Can i have multiple life insurance policies information

Home » Trending » Can i have multiple life insurance policies informationYour Can i have multiple life insurance policies images are available in this site. Can i have multiple life insurance policies are a topic that is being searched for and liked by netizens now. You can Get the Can i have multiple life insurance policies files here. Get all free photos and vectors.

If you’re searching for can i have multiple life insurance policies images information related to the can i have multiple life insurance policies interest, you have come to the ideal site. Our site always provides you with suggestions for refferencing the highest quality video and image content, please kindly hunt and find more enlightening video articles and images that match your interests.

Can I Have Multiple Life Insurance Policies. An important thing to mention here is the restrictions life insurance policies have in case you have more than one policy. Generally, people do have multiple life insurance policies, wherein one is provided by the employer, and the other is through their own term life policy, which isn’t tied to their employment. Carrying multiple life insurance policies can be a savvy way to protect your family as your needs change. If you have one policy for $200,000, and you have a second policy for $200,000, you have $400,000 in life insurance coverage.

Can I Claim on Multiple Life Insurance Policies From ailife.com

Can I Claim on Multiple Life Insurance Policies From ailife.com

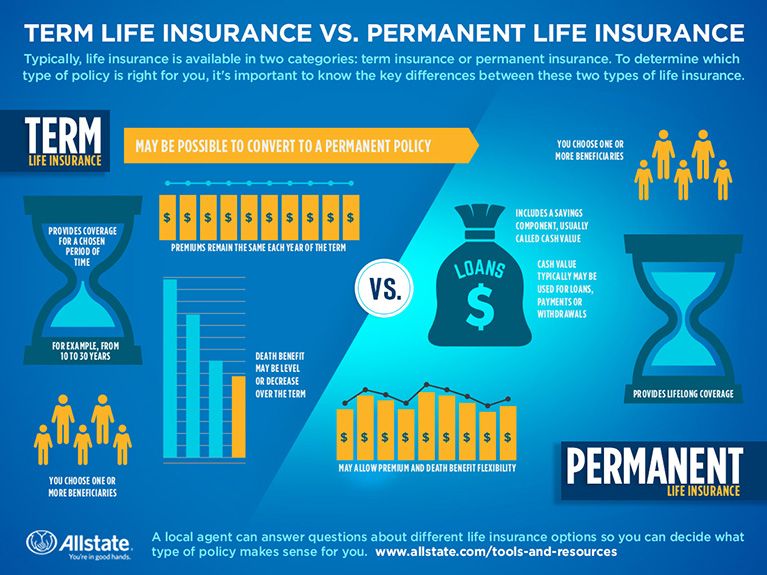

So while you can have more than one life insurance policy if you wish, there may be better options if you need to review your cover. Today, air travel is far safer and those kiosks are long forgotten, but you may have many reasons for having multiple life insurance policies, either term life, whole life, or both. It is possible to buy two or more life insurance policies for one person. It is possible to take out more than one life insurance policy on yourself in south africa, but if you opt for this route then care must be taken not to over insure yourself. However, in the interest of complete transparency and to ensure that your beneficiary’s claims are not later rejected, you need to inform the insurer about the different term policies that you have applied. 1 insure.com gives the example of having a “permanent life insurance policy like whole life and also a term life policy for a shorter need.” you should speak with a.

20 lakhs for 10 years, you can buy three life insurance plans:

Generally, people do have multiple life insurance policies, wherein one is provided by the employer, and the other is through their own term life policy, which isn’t tied to their employment. An important thing to mention here is the restrictions life insurance policies have in case you have more than one policy. Although you can own more than one life insurance policy, you will be limited in the total amount of coverage you can get. However, in the interest of complete transparency and to ensure that your beneficiary’s claims are not later rejected, you need to inform the insurer about the different term policies that you have applied. This is the most basic advantage. So while you can have more than one life insurance policy if you wish, there may be better options if you need to review your cover.

Source: guardianlife.com

Source: guardianlife.com

For most people, having more life insurance is an outstanding idea. You can legally have more than one life insurance policy in the uk. Because buying multiple policies can help you make sure you have enough coverage to meet the needs of your loved ones, for as long as they need protection, at a price you can afford. The third policy would be a term insurance plan with a sum assured as per your family’s financial. Often, it’s better to have a single policy that meets all your needs.

