Can i get mnsure if my employer offers insurance information

Home » Trend » Can i get mnsure if my employer offers insurance informationYour Can i get mnsure if my employer offers insurance images are ready in this website. Can i get mnsure if my employer offers insurance are a topic that is being searched for and liked by netizens now. You can Download the Can i get mnsure if my employer offers insurance files here. Get all free images.

If you’re looking for can i get mnsure if my employer offers insurance images information linked to the can i get mnsure if my employer offers insurance interest, you have visit the ideal blog. Our site always provides you with hints for viewing the highest quality video and picture content, please kindly hunt and locate more enlightening video content and images that fit your interests.

Can I Get Mnsure If My Employer Offers Insurance. My work offers health insurance, but i opted to go into the marketplace last winter and buy it individually instead. Short term policies will no longer be available in 2014, but you would be able to drop the policy purchased through mnsure if you get a job with coverage since that is considered a life event. However, if your employer, your parent’s employer, or your spouse’s employer offers affordable health insurance, you are required to get it as well. For the state�s median household income of $58,476, 9.5 percent amounts to.

If My Employer Offers Health Insurance, Can I Get Obamacare? From keenandirect.com

If My Employer Offers Health Insurance, Can I Get Obamacare? From keenandirect.com

The maximum penalty for individuals and families depends on annual income. If your employer offers health insurance to you, they’re also required to provide the same coverage to your children who are 25 or younger. According to obamacare facts, an individual or family with an annual income of about $48,750 or less pays a flat fee. We hear this question a lot. As of the date of publication, the maximum penalty for an adult is $325, $162.50 for a child and up to $975 per household. This year, mnsure is offering over 150 health insurance plans to choose from.

It can help you learn about:

However, if your employer, your parent’s employer, or your spouse’s employer offers affordable health insurance, you are required to get it as well. Can employers reimburse employees for health insurance? This year, mnsure is offering over 150 health insurance plans to choose from. For plan years through 2018, if you have insurance from a job (or a family member’s job), you�re considered covered under the health care law and may not have to pay the penalty that uninsured people must pay. If you enroll in a marketplace plan instead, the employer won’t contribute to your premiums. It’s the only place where you can get government help paying for your premiums and other health expenses.

