Can i have 2 term insurance policies information

Home » Trending » Can i have 2 term insurance policies informationYour Can i have 2 term insurance policies images are ready. Can i have 2 term insurance policies are a topic that is being searched for and liked by netizens now. You can Find and Download the Can i have 2 term insurance policies files here. Download all free photos.

If you’re searching for can i have 2 term insurance policies pictures information linked to the can i have 2 term insurance policies topic, you have visit the right blog. Our website frequently provides you with suggestions for downloading the maximum quality video and picture content, please kindly surf and find more enlightening video articles and graphics that match your interests.

Can I Have 2 Term Insurance Policies. You can buy two or more term insurance plans to fulfill your insurance needs. You can see list of insurance policies here: Hence, for maintaining two policies, the total premium amount you are required to pay is rs 3000 per month. Could you please suggest me on this.

Can I Get Insurance The Same Day I Have An Accident From beritafintek.com

Can I Get Insurance The Same Day I Have An Accident From beritafintek.com

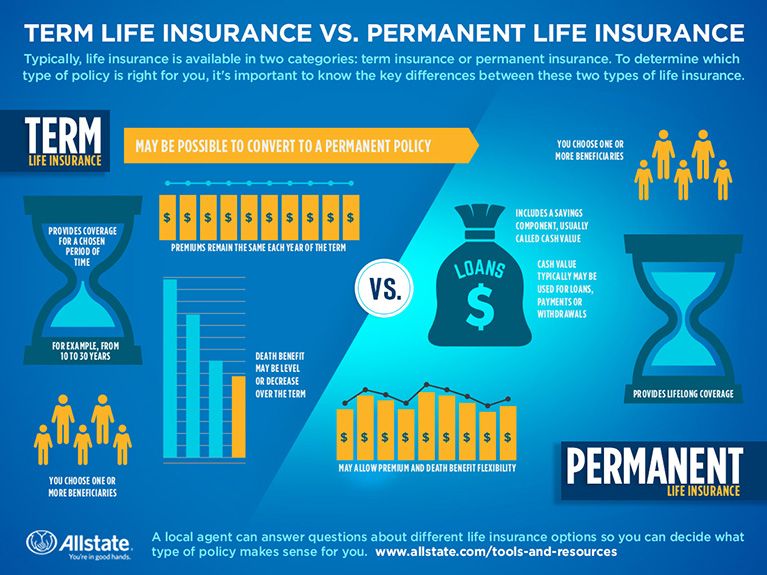

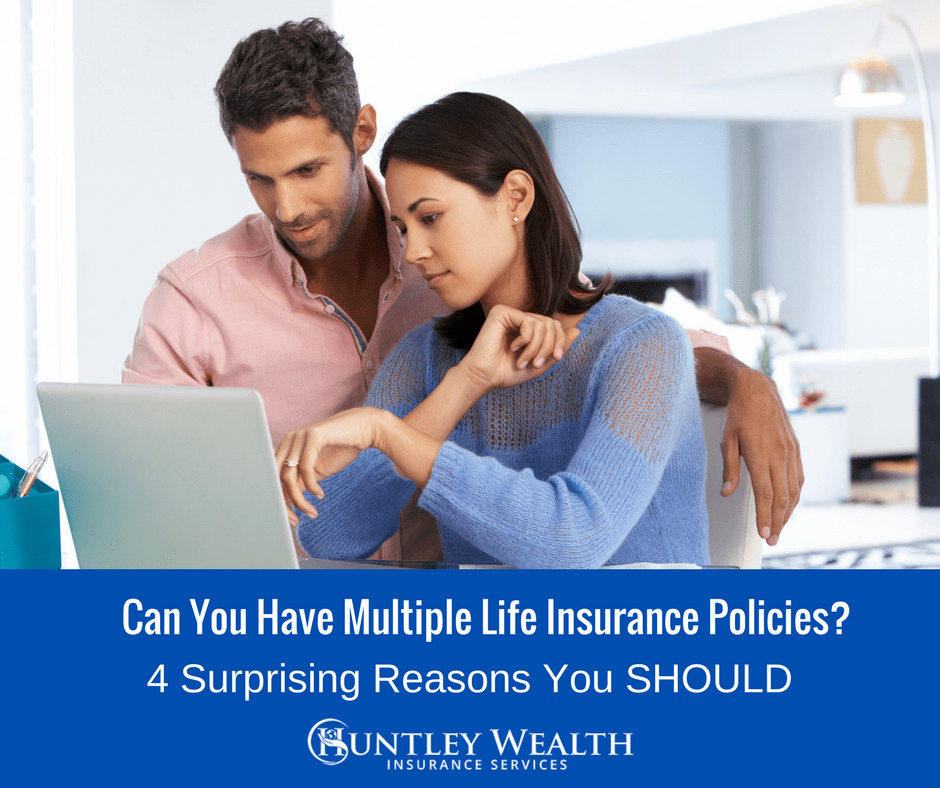

“a term policy is great for basic income replacement, while the cash value of a permanent policy can help with retirement planning later in life,” says ryan pinney, president of pinney insurance. Overlapping policies it’s also possible to have two separate policies covering the same thing. Common reasons to own more than one policy experience a major life event You may want to consider keeping just one policy with higher policy limits. Is it good have two term policies?. You can see list of insurance policies here:

Unfortunately, although this doesn’t mean you have double the cover, you could be paying twice to insure the same car or van.