Source: healthmarkets.com

Source: healthmarkets.com

You can purchase additional life coverage from the same insurer or a different company, and take out different types of policies in combination with. Yes, you can apply to multiple insurance carriers, but there are often better and faster ways to get multiple life insurance policies then applying to several providers at the same time. Yes, if you die and you have multiple life insurance policies covering you at the time, a claim can be made against all of them. That limit is tied, in large part, to your income or net worth. You can have more than one life insurance policy, and you don’t have to get them from the same company.

Source: edmchicago.com

Source: edmchicago.com

It is always better to have multiple life insurance plans so that your beneficiary is well equipped to meet their different life goals at different stages of their lives. Carrying multiple life insurance policies can be a savvy way to protect your family as your needs change. It is possible to take out more than one life insurance policy on yourself in south africa, but if you opt for this route then care must be taken not to over insure yourself. Yes, you can apply to multiple insurance carriers, but there are often better and faster ways to get multiple life insurance policies then applying to several providers at the same time. It is possible to buy two or more life insurance policies for one person.

Source: sbilife.co.in

Source: sbilife.co.in

Multiple life insurance policies = more life insurance coverage. For most people with life insurance, however, it may be more beneficial to stick with one policy and change the terms to meet your current needs. 20 lakhs for 10 years, you can buy three life insurance plans: An important thing to mention here is the restrictions life insurance policies have in case you have more than one policy. Yes, multiple life insurance policies are generally not restricted in australia, with many people preferring to diversify their insurance coverage to reduce any potential shortfall you might have.

Source: groupplansinc.com

Source: groupplansinc.com

It’s absolutely possible and legal to have multiple life insurance policies at once. Can you have multiple life insurance policies? An important thing to mention here is the restrictions life insurance policies have in case you have more than one policy. So while you can have more than one life insurance policy if you wish, there may be better options if you need to review your cover. You can legally have more than one life insurance policy in the uk.

Source: canarahsbclife.com

Source: canarahsbclife.com

Discover how the process works and how many policies you can have. Often, it’s better to have a single policy that meets all your needs. Yes, you can apply to multiple insurance carriers, but there are often better and faster ways to get multiple life insurance policies then applying to several providers at the same time. Can you have life insurance with more than one. Discover how the process works and how many policies you can have.

Source: ailife.com

Source: ailife.com

You can have multiple life insurance policies, but there�s a limit to your total coverage amount based on your income and assets. There is no government rule or regulation restricting the number of policies you can buy. Because buying multiple policies can help you make sure you have enough coverage to meet the needs of your loved ones, for as long as they need protection, at a price you can afford. That limit is tied, in large part, to your income or net worth. Generally, people do have multiple life insurance policies, wherein one is provided by the employer, and the other is through their own term life policy, which isn’t tied to their employment.

Source: pocketsense.com

Source: pocketsense.com

If you have one policy for $200,000, and you have a second policy for $200,000, you have $400,000 in life insurance coverage. But the more important question is, why would anyone want to do so? Today, air travel is far safer and those kiosks are long forgotten, but you may have many reasons for having multiple life insurance policies, either term life, whole life, or both. Purchasing multiple policies can help you find the right combination of protection at the right price, rather than opting for a high level of coverage beyond the time when your family needs it. A lot of people assume that they can only take out one life insurance policy because other insurance products such as home insurance or car insurance only allow one policy per person.

Source: progressive.com

Source: progressive.com

So while you can have more than one life insurance policy if you wish, there may be better options if you need to review your cover. A lot of people assume that they can only take out one life insurance policy because other insurance products such as home insurance or car insurance only allow one policy per person. If you have one policy for $200,000, and you have a second policy for $200,000, you have $400,000 in life insurance coverage. For example, if you have a home loan of rs. In north america, insurance companies share limited information regarding insurability of an applicant through a regulated body called the medical information bureau (mib).