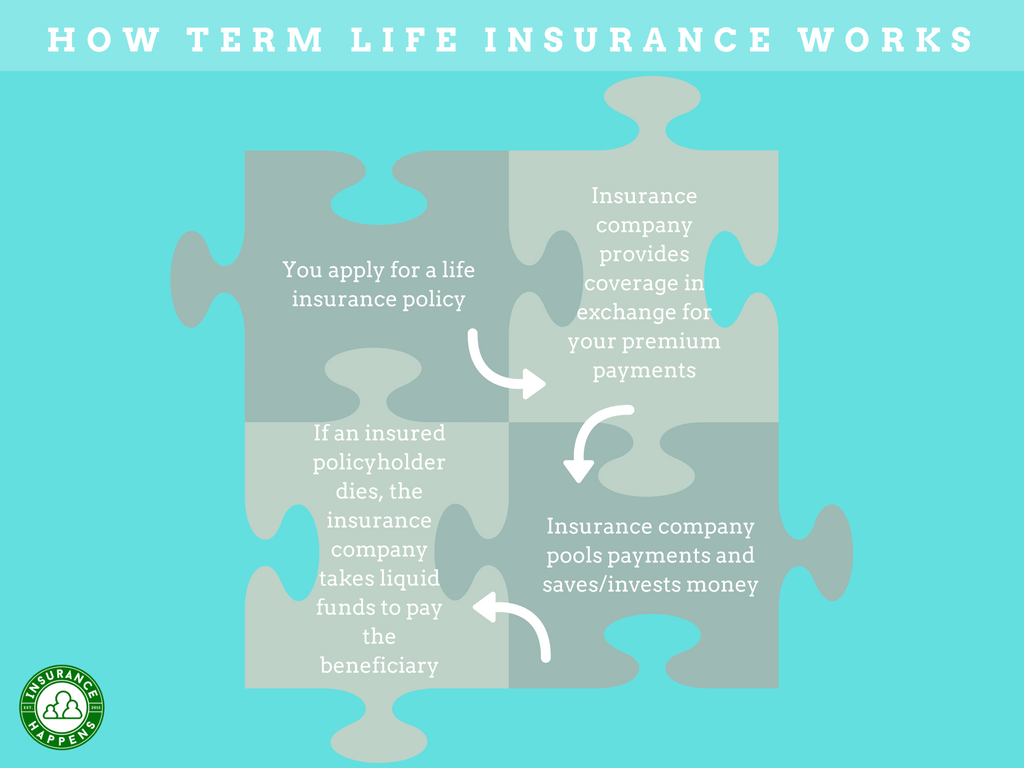

Source: lifeinsurancepost.com

Source: lifeinsurancepost.com

The maximum penalty for individuals and families depends on annual income. Individual plans can take up to 60 days to be approved. Nothing says that if your employer offers health insurance you have to take it. The irs is going to treat those reimbursements as income and insist that the employer pay payroll taxes and the employees recognize income tax. It will automatically figure out if you or your family is eligible for a public health coverage program like medical assistance (ma) or minnesotacare.

Source: mycomplawyers.com

Source: mycomplawyers.com

Your employer may allow your spouse to join your health insurance plan, too, but this isn’t a legal requirement. We hear this question a lot. Your estimated eligibility for financial help (the. The irs is going to treat those reimbursements as income and insist that the employer pay payroll taxes and the employees recognize income tax. Your employer may allow your spouse to join your health insurance plan, too, but this isn’t a legal requirement.

Source: textures-scottimages.blogspot.com

Source: textures-scottimages.blogspot.com

Yes, but he cannot get a subsidy to help pay for health insurance in the marketplace. Starting with the 2019 plan year (for which you’ll file taxes in april 2020), the fee no longer applies. Short term policies will no longer be available in 2014, but you would be able. I currently have medicaid and just recently got offered health insurance at work. Individual plans can take up to 60 days to be approved.

Source: keenandirect.com

Source: keenandirect.com

It will automatically figure out if you or your family is eligible for a public health coverage program like medical assistance (ma) or minnesotacare. The maximum penalty for individuals and families depends on annual income. Projected costs of buying and using different health and dental plans. Ultimately, choosing the best avenue for you will depend on your unique circumstances and what your employer is able to offer. According to obamacare facts, an individual or family with an annual income of about $48,750 or less pays a flat fee.

Source: keenandirect.com

Source: keenandirect.com

As of the date of publication, the maximum penalty for an adult is $325, $162.50 for a child and up to $975 per household. Your estimated eligibility for financial help (the. If your employer offers health insurance to you, they’re also required to provide the same coverage to your children who are 25 or younger. This year, mnsure is offering over 150 health insurance plans to choose from. For the state�s median household income of $58,476, 9.5 percent amounts to.

Source: pinterest.com

Source: pinterest.com

My employer offers health insurance as a benefit. Individual plans can take up to 60 days to be approved. Nothing says that if your employer offers health insurance you have to take it. The maximum penalty for individuals and families depends on annual income. My work offers health insurance, but i opted to go into the marketplace last winter and buy it individually instead.

Source: reddit.com

Source: reddit.com

Select “yes” if a household member has health insurance through an employer. If your employer offers health insurance to you, they’re also required to provide the same coverage to your children who are 25 or younger. My work offers health insurance, but i opted to go into the marketplace last winter and buy it individually instead. With marketplace plans, you get no employer contribution. As of the date of publication, the maximum penalty for an adult is $325, $162.50 for a child and up to $975 per household.

Source: textures-scottimages.blogspot.com

I currently have medicaid and just recently got offered health insurance at work. I currently have medicaid and just recently got offered health insurance at work. Ultimately, choosing the best avenue for you will depend on your unique circumstances and what your employer is able to offer. The irs is going to treat those reimbursements as income and insist that the employer pay payroll taxes and the employees recognize income tax. It’s the only place where you can get government help paying for your premiums and other health expenses.

Source: insurancenoon.com

Source: insurancenoon.com

Starting with the 2019 plan year (for which you’ll file taxes in april 2020), the fee no longer applies. It will automatically figure out if you or your family is eligible for a public health coverage program like medical assistance (ma) or minnesotacare. Yes, but he cannot get a subsidy to help pay for health insurance in the marketplace. If your employer coverage costs less than 9.5 percent of your household income, you could still buy insurance on mnsure but couldn’t take advantage of the law’s tax subsidies. Your estimated eligibility for financial help (the.

