Can i claim life insurance as a business expense uk information

Home » Trend » Can i claim life insurance as a business expense uk informationYour Can i claim life insurance as a business expense uk images are available in this site. Can i claim life insurance as a business expense uk are a topic that is being searched for and liked by netizens today. You can Find and Download the Can i claim life insurance as a business expense uk files here. Get all free images.

If you’re searching for can i claim life insurance as a business expense uk pictures information connected with to the can i claim life insurance as a business expense uk topic, you have pay a visit to the right site. Our site frequently provides you with suggestions for seeking the highest quality video and image content, please kindly search and locate more enlightening video content and graphics that fit your interests.

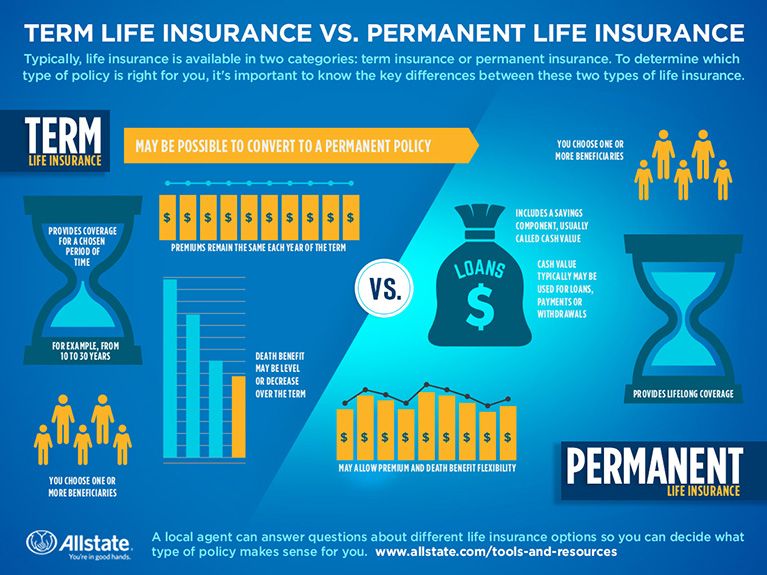

Can I Claim Life Insurance As A Business Expense Uk. If you�re a sole trader you will not be able to claim a tax deduction for your medical expenses unless you can prove that the expense (or a specific proportion of it) was incurred wholly and exclusively for the purposes of your trade. You can claim for any insurance policy for your. Of a local sports team) as a business expense, but charitable donations which do not provide a direct benefit to your company in return are not treated as ‘expenses’ in your accounts, although they still can be offset against your corporation tax bill. Whether you can claim the expense is dependent on who benefits from the policy, and even in cases where you can claim life insurance as a.

How Long After An Accident Can I File An Insurance Claim From business-corp.com

How Long After An Accident Can I File An Insurance Claim From business-corp.com

You can claim for any insurance policy for your. Costs of the premiums are met by the business and are usually an allowable business expense. The premiums must be incurred wholly and exclusively for the purpose of the business. Clearly, childcare is not a legitimate business expense, however, employees themselves can claim tax relief up to a certain amount each month. Your own wages, salary, or other money drawn from the business. The irs will view this type of policy as the cost of doing business, and therefore, you can claim deduct the premiums.

You can claim the cost of sponsorship (e.g.

If you�re a sole trader you will not be able to claim a tax deduction for your medical expenses unless you can prove that the expense (or a specific proportion of it) was incurred wholly and exclusively for the purposes of your trade. Relevant life insurance can be considered for those approaching or exceeding their pension lifetime allowance. Looking to hone your skills to keep ahead of the pack? The only way that could be considered a business expense is if it was part of his remuneration (assuming he is operating through a company) and he was then taxed on it as income. There’s no way you can claim this. It should be a group policy and members must.

Source: beritamistis.com

Source: beritamistis.com

You can claim for any insurance policy for your. To a higher rate taxpayer, a £200 per month life insurance policy will cost £392 of gross pay after accounting for tax and national insurance. Medical expenses tax rules for sole traders. You cannot claim for repayments of loans, overdrafts or finance arrangements. Your own wages, salary, or other money drawn from the business.

