Can i have 2 life insurance policies information

Home » Trend » Can i have 2 life insurance policies informationYour Can i have 2 life insurance policies images are ready in this website. Can i have 2 life insurance policies are a topic that is being searched for and liked by netizens today. You can Find and Download the Can i have 2 life insurance policies files here. Find and Download all royalty-free photos and vectors.

If you’re looking for can i have 2 life insurance policies images information related to the can i have 2 life insurance policies keyword, you have visit the ideal blog. Our site frequently gives you suggestions for downloading the maximum quality video and image content, please kindly search and find more informative video content and images that match your interests.

Can I Have 2 Life Insurance Policies. However, if you are taking out life insurance policies with numerous companies it is important to inform them. A typical claim process includes getting the death certificate, filling. The beneficiary is the person who receives the death benefit from your insurance policy. Can you have two primary beneficiaries on life insurance?

Can I Borrow Against Term Life Insurance at Insurance From revisi.net

Can I Borrow Against Term Life Insurance at Insurance From revisi.net

You can have two or more life insurance policies as long as you are able to pay the premiums. Having multiple life insurance policies can give you peace of mind when it comes to planning for the future. 20 lakhs for 10 years, you can buy three life insurance plans: Can i buy more than one life insurance policy? This cash fund can earn interest as it grows. Owning multiple life insurance policies makes sense if you have different goals for the coverage or want to match needs precisely over time.

When you buy life insurance, you can decide on its maturity period after.

The third policy would be a term insurance plan with a sum assured as per your family’s financial. Whatever option you choose as long as you meet the financial / income guidelines. So this means on a $50,000 salary you can have 1 policy for $1.5 million, 2 policies at the same or different company for $750,000 or 3 policies at the same or a different company for $500,000. It is possible to buy two or more life insurance policies for one person. Can you claim two or more life insurance policies? Your insurability limit is the total amount of coverage you can be insured for across all policies at one time.

Source: revisi.net

Source: revisi.net

That limit is tied, in large part, to your income or net worth. This cash fund can earn interest as it grows. For more information on life insurance policies, speak with a licensed agent. Can you have two primary beneficiaries on life insurance? But here are the implications you need to know about having multiple policies.

Source: groupplansinc.com

Source: groupplansinc.com

20 lakhs for 10 years, you can buy three life insurance plans: A typical claim process includes getting the death certificate, filling. But here are the implications you need to know about having multiple policies. Owning multiple life insurance policies makes sense if you have different goals for the coverage or want to match needs precisely over time. You can buy two or more life insurance plans to fulfill your insurance protection needs.