Could you please suggest me on this. However, the same claim cannot be submitted to both insurance companies. However, there may be limits in terms of benefit amount (up to 65% of income), benefit period (how long the benefit will be paid) and waiting period (when the benefit starts). The other fees such as the agent�s commission and insurance company administration expenses will be more with two policies instead of one. “a term policy is great for basic income replacement, while the cash value of a permanent policy can help with retirement planning later in life,” says ryan pinney, president of pinney insurance. However, there are specific requirements that you must meet to have multiple policies, and we detail them below:

Source: allstate.com

Source: allstate.com

Yes, a person can have more than one disability insurance policy. Unfortunately, although this doesn’t mean you have double the cover, you could be paying twice to insure the same car or van. Hence, for maintaining two policies, the total premium amount you are required to pay is rs 3000 per month. Multiple policies because of business taking action can you have multiple life insurance policies? Yes, a person can have more than one disability insurance policy.

Source: healthmarkets.com

Source: healthmarkets.com

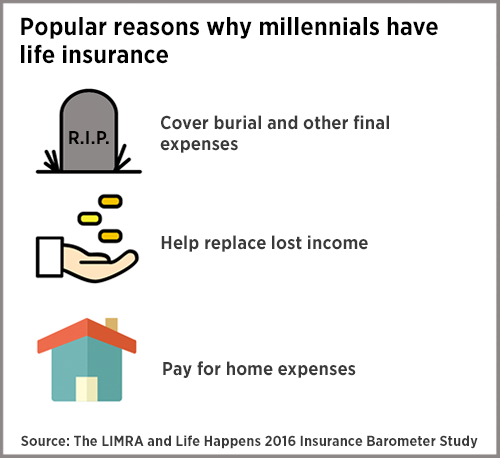

If you have two life insurance policies, there is no stipulation of nominating the same person as beneficiary for both of your insurance plans. By amanda shih & rebecca shoenthal updated february 3, 2022 | 4 min read policygenius content follows strict guidelines for editorial accuracy and integrity. Generally, people do have multiple life insurance policies, wherein one is provided by the employer, and the other is through their own term life policy, which isn’t tied to their employment. If you have two life insurance policies, there is no stipulation of nominating the same person as beneficiary for both of your insurance plans. Hence, for maintaining two policies, the total premium amount you are required to pay is rs 3000 per month.

Source: compareukquotes.com

Source: compareukquotes.com

You can buy two or more term insurance plans to fulfill your insurance needs. I am planning to take two online term insurance policies for 30 years tenure. However, there may be limits in terms of benefit amount (up to 65% of income), benefit period (how long the benefit will be paid) and waiting period (when the benefit starts). It’s absolutely possible and legal to have multiple life insurance policies at once. By amanda shih & rebecca shoenthal updated february 3, 2022 | 4 min read policygenius content follows strict guidelines for editorial accuracy and integrity.

Source: linkmycontent.com

Source: linkmycontent.com

While owning multiple insurance policies is an option, it�s not always be the option for your needs. If you need more insurance, you may be able to increase the limit of your current policy. There are a few different reasons why someone might have two health insurance plans: Third, i am a big fan of this strategy and have two separate term life insurance policies, a $750k policy that ends around age 52 or so and a $1 million policy that ends around age 57. I have couple of queries on this.

Source: beritafintek.com

Source: beritafintek.com

You may want to consider keeping just one policy with higher policy limits. You can have multiple policies from different insurance companies. After all, even if there are two insurance policies, only one person could be driving the car when the accident. Multiple policies because of business taking action can you have multiple life insurance policies? Having more than one policy would depend on an individual needs.

Source: insurancefouryou.com

Source: insurancefouryou.com

Yes, you can have two health insurance plans. The increasing term prevents having to qualify for another policy at an older age to get the added benefit as would be the case with traditional term insurance. Common reasons to own more than one policy experience a major life event You can have more than one life insurance policy, but there�s a limit to how much total coverage you can apply for at once (typically 15 times your income). I am planning to take two online term insurance policies for 30 years tenure.

Source: revisi.net

Source: revisi.net

You now have a baby and want more coverage but found a better rate with life insurance company b. 4 rows at some point in life, every individual is faced with the question, “can i have two term. You can absolutely have more than one insurance policy. There are a few different reasons why someone might have two health insurance plans: The other fees such as the agent�s commission and insurance company administration expenses will be more with two policies instead of one.