Source: waterdowndesign.blogspot.com

Source: waterdowndesign.blogspot.com

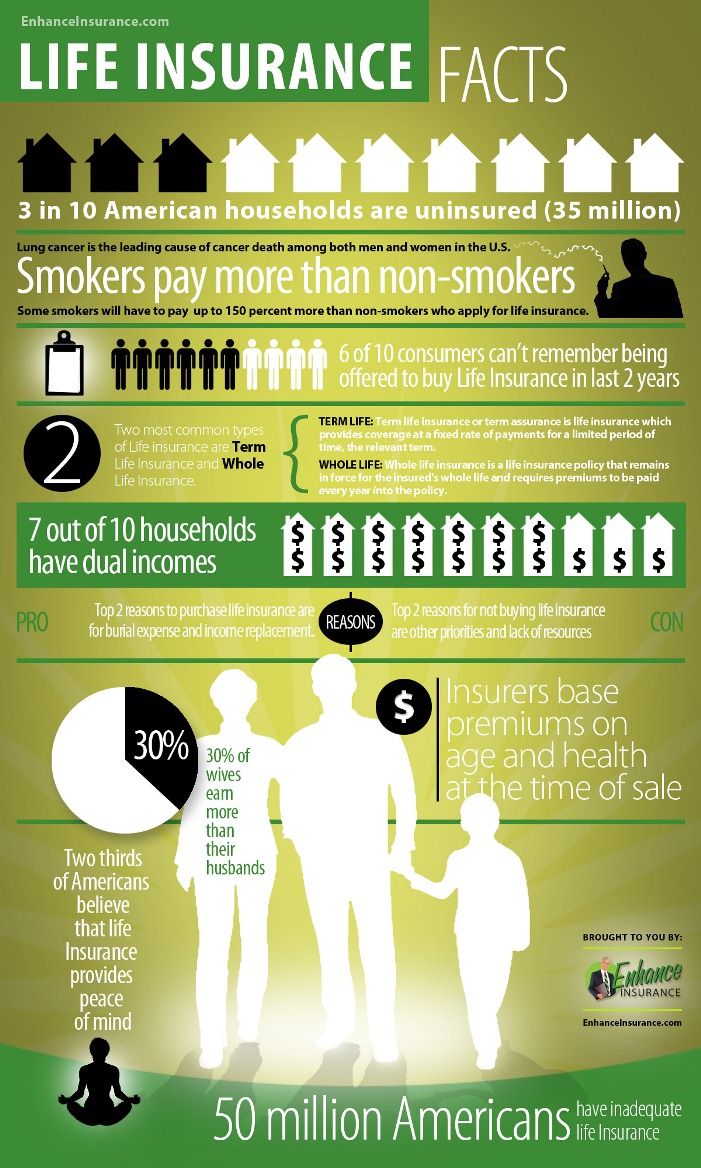

The employee also does not pay income tax or national insurance. Life insurance cannot be claimed as part of business expense in dply life insurance as a business expense uk? You (as an employee) can claim £243, £124 or £110 per month in tax relief against their childcare costs according to your tax band (basic, higher or additional). Claiming expenses on salaries and benefits. Many small businesses provide life insurance as a benefit for their employees, and as such, they claim it as a business expense.

Source: infographicszone.com

Source: infographicszone.com

Clearly, childcare is not a legitimate business expense, however, employees themselves can claim tax relief up to a certain amount each month. Looking to hone your skills to keep ahead of the pack? The cost of training employees. You can claim the cost of sponsorship (e.g. Excluding certain expenses cannot be claimed as business expenses.

Source: visual.ly

Source: visual.ly

Insurance and pension benefits for employees. Excluding certain expenses cannot be claimed as business expenses. What expenses can i claim without receipts uk? Any employee childcare provision you make. This cost could include an office cost, business insurance, insurance rates, business rates, marketing costs, capital allowances, and staff salaries.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

This cost could include an office cost, business insurance, insurance rates, business rates, marketing costs, capital allowances, and staff salaries. Any employee childcare provision you make. The expenses listed form a class that would include any incidental costs of taking out a life insurance policy, but not the premiums, which are the cost of the policy itself. The only way that could be considered a business expense is if it was part of his remuneration (assuming he is operating through a company) and he was then taxed on it as income. Helping business owners for over 15 years.

Source: allstate.com

Source: allstate.com

By running a life insurance policy through the business, you can save money. There’s no way you can claim this. In short the answer is yes, your business can pay. This is a common theme for any expense where your business is looking to claim tax relief. Any employee childcare provision you make.

Source: business-corp.com

Source: business-corp.com

What expenses can i claim without receipts uk? The irs will view this type of policy as the cost of doing business, and therefore, you can claim deduct the premiums. And the benefits of relevant life insurance can save you huge amounts on tax. Whether you can claim the expense is dependent on who benefits from the policy, and even in cases where you can claim life insurance as a. If you�re a sole trader you will not be able to claim a tax deduction for your medical expenses unless you can prove that the expense (or a specific proportion of it) was incurred wholly and exclusively for the purposes of your trade.

Source: compareinsurancesonline.ca

Source: compareinsurancesonline.ca

The company can claim back corporation tax relief and no employer national insurance is due. The company can claim back corporation tax relief and no employer national insurance is due. However, when it comes to your own salary, national insurance contributions, income tax, pension and life insurance, you can’t claim these allowable business expenses. Whether you can claim the expense is dependent on who benefits from the policy, and even in cases where you can claim life insurance as a. Save money and claim life insurance as a business expense.