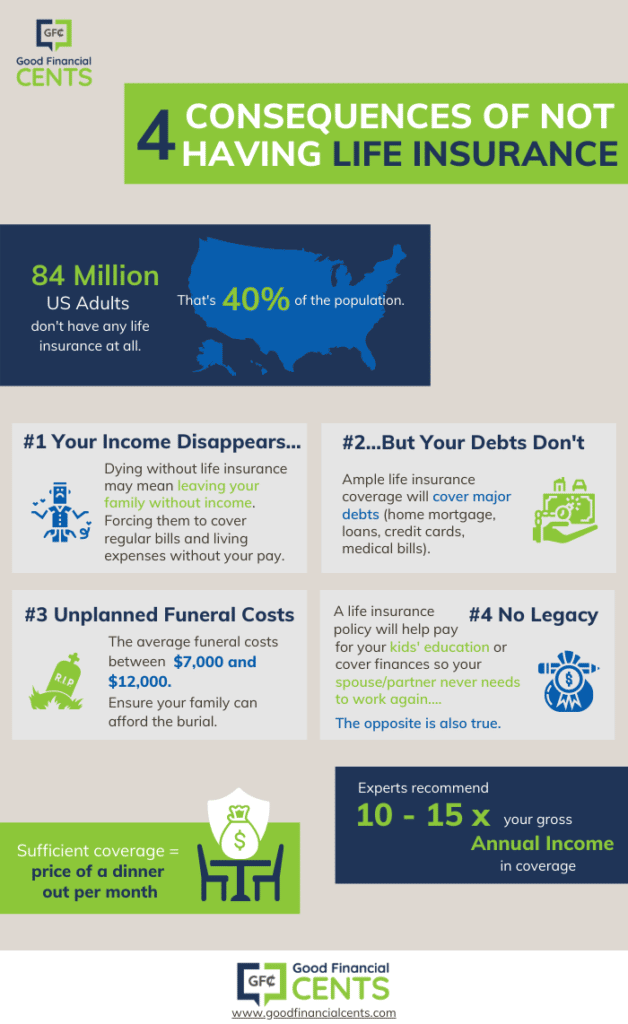

Source: goodfinancialcents.com

Source: goodfinancialcents.com

As long as your financial affairs justify the amount of life insurance you are buying, there is no reason why you cannot have more than one life insurance policy. Owning multiple life insurance policies makes sense if you have different goals for the coverage or want to match needs precisely over time. Generally, people do have multiple life insurance policies, wherein one is provided by the employer, and the other is through their own term life policy, which isn’t tied to their employment. You can have more than one life insurance policy, and you don’t have to get them from the same company. If you have two life insurance policies, there is no stipulation of nominating the same person.

Source: revisi.net

Source: revisi.net

Owning multiple life insurance policies makes sense if you have different goals for the coverage or want to match needs precisely over time. So this means on a $50,000 salary you can have 1 policy for $1.5 million, 2 policies at the same or different company for $750,000 or 3 policies at the same or a different company for $500,000. At that point, the $100,000 whole life policy will be insufficient. Yes, you can have more than one life insurance policy. 40 lakhs for 20 years and a business loan of rs.

Source: livemint.com

Source: livemint.com

But for most people’s circumstances, having one life insurance policy is usually enough. The short answer is yes, you can have multiple policies. A typical claim process includes getting the death certificate, filling. That can serve as a foundational life insurance policy. At that point, the $100,000 whole life policy will be insufficient.

Source: healthmarkets.com

Source: healthmarkets.com

If there is more than one primary beneficiary, the primary beneficiaries share the death benefit equally or in a percentage determined by the insured at the time of designation. The only time you cannot buy more than one life insurance policy is when you’re trying to get more coverage than you actually need (most people can only qualify for up to 15 times their annual income in total life insurance coverage). Generally, people do have multiple life insurance policies, wherein one is provided by the employer, and the other is through their own term life policy, which isn’t tied to their employment. 40 lakhs for 20 years and a business loan of rs. Although you can own more than one life insurance policy, you will be limited in the total amount of coverage you can get.

