Can a life insurance beneficiary be changed after death Idea

Home » Trending » Can a life insurance beneficiary be changed after death IdeaYour Can a life insurance beneficiary be changed after death images are available. Can a life insurance beneficiary be changed after death are a topic that is being searched for and liked by netizens now. You can Get the Can a life insurance beneficiary be changed after death files here. Get all royalty-free photos.

If you’re searching for can a life insurance beneficiary be changed after death pictures information linked to the can a life insurance beneficiary be changed after death interest, you have come to the ideal blog. Our site frequently gives you suggestions for downloading the maximum quality video and image content, please kindly hunt and locate more enlightening video articles and images that match your interests.

Can A Life Insurance Beneficiary Be Changed After Death. If the policyholder lives in a community property state or if they designated an irrevocable beneficiary. Insurance companies will often reject forms which are incomplete or improperly formatted, in which case the originally designated beneficiary receives the death benefit instead of the “new”. If you’re single and don’t have children, you are free to name anyone that you want as your beneficiary. There are two circumstances when you need another person’s permission to update a beneficiary:

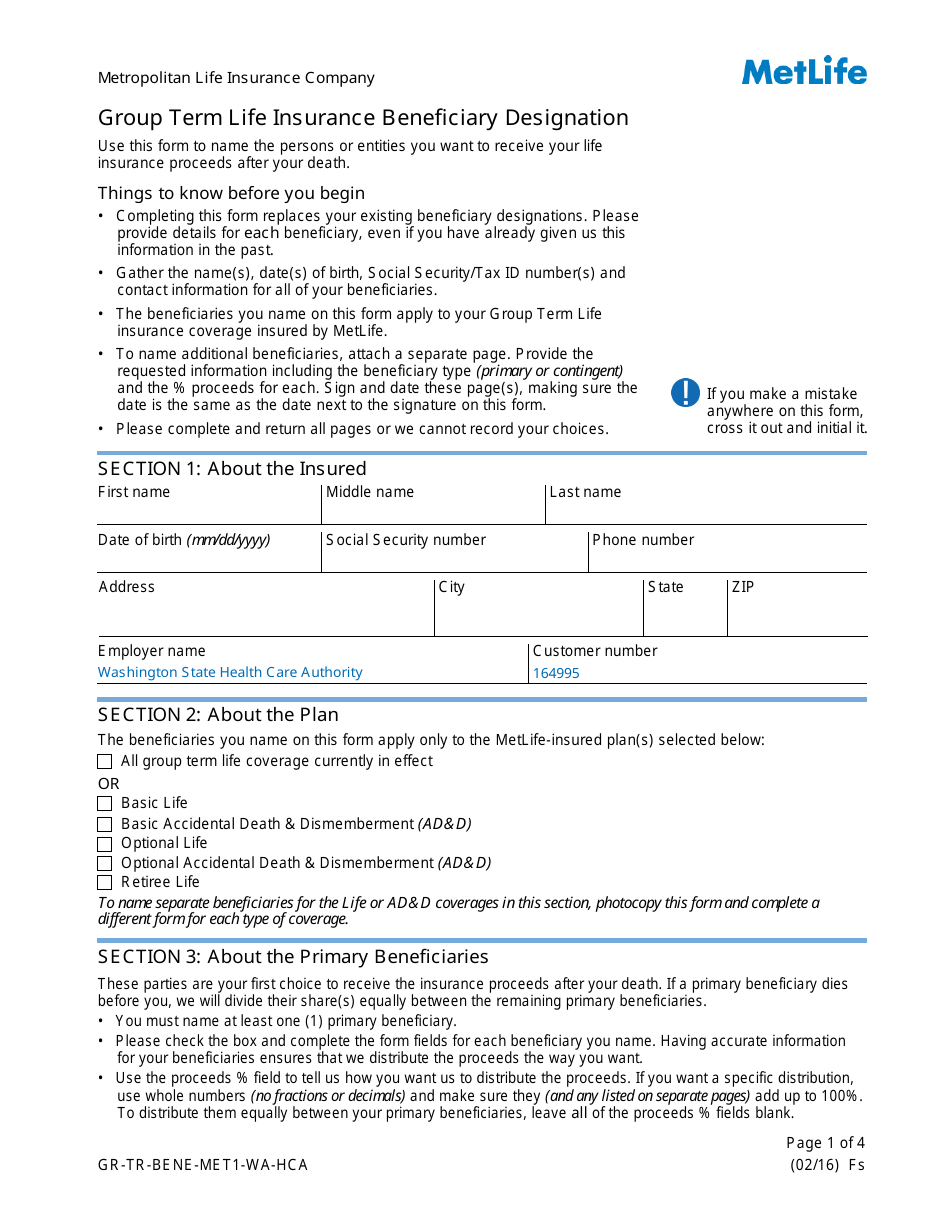

Group Term Life Insurance Beneficiary Designation Form From templateroller.com

Group Term Life Insurance Beneficiary Designation Form From templateroller.com

If you’re single and don’t have children, you are free to name anyone that you want as your beneficiary. Perhaps getting an inheritance now could be a problem for you. Insurance companies will often reject forms which are incomplete or improperly formatted, in which case the originally designated beneficiary receives the death benefit instead of the “new”. A relatively minor topic that doesn�t seem to get much coverage is one�s ability to change death beneficiaries on nonprobate assets (e.g., life insurance policies, retirement accounts, etc.) after obtaining his or her spouse�s consent to the transfer. Changes made shortly before death or while the insured is physically or mentally incapacitated are more likely to be contested. It is possible to contest the beneficiary of a life insurance policy after the death of the insured in a variety of situations.

If you’re single and don’t have children, you are free to name anyone that you want as your beneficiary.

0 found this answer helpful. Beneficiary changes — having your spouse as your beneficiary ensures that they can of a life insurance policy cannot be changed after the insured (31). If you�re looking for life insurance coverage or simply want to learn more about your options, you can get a free plan quote online that allows you to compare different insurance. Here are some ways in which a life insurance beneficiary can be challenged. There are two circumstances when you need another person’s permission to update a beneficiary: A beneficiary is a person who is named in this contract as a recipient of the life insurance proceeds in the event of the insured person’s death.

Source: seilersingleton.com

Source: seilersingleton.com

