Can i borrow from my life insurance policy information

Home » Trend » Can i borrow from my life insurance policy informationYour Can i borrow from my life insurance policy images are ready. Can i borrow from my life insurance policy are a topic that is being searched for and liked by netizens now. You can Download the Can i borrow from my life insurance policy files here. Find and Download all free vectors.

If you’re searching for can i borrow from my life insurance policy pictures information connected with to the can i borrow from my life insurance policy keyword, you have come to the ideal blog. Our website frequently provides you with suggestions for downloading the maximum quality video and picture content, please kindly search and find more informative video content and graphics that match your interests.

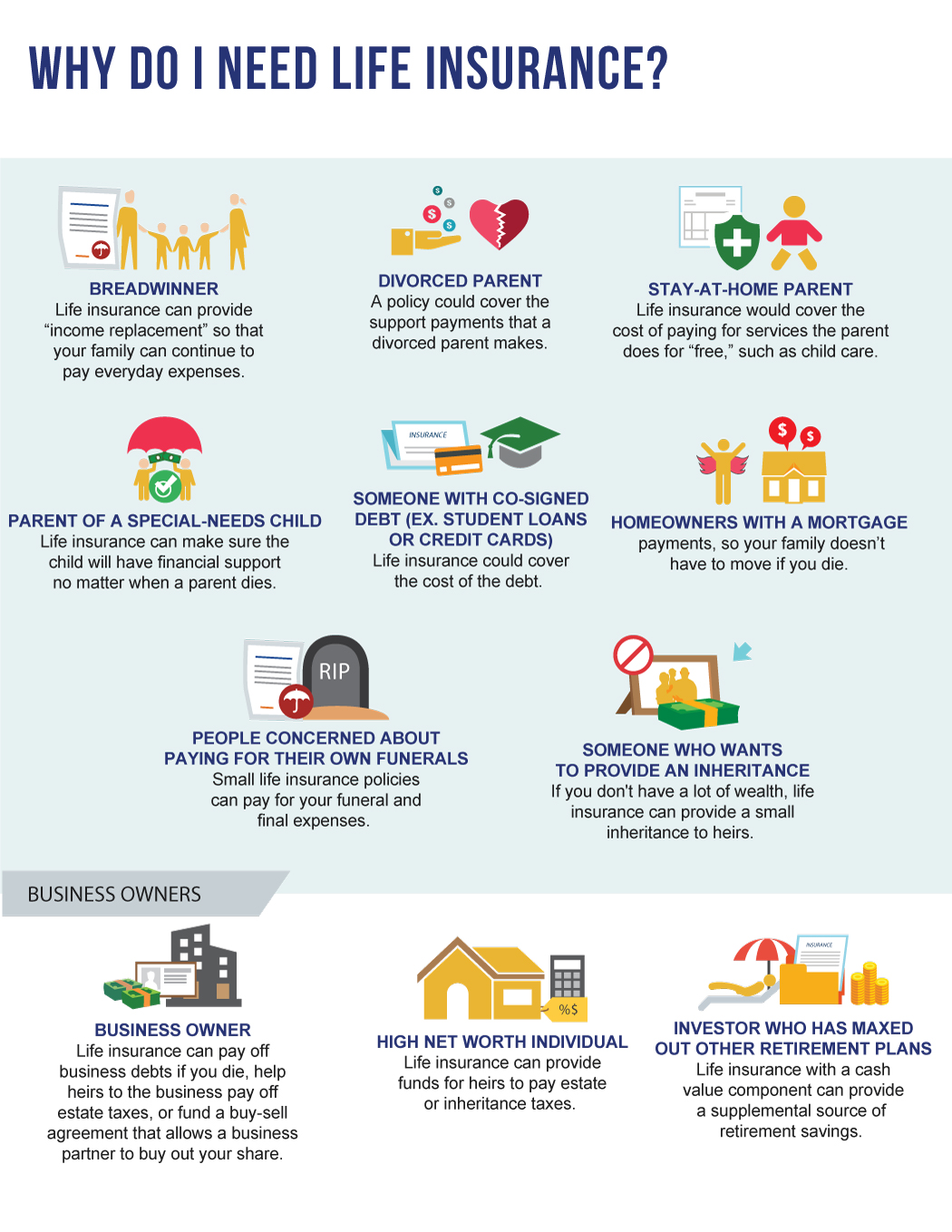

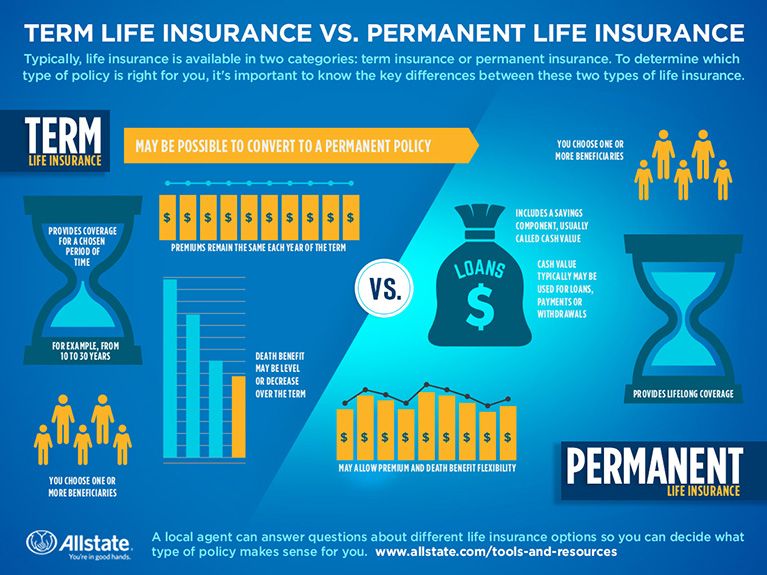

Can I Borrow From My Life Insurance Policy. I want to share with you that this benefit, this process of being able to accumulate cash value in your life insurance contract is one of the best ways to grow your economy in a steady, safe and efficient way available. No, not if you mean make a loan against a term life insurance policy�s cash value. The rules that govern life insurance policy loans do vary from company to company, however, so it�s important to understand a few basic rules about how much and when specifically you�ll have the option to borrow money against your policy. Should i take a loan against my.

When Should I Borrow from My Life Insurance Policy? Penn From blog.pennmutual.com

When Should I Borrow from My Life Insurance Policy? Penn From blog.pennmutual.com

As you pay premiums for your cash value life insurance policy (this would be a whole or universal life insurance policy ), a portion of your premium is also going to go toward the cash value. How much can i borrow from my life insurance policy? Policy loans are borrowed against the death benefit, and the insurance company uses the policy as collateral for the loan. The most common types of life insurance policies are:. Permanent or whole life insurance policy. You can usually borrow around 95% of a life insurance policy�s cash surrender value in any given year.

So if you have a $30,000 policy and borrow $1,000 your policy will pay out $29,000 at most to your.

But any unpaid balance will subtract from the death benefit. Talk to your agent or life insurance company to find out how withdrawing money from your specific policy works. If you are interested in borrowing against your term or group life insurance policy, please contact us. The case for a loan. I want to share with you that this benefit, this process of being able to accumulate cash value in your life insurance contract is one of the best ways to grow your economy in a steady, safe and efficient way available. Unfortunately, it�s also the hardest debt option to understand.

Source: chooseinsuranceonlinecom.com

Source: chooseinsuranceonlinecom.com

Not all life insurance policies allow you to borrow against them, so you need to find out the type of policy you own. Providing you own the right type of life insurance, and you have accumulated enough cash value to allow you to borrow the amount you need. That can�t be done because a term life policy doesn�t have cash value! It can take many years to build up any significant cash value in a permanent life insurance policy. Some policies accrue cash value quicker than others.

