Can an employer contribute different amounts towards employee medical insurance Idea

Home » Trend » Can an employer contribute different amounts towards employee medical insurance IdeaYour Can an employer contribute different amounts towards employee medical insurance images are available. Can an employer contribute different amounts towards employee medical insurance are a topic that is being searched for and liked by netizens now. You can Get the Can an employer contribute different amounts towards employee medical insurance files here. Find and Download all royalty-free images.

If you’re searching for can an employer contribute different amounts towards employee medical insurance images information connected with to the can an employer contribute different amounts towards employee medical insurance topic, you have come to the ideal blog. Our site frequently gives you suggestions for seeing the highest quality video and picture content, please kindly hunt and locate more enlightening video content and images that match your interests.

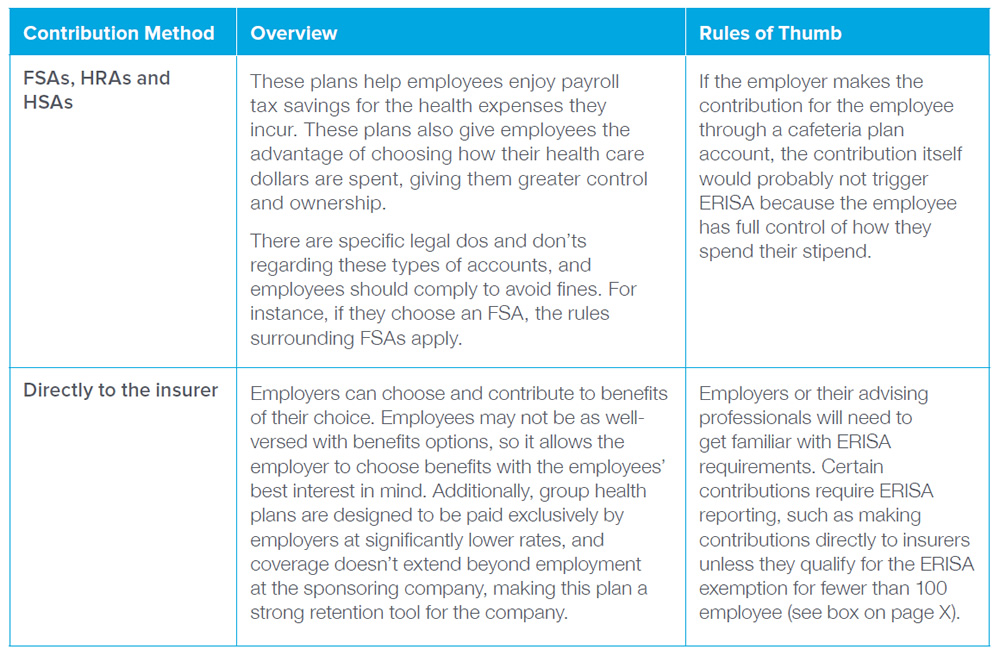

Can An Employer Contribute Different Amounts Towards Employee Medical Insurance. Means that employers are allowed to contribute toward the premium for any eligible employee an amount between 50% and 105% of the least costly qualified health plan within the county of the employer. Insurance carriers generally require that companies contribute to at least half of employee premiums. Some of our employer clients have asked: This means that a business is required to share the cost of group health insurance with employees.

FAQ Defined contribution for employee health care From aflac.com

FAQ Defined contribution for employee health care From aflac.com

One of the first terms i learned as an employee benefits consultant for a midwest insurance company was adverse selection, i.e., when there was no employer contrib toward the group insurance premium the only enrollees will be people who have to have insurance. Insurance carriers generally require that companies contribute to at least half of employee premiums. Some of our employer clients have asked: The aca indicates that health care for a calendar year should not exceed 9.8 percent of an employee�s total annual income. Kirk is right regarding a minimum employer contribution. However, they don’t want to violate any discrimination laws.

