Can i have two life insurance policies information

Home » Trending » Can i have two life insurance policies informationYour Can i have two life insurance policies images are ready. Can i have two life insurance policies are a topic that is being searched for and liked by netizens today. You can Find and Download the Can i have two life insurance policies files here. Download all free images.

If you’re searching for can i have two life insurance policies images information connected with to the can i have two life insurance policies interest, you have visit the right site. Our site frequently gives you suggestions for seeking the highest quality video and picture content, please kindly search and find more enlightening video articles and graphics that fit your interests.

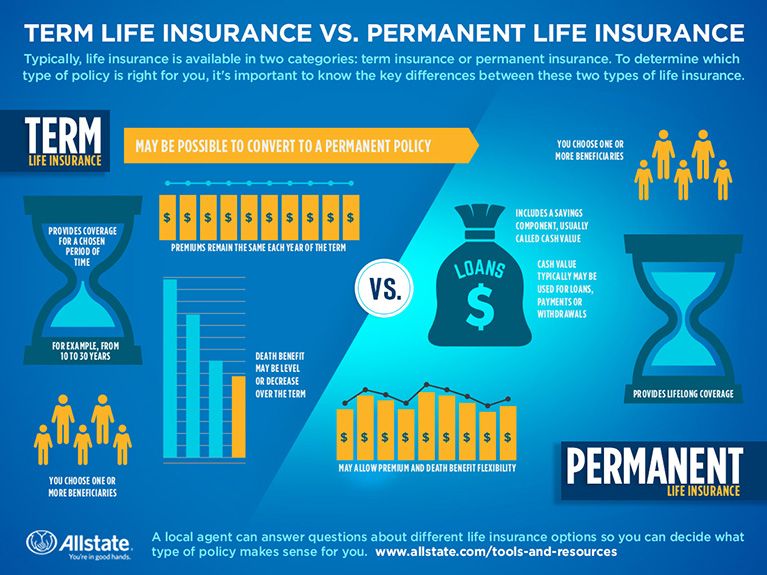

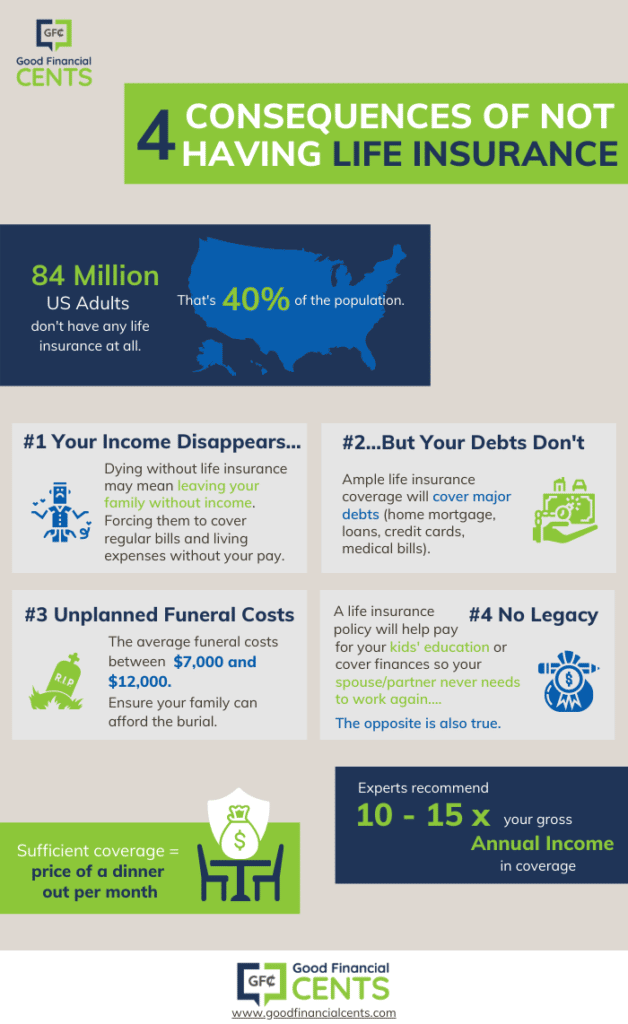

Can I Have Two Life Insurance Policies. It is possible to buy two or more life insurance policies for one person. Yes, if you die and you have multiple life insurance policies covering you at the time, a claim can be made against all of them. At that point, the $100,000 whole life policy will be insufficient. Some permanent life insurance policies have a cash value component, meaning the insurance company places a portion of your monthly or annual payments in a cash fund.