After the policyholder�s death, opportunities to change a beneficiary or prevent a contest are minimal. Can a life insurance beneficiary be changed after death? People involved in these situations may wish to seek the advice of an attorney. When the insured dies, the interest in the life insurance proceeds immediately transfers to the primary beneficiary named on the policy and only that designated person has the right to collect the proceeds. No one can change beneficiary designations after the insured dies.

Source: blog.massmutual.com

Source: blog.massmutual.com

It will also help to notify the original beneficiary you are changing your life insurance policy so he or she is not angered when learning of their removal from the policy after you pass away. When life changes happen, changes in the life insurance policy should reflect them. If you’re single and don’t have children, you are free to name anyone that you want as your beneficiary. The form cannot be changed by the executor after death. Usually in such cases, a former beneficiary questions whether the newly named beneficiary took advantage of the policyholder.

Source: andersonadvisors.com

Source: andersonadvisors.com

A beneficiary is a person who is named in this contract as a recipient of the life insurance proceeds in the event of the insured person’s death. Often, someone who believes they were the policy’s rightful beneficiary is the one to initiate such a dispute. A revocable beneficiary can be changed by the owner of the policy without the signature of the beneficiary. If you’re single and don’t have children, you are free to name anyone that you want as your beneficiary. After the policyholder�s death, opportunities to change a beneficiary or prevent a contest are minimal.

Source: revisi.net

Source: revisi.net

Beneficiary changes — having your spouse as your beneficiary ensures that they can of a life insurance policy cannot be changed after the insured (31). Be honest with all parties, make your intentions clear, change your life insurance beneficiary before you lose your mental or physical faculties and there is a good chance it will. The beneficiary may be a spouse, a relative, a child, a friend, a trust, etc. A beneficiary cannot be changed after the death of an insured. No one can change beneficiary designations after the insured dies.

Source: newyorkcityvoices.org

Source: newyorkcityvoices.org

This may come up for example, if you and your spouse decide on the beneficiaries of your life. Life insurance policies can have either a revocable or irrevocable beneficiary designation. Insurance companies will often reject forms which are incomplete or improperly formatted, in which case the originally designated beneficiary receives the death benefit instead of the “new”. It is possible to contest the beneficiary of a life insurance policy after the death of the insured in a variety of situations. Beneficiaries usually can’t be changed through other means, like a last will and testament.

Source: revisi.net

Source: revisi.net

No, the beneficiary designation cannot be changed after someone�s death. A life insurance beneficiary rule is a rule put in place either by the life insurance company or the insurance commissioner of the state you live in. Once a life insurance policyholder dies, little can be done to change the beneficiary designation and prevent a dispute. There are two circumstances when you need another person’s permission to update a beneficiary: Insurance companies will often reject forms which are incomplete or improperly formatted, in which case the originally designated beneficiary receives the death benefit instead of the “new”.