For example, it is not uncommon for an employer to contribute on dollar or percentage amount towards the coverage of salaried employees and another dollar or percentage amount towards hourly employees.

The firm�s health benefits data covering 1,600 employers found that 21 percent set health insurance premium amounts based on employee pay levels. Employers offering small business group health insurance benefits have flexibility treating employees differently as long as the contribution policy complies with the insurance company’s employer contribution requirements and basic non. The employer contribution for health insurance might change based upon the type of plan the company offers. While distinctions cannot be based on any of the health factors listed above, employers may provide different health benefits to different groups of employees, so long as the individuals are not “similarly situated individuals.”. The firm�s health benefits data covering 1,600 employers found that 21 percent set health insurance premium amounts based on employee pay levels. To help us get a general idea of how much employers contribute to health plans, we turn to the the annual kaiser family foundation (kff) health benefits survey for insight.

Source: aflac.com

Source: aflac.com

Some of our employer clients have asked: Means that employers are allowed to contribute toward the premium for any eligible employee an amount between 50% and 105% of the least costly qualified health plan within the county of the employer. Often, health insurance is offered at a group rate through an employer. Can an employer contribute different amounts towards employee medical insurance. As long as the employer doesn’t make these decisions on a discriminatory basis, offering different benefits to (1) currently, there are no laws ** requiring plans to provide.

Source: marketbusinessnews.com

Source: marketbusinessnews.com

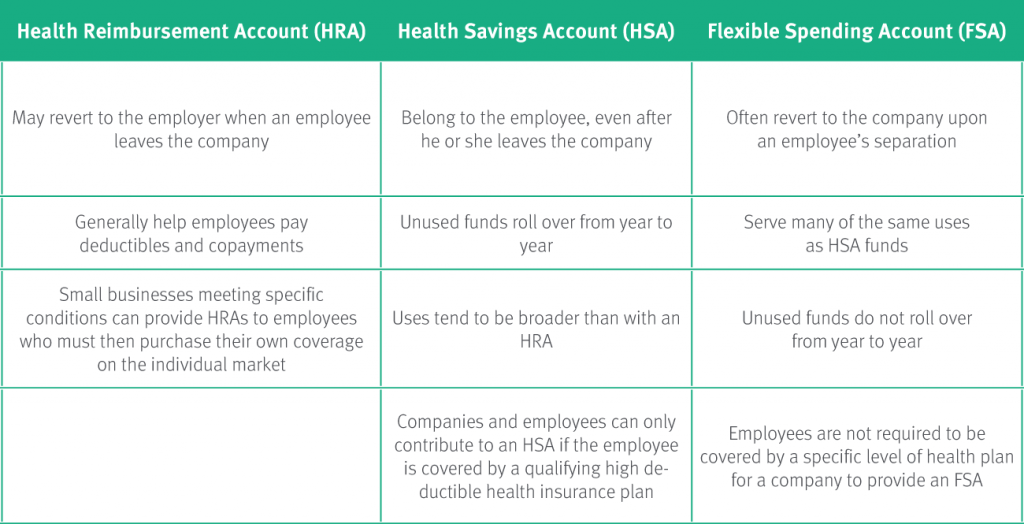

They can as long as they are not discriminating within a class of employees. This means that a business is required to share the cost of group health insurance with employees. If your organization chooses, you can contribute to employees’ hsas periodically, i.e. For example, it is not uncommon for an employer to contribute on dollar or percentage amount towards the coverage of salaried employees and another dollar or percentage amount towards hourly employees. One of the first terms i learned as an employee benefits consultant for a midwest insurance company was adverse selection, i.e., when there was no employer contrib toward the group insurance premium the only enrollees will be people who have to have insurance.

Source: get.fountain.com

Source: get.fountain.com

For example, it is not uncommon for an employer to contribute on dollar or percentage amount towards the coverage of salaried employees and another dollar or percentage amount towards hourly employees. Quarterly, biannually, or by pay period. Contributing to employees’ health savings accounts (hsa) is an added benefit that many employers are choosing to provide to their people. Some of our employer clients have asked: Can an employer contribute different amounts towards employee medical insurance.

