Can i claim my national insurance back information

Home » Trending » Can i claim my national insurance back informationYour Can i claim my national insurance back images are ready. Can i claim my national insurance back are a topic that is being searched for and liked by netizens now. You can Get the Can i claim my national insurance back files here. Find and Download all royalty-free photos and vectors.

If you’re searching for can i claim my national insurance back images information related to the can i claim my national insurance back topic, you have visit the right blog. Our site frequently gives you suggestions for seeking the maximum quality video and picture content, please kindly hunt and find more informative video content and graphics that match your interests.

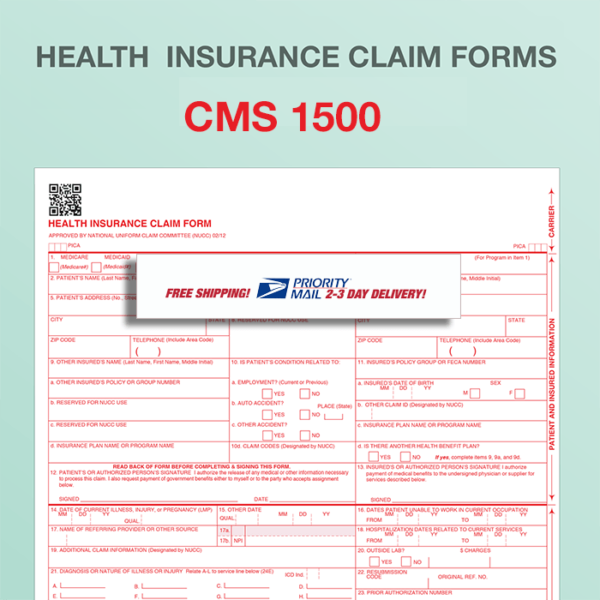

Can I Claim My National Insurance Back. Many different organisations can request your national insurance number as a form of proof of. You may have paid some or partial national insurance contributions in a financial year but not enough to get a full qualifying year. Hmrc will be able to confirm your actual liability. Can my company claim back vat for the cost of health insurance?

Claims MetLife Insurance Bangladesh From metlife.com.bd

Claims MetLife Insurance Bangladesh From metlife.com.bd

Even if you only work in the uk on a temporary basis and then return to your home country, you can’t claim any of your national insurance contributions back. Can i choose the date of my national insurance appointment? Start with the grant you’re claiming for employee’s wages. To claim a refund of uk national insurance contributions paid while working abroad, you can either: Many different organisations can request your national insurance number as a form of proof of. Can i claim my national insurance back when i leave the uk?

If, when you speak to hmrc, they think you might be due a refund, they will probably ask you to complete form ca5610.

If you think you�ve paid more national insurance than your record shows, you should contact the national insurance contributions office. You cannot claim a refund of nic simply because you stop work or do not work for the whole tax year. However, the contributions you have made may count towards your state pension in your home country, so long as it’s one of the. Who does and does not have to pay, circumstances in which you might be due a ni refund and how to make a. Knowing what to do after a car accident will help the insurance claims process go as smoothly as possible. You shouldn’t have paid national insurance, for example you’re state pension age you paid the wrong rate your employer made a mistake you may be able to claim after this deadline if you have a reasonable excuse.

Source: metlife.com.bd

Source: metlife.com.bd

To work out how much you can claim to cover employer national insurance contributions: For more information visit the migrants section. Can i claim my national insurance back when i leave the uk? If you are on an irish passport, no, you cannot choose the date, it is automatically chosen. The good news is that you can reclaim any overpayment with a national insurance refund.

Source: fiachraforms.com

Source: fiachraforms.com

National insurance claim a national insurance refund this tool helps you apply for a refund on your national insurance contributions from hm revenue and. If you�ve been told you haven�t paid enough national insurance to claim a benefit. Your state pension forecast (mentioned above) will tell you how. Example a ltd pays employees on a calendar monthly basis. You must claim the refund within 6 years if you overpaid because:

Source: ga-health-insurance.com

Source: ga-health-insurance.com

For more information visit the migrants section. Start with the grant you’re claiming for employee’s wages. National insurance claim a national insurance refund this tool helps you apply for a refund on your national insurance contributions from hm revenue and. Knowing what to do after a car accident will help the insurance claims process go as smoothly as possible. Hm customs and revenue will not make cash refunds of any national insurance contributions that you pay.

Source: oid.ok.gov

Source: oid.ok.gov

Can my company claim back vat for the cost of health insurance? One year of national insurance contributions can easily turn into £5,000 or more in state pension over the course of a typical retirement. If you�ve been told you haven�t paid enough national insurance to claim a benefit. Note there is also the additional state pension based on your ni contributions. Hm customs and revenue will not make cash refunds of any national insurance contributions that you pay.

Source: 2dobest.com

Source: 2dobest.com

You can check how much national insurance you�ve paid on gov.uk. Can i claim my national insurance back when i leave the uk? Jury duty and ni credits Your state pension forecast (mentioned above) will tell you how. Unless you are on an irish passport, you no longer have to go to an appointment as the system has now changed and you can apply online.

