements of claims and to otherwise process claims in a fair and reasonable manner. One hallmark of an insurer’s bad faith insurance practices is their unreasonable delay in adjusting a claim. Fair claims settlement practices regulations all insurers doing business in california must comply with the requirements of california fair claims settlement practices regulations (the “regulations”) or face the ire of, and attempts at financial punishment from the california department of insurance (“cdoi”). Code § 790, et seq., in order to regulate trade practices in the business of insurance by defining and prohibiting unfair or deceptive acts or practices. Wind driven rain what is in my insurance policy?

Source: furtadolaw.com

Source: furtadolaw.com

There are many methods or tactics that insurance companies might use to unfairly handle the settlement of claims, and it unfortunately happens quite often. Following about a decade of ambiguity as to their enforceability, the california cloister of address upheld key apparatus of the california fair claims adjustment practices regulations on september 20, 2018 and affirmed that the california allowance abettor has the ascendancy to amerce insurers for agreeable in abnormal affirmation adjustment practices. (2) failing to acknowledge and act reasonably promptly upon communications with respect to claims arising under insurance policies. This a better practice than just merely accusing an insurer of bad faith. Wind driven rain what is in my insurance policy?

Source: propertyinsurancecoveragelaw.com

Source: propertyinsurancecoveragelaw.com

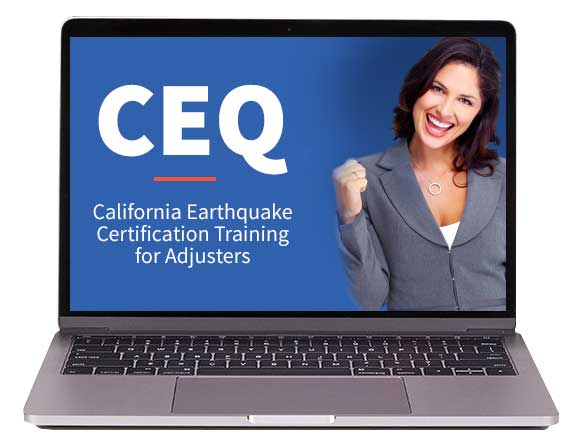

California fair claims practices california fair claims practices › california fair claims settlement training › fair claims settlement practices california › california fair claims act training ›. Get free online courses from famous schools The california fair claims settlement practices act outlines specific insurer conduct prohibited and considered unfair to insureds. Insurance code section 790 (h); The department considers the use of reliable

Source: estelavista.com

Source: estelavista.com

Get free online courses from famous schools (2) failing to acknowledge and act reasonably promptly upon communications with respect to claims arising under insurance policies. There are many methods or tactics that insurance companies might use to unfairly handle the settlement of claims, and it unfortunately happens quite often. Under most unfair claims settlement practices acts, an auto insurance company may not knowingly misrepresent material facts or relevant policy provisions in connection with a claim. We would like to show you a description here but the site won�t allow us.

Source: landsales.com.ng

Source: landsales.com.ng

California fair claims practices california fair claims practices › california fair claims settlement training › fair claims settlement practices california › california fair claims act training ›. California insurance code section 790.03 (h) requires all persons engaged in the business of insurance to effectuate prompt, fair and equitable settlements of claims and to otherwise process claims in a fair and reasonable manner. It may not attempt to enforce policy provisions that were altered by the company without notice to you or without your knowledge or consent. Code § 790, et seq., in order to regulate trade practices in the business of insurance by defining and prohibiting unfair or deceptive acts or practices. The purpose of this act is to set forth standards for the investigation and disposition of claims arising under policies or certificates of insurance issued to residents of [insert state].

Source: editorialtodoslosfuegos.blogspot.com

Source: editorialtodoslosfuegos.blogspot.com

Knowing and understanding an insurer’s reporting duties and deadlines can speed up the adjustment and payment of a claim. You can also go to www.insurance.ca.gov and search for fair claims amendments ← partial losses: (a) section 790.03(h) of the california insurance code enumerates sixteen claims settlement practices that, when either knowingly committed on a single occasion, or performed with such frequency as to indicate a general business practice, are considered to be unfair claims settlement practices and are, thus, prohibited by this section of the california insurance code. Person is engaged in any unfair or deceptive act or practice. Co., (1973) 9 cal.3d 566, 573.

