Can a special needs trust pay for private health insurance information

Home » Trending » Can a special needs trust pay for private health insurance informationYour Can a special needs trust pay for private health insurance images are ready. Can a special needs trust pay for private health insurance are a topic that is being searched for and liked by netizens now. You can Get the Can a special needs trust pay for private health insurance files here. Find and Download all royalty-free images.

If you’re looking for can a special needs trust pay for private health insurance pictures information connected with to the can a special needs trust pay for private health insurance keyword, you have visit the ideal blog. Our site always gives you hints for seeing the highest quality video and picture content, please kindly search and find more enlightening video content and graphics that fit your interests.

Can A Special Needs Trust Pay For Private Health Insurance. The person with disabilities, no matter how competent, cannot be the “creator” of the trust (even if the trust is funded Craig added that many medicaid recipients are also on supplemental security income (ssi) — part of the social security program. It can be used to buy. Health insurance regulations do not allow health insurers to insure for this cost.

PROPERTY PROTECTION TRUST WILLS in 2020 A complete guide. From ukcareguide.co.uk

PROPERTY PROTECTION TRUST WILLS in 2020 A complete guide. From ukcareguide.co.uk

Special needs trust being established, here are some of the rules that apply to special needs trusts in general: Craig added that many medicaid recipients are also on supplemental security income (ssi) — part of the social security program. An snp provides benefits targeted to its members’ special needs, including care coordination services. • generally, only a parent, grandparent, legal guardian or court can set up a special needs trust. Special needs trusts are typically funded by a gift, an inheritance, life insurance, or a personal injury lawsuit settlement. A special needs trust helps plan for individualized care over your child’s lifetime while protecting his or her eligibility for public benefits.

Trustee fees may be a fixed amount, an hourly rate, or a percentage of the trust assets.

Special needs trust being established, here are some of the rules that apply to special needs trusts in general: The trust can pay for ordinary or special furniture, medical and health costs not covered by medicaid, such as experimental and alternative medical treatments, massage therapy, vitamins, certain durable medical equipment and special aids. Physical therapy not covered by insurance or benefits; Additional health insurance products, such as private or supplementary health insurance, may help you: • generally, only a parent, grandparent, legal guardian or court can set up a special needs trust. It can pay for vacations, summer camp, trips, travel companions, or other recreation or entertainment.

Source: debrarobinsonlaw.com

Source: debrarobinsonlaw.com

Special needs trust being established, here are some of the rules that apply to special needs trusts in general: Depending on your policy, this limitation can apply in a private hospital, or. Even after moving to a nursing home, if you have a child, other relative, or even a friend who is under age 65 and disabled, you can transfer assets into a trust for his or her benefit without incurring any period of ineligibility. Special needs trusts are typically funded by a gift, an inheritance, life insurance, or a personal injury lawsuit settlement. Special needs trust being established, here are some of the rules that apply to special needs trusts in general:

Source: shalloway.com

Source: shalloway.com

Still, if a beneficiary�s shelter needs can be met only through rental assistance from the special needs trust, a $270 reduction in the monthly ssi grant is usually a great deal. The trust can pay for ordinary or special furniture, medical and health costs not covered by medicaid, such as experimental and alternative medical treatments, massage therapy, vitamins, certain durable medical equipment and special aids. Pay for services that aren�t covered by your regular health care plan such as special nursing services, ambulance services, wheelchairs and other durable equipment the policy pays out only after the second partner dies and that money can, if there is a special needs trust, go directly into the trust without. An snp provides benefits targeted to its members’ special needs, including care coordination services. A special needs trust helps plan for individualized care over your child’s lifetime while protecting his or her eligibility for public benefits.

Source: hospiceoftheeup.com

Source: hospiceoftheeup.com

If the trustee is responsible for investments, they can pay for. The funds in a special needs trust can be used to provide certain amenities to the disabled beneficiary. If you have medicare and medicaid [glossary], your plan should make sure that all of the plan doctors or other. Even after moving to a nursing home, if you have a child, other relative, or even a friend who is under age 65 and disabled, you can transfer assets into a trust for his or her benefit without incurring any period of ineligibility. The trustee can use trust funds to pay filing fees, registration fees, title fees as necessary when transferring assets into the trust’s name.

