Can church pay pastors health insurance 2019 information

Home » Trend » Can church pay pastors health insurance 2019 informationYour Can church pay pastors health insurance 2019 images are ready in this website. Can church pay pastors health insurance 2019 are a topic that is being searched for and liked by netizens now. You can Download the Can church pay pastors health insurance 2019 files here. Get all royalty-free images.

If you’re looking for can church pay pastors health insurance 2019 pictures information linked to the can church pay pastors health insurance 2019 topic, you have come to the right blog. Our website frequently gives you suggestions for downloading the highest quality video and image content, please kindly surf and find more enlightening video articles and graphics that fit your interests.

Can Church Pay Pastors Health Insurance 2019. Churches can once again reimburse employee The process for reimbursing a pastor for individual health insurance is: Particular denominations also offer group health insurance for churches that can be competitive with the plans presented below, which represent more widely available plans. He is listed as an �employee� of the church in order to get the health benefits through the denomination.

Megachurch pastor steps away from pulpit because he feels From endtimeheadlines.org

Megachurch pastor steps away from pulpit because he feels From endtimeheadlines.org

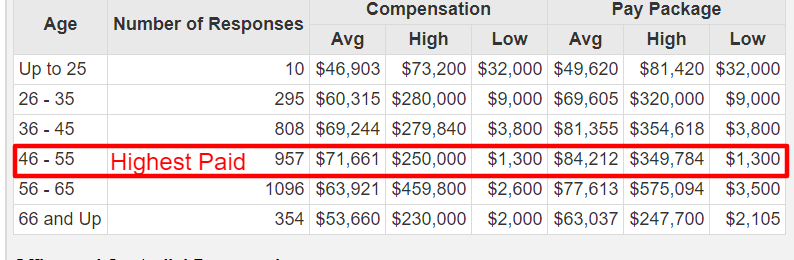

Continuing health insurance can a church pay for a pastor�s individual health insurance policy after they no longer work for the church? Vital coverage of critical developments, news, insights, and resources about legal and tax matters affecting churches, clergy, staff, and volunteers nationwide. The church reimburses the pastor for the expenses, up to the preset limit. The cost of health insurance has stabilized recently — a moderate 6 percent raise in costs in 2019 — but it’s still high, he said. This is out of reach for many small churches. As a general rule in 2019, most churches should plan on between $10,000 and $20,000 in benefits expenses per employee (remember, that’s on top of salary).

As a general rule in 2019, most churches should plan on between $10,000 and $20,000 in benefits expenses per employee (remember, that’s on top of salary).

Larger churches can purchase their own group plans, but small churches often struggle to offer any type of health coverage for their pastor. In 2019, 137 million americans reported financial hardship due to medical costs. Vital coverage of critical developments, news, insights, and resources about legal and tax matters affecting churches, clergy, staff, and volunteers nationwide. The one exception is differentiating between single coverage and those with families. Churches can once again reimburse employee He does not get any salary.

Source: canadianlutheran.ca

Source: canadianlutheran.ca

Update:two developments restore the ability for churches to make reimbursements and pay premiums.read about each development in “churches can once again reimburse employee health care costs.” prior to the enactment of the affordable care act (obamacare) many employers provided health benefits for their employees by paying health insurers directly. In this scenario, with the pastor at $60,000 in 2019, i would set the pastor at $75,000 in 2020, $90,000 in 2021 and $105,000 in 2022. Can a church give a gift to a pastor? What taxes do pastors pay? Do pastors get tax breaks?

Source: masslive.com

Source: masslive.com

In 2019 (collectively, the departments) may. Many churches cannot afford to pay as much of their pastors’ premiums or even offer health insurance at all. Can a church give a gift to a pastor? However, recent internal revenue service guidance effectively eliminates these health care reimbursement plans after december 31, 2013. An employee is not taxed on the medical expense reimbursements received through a qsehra.

Source: ehow.com

Source: ehow.com

What are health insurance premiums? Many churches cannot afford to pay as much of their pastors’ premiums or even offer health insurance at all. Development will again allow employers to: The pastor pays for health expenses. Larger churches can purchase their own group plans, but small churches often struggle to offer any type of health coverage for their pastor.

Source: silive.com

Source: silive.com

The cost of health insurance has stabilized recently — a moderate 6 percent raise in costs in 2019 — but it’s still high, he said. Can a church give a gift to a pastor? He does not get any salary. Many churches cannot afford to pay as much of their pastors’ premiums or even offer health insurance at all. Continuing health insurance can a church pay for a pastor�s individual health insurance policy after they no longer work for the church?

Source: gatewaypeople.com

Source: gatewaypeople.com

What taxes do pastors pay? The process for reimbursing a pastor for individual health insurance is: An employee is not taxed on the medical expense reimbursements received through a qsehra. Larger churches can purchase their own group plans, but small churches often struggle to offer any type of health coverage for their pastor. However, recent internal revenue service guidance effectively eliminates these health care reimbursement plans after december 31, 2013.

Source: servantchurchaustin.org

Source: servantchurchaustin.org

The pastor pays for health expenses. The pastor pays for health expenses. • reimburse employees for some or all of the premium expenses they pay for an individual health insurance policy, and • use their funds to directly pay the premiums. In this scenario, with the pastor at $60,000 in 2019, i would set the pastor at $75,000 in 2020, $90,000 in 2021 and $105,000 in 2022. Are pastors exempt from social security and medicare?