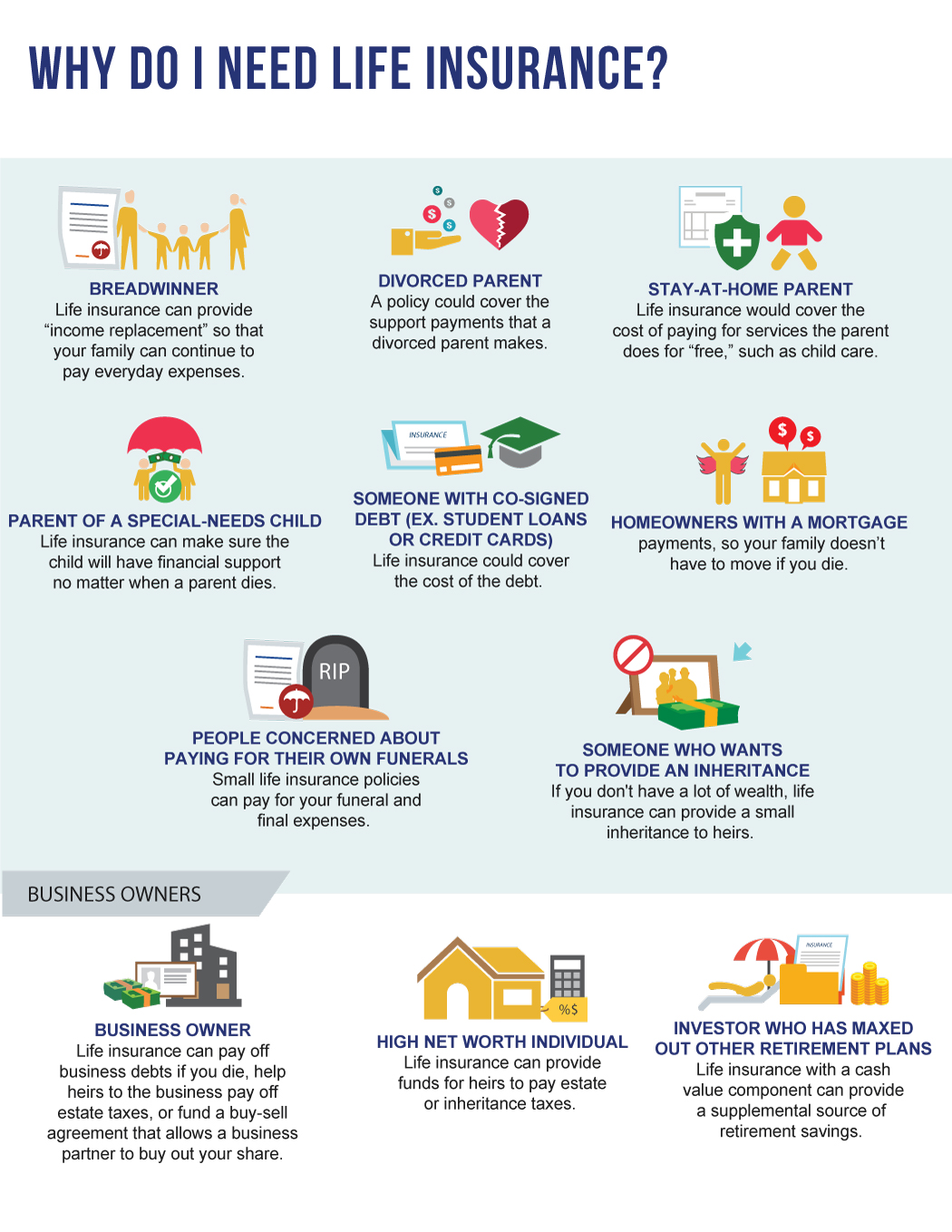

Source: pinterest.ph

Source: pinterest.ph

Some permanent life insurance policies have a cash value component, meaning the insurance company places a portion of your monthly or annual payments in a cash fund. At that point, the $100,000 whole life policy will be insufficient. Unlocking opportunities in metal and mining. You can own multiple life insurance policies as long as the amounts are justified and you do not go over your insurability limit. If you have two life insurance policies, there is no stipulation of nominating the same person.

Source: bankbazaar.com

Source: bankbazaar.com

At that point, the $100,000 whole life policy will be insufficient. The third policy would be a term insurance plan with a sum assured as per your family’s financial. The short answer is yes, you can have multiple policies. As long as your financial affairs justify the amount of life insurance you are buying, there is no reason why you cannot have more than one life insurance policy. A typical claim process includes getting the death certificate, filling.

Source: legacywealthcanada.com

Source: legacywealthcanada.com

Your insurability limit is the total amount of coverage you can be insured for across all policies at one time. You’re allowed to have more than one life insurance policy, but that doesn’t mean you should have a fistful. Generally, people do have multiple life insurance policies, wherein one is provided by the employer, and the other is through their own term life policy, which isn’t tied to their employment. Read on to know about why you should. You can buy two or more life insurance plans to fulfill your insurance protection needs.

Source: slideshare.net

Source: slideshare.net

So this means on a $50,000 salary you can have 1 policy for $1.5 million, 2 policies at the same or different company for $750,000 or 3 policies at the same or a different company for $500,000. It is possible to have more than one beneficiary for the insurance plan. As long as your financial affairs justify the amount of life insurance you are buying, there is no reason why you cannot have more than one life insurance policy. Often, it’s better to have a single policy that meets all your needs. The short answer is yes, you can have multiple policies.