Can You Have Multiple Life Insurance Policies? Progressive From progressive.com

Can You Have Multiple Life Insurance Policies? Progressive From progressive.com

That can serve as a foundational life insurance policy. You’re allowed to have more than one life insurance policy, but that doesn’t mean you should have a fistful. The answer depends on the types of policies that you own, but each policy will continue to provide coverage as planned. But here are the implications you need to know about having multiple policies. Yes, if you die and you have multiple life insurance policies covering you at the time, a claim can be made against all of them. You can buy two or more life insurance plans to fulfill your insurance protection needs.

The answer depends on the types of policies that you own, but each policy will continue to provide coverage as planned.

The sum assured of all the insurance policies should not exceed the human life value. At that point, the $100,000 whole life policy will be insufficient. This cash fund can earn interest as it grows. If there is more than one primary beneficiary, the primary beneficiaries share the death benefit equally or in a percentage determined by the insured at the time of designation. The answer depends on the types of policies that you own, but each policy will continue to provide coverage as planned. Buying multiple life insurance policies makes sense if you have multiple loans running.

Source: progressive.com

Source: progressive.com

This cash fund can earn interest as it grows. If you have two life insurance policies, there is no stipulation of nominating the same person. Yes, you can have more than one life insurance policy. Thus, in order to avoid a situation where your need for coverage increases, it is best to have bought two or more life insurance plans well in advance. But for most people’s circumstances, having one life insurance policy is usually enough.

Source: partners4prosperity.com

Source: partners4prosperity.com

A lot of people assume that they can only take out one life insurance policy because other insurance products such as home insurance or car insurance only allow one policy per person. Your life insurance policies can be with one insurer or more than one insurer, it. Often, it’s better to have a single policy that meets all your needs. That can serve as a foundational life insurance policy. It is possible to take out more than one life insurance policy on yourself in south africa, but if you opt for this route.

Source: allstate.com

Source: allstate.com

40 lakhs for 20 years and a business loan of rs. The insurance company conducts the risk assessment. Discover how the process works and how many policies you can have. What happens if you have two life insurance policies? Your life insurance policies can be with one insurer or more than one insurer, it.

Source: revisi.net

Source: revisi.net

However, if you are taking out life insurance policies with numerous companies it is important to inform them. Yes, you can have multiple life insurance policies in 2022. The basic answer to this question is yes, you can have more than one life insurance policy, and, depending on your insurance provider, you may be able to save money by having all of your policies with the same company. The answer depends on the types of policies that you own, but each policy will continue to provide coverage as planned. Yes, you can have more than one life insurance policy.

Source: thefinancesection.com

Source: thefinancesection.com

If you have two life insurance policies, there is no stipulation of nominating the same person. That limit is tied, in large part, to your income or net worth. The third policy would be a term insurance plan with a sum assured as per your family’s financial. The short answer is yes, you can have multiple policies. Multiple life insurance polices = more life coverage.

Source: goodfinancialcents.com

Source: goodfinancialcents.com

Can you claim two or more life insurance policies? Having multiple life insurance policies can give you peace of mind when it comes to planning for the future. Discover how the process works and how many policies you can have. If you have a term policy (or policies), it will continue to provide coverage until the term runs out. That can serve as a foundational life insurance policy.

Source: pinterest.ph

Source: pinterest.ph

Discover how the process works and how many policies you can have. Can you have more than one income protection policy? Some permanent life insurance policies have a cash value component, meaning the insurance company places a portion of your monthly or annual payments in a cash fund. Can you have two primary beneficiaries on life insurance? Your life insurance policies can be with one insurer or more than one insurer, it.