Source: brainline.org

Source: brainline.org

They can withdraw money to maintain trust property, like paying property taxes or homeowners insurance or for general upkeep of a house owned by the trust. They can withdraw money to maintain trust property, like paying property taxes or homeowners insurance or for general upkeep of a house owned by the trust. Special needs trusts are typically funded by a gift, an inheritance, life insurance, or a personal injury lawsuit settlement. Typically, ownership of assets in excess of $2,000 would cause the individual to become disqualified from certain public benefits. The most common kind of.

Source: world4nurses.com

Source: world4nurses.com

They can withdraw money to maintain trust property, like paying property taxes or homeowners insurance or for general upkeep of a house owned by the trust. The funds in a special needs trust can be used to provide certain amenities to the disabled beneficiary. Pay for services that aren�t covered by your regular health care plan such as special nursing services, ambulance services, wheelchairs and other durable equipment. Special needs trusts are typically funded by a gift, an inheritance, life insurance, or a personal injury lawsuit settlement. Assets held in a special needs trust do not count toward this amount.

Source: bizjournals.com

Source: bizjournals.com

A special needs trust helps plan for individualized care over your child’s lifetime while protecting his or her eligibility for public benefits. Your specialist can help you. Special needs trust being established, here are some of the rules that apply to special needs trusts in general: Trustee fees may be a fixed amount, an hourly rate, or a percentage of the trust assets. You can join a snp at any time.

Source: lyndahinkle.com

Source: lyndahinkle.com

• a trust beneficiary must be under the age of 65 when the snt is established and there can be no additions to the trust after the trust beneficiary turns age 65. You don’t have to go through probate.” Any payment by the trust to an individual or entity, that is expected to be greater than $5,000, either per expenditure or Pay for services that aren�t covered by your regular health care plan such as special nursing services, ambulance services, wheelchairs and other durable equipment. Special needs trust (snt) • an snt is established with the resources of a disabled individual for the purpose of allowing the individual to qualify for medical assistance (ma).

Source: clearpathhomehealth.com

Source: clearpathhomehealth.com

You don’t have to go through probate.” Once you move your assets into an irrevocable trust, you’re effectively depleting your estate of disposable assets, a move that eventually will allow you to. • generally, only a parent, grandparent, legal guardian or court can set up a special needs trust. An snp provides benefits targeted to its members’ special needs, including care coordination services. The funds in a special needs trust can be used to provide certain amenities to the disabled beneficiary.

Source: jlutgenslaw.com

Source: jlutgenslaw.com

Physical therapy not covered by insurance or benefits; • generally, only a parent, grandparent, legal guardian or court can set up a special needs trust. Typically, ownership of assets in excess of $2,000 would cause the individual to become disqualified from certain public benefits. Your specialist can help you. Pay for services that aren�t covered by your regular health care plan such as special nursing services, ambulance services, wheelchairs and other durable equipment.

Source: fndusa.org

Source: fndusa.org

• generally, only a parent, grandparent, legal guardian or court can set up a special needs trust. Even after moving to a nursing home, if you have a child, other relative, or even a friend who is under age 65 and disabled, you can transfer assets into a trust for his or her benefit without incurring any period of ineligibility. You don’t have to go through probate.” Trust payments for rent or mortgage payments on a house owned by the beneficiary are considered ism, so they trigger a reduction of the ssi grant. The trustee can use trust funds to pay filing fees, registration fees, title fees as necessary when transferring assets into the trust’s name.

Source: emccmarketing.com

Source: emccmarketing.com

Physical therapy not covered by insurance or benefits; You don’t have to go through probate.” You can join a snp at any time. Craig added that many medicaid recipients are also on supplemental security income (ssi) — part of the social security program. A special needs trust helps plan for individualized care over your child’s lifetime while protecting his or her eligibility for public benefits.