Source: carriehightower.net

Source: carriehightower.net

After the policyholder�s death, opportunities to change a beneficiary or prevent a contest are minimal. It is possible to contest the beneficiary of a life insurance policy after the death of the insured in a variety of situations. Here are some ways in which a life insurance beneficiary can be challenged. Changes made shortly before death or while the insured is physically or mentally incapacitated are more likely to be contested. If you’re married or have children, it’s important that you know what these rules are.

Source: templateroller.com

Source: templateroller.com

Any person with a valid legal claim can contest a life insurance policy’s beneficiary after the death of the insured. If you’re single and don’t have children, you are free to name anyone that you want as your beneficiary. No one can change beneficiary designations after the insured dies. Changes made shortly before death or while the insured is physically or mentally incapacitated are more likely to be contested. A beneficiary cannot be changed after the death of an insured.

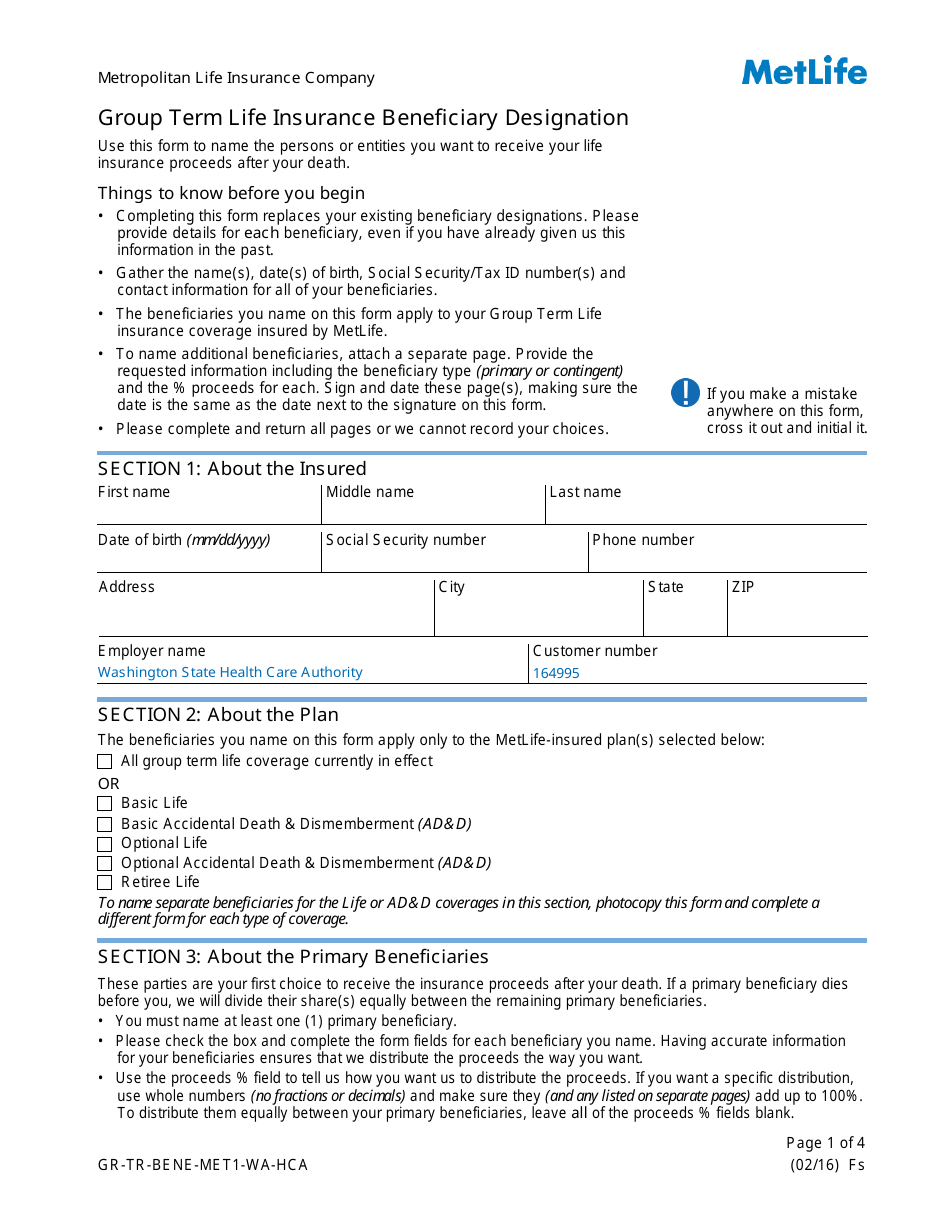

Source: nyretirementnews.com

Source: nyretirementnews.com

Perhaps getting an inheritance now could be a problem for you. Beneficiaries usually can’t be changed through other means, like a last will and testament. Perhaps getting an inheritance now could be a problem for you. If you’re single and don’t have children, you are free to name anyone that you want as your beneficiary. No one can change beneficiary designations after the insured dies.