Source: helpandadvice.co.uk

Source: helpandadvice.co.uk

Often, it’s better to have a single policy that meets all your needs. What happens if you have two life insurance policies? The basic answer to this question is yes, you can have more than one life insurance policy, and, depending on your insurance provider, you may be able to save money by having all of your policies with the same company. For more information on life insurance policies, speak with a licensed agent. For example, once you get married, you’ll need to leave money to your spouse.

Source: pocketsense.com

Source: pocketsense.com

The sum assured of all the insurance policies should not exceed the human life value. If there is more than one primary beneficiary, the primary beneficiaries share the death benefit equally or in a percentage determined by the insured at the time of designation. Often, it’s better to have a single policy that meets all your needs. If you have two life insurance policies, there is no stipulation of nominating the same person. However, if you are taking out life insurance policies with numerous companies it is important to inform them.

Source: revisi.net

Source: revisi.net

Discover how the process works and how many policies you can have. Yes, you can have multiple life insurance policies in 2022. Can you claim two or more life insurance policies? But as your life expands, so will your need for life insurance coverage. It is possible to buy two or more life insurance policies for one person.

Source: ailife.com

Source: ailife.com

Yes, you can generally have two income protection policies. For example, if you have a home loan of rs. The beneficiary is the person who receives the death benefit from your insurance policy. Some permanent life insurance policies have a cash value component, meaning the insurance company places a portion of your monthly or annual payments in a cash fund. Discover how the process works and how many policies you can have.

Source: insuranceblogbychris.com

Source: insuranceblogbychris.com

This cash fund can earn interest as it grows. At that point, the $100,000 whole life policy will be insufficient. If you have a term policy (or policies), it will continue to provide coverage until the term runs out. There’s no law that prevents you from having a combination of different life insurance arrangements. Can you claim two or more life insurance policies?

Source: loanxpres.com

Source: loanxpres.com

But as your life expands, so will your need for life insurance coverage. You can have two or more life insurance policies as long as you are able to pay the premiums. Yes, you can have more than one life insurance policy. For example, if you have a home loan of rs. The short answer is yes, you can have multiple policies.

Source: revisi.net

Source: revisi.net

But as your life expands, so will your need for life insurance coverage. The sum assured of all the insurance policies should not exceed the human life value. There’s no law that prevents you from having a combination of different life insurance arrangements. But for most people’s circumstances, having one life insurance policy is usually enough. For example, if you have a home loan of rs.

Source: slideshare.net

Source: slideshare.net

Yes, if you die and you have multiple life insurance policies covering you at the time, a claim can be made against all of them. But as your life expands, so will your need for life insurance coverage. Can you have two primary beneficiaries on life insurance? It is possible to take out more than one life insurance policy on yourself in south africa, but if you opt for this route. The sum assured of all the insurance policies should not exceed the human life value.

Source: legacywealthcanada.com

Source: legacywealthcanada.com

The answer depends on the types of policies that you own, but each policy will continue to provide coverage as planned. Multiple life insurance polices = more life coverage. Although you can own more than one life insurance policy, you will be limited in the total amount of coverage you can get. There are certain restrictions on holding more than one life insurance plan. There’s no law that prevents you from having a combination of different life insurance arrangements.

Source: economictimes.indiatimes.com

Source: economictimes.indiatimes.com

That can serve as a foundational life insurance policy. Insurers will usually allow you to nominate up to 5 beneficiaries for each life insurance policy you have, although this depends on the provider. For example, once you get married, you’ll need to leave money to your spouse. That can serve as a foundational life insurance policy. That limit is tied, in large part, to your income or net worth.

Source: absoluteinsurance.com.au

Source: absoluteinsurance.com.au

That limit is tied, in large part, to your income or net worth. For more information on life insurance policies, speak with a licensed agent. There’s no law that prevents you from having a combination of different life insurance arrangements. It’s absolutely possible and