Source: insurancejournal.com

Source: insurancejournal.com

What expenses can i claim without receipts uk? Relevant life insurance can be considered for those approaching or exceeding their pension lifetime allowance. Insurance and pension benefits for employees. If you�re a sole trader you will not be able to claim a tax deduction for your medical expenses unless you can prove that the expense (or a specific proportion of it) was incurred wholly and exclusively for the purposes of your trade. This cost could include an office cost, business insurance, insurance rates, business rates, marketing costs, capital allowances, and staff salaries.

Source: waterdowndesign.blogspot.com

Source: waterdowndesign.blogspot.com

This cost could include an office cost, business insurance, insurance rates, business rates, marketing costs, capital allowances, and staff salaries. The company can claim back corporation tax relief and no employer national insurance is due. Straight life insurance would presumably be for the benefit of his family in the event of something happening to him out there. Many small businesses provide life insurance as a benefit for their employees, and as such, they claim it as a business expense. Your own wages, salary, or other money drawn from the business.

Source: waterdowndesign.blogspot.com

Source: waterdowndesign.blogspot.com

And the benefits of relevant life insurance can save you huge amounts on tax. The business pays for the life insurance but does not and cannot receive the benefits from the policy if a claim is made. In short the answer is yes, your business can pay. At drewberry, many of our company director and contractor clients are used to offsetting expenses through their business. Whether you can claim the expense is dependent on who benefits from the policy, and even in cases where you can claim life insurance as a.

Source: theagentinsurance.com

Source: theagentinsurance.com

Claiming expenses on salaries and benefits. Of a local sports team) as a business expense, but charitable donations which do not provide a direct benefit to your company in return are not treated as ‘expenses’ in your accounts, although they still can be offset against your corporation tax bill. Claiming expenses on salaries and benefits. Employees� wages and redundancy payments. Costs of the premiums are met by the business and are usually an allowable business expense.

The employee also does not pay income tax or national insurance. At drewberry, many of our company director and contractor clients are used to offsetting expenses through their business. Looking to hone your skills to keep ahead of the pack? It should be a group policy and members must. In short the answer is yes, your business can pay.

Source: companyinworld.com

Source: companyinworld.com

It should be a group policy and members must. Eye tests for employees working at screens. You can claim for any insurance policy for your. The irs will view this type of policy as the cost of doing business, and therefore, you can claim deduct the premiums. Your own wages, salary, or other money drawn from the business.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

You can claim for any insurance policy for your. This is a common theme for any expense where your business is looking to claim tax relief. Key man insurance can help you save on corporation tax or tax on the payout, depending on how the money is used. You (as an employee) can claim £243, £124 or £110 per month in tax relief against their childcare costs according to your tax band (basic, higher or additional). The irs will view this type of policy as the cost of doing business, and therefore, you can claim deduct the premiums.

Source: worldbusiness.store

Source: worldbusiness.store

Of a local sports team) as a business expense, but charitable donations which do not provide a direct benefit to your company in return are not treated as ‘expenses’ in your accounts, although they still can be offset against your corporation tax bill. Clearly, childcare is not a legitimate business expense, however, employees themselves can claim tax relief up to a certain amount each month. Whether you can claim the expense is dependent on who benefits from the policy, and even in cases where you can claim life insurance as a. Of a local sports team) as a business expense, but charitable donations which do not provide a direct benefit to your company in return are not treated as ‘expenses’ in your accounts, although they still can be offset against your corporation tax bill. Medical expenses tax rules for sole traders.

Source: waterdowndesign.blogspot.com

Source: waterdowndesign.blogspot.com

The cost of the policy is considered a business expense and can be treated as such. How to claim life insurance as a business expense on your taxes. While business owners can technically deduct life insurance premiums as an expense, it is a bad idea. Of a local sports team) as a business expense, but charitable donations which do not provide a direct benefit to your company in return are not treated as ‘expenses’ in your accounts, although they still can be offset against your corporation tax bill. Excluding certain expenses cannot be claimed as business expenses.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

Whether you can claim the expense is dependent on who benefits from the policy, and even in cases where you can claim life insurance as a. To a higher rate taxpayer, a £200 per month life insurance policy will cost £392 of gross pay after accounting for tax and national insurance. Costs of the premiums are met by the business and are usually an allowable business expense. There’s no way you can claim this. Many small businesses provide life insurance as a benefit for their employees, and as such, they claim it as a business expense.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title can i claim life insurance as a business expense uk by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Craft insurance arab al Idea

- Colonial life insurance claims Idea

- Business insurance and benefits information

- Deans and homer insurance Idea

- Crown cost without insurance information

- Delmonico insurance syracuse ny Idea

- Department of insurance and financial services michigan duties information

- Cost of eye exam with insurance Idea

- Cashless hospital list under national insurance company Idea

- Crowel insurance agency information