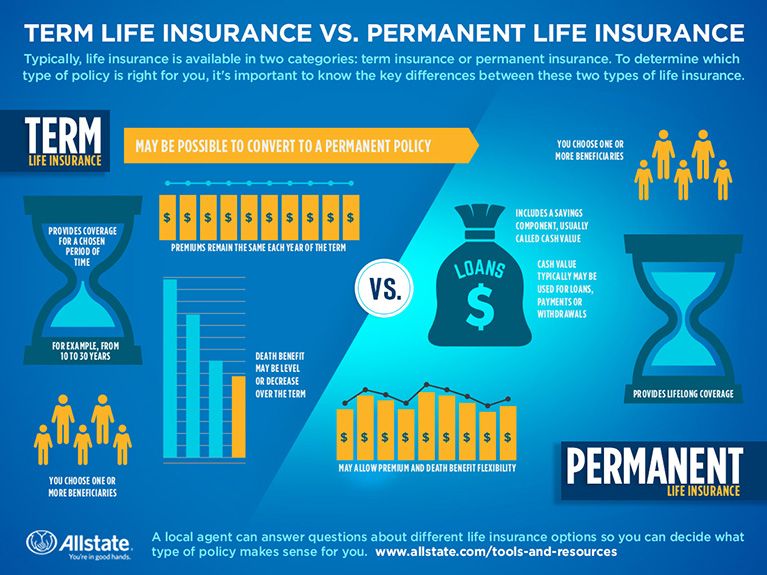

Source: allstate.com

Source: allstate.com

40 lakhs for 20 years and a business loan of rs. Increase in responsibilities as you age. Often, it’s better to have a single policy that meets all your needs. For example, once you get married, you’ll need to leave money to your spouse. But for most people’s circumstances, having one life insurance policy is usually enough.

Source: pocketsense.com

Source: pocketsense.com

And once you have children, the need only gets bigger. When you buy life insurance, you can decide on its maturity period after. You can have two or more life insurance policies as long as you are able to pay the premiums. Increase in responsibilities as you age. Often, it’s better to have a single policy that meets all your needs.

Source: revisi.net

Source: revisi.net

Yes, usually your beneficiaries will not have to worry about the payout from multiple life insurance policies if the claim is valid, and you fully disclosed all relevant information when you applied for life cover, including how much insurance you have. Why would someone get more than one policy? Some people have life insurance coverage. You can have two or more life insurance policies as long as you are able to pay the premiums. Can you claim from multiple life insurance policies?

Source: partners4prosperity.com

Source: partners4prosperity.com

So this means on a $50,000 salary you can have 1 policy for $1.5 million, 2 policies at the same or different company for $750,000 or 3 policies at the same or a different company for $500,000. At that point, the $100,000 whole life policy will be insufficient. You can have more than one life insurance policy, and you don’t have to get them from the same company. 20 lakhs for 10 years, you can buy three life insurance plans: For example, if you have a home loan of rs.

Source: thefinancesection.com

Source: thefinancesection.com

That can serve as a foundational life insurance policy. It’s absolutely possible and legal to have multiple life insurance policies at once. The third policy would be a term insurance plan with a sum assured as per your family’s financial. Your insurability limit is the total amount of coverage you can be insured for across all policies at one time. For example, once you get married, you’ll need to leave money to your spouse.

Source: ilstv.com

Source: ilstv.com

Generally, people do have multiple life insurance policies, wherein one is provided by the employer, and the other is through their own term life policy, which isn’t tied to their employment. The short answer is yes. A lot of people assume that they can only take out one life insurance policy because other insurance products such as home insurance or car insurance only allow one policy per person. And once you have children, the need only gets bigger. Can you have two primary beneficiaries on life insurance?

Source: insuranceblogbychris.com

Source: insuranceblogbychris.com

Buying multiple life insurance policies makes sense if you have multiple loans running. It is possible to buy two or more life insurance policies for one person. 40 lakhs for 20 years and a business loan of rs. But for most people’s circumstances, having one life insurance policy is usually enough. When you buy life insurance, you can decide on its maturity period after.

Source: briefly.co.za

Source: briefly.co.za

Yes, usually your beneficiaries will not have to worry about the payout from multiple life insurance policies if the claim is valid, and you fully disclosed all relevant information when you applied for life cover, including how much insurance you have. Although you can own more than one life insurance policy, you will be limited in the total amount of coverage you can get. Some people have life insurance coverage. A lot of people assume that they can only take out one life insurance policy because other insurance products such as home insurance or car insurance only allow one policy per person. Yes, if you die and you have multiple life insurance policies covering you at the time, a claim can be made against all of them.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title can i have 2 life insurance policies by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Craft insurance arab al Idea

- Colonial life insurance claims Idea

- Business insurance and benefits information

- Deans and homer insurance Idea

- Crown cost without insurance information

- Delmonico insurance syracuse ny Idea

- Department of insurance and financial services michigan duties information

- Cost of eye exam with insurance Idea

- Cashless hospital list under national insurance company Idea

- Crowel insurance agency information