Source: termly.io

Source: termly.io

Wind driven rain what is in my insurance policy? Get free online courses from famous schools Insurance company unfair claims settlement practices. In 1959, the california legislature enacted the unfair insurance practices act (“uipa”), cal. Code § 790, et seq., in order to regulate trade practices in the business of insurance by defining and prohibiting unfair or deceptive acts or practices.

Source: megeredchianlaw.com

Source: megeredchianlaw.com

The purpose of this act is to set forth standards for the investigation and disposition of claims arising under policies or certificates of insurance issued to residents of [insert state]. California insurance code section 790.03(h) requires all persons engaged in the business of insurance to effectuate prompt, fair and equitable settlements of claims and to otherwise process claims in a fair and reasonable manner. Wind driven rain what is in my insurance policy? Code § 790, et seq., in order to regulate trade practices in. California insurance fair claims practices act.

Source: fmglegal.com

Source: fmglegal.com

One hallmark of an insurer’s bad faith insurance practices is their unreasonable delay in adjusting a claim. The insurer cited to section 2695.7 (f) of the fair claims settlement regulations, which states: (a) section 790.03 (h) of the california insurance code enumerates sixteen claims settlement practices that, when either knowingly committed on a single occasion, or performed with such frequency as to indicate a general business practice, are considered to be unfair claims settlement practices and are, thus, prohibited by this section of the. There are many methods or tactics that insurance companies might use to unfairly handle the settlement of claims, and it unfortunately happens quite often. (2) failing to acknowledge and act reasonably promptly upon communications with respect to claims arising under insurance policies.

Source: larryhparker.com

Source: larryhparker.com

The purpose of this act is to set forth standards for the investigation and disposition of claims arising under policies or certificates of insurance issued to residents of [insert state]. (2) failing to acknowledge and act reasonably promptly upon communications with respect to claims arising under insurance policies. California insurance code section 790.03(h) requires all persons engaged in the business of insurance to effectuate prompt, fair and equitable settlements of claims and to otherwise process claims in a fair and reasonable manner. The california fair claims settlement practices act imposes multiple deadlines to respond and report to insureds during a claim adjustment. “every insurer shall provide written notice of any statute of limitation or other time period requirement upon which the insurer may rely to deny a claim.

Source: consumerlawfirm.com

Source: consumerlawfirm.com

California insurance code section 790.03 (h) requires all persons engaged in the business of insurance to effectuate prompt, fair and equitable settlements of claims and to otherwise process claims in a fair and reasonable manner. Under most unfair claims settlement practices acts, an auto insurance company may not knowingly misrepresent material facts or relevant policy provisions in connection with a claim. An insurance company commits bad faith when it fails to act reasonably in processing and handling a claim. Insurance code section 790 (h); (1) misrepresenting to claimants pertinent facts or insurance policy provisions relating to any coverages at issue.

Source: sfchronicle.com

Source: sfchronicle.com

Unfair claims settlement practice is the improper avoidance, or reduction of a claim by an insurance company. In addition to section 790.03 of the insurance. Unfair claims settlement practice is the improper avoidance, or reduction of a claim by an insurance company. The california fair claims settlement practices act imposes multiple deadlines to respond and report to insureds during a claim adjustment. Under most unfair claims settlement practices acts, an auto insurance company may not knowingly misrepresent material facts or relevant policy provisions in connection with a claim.