Source: globelifeofnewyork.com

Source: globelifeofnewyork.com

Most of the time, you can take cash from your life insurance policy after you have built up the cash value. In the early years of the policy, there may be little value, if any, to borrow against. Your cash value balance sets the upper limit on your borrowing capacity. You will have to contact your financial advisor or insurance agent to determine your policy�s cash value. It can take many years to build up any significant cash value in a permanent life insurance policy.

Source: blog.pennmutual.com

Source: blog.pennmutual.com

Payout of pocket or put your policy at risk ; You can only borrow against a permanent or whole life insurance policy. The rules that govern life insurance policy loans do vary from company to company, however, so it�s important to understand a few basic rules about how much and when specifically you�ll have the option to borrow money against your policy. Not all life insurance policies allow you to borrow against them, so you need to find out the type of policy you own. You can typically borrow money through your policy, although the amount varies.

Source: legacywealthcanada.com

Source: legacywealthcanada.com

In the early years of the policy, there may be little value, if any, to borrow against. How much can i borrow from my life insurance policy? Life insurance is a great way to ensure financial security for yourself and the beneficiaries. So try to get on a repayment plan to put the money back as soon as you can. You can take a loan on the cash value of a life insurance policy without needing to go through a credit check.

Source: pinterest.com

Source: pinterest.com

No, some life insurance policies such as a term life policy don’t accumulate a cash value. You can only borrow against a permanent or whole life insurance policy. How much can i borrow from my life insurance policy? Most of the time, you can take cash from your life insurance policy after you have built up the cash value. As you pay premiums for your cash value life insurance policy (this would be a whole or universal life insurance policy ), a portion of your premium is also going to go toward the cash value.

Source: tdi.texas.gov

Source: tdi.texas.gov

How much you can borrow from a life insurance policy varies by insurer, but the maximum policy loan amount is typically at least 90% of the cash value, with no minimum amount. You can only borrow against a permanent or whole life insurance policy. The money does not actually come from your policy but rather from the insurer who then uses your policy as collateral. Permanent or universal life insurance policy ; When you take out a policy loan, you�re not removing money from the cash value of your account.

Source: slideshare.net

Source: slideshare.net

That can�t be done because a term life policy doesn�t have cash value! Most of the time, you can take cash from your life insurance policy after you have built up the cash value. It can take many years to build up any significant cash value in a permanent life insurance policy. Whatever amount you borrow from the life insurance policy reduces the amount your beneficiaries will receive when you die. Policy loans are borrowed against the death benefit, and the insurance company uses the policy as collateral for the loan.