Source: revisi.net

Source: revisi.net

Grounds to contest a life insurance beneficiary. If you’re married or have children, it’s important that you know what these rules are. It is possible to contest the beneficiary of a life insurance policy after the death of the insured in a variety of situations. A relatively minor topic that doesn�t seem to get much coverage is one�s ability to change death beneficiaries on nonprobate assets (e.g., life insurance policies, retirement accounts, etc.) after obtaining his or her spouse�s consent to the transfer. Be honest with all parties, make your intentions clear, change your life insurance beneficiary before you lose your mental or physical faculties and there is a good chance it will.

Source: briansoinsurance.com

Source: briansoinsurance.com

Usually, the owner of the policy may name any person or an entity as the beneficiary. There are many cases we’ve represented where the insurer has been the cause of the problem for paying a claim. Beneficiary changes — having your spouse as your beneficiary ensures that they can of a life insurance policy cannot be changed after the insured (31). If you�re looking for life insurance coverage or simply want to learn more about your options, you can get a free plan quote online that allows you to compare different insurance. A relatively minor topic that doesn�t seem to get much coverage is one�s ability to change death beneficiaries on nonprobate assets (e.g., life insurance policies, retirement accounts, etc.) after obtaining his or her spouse�s consent to the transfer.

Source: life-insurance-lawyer.com

Source: life-insurance-lawyer.com

No, the beneficiary designation cannot be changed after someone�s death. If the insured person does not contact the life insurance company and change the beneficiary to another person, severe complications can result. Any person with a valid legal claim can contest a life insurance policy’s beneficiary after the death of the insured. Can a life insurance beneficiary be changed after death? Beneficiary changes — having your spouse as your beneficiary ensures that they can of a life insurance policy cannot be changed after the insured (31).