Source: stolpmanlawgroup.com

Source: stolpmanlawgroup.com

Identifying prohibited insurer conduct and effectively communicating to a carrier it committed prohibited acts will lead to better claim results. “every insurer shall provide written notice of any statute of limitation or other time period requirement upon which the insurer may rely to deny a claim. Unfair claims settlement practice is the improper avoidance, or reduction of a claim by an insurance company. California insurance code section 790.03 (h) requires all persons engaged in the business of insurance to effectuate prompt, fair and equitable settlements of claims and to otherwise process claims in a fair and reasonable manner. California fair claims practices california fair claims practices › california fair claims settlement training › fair claims settlement practices california › california fair claims act training ›.

Source: courtlawyerca.com

Source: courtlawyerca.com

(a) section 790.03 (h) of the california insurance code enumerates sixteen claims settlement practices that, when either knowingly committed on a single occasion, or performed with such frequency as to indicate a general business practice, are considered to be unfair claims settlement practices and are, thus, prohibited by this section of the. The insurer cited to section 2695.7 (f) of the fair claims settlement regulations, which states: Fair claims settlement practices regulations all insurers doing business in california must comply with the requirements of california fair claims settlement practices regulations (the “regulations”) or face the ire of, and attempts at financial punishment from the california department of insurance (“cdoi”). (3) failing to adopt and implement reasonable standards for the The purpose of this act is to set forth standards for the investigation and disposition of claims arising under policies or certificates of insurance issued to residents of [insert state].

Source: consumerwatchdog.org

Source: consumerwatchdog.org

This a better practice than just merely accusing an insurer of bad faith. One hallmark of an insurer’s bad faith insurance practices is their unreasonable delay in adjusting a claim. The purpose of this act is to set forth standards for the investigation and disposition of claims arising under policies or certificates of insurance issued to residents of [insert state]. In addition to section 790.03 of the insurance. The department considers the use of reliable

Source: proadjuster.com

Source: proadjuster.com

Unfair claims practices, this separation of unfair claims from unfair trade practices is recommended. Unfair claims settlement practice is the improper avoidance, or reduction of a claim by an insurance company. “every insurer shall provide written notice of any statute of limitation or other time period requirement upon which the insurer may rely to deny a claim. In 1959, the california legislature enacted the unfair insurance practices act (“uipa”), cal. The department considers the use of reliable

Source: fapriansyah.blogspot.com

Source: fapriansyah.blogspot.com

Individuals involved in handling claims in california are required to complete training on the fair claims settlement practices regulations or submit a sworn statement attesting to having read and understood the regulations by september 1 each year, and have a copy with them at all times when handling california claims. It may not attempt to enforce policy provisions that were altered by the company without notice to you or without your knowledge or consent. California fair claims practices california fair claims practices › california fair claims settlement training › fair claims settlement practices california › california fair claims act training ›. In addition to section 790.03 of the insurance. The california fair claims settlement practices act outlines specific insurer conduct prohibited and considered unfair to insureds.

Source: fapriansyah.blogspot.com

Source: fapriansyah.blogspot.com

Wind driven rain what is in my insurance policy? It may not attempt to enforce policy provisions that were altered by the company without notice to you or without your knowledge or consent. Insurance code section 790 (h); The california fair claims settlement practices act outlines specific insurer conduct prohibited and considered unfair to insureds. Insurance company unfair claims settlement practices.

Source: liljegrenlaw.com

Source: liljegrenlaw.com

(3) failing to adopt and implement reasonable standards for the Fair claims settlement practices regulations all insurers doing business in california must comply with the requirements of california fair claims settlement practices regulations (the “regulations”) or face the ire of, and attempts at financial punishment from the california department of insurance (“cdoi”). You can also go to www.insurance.ca.gov and search for fair claims amendments ← partial losses: Insurance code section 790 (h); The insurer cited to section 2695.7 (f) of the fair claims settlement regulations, which states:

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title california insurance fair claims practices act by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Claims vs occurrence based insurance Idea

- Cheap tablet insurance Idea

- Calling insurance leads Idea

- Disability insurance for postal workers Idea

- Business insurance peoria il information

- Bright health insurance reviews Idea

- Carrier liability vs cargo insurance Idea

- Can you insure a written off car Idea

- Can convicted felons get life insurance information

- Car insurance administrator Idea