Source: mysouthwell.com

Source: mysouthwell.com

These trusts can also be used to qualify for supplemental security income (ssi). If the trustee is responsible for investments, they can pay for. These trusts may also be called a supplemental needs trusts, or “(d)(4)(a)” trusts after the federal law that authorized them, 42 u.s.c. Additional health insurance products, such as private or supplementary health insurance, may help you: Special needs trust (snt) • an snt is established with the resources of a disabled individual for the purpose of allowing the individual to qualify for medical assistance (ma).

Source: lovingcarehealth.com

Source: lovingcarehealth.com

Pay for services that aren�t covered by your regular health care plan such as special nursing services, ambulance services, wheelchairs and other durable equipment. Depending on your policy, this limitation can apply in a private hospital, or. The trustee can use trust funds to pay filing fees, registration fees, title fees as necessary when transferring assets into the trust’s name. Typically, ownership of assets in excess of $2,000 would cause the individual to become disqualified from certain public benefits. It can be used to buy.

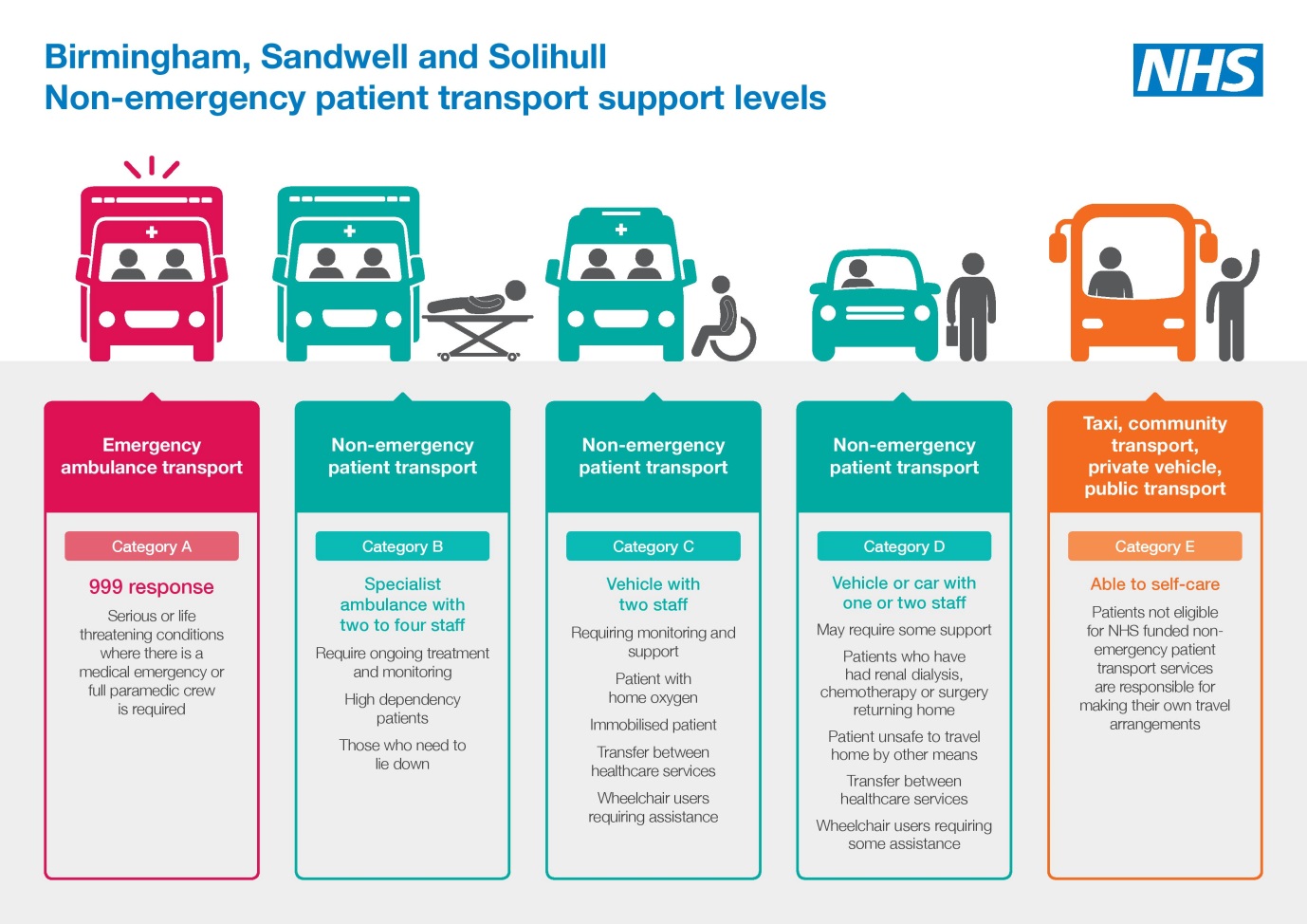

Source: royalmarsden.nhs.uk

Source: royalmarsden.nhs.uk

The trust can pay for ordinary or special furniture, medical and health costs not covered by medicaid, such as experimental and alternative medical treatments, massage therapy, vitamins, certain durable medical equipment and special aids. These trusts can also be used to qualify for supplemental security income (ssi). Trust payments for rent or mortgage payments on a house owned by the beneficiary are considered ism, so they trigger a reduction of the ssi grant. Health insurance regulations do not allow health insurers to insure for this cost. Once you move your assets into an irrevocable trust, you’re effectively depleting your estate of disposable assets, a move that eventually will allow you to.

Source: hgs.uhb.nhs.uk

Source: hgs.uhb.nhs.uk

Typically, ownership of assets in excess of $2,000 would cause the individual to become disqualified from certain public benefits. The funds in a special needs trust can be used to provide certain amenities to the disabled beneficiary. Once you move your assets into an irrevocable trust, you’re effectively depleting your estate of disposable assets, a move that eventually will allow you to. A special needs trust helps plan for individualized care over your child’s lifetime while protecting his or her eligibility for public benefits. Your specialist can help you.

