California non owner sr22 insurance Idea

Home » Trending » California non owner sr22 insurance IdeaYour California non owner sr22 insurance images are available in this site. California non owner sr22 insurance are a topic that is being searched for and liked by netizens today. You can Find and Download the California non owner sr22 insurance files here. Get all free vectors.

If you’re searching for california non owner sr22 insurance images information linked to the california non owner sr22 insurance keyword, you have visit the ideal site. Our website always provides you with hints for seeing the maximum quality video and image content, please kindly surf and find more enlightening video articles and images that match your interests.

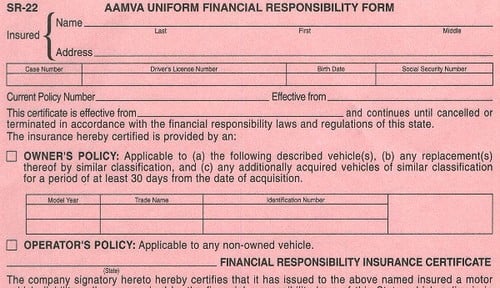

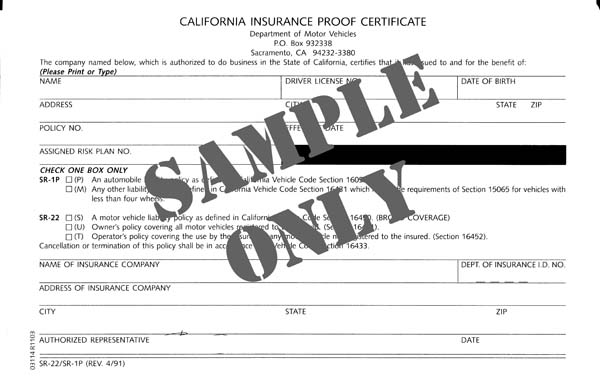

California Non Owner Sr22 Insurance. What is california non owner sr22 insurance? When you don’t own a car the sr22 certificate is endorsed to a non owner insurance policy. The sr22 is generally mandated for any drunk driving / alcohol related incident. The motorist will not actually own the vehicle, plus it really is a kind of insurance that is for unplanned or occasional driving of a vehicle registered to someone else.

When you don’t own a car the sr22 certificate is endorsed to a non owner insurance policy. One restriction of non owner insurance is that you only drive on an occasional basis. That is the purpose of sr22 insurance. A non owner sr22 insurance in california is one option that many individuals who do not own cars choose to save on their rental car fees. The motorist will not actually own the vehicle, plus it really is a kind of insurance that is for unplanned or occasional driving of a vehicle registered to someone else. If you do not own a vehicle but need sr22 insurance the non owner policy is half of what a owner operator policy sells for.

California non owner sr22 insurance this type of policy is perfect for those drivers that may live in san francisco, los angeles, or another big city which owning a car may not make sense.

The insurance coverage required on a california sr22 is 15/30/5. California sr22 auto insurance is usually required for a period of 3 years from the date of conviction. California non owner sr22 insurance is a document you must file with the state to regain driving privileges. One restriction of non owner insurance is that you only drive on an occasional basis. This is because the non owner sr22 insurance provides coverage even to rented cars. Low cost california non owner sr22 auto insurance:

Source: ultracarinsurance.com

Source: ultracarinsurance.com

$15,000 is the maximum amount paid per person for bodily injury (bi) That is the purpose of sr22 insurance. The non owners insurance policy ensures protection against certain things, such as tickets and property damage, but it won�t. A non owner sr22 insurance in california is one option that many individuals who do not own cars choose to save on their rental car fees. Purchase a california non owner sr22 auto insurance policy and have your sr22 filed with the dmv.

Source: mckennainsurance.com

Source: mckennainsurance.com

The insurance coverage is secondary over the vehicle you borrow. If your license is suspended, california requires a guarantee of financial responsibility from you. Save 50% on california non owner sr22 insurance. A non owner policy insures one individual, rather than a vehicle. California non owner sr22 insurance this type of policy is perfect for those drivers that may live in san francisco, los angeles, or another big city which owning a car may not make sense.

Source: lifeinsurance0000.blogspot.com

Source: lifeinsurance0000.blogspot.com

The non owners insurance policy ensures protection against certain things, such as tickets and property damage, but it won�t. $15,000 is the maximum amount paid per person for bodily injury (bi) a non owners policy is typically a bit more affordable than a. The sr22 is attached to your non owner insurance and sent to the dmv on your behalf electronically. This means that if you hit another driver or someone�s property it provides coverage to repair the damage. What is california non owner sr22 insurance?

Source: selectsr22insurance.com

Source: selectsr22insurance.com

Tell the agent about your situation. $15,000 is the maximum amount paid per person for bodily injury (bi) The motorist will not actually own the vehicle, plus it really is a kind of insurance that is for unplanned or occasional driving of a vehicle registered to someone else. Tell the agent about your situation. A non owner policy insures one individual, rather than a vehicle.

Source: cheapinsurance.com

Source: cheapinsurance.com

The insurance coverage required on a california sr22 is 15/30/5. A non owner sr22 insurance in california is one option that many individuals who do not own cars choose to save on their rental car fees. California sr22 auto insurance is usually required for a period of 3 years from the date of conviction. California non owner sr22 insurance is a document you must file with the state to regain driving privileges. This gives you liability insurance to drive on the road occasionally when needing to borrow a car.