Source: endtimeheadlines.org

Source: endtimeheadlines.org

He is listed as an �employee� of the church in order to get the health benefits through the denomination. This might be new for you but literally, if the year is 2019, you can create a chart that sets the pastor’s salary for 2020, 2021 and 2022 right now. The cost of health insurance has stabilized recently — a moderate 6 percent raise in costs in 2019 — but it’s still high, he said. Vital coverage of critical developments, news, insights, and resources about legal and tax matters affecting churches, clergy, staff, and volunteers nationwide. In fact, 64% of ministers receive no health insurance benefits from their churches.

Source: mlive.com

Source: mlive.com

Lets say your pastor has medical expenses of 5300.00 and someone from the congregation wants to pay those. The process for reimbursing a pastor for individual health insurance is: For qsehras, the church must offer the same reimbursement to all eligible employees. In 2019, 137 million americans reported financial hardship due to medical costs. Reimburse employees for some or all of the premium expenses they pay for an individual health insurance policy, and;

Source: alabamanews.net

Source: alabamanews.net

This is out of reach for many small churches. Larger churches can purchase their own group plans, but small churches often struggle to offer any type of health coverage for their pastor. With a stipend, organizations can simply offer their pastors and other church staff a fixed amount of money that can be spent on health insurance premiums and other medical costs. Vital coverage of critical developments, news, insights, and resources about legal and tax matters affecting churches, clergy, staff, and volunteers nationwide. Unless they can get insurance through a spouse’s job, this leaves a pastor and his family.

Source: reachrightstudios.com

Source: reachrightstudios.com

Vital coverage of critical developments, news, insights, and resources about legal and tax matters affecting churches, clergy, staff, and volunteers nationwide. Lets say your pastor has medical expenses of 5300.00 and someone from the congregation wants to pay those. The one exception is differentiating between single coverage and those with families. The cost of health insurance has stabilized recently — a moderate 6 percent raise in costs in 2019 — but it’s still high, he said. Reimburse employees for some or all of the premium expenses they pay for an individual health insurance policy, and;

Source: ehow.com

Source: ehow.com

Churches can once again reimburse employee Lets say your pastor has medical expenses of 5300.00 and someone from the congregation wants to pay those. Are pastors exempt from social security and medicare? Vital coverage of critical developments, news, insights, and resources about legal and tax matters affecting churches, clergy, staff, and volunteers nationwide. The pastor submits proof of expenses to the church.

Source: hallelujah.co.ke

Source: hallelujah.co.ke

If you are without health insurance, it is open enrollment right now for the affordable care act and you can sign up right now on the national exchange. Churches can once again reimburse employee health care costs. Continuing health insurance can a church pay for a pastor�s individual health insurance policy after they no longer work for the church? The church reimburses the pastor for the expenses, up to the preset limit. In this scenario, with the pastor at $60,000 in 2019, i would set the pastor at $75,000 in 2020, $90,000 in 2021 and $105,000 in 2022.

Source: ub.org

Source: ub.org

The church reimburses the pastor for the expenses, up to the preset limit. The pastor submits proof of expenses to the church. Development will again allow employers to: The process for reimbursing a pastor for individual health insurance is: The one exception is differentiating between single coverage and those with families.

Source: al.com

Source: al.com

Continuing health insurance can a church pay for a pastor�s individual health insurance policy after they no longer work for the church? In this scenario, with the pastor at $60,000 in 2019, i would set the pastor at $75,000 in 2020, $90,000 in 2021 and $105,000 in 2022. Larger churches can purchase their own group plans, but small churches often struggle to offer any type of health coverage for their pastor. Yes, you can do that. The pastor pays for health expenses.

Source: chicagotribune.com

Source: chicagotribune.com

Denominational health plan benefits for lay employees regularly scheduled to work 1,500 hours per year or more are described in “2019 policies for clergy and lay participation in the denominational health plan of the episcopal church,” available from the diocese. Reimburse employees for some or all of the premium expenses they pay for an individual health insurance policy, and; Unless they can get insurance through a spouse’s job, this leaves a pastor and his family. Are health insurance premiums included in gross income? He does not get any salary.

Source: faithfulteaching.com

Source: faithfulteaching.com

And you put it in place in the. Continuing health insurance can a church pay for a pastor�s individual health insurance policy after they no longer work for the church? Unless they can get insurance through a spouse’s job, this leaves a pastor and his family. Update:two developments restore the ability for churches to make reimbursements and pay premiums.read about each development in “churches can once again reimburse employee health care costs.” prior to the enactment of the affordable care act (obamacare) many employers provided health benefits for their employees by paying health insurers directly. Are pastors exempt from social security and medicare?

Source: goodshepherdpres.com

Source: goodshepherdpres.com

However, recent internal revenue service guidance effectively eliminates these health care reimbursement plans after december 31, 2013. Development will again allow employers to: Are health insurance premiums included in gross income? In fact, 64% of ministers receive no health insurance benefits from their churches. He does not get any salary.

Source: pennlive.com

Source: pennlive.com

The church reimburses the pastor for the expenses, up to the preset limit. However, recent internal revenue service guidance effectively eliminates these health care reimbursement plans after december 31, 2013. For qsehras, the church must offer the same reimbursement to all eligible employees. The pastor submits proof of expenses to the church. In 2019 (collectively, the departments) may.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title can church pay pastors health insurance 2019 by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Craft insurance arab al Idea

- Colonial life insurance claims Idea

- Business insurance and benefits information

- Deans and homer insurance Idea

- Crown cost without insurance information

- Delmonico insurance syracuse ny Idea

- Department of insurance and financial services michigan duties information

- Cost of eye exam with insurance Idea

- Cashless hospital list under national insurance company Idea

- Crowel insurance agency information