Source: caregiversoncall.net

Source: caregiversoncall.net

If the trustee is responsible for investments, they can pay for. They can withdraw money to maintain trust property, like paying property taxes or homeowners insurance or for general upkeep of a house owned by the trust. Supplement your income if you suffer a major illness or severe injury. A special needs trust helps plan for individualized care over your child’s lifetime while protecting his or her eligibility for public benefits. It can be used to buy.

Source: ayusyahomehealthcare.com

Source: ayusyahomehealthcare.com

Supplemental needs trusts the medicaid rules also have certain exceptions for transfers for the sole benefit of disabled people under age 65. Physical therapy not covered by insurance or benefits; The trustee can use trust funds to pay filing fees, registration fees, title fees as necessary when transferring assets into the trust’s name. Any payment by the trust to an individual or entity, that is expected to be greater than $5,000, either per expenditure or Special needs trusts are typically funded by a gift, an inheritance, life insurance, or a personal injury lawsuit settlement.

Source: trusthealth.co.uk

Source: trusthealth.co.uk

Typically, ownership of assets in excess of $2,000 would cause the individual to become disqualified from certain public benefits. The person with disabilities, no matter how competent, cannot be the “creator” of the trust (even if the trust is funded Your specialist can help you. Pay for services that aren�t covered by your regular health care plan such as special nursing services, ambulance services, wheelchairs and other durable equipment the policy pays out only after the second partner dies and that money can, if there is a special needs trust, go directly into the trust without. Still, if a beneficiary�s shelter needs can be met only through rental assistance from the special needs trust, a $270 reduction in the monthly ssi grant is usually a great deal.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title can a special needs trust pay for private health insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Claims vs occurrence based insurance Idea

- Cheap tablet insurance Idea

- Calling insurance leads Idea

- Disability insurance for postal workers Idea

- Business insurance peoria il information

- Bright health insurance reviews Idea

- Carrier liability vs cargo insurance Idea

- Can you insure a written off car Idea

- Can convicted felons get life insurance information

- Car insurance administrator Idea