Source: revisi.net

Source: revisi.net

You can have multiple life insurance policies, but there�s a limit to your total coverage amount based on your income and assets. Yes, if you die and you have multiple life insurance policies covering you at the time, a claim can be made against all of them. You can have multiple life insurance policies, but there�s a limit to your total coverage amount based on your income and assets. It is possible to take out more than one life insurance policy on yourself in south africa, but if you opt for this route then care must be taken not to over insure yourself. For most people with life insurance, however, it may be more beneficial to stick with one policy and change the terms to meet your current needs.

Source: topquotelifeinsurance.com

Source: topquotelifeinsurance.com

There are multiple types of life insurance policies. As per the restriction, the total coverage amount for all your policies cannot be more than the future income that you would earn. You can have more than one life insurance policy, and you don’t have to get them from the same company. Carrying multiple life insurance policies can be a savvy way to protect your family as your needs change. It is always better to have multiple life insurance plans so that your beneficiary is well equipped to meet their different life goals at different stages of their lives.

Source: pinterest.com

Source: pinterest.com

There are multiple types of life insurance policies. You can legally have more than one life insurance policy in the uk. It is always better to have multiple life insurance plans so that your beneficiary is well equipped to meet their different life goals at different stages of their lives. 20 lakhs for 10 years, you can buy three life insurance plans: But the more important question is, why would anyone want to do so?

Source: resolvion.com

Source: resolvion.com

Your life insurance policies can be with one insurer or more than one insurer, it doesn�t make any difference. Discover how the process works and how many policies you can have. Often, it’s better to have a single policy that meets all your needs. Yes, multiple life insurance policies are generally not restricted in australia, with many people preferring to diversify their insurance coverage to reduce any potential shortfall you might have. Although you can own more than one life insurance policy, you will be limited in the total amount of coverage you can get.

Source: insuranceblogbychris.com

Source: insuranceblogbychris.com

Yes, if you die and you have multiple life insurance policies covering you at the time, a claim can be made against all of them. You can have more than one life insurance policy, and you don’t have to get them from the same company. Can you have life insurance with more than one. Because buying multiple policies can help you make sure you have enough coverage to meet the needs of your loved ones, for as long as they need protection, at a price you can afford. If you have one policy for $200,000, and you have a second policy for $200,000, you have $400,000 in life insurance coverage.

Source: einsurance.com

Source: einsurance.com

You’re allowed to have more than one life insurance policy, but that doesn’t mean you should have a fistful. But here are the implications you need to know about having multiple policies. For most people, having more life insurance is an outstanding idea. But remember, if you find your situation changes in the future it’s sometimes possible to adapt your existing policy. It’s absolutely possible and legal to have multiple life insurance policies at once.

Source: revisi.net

Source: revisi.net

For example, if you have a home loan of rs. Multiple life insurance policies = more life insurance coverage. As per the restriction, the total coverage amount for all your policies cannot be more than the future income that you would earn. This is the most basic advantage. The short answer is yes, you can have multiple policies.

Source: allstate.com

Source: allstate.com

You can purchase additional life coverage from the same insurer or a different company, and take out different types of policies in combination with. In fact, most life insurance companies generally have very little concern over the number of policies you own and instead look more closely at the total amount of your benefits. The third policy would be a term insurance plan with a sum assured as per your family’s financial. 1 insure.com gives the example of having a “permanent life insurance policy like whole life and also a term life policy for a shorter need.” you should speak with a. Generally, people do have multiple life insurance policies, wherein one is provided by the employer, and the other is through their own term life policy, which isn’t tied to their employment.

Source: slideshare.net

Source: slideshare.net

Yes, you can have multiple life insurance policies in 2022. But remember, if you find your situation changes in the future it’s sometimes possible to adapt your existing policy. As per the restriction, the total coverage amount for all your policies cannot be more than the future income that you would earn. According to insure.com, “you can have multiple policies from the same or different life insurance companies,” and a reason for that may be to fill different needs. Although you can own more than one life insurance policy, you will be limited in the total amount of coverage you can get.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title can i have multiple life insurance policies by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Claims vs occurrence based insurance Idea

- Cheap tablet insurance Idea

- Calling insurance leads Idea

- Disability insurance for postal workers Idea

- Business insurance peoria il information

- Bright health insurance reviews Idea

- Carrier liability vs cargo insurance Idea

- Can you insure a written off car Idea

- Can convicted felons get life insurance information

- Car insurance administrator Idea