Source: mainstreetinsct.com

Source: mainstreetinsct.com

Can an employer pay different amounts of health insurance contributions for different employees (e.g. To help us get a general idea of how much employers contribute to health plans, we turn to the the annual kaiser family foundation (kff) health benefits survey for insight. As an employer, you decide whether or not to contribute to employee hsas. Sometimes employers wish to give managers. However, they don’t want to violate any discrimination laws.

Source: goselfemployed.co

Source: goselfemployed.co

“can an employer contribute different amounts towards employee medical insurance for different employees?” employers often treat employees differently (for example not all employees earn the same wage). Employers offering small business group health insurance benefits have flexibility treating employees differently as long as the contribution policy complies with the insurance company’s employer contribution requirements and basic non. Offering different benefits for different employee classes. Can an employer contribute different amounts towards employee medical insurance. In 2019, employers contributed an average of:

Source: olympiabenefits.com

Sometimes this is due to a geographic difference between employees, job types, staff versus management, and more. “can an employer contribute different amounts towards employee medical insurance for different employees?” employers often treat employees differently (for example not all employees earn the same wage). As an employer, the amount you have to contribute to your employees’ group health plan varies by insurance carrier. The employer contribution for health insurance might change based upon the type of plan the company offers. Insurance carriers generally require that companies contribute to at least half of employee premiums.

Source: formadellecose.blogspot.com

Source: formadellecose.blogspot.com

They can as long as they are not discriminating within a class of employees. For example, it is not uncommon for an employer to contribute on dollar or percentage amount towards the coverage of salaried employees and another dollar or percentage amount towards hourly employees. However, they don’t want to violate any discrimination laws. The employer contribution for health insurance might change based upon the type of plan the company offers. “can an employer contribute different amounts towards employee medical insurance for different employees?” employers often treat employees differently (for example not all employees earn the same wage).

Source: blog.healthequity.com

One of the first terms i learned as an employee benefits consultant for a midwest insurance company was adverse selection, i.e., when there was no employer contrib toward the group insurance premium the only enrollees will be people who have to have insurance. The employer contribution for health insurance might change based upon the type of plan the company offers. “can an employer contribute different amounts towards employee medical insurance for different employees?” employers often treat employees differently (for example not all employees earn the same wage). Employer contributions are entirely optional. For example, it is not uncommon for an employer to contribute on dollar or percentage amount towards the coverage of salaried employees and another dollar or.

Source: ltcnews.com

Source: ltcnews.com

Sometimes this is due to a geographic difference between employees, job types, staff versus management, and more. Contributing to employees’ health savings accounts (hsa) is an added benefit that many employers are choosing to provide to their people. Means that employers are allowed to contribute toward the premium for any eligible employee an amount between 50% and 105% of the least costly qualified health plan within the county of the employer. 27% of covered workers in small firms are in a plan where the employer pays the entire premium for single coverage, compared to only 4% of covered workers in large firms. For example, it is not uncommon for an employer to contribute on dollar or percentage amount towards the coverage of salaried employees and another dollar or.

Source: moneyexcel.com

Source: moneyexcel.com

Often, health insurance is offered at a group rate through an employer. While distinctions cannot be based on any of the health factors listed above, employers may provide different health benefits to different groups of employees, so long as the individuals are not “similarly situated individuals.”. Employer contributions are entirely optional. A few states, like new york, allow you to contribute whatever you would like, going as low as 0 percent contribution. The employer contribution for health insurance might change based upon the type of plan the company offers.

Source: formadellecose.blogspot.com

Source: formadellecose.blogspot.com

In 2019, employers contributed an average of: For example, it is not uncommon for an employer to contribute on dollar or percentage amount towards the coverage of salaried employees and another dollar or percentage amount towards hourly employees. Quarterly, biannually, or by pay period. Meaning that employees who earn less, pay lower insurance premiums. Offering different benefits for different employee classes.