Source: revisi.net

Source: revisi.net

“a term policy is great for basic income replacement, while the cash value of a permanent policy can help with retirement planning later in life,” says ryan pinney, president of pinney insurance. Be sure to take this effect into account when determining your term insurance plan. However, there may be limits in terms of benefit amount (up to 65% of income), benefit period (how long the benefit will be paid) and waiting period (when the benefit starts). As car insurance is linked to both the person driving and to the vehicle, two people insuring the same vehicle is a little different to one person having two insurance policies for the same car. After all, even if there are two insurance policies, only one person could be driving the car when the accident.

Source: justuspsmc.com

Source: justuspsmc.com

It’s absolutely possible and legal to have multiple life insurance policies at once. Why would i have two plans? Now, if you weigh all the pros and cons and also consider that your financial needs change as per your circumstances and you can’t actually predict the future, it is always beneficial to have a two term insurance policy instead of one. The claimant was approved for disability benefits that were paid out by both of the unum policies. There are a few different reasons why someone might have two health insurance plans:

Source: slideshare.net

Source: slideshare.net

It’s absolutely possible and legal to have multiple life insurance policies at once. Unfortunately, although this doesn’t mean you have double the cover, you could be paying twice to insure the same car or van. In a california case brought against unum, the claimant had two separate disability insurance policies that were provided by two separate employers, but both policies were administered by unum. Having more than one policy would depend on an individual needs. It is possible to have more than one beneficiary for the insurance plan.

Source: insuranceblogbychris.com

Source: insuranceblogbychris.com

However, there may be limits in terms of benefit amount (up to 65% of income), benefit period (how long the benefit will be paid) and waiting period (when the benefit starts). Yes, a person can have more than one disability insurance policy. After all, even if there are two insurance policies, only one person could be driving the car when the accident. Having two health insurance plans is perfectly legal, and many people have multiple health insurance policies under certain circumstances. You can see list of insurance policies here:

Source: revisi.net

Source: revisi.net

Also, you can have more than one beneficiary for each life insurance policy, and different beneficiaries for each policy. Yes, you can have two health insurance plans. There are a few different reasons why someone might have two health insurance plans: The claims process becomes far easier. The increasing term prevents having to qualify for another policy at an older age to get the added benefit as would be the case with traditional term insurance.

Source: revisi.net

Source: revisi.net

Having two health insurance plans is perfectly legal, and many people have multiple health insurance policies under certain circumstances. Overlapping policies it’s also possible to have two separate policies covering the same thing. 4 rows at some point in life, every individual is faced with the question, “can i have two term. I am planning to take two online term insurance policies for 30 years tenure. While owning multiple insurance policies is an option, it�s not always be the option for your needs.

Source: keithmichaels.co.uk

Source: keithmichaels.co.uk

There are a few different reasons why someone might have two health insurance plans: The claimant was approved for disability benefits that were paid out by both of the unum policies. “a term policy is great for basic income replacement, while the cash value of a permanent policy can help with retirement planning later in life,” says ryan pinney, president of pinney insurance. However, there are specific requirements that you must meet to have multiple policies, and we detail them below: Also, you can have more than one beneficiary for each life insurance policy, and different beneficiaries for each policy.

Source: ilstv.com

Source: ilstv.com

Having two health insurance plans is perfectly legal, and many people have multiple health insurance policies under certain circumstances. Yes, you can have two health insurance plans. However, there are specific requirements that you must meet to have multiple policies, and we detail them below: This often happens with breakdown cover. However, there may be limits in terms of benefit amount (up to 65% of income), benefit period (how long the benefit will be paid) and waiting period (when the benefit starts).

Source: revisi.net

Source: revisi.net

You can have multiple policies from different insurance companies. You can have more than one life insurance policy, but there�s a limit to how much total coverage you can apply for at once (typically 15 times your income). It is possible to have more than one beneficiary for the insurance plan. You can see list of insurance policies here: 4 rows at some point in life, every individual is faced with the question, “can i have two term.

Source: revisi.net

Source: revisi.net

You can absolutely have more than one insurance policy. The increasing term prevents having to qualify for another policy at an older age to get the added benefit as would be the case with traditional term insurance. Mortgage term or decreasing term The claimant was approved for disability benefits that were paid out by both of the unum policies. You can buy two or more term insurance plans to fulfill your insurance needs.

Source: motor1.com

Source: motor1.com

This often happens with breakdown cover. Could you please suggest me on this. I have couple of queries on this. The increasing term prevents having to qualify for another policy at an older age to get the added benefit as would be the case with traditional term insurance. Is it good have two term policies?.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title can i have 2 term insurance policies by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Claims vs occurrence based insurance Idea

- Cheap tablet insurance Idea

- Calling insurance leads Idea

- Disability insurance for postal workers Idea

- Business insurance peoria il information

- Bright health insurance reviews Idea

- Carrier liability vs cargo insurance Idea

- Can you insure a written off car Idea

- Can convicted felons get life insurance information

- Car insurance administrator Idea