Source: einsurance.com

Source: einsurance.com

Borrowing against a life insurance policy. No, not if you mean make a loan against a term life insurance policy�s cash value. Borrowing money from a life insurance policy may be a better option than borrowing money from a bank for some policyholders. Most insurers will cap policy loans at 90% of your cash value. How much can you borrow from a life insurance policy?

Source: pinterest.com

Source: pinterest.com

In the early years of the policy, there may be little value, if any, to borrow against. But any unpaid balance will subtract from the death benefit. Most insurers will cap policy loans at 90% of your cash value. Talk to your agent or life insurance company to find out how withdrawing money from your specific policy works. Permanent or universal life insurance policy ;

Source: youtuberocks.com

Source: youtuberocks.com

Life insurance companies add interest to the balance, which accrues whether the loan is paid monthly or not. It’s important to note that you can only borrow against permanent or whole life insurance You can take a loan on the cash value of a life insurance policy without needing to go through a credit check. How much can i borrow from my life insurance policy? Your cash value balance sets the upper limit on your borrowing capacity.

Source: thefinancesection.com

Source: thefinancesection.com

You can only borrow against a permanent or whole life insurance policy. First, the insurance company can’t turn down your application for this loan. Life insurance is a great way to ensure financial security for yourself and the beneficiaries. But any unpaid balance will subtract from the death benefit. Our program works with all types of life insurance policies including the federal employees’ group life insurance (fegli) program.

Source: impresshow.blogspot.com

Talk to your agent or life insurance company to find out how withdrawing money from your specific policy works. It is not necessary to avail the benefits of life insurance after you die, rather if you are amongst the lucky ones who survive through the period, you can enjoy a. No, not if you mean make a loan against a term life insurance policy�s cash value. The case for a loan. Unfortunately, it�s also the hardest debt option to understand.

Source: revisi.net

Source: revisi.net

Whatever amount you borrow from the life insurance policy reduces the amount your beneficiaries will receive when you die. Policy loans are borrowed against the death benefit, and the insurance company uses the policy as collateral for the loan. Discuss what the impact will be on your policy, as well as any tax implications. If there’s money available to borrow inside your policy, it’s yours to borrow, regardless of your current income or credit report. In the early years of the policy, there may be little value, if any, to borrow against.

Source: blog.pennmutual.com

Source: blog.pennmutual.com

The answer is yes, though only if it�s a whole life policy with cash values and only up to the amount of the surrender or loan value. Policy loans are borrowed against the death benefit, and the insurance company uses the policy as collateral for the loan. It’s important to note that you can only borrow against permanent or whole life insurance How much can i borrow from my life insurance policy otuya chukwudi january 26, 2022. Either way, here are the main highlights when you borrow from your life insurance policy:

Source: allstate.com

Source: allstate.com

You can normally borrow from any life insurance policy that has cash value, including whole life insurance, universal life insurance, and variable life insurance. If you are interested in borrowing against your term or group life insurance policy, please contact us. Policy loans are borrowed against the death benefit, and the insurance company uses the policy as collateral for the loan. Most of the time, you can take cash from your life insurance policy after you have built up the cash value. You can only borrow against a permanent or whole life insurance policy.

Source: theinsuranceproblog.com

Source: theinsuranceproblog.com

Your cash value balance sets the upper limit on your borrowing capacity. Borrowing against a life insurance policy. The rules that govern life insurance policy loans do vary from company to company, however, so it�s important to understand a few basic rules about how much and when specifically you�ll have the option to borrow money against your policy. However, most whole life or universal life insurance policies offer a cash value benefit that. How much you can borrow from a life insurance policy varies by insurer, but the maximum policy loan amount is typically at least 90% of the cash value, with no minimum amount.

Source: theinsuranceproblog.com

Source: theinsuranceproblog.com

Policy loans are borrowed against the death benefit, and the insurance company uses the policy as collateral for the loan. Learn more about taking a loan out on a term life insurance policy. The policy terms will advise you when you can borrow against the policy. Your death benefit acts as collateral ; The answer is yes, though only if it�s a whole life policy with cash values and only up to the amount of the surrender or loan value.

Source: theinsuranceproblog.com

Source: theinsuranceproblog.com

How much can i borrow from my life insurance policy? If you are interested in borrowing against your term or group life insurance policy, please contact us. Our program works with all types of life insurance policies including the federal employees’ group life insurance (fegli) program. Yes, it is possible to borrow against your life insurance policy. Most insurers will cap policy loans at 90% of your cash value.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title can i borrow from my life insurance policy by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Craft insurance arab al Idea

- Colonial life insurance claims Idea

- Business insurance and benefits information

- Deans and homer insurance Idea

- Crown cost without insurance information

- Delmonico insurance syracuse ny Idea

- Department of insurance and financial services michigan duties information

- Cost of eye exam with insurance Idea

- Cashless hospital list under national insurance company Idea

- Crowel insurance agency information