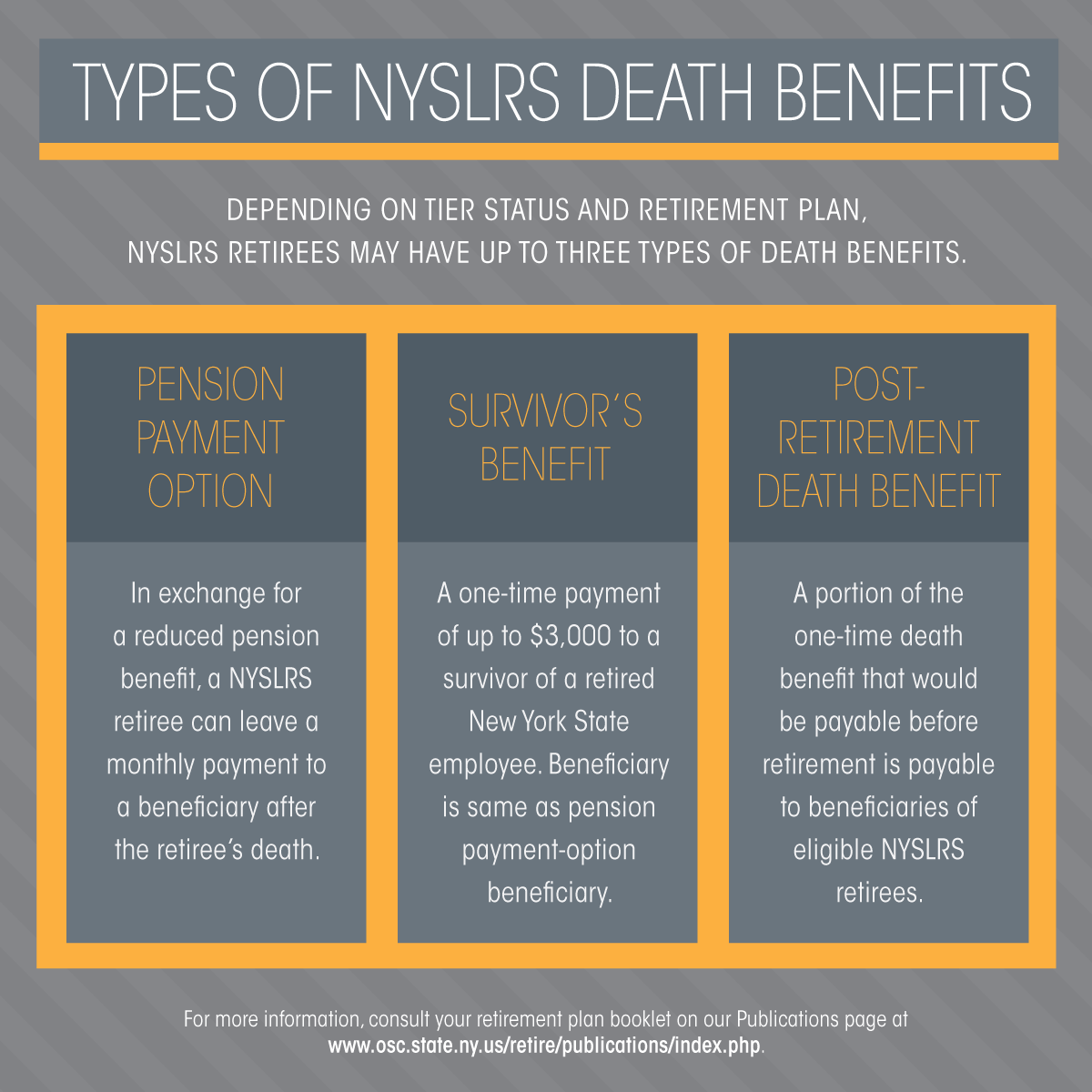

Source: signnow.com

Source: signnow.com

A beneficiary cannot be changed after the death of an insured. There are two circumstances when you need another person’s permission to update a beneficiary: Life insurance policies can have either a revocable or irrevocable beneficiary designation. What’s a life insurance beneficiary rule? One may also ask, what is assignee irrevocable beneficiary?

Source: lifeandaccidentaldeathclaimlawyers.com

Source: lifeandaccidentaldeathclaimlawyers.com

No one can change beneficiary designations after the insured dies. Usually in such cases, a former beneficiary questions whether the newly named beneficiary took advantage of the policyholder. No, the beneficiary designation cannot be changed after someone�s death. Insurance companies will often reject forms which are incomplete or improperly formatted, in which case the originally designated beneficiary receives the death benefit instead of the “new”. More importantly, i doubt that your friend could have been named beneficiary in the first place as he had no insurable interest in his girlfriend�s life.

Source: printablelegaldoc.com

Source: printablelegaldoc.com

Beneficiaries must be changed by following the correct procedures with the insurance company. After the policyholder�s death, opportunities to change a beneficiary or prevent a contest are minimal. A beneficiary cannot be changed after the death of an insured. If you�re looking for life insurance coverage or simply want to learn more about your options, you can get a free plan quote online that allows you to compare different insurance. 0 found this answer helpful.

Source: progressive.com

Source: progressive.com

When life changes happen, changes in the life insurance policy should reflect them. The beneficiary may be a spouse, a relative, a child, a friend, a trust, etc. If you�re looking for life insurance coverage or simply want to learn more about your options, you can get a free plan quote online that allows you to compare different insurance. If you need assistance with an initial estate plan or would like to modify an. If you’re single and don’t have children, you are free to name anyone that you want as your beneficiary.

Source: printablelegaldoc.com

Source: printablelegaldoc.com

If you’re single and don’t have children, you are free to name anyone that you want as your beneficiary. 0 found this answer helpful. This may come up for example, if you and your spouse decide on the beneficiaries of your life. Can you fight a life insurance beneficiary? There are two circumstances when you need another person’s permission to update a beneficiary:

Source: lifeinsurance.satukara.com

Source: lifeinsurance.satukara.com

There are two circumstances when you need another person’s permission to update a beneficiary: Perhaps getting an inheritance now could be a problem for you. Grounds to contest a life insurance beneficiary. Can you fight a life insurance beneficiary? Often, someone who believes they were the policy’s rightful beneficiary is the one to initiate such a dispute.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title can a life insurance beneficiary be changed after death by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Claims vs occurrence based insurance Idea

- Cheap tablet insurance Idea

- Calling insurance leads Idea

- Disability insurance for postal workers Idea

- Business insurance peoria il information

- Bright health insurance reviews Idea

- Carrier liability vs cargo insurance Idea

- Can you insure a written off car Idea

- Can convicted felons get life insurance information

- Car insurance administrator Idea