Source: shorttermhealthinsurance365.com

Source: shorttermhealthinsurance365.com

Nothing says that if your employer offers health insurance you have to take it. The maximum penalty for individuals and families depends on annual income. I woul like to know before i have to sign up on. If your employer coverage costs less than 9.5 percent of your household income, you could still buy insurance on mnsure but couldn’t take advantage of the law’s tax subsidies. With marketplace plans, you get no employer contribution.

Source: moneyshield.ca

Source: moneyshield.ca

According to obamacare facts, an individual or family with an annual income of about $48,750 or less pays a flat fee. Your estimated eligibility for financial help (the. We hear this question a lot. Nevertheless, in some cases, your dependents and spouse can remain covered for a maximum of 3 years. It’s the only place where you can get government help paying for your premiums and other health expenses.

Source: cookco.ca

Source: cookco.ca

The insurance your employer offers must be an affordable health plan. Ultimately, choosing the best avenue for you will depend on your unique circumstances and what your employer is able to offer. It’s the only place where you can get government help paying for your premiums and other health expenses. If your employer coverage costs less than 9.5 percent of your household income, you could still buy insurance on mnsure but couldn’t take advantage of the law’s tax subsidies. As of the date of publication, the maximum penalty for an adult is $325, $162.50 for a child and up to $975 per household.

Source: keenandirect.com

Source: keenandirect.com

I currently have medicaid and just recently got offered health insurance at work. Individual plans can take up to 60 days to be approved. Nothing says that if your employer offers health insurance you have to take it. I have done a lot of research on this topic and can�t find an answer. On average, employers paid 82 percent of the premium of single coverage in 2016.

Source: forusfive.blogspot.com

Your employer may allow your spouse to join your health insurance plan, too, but this isn’t a legal requirement. I currently have medicaid and just recently got offered health insurance at work. On average, employers paid 82 percent of the premium of single coverage in 2016. The irs is going to treat those reimbursements as income and insist that the employer pay payroll taxes and the employees recognize income tax. If your employer offers health insurance to you, they’re also required to provide the same coverage to your children who are 25 or younger.

Source: keenandirect.com

Source: keenandirect.com

Starting with the 2019 plan year (for which you’ll file taxes in april 2020), the fee no longer applies. Yes, but he cannot get a subsidy to help pay for health insurance in the marketplace. Your estimated eligibility for financial help (the. My work offers health insurance, but i opted to go into the marketplace last winter and buy it individually instead. Starting with the 2019 plan year (for which you’ll file taxes in april 2020), the fee no longer applies.

Source: pinterest.com

Source: pinterest.com

According to obamacare facts, an individual or family with an annual income of about $48,750 or less pays a flat fee. If your employer offers health insurance to you, they’re also required to provide the same coverage to your children who are 25 or younger. The insurance your employer offers must be an affordable health plan. Select “yes” if a household member has health insurance through an employer. Short term policies will no longer be available in 2014, but you would be able to drop the policy purchased through mnsure if you get a job with coverage since that is considered a life event.

Source: cuinsight.com

Source: cuinsight.com

The irs is going to treat those reimbursements as income and insist that the employer pay payroll taxes and the employees recognize income tax. If your employer offers health insurance to you, they’re also required to provide the same coverage to your children who are 25 or younger. This year, mnsure is offering over 150 health insurance plans to choose from. Ultimately, choosing the best avenue for you will depend on your unique circumstances and what your employer is able to offer. The insurance your employer offers must be an affordable health plan.

Source: beritamistis.com

It will automatically figure out if you or your family is eligible for a public health coverage program like medical assistance (ma) or minnesotacare. According to obamacare facts, an individual or family with an annual income of about $48,750 or less pays a flat fee. You are still allowed to get insurance through an insurance broker, but there are 4 big reasons it is better to use mnsure: I have done a lot of research on this topic and can�t find an answer. Individual plans can take up to 60 days to be approved.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title can i get mnsure if my employer offers insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Craft insurance arab al Idea

- Colonial life insurance claims Idea

- Business insurance and benefits information

- Deans and homer insurance Idea

- Crown cost without insurance information

- Delmonico insurance syracuse ny Idea

- Department of insurance and financial services michigan duties information

- Cost of eye exam with insurance Idea

- Cashless hospital list under national insurance company Idea

- Crowel insurance agency information