Source: blog.cdphp.com

Source: blog.cdphp.com

There are many variations of the question posed in the title of this article, but the question basically is whether an employer can provide different/better health benefits to certain employees (usually managers or executives) than to others, or can provide the same benefits to all employees but charge managers or executives less for the same benefits. Employers offering small business group health insurance benefits have flexibility treating employees differently as long as the contribution policy complies with the insurance company’s employer contribution requirements and basic non. Meaning that employees who earn less, pay lower insurance premiums. Means that employers are allowed to contribute toward the premium for any eligible employee an amount between 50% and 105% of the least costly qualified health plan within the county of the employer. Kirk is right regarding a minimum employer contribution.

Source: propelinsurance.com

Source: propelinsurance.com

Offering different benefits for different employee classes. Insurance carriers generally require that companies contribute to at least half of employee premiums. Some of our employer clients have asked: One of the first terms i learned as an employee benefits consultant for a midwest insurance company was adverse selection, i.e., when there was no employer contrib toward the group insurance premium the only enrollees will be people who have to have insurance. •the minimum employer premium contribution for all local employees cannot be less than 50% for employees who work 1,044 hours or more per

Source: eremitica.blogspot.com

Source: eremitica.blogspot.com

This means that a business is required to share the cost of group health insurance with employees. To help us get a general idea of how much employers contribute to health plans, we turn to the the annual kaiser family foundation (kff) health benefits survey for insight. Means that employers are allowed to contribute toward the premium for any eligible employee an amount between 50% and 105% of the least costly qualified health plan within the county of the employer. Insurance carriers generally require that companies contribute to at least half of employee premiums. As an employer, you decide whether or not to contribute to employee hsas.

Source: benefitcomply.com

Source: benefitcomply.com

Employee contributions to health insurance. Kirk is right regarding a minimum employer contribution. Employer contributions are entirely optional. The employer contribution for health insurance might change based upon the type of plan the company offers. However, they don’t want to violate any discrimination laws.

Source: eremitica.blogspot.com

Source: eremitica.blogspot.com

There are many variations of the question posed in the title of this article, but the question basically is whether an employer can provide different/better health benefits to certain employees (usually managers or executives) than to others, or can provide the same benefits to all employees but charge managers or executives less for the same benefits. However, they don’t want to violate any discrimination laws. As long as the employer doesn’t make these decisions on a discriminatory basis, offering different benefits to (1) currently, there are no laws ** requiring plans to provide. Often, health insurance is offered at a group rate through an employer. The aca indicates that health care for a calendar year should not exceed 9.8 percent of an employee�s total annual income.

Source: hrapp.in

Source: hrapp.in

Contributing to employees’ health savings accounts (hsa) is an added benefit that many employers are choosing to provide to their people. Employee contributions to health insurance. Some of our employer clients have asked: In 2019, employers contributed an average of: However, they don’t want to violate any discrimination laws.

Source: mycalchoice.com

Source: mycalchoice.com

Means that employers are allowed to contribute toward the premium for any eligible employee an amount between 50% and 105% of the least costly qualified health plan within the county of the employer. Can an employer pay different amounts of health insurance contributions for different employees (e.g. This means that a business is required to share the cost of group health insurance with employees. “can an employer contribute different amounts towards employee medical insurance for different employees?” employers often treat employees differently (for example not all employees earn the same wage). In 2019, employers contributed an average of:

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title can an employer contribute different amounts towards employee medical insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Craft insurance arab al Idea

- Colonial life insurance claims Idea

- Business insurance and benefits information

- Deans and homer insurance Idea

- Crown cost without insurance information

- Delmonico insurance syracuse ny Idea

- Department of insurance and financial services michigan duties information

- Cost of eye exam with insurance Idea

- Cashless hospital list under national insurance company Idea

- Crowel insurance agency information