Source: duiandsr22.com

Source: duiandsr22.com

The sr22 is attached to your non owner insurance and. One restriction of non owner insurance is that you only drive on an occasional basis. The sr22 is attached to your non owner insurance and. This means that if you hit another driver or someone�s property it provides coverage to repair the damage. $15,000 is the maximum amount paid per person for bodily injury (bi)

Source: thebuzzernews.blogspot.com

Source: thebuzzernews.blogspot.com

A non owner sr22 insurance in california is one option that many individuals who do not own cars choose to save on their rental car fees. What is california non owner sr22 insurance? If you do not own a vehicle but need sr22 insurance the non owner policy is half of what a owner operator policy sells for. The non owners insurance policy ensures protection against certain things, such as tickets and property damage, but it won�t. California non owner sr22 insurance this type of policy is perfect for those drivers that may live in san francisco, los angeles, or another big city which owning a car may not make sense.

Source: sr22savings.com

Source: sr22savings.com

A non owner sr22 insurance in california is one option that many individuals who do not own cars choose to save on their rental car fees. Tell the agent about your situation. $15,000 is the maximum amount paid per person for bodily injury (bi) a non owners policy is typically a bit more affordable than a. This is because the non owner sr22 insurance provides coverage even to rented cars. The sr22 is attached to your non owner insurance and sent to the dmv on your behalf electronically.

Source: sabrinewpr.wordpress.com

Source: sabrinewpr.wordpress.com

The sr22 is attached to your non owner insurance and. California non owner sr22 insurance this type of policy is perfect for those drivers that may live in san francisco, los angeles, or another big city which owning a car may not make sense. Even if you don�t own a vehicle, this requirement is in place. The sr22 is generally mandated for any drunk driving / alcohol related incident. Save 50% on california non owner sr22 insurance.

Source: sandiegosr22insurance.com

Source: sandiegosr22insurance.com

If you do not own a vehicle but need sr22 insurance the non owner policy is half of what a owner operator policy sells for. Purchase a california non owner sr22 auto insurance policy and have your sr22 filed with the dmv. The insurance coverage required on a california sr22 is 15/30/5. California non owner sr22 insurance is a document you must file with the state to regain driving privileges. The sr22 is attached to your non owner insurance and sent to the dmv on your behalf electronically.

Source: mis-insurance.com

Source: mis-insurance.com

A non owners policy is typically a bit more affordable than a. Save 50% on california non owner sr22 insurance. Low cost california non owner sr22 auto insurance: Which means the borrowed cars insurance would pay first and if exhausted then the non owner policy will pay second. Non owner sr22 insurance can also be a type of coverage contract which a person that occasionally drives another individual’s vehicle purchases.

Source: sr22insurancenow.com

Source: sr22insurancenow.com

The motorist will not actually own the vehicle, plus it really is a kind of insurance that is for unplanned or occasional driving of a vehicle registered to someone else. $15,000 is the maximum amount paid per person for bodily injury (bi) a non owners policy is typically a bit more affordable than a. That is the purpose of sr22 insurance. The sr22 is attached to your non owner insurance and. Non owner sr22 insurance can also be a type of coverage contract which a person that occasionally drives another individual’s vehicle purchases.

Source: sr22savings.com

Source: sr22savings.com

This is because the non owner sr22 insurance provides coverage even to rented cars. Which means the borrowed cars insurance would pay first and if exhausted then the non owner policy will pay second. When you don’t own a car the sr22 certificate is endorsed to a non owner insurance policy. Low cost california non owner sr22 auto insurance: This means that if you hit another driver or someone�s property it provides coverage to repair the damage.

Source: eeelopibe.blogspot.com

Source: eeelopibe.blogspot.com

California non owner sr22 insurance this type of policy is perfect for those drivers that may live in san francisco, los angeles, or another big city which owning a car may not make sense. Even if you don�t own a vehicle, this requirement is in place. California non owner sr22 insurance is a document you must file with the state to regain driving privileges. The sr22 is attached to your non owner insurance and. Tell the agent about your situation.

Source: revisi.net

Source: revisi.net

Non owner sr22 insurance can also be a type of coverage contract which a person that occasionally drives another individual’s vehicle purchases. The agent will guide you through the process and sr22 requirements. What is california non owner sr22 insurance? Non owner sr22 insurance can also be a type of coverage contract which a person that occasionally drives another individual’s vehicle purchases. This is because the non owner sr22 insurance provides coverage even to rented cars.

Source: sr22savings.com

Source: sr22savings.com

What is california non owner sr22 insurance? Non owner sr22 insurance can also be a type of coverage contract which a person that occasionally drives another individual’s vehicle purchases. If you do not own a vehicle but need sr22 insurance the non owner policy is half of what a owner operator policy sells for. California non owner sr22 insurance this type of policy is perfect for those drivers that may live in san francisco, los angeles, or another big city which owning a car may not make sense. Save up to 50% on your sr22 insurance by purchasing a non owner policy.

Source: ultracarinsurance.com

Source: ultracarinsurance.com

Save 50% on california non owner sr22 insurance. California non owner sr22 insurance is a document you must file with the state to regain driving privileges. This means that if you hit another driver or someone�s property it provides coverage to repair the damage. Even if you don�t own a vehicle, this requirement is in place. One restriction of non owner insurance is that you only drive on an occasional basis.

This means that if you hit another driver or someone�s property it provides coverage to repair the damage. What is california non owner sr22 insurance? This gives you liability insurance to drive on the road occasionally when needing to borrow a car. This means that if you hit another driver or someone�s property it provides coverage to repair the damage. If you do not own a vehicle but need sr22 insurance the non owner policy is half of what a owner operator policy sells for.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title california non owner sr22 insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Claims vs occurrence based insurance Idea

- Cheap tablet insurance Idea

- Calling insurance leads Idea

- Disability insurance for postal workers Idea

- Business insurance peoria il information

- Bright health insurance reviews Idea

- Carrier liability vs cargo insurance Idea

- Can you insure a written off car Idea

- Can convicted felons get life insurance information

- Car insurance administrator Idea