Source: brentacre.co.uk

Source: brentacre.co.uk

For more information visit the migrants section. National insurance claim a national insurance refund this tool helps you apply for a refund on your national insurance contributions from hm revenue and. This nic’s guide sets out some of the basic elements of national insurance including; If you overpay nic or pay nic incorrectly, you can claim a refund. Hmrc will be able to confirm your actual liability.

Source: dingorecruitment.com

Source: dingorecruitment.com

This nic’s guide sets out some of the basic elements of national insurance including; If you think you�ve paid more national insurance than your record shows, you should contact the national insurance contributions office. Hm customs and revenue will not make cash refunds of any national insurance contributions that you pay. You can check how much national insurance you�ve paid on gov.uk. Start with the grant you’re claiming for employee’s wages.

Source: carcrot.blogspot.com

Source: carcrot.blogspot.com

Who does and does not have to pay, circumstances in which you might be due a ni refund and how to make a. Recognising your national insurance number. However i should have applied two years ago to earn ni credits and protect my state pension. Can i choose the date of my national insurance appointment? If you think you�ve paid more national insurance than your record shows, you should contact the national insurance contributions office.

Source: claimmytaxback.co.uk

Source: claimmytaxback.co.uk

Use the online form service; However, the contributions you have made may count towards your state pension in your home country, so long as it’s one of the. If, when you speak to hmrc, they think you might be due a refund, they will probably ask you to complete form ca5610. Hmrc will be able to confirm your actual liability. I didn�t and am now wondering if i can have this back dated in some way?

Source: growthbusiness.co.uk

Source: growthbusiness.co.uk

It can be a shock if you have had a car accident but your insurer can help you make a claim. So it’s important to claim any national insurance credits you might be entitled to, to avoid missing out on state pension income that you’re entitled to. Note for a full state pension you need 30 years contributions and only full years count. If you are on an irish passport, no, you cannot choose the date, it is automatically chosen. For more information visit the migrants section.

Source: ictsd.org

Source: ictsd.org

It will always be in the format of aa 11 11 11 a. Where an employee has overpaid class 1 nic because of a mistake made by their employer, the employer will normally be able to refund the overpaid contributions at the next pay day. If you think you might be due a refund, or would like to check with hmrc, they provide guidance on how to claim back overpaid national insurance contributions. For more information visit the migrants section. Note for a full state pension you need 30 years contributions and only full years count.

Source: linksinsight.co.uk

Source: linksinsight.co.uk

Note there is also the additional state pension based on your ni contributions. If you are on an irish passport, no, you cannot choose the date, it is automatically chosen. Hm customs and revenue will not make cash refunds of any national insurance contributions that you pay. For more information visit the migrants section. You cannot claim a refund of nic simply because you are leaving the uk to live in another country.

Source: pensionbee.com

Source: pensionbee.com

Many different organisations can request your national insurance number as a form of proof of. If you think you�ve paid more national insurance than your record shows, you should contact the national insurance contributions office. One year of national insurance contributions can easily turn into £5,000 or more in state pension over the course of a typical retirement. Hm customs and revenue will not make cash refunds of any national insurance contributions that you pay. This nic’s guide sets out some of the basic elements of national insurance including;

Source: safelite.com

Source: safelite.com

However i should have applied two years ago to earn ni credits and protect my state pension. Your national insurance number is alphanumeric and 9 digits long, it will never change. Who does and does not have to pay, circumstances in which you might be due a ni refund and how to make a. Can i choose the date of my national insurance appointment? However i should have applied two years ago to earn ni credits and protect my state pension.

Source: gratitudelodge.com

Source: gratitudelodge.com

You just need to do it. This nic’s guide sets out some of the basic elements of national insurance including; It ensures that any nic you pay will be logged against your name. Where an employee has overpaid class 1 nic because of a mistake made by their employer, the employer will normally be able to refund the overpaid contributions at the next pay day. You cannot claim a refund of nic simply because you stop work or do not work for the whole tax year.

Source: nationalresourceconnect.us

Source: nationalresourceconnect.us

Recognising your national insurance number. For more information visit the migrants section. To work out how much you can claim to cover employer national insurance contributions: Only certain brits can claim national insurance credits. This nic’s guide sets out some of the basic elements of national insurance including;

Source: thisismoney.co.uk

Source: thisismoney.co.uk

You just need to do it. Your state pension forecast (mentioned above) will tell you how. Use the online form service; Only certain brits can claim national insurance credits. One year of national insurance contributions can easily turn into £5,000 or more in state pension over the course of a typical retirement.

Source: inflatablefootballtunnels.blogspot.com

Source: inflatablefootballtunnels.blogspot.com

You shouldn’t have paid national insurance, for example you’re state pension age you paid the wrong rate your employer made a mistake you may be able to claim after this deadline if you have a reasonable excuse. You just need to do it. The good news is that you can reclaim any overpayment with a national insurance refund. You’re on jobseeker’s allowance and not in education or working 16 hours or more a week or you’re unemployed and. Can my company claim back vat for the cost of health insurance?

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title can i claim my national insurance back by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Claims vs occurrence based insurance Idea

- Cheap tablet insurance Idea

- Calling insurance leads Idea

- Disability insurance for postal workers Idea

- Business insurance peoria il information

- Bright health insurance reviews Idea

- Carrier liability vs cargo insurance Idea

- Can you insure a written off car Idea

- Can convicted felons get life insurance information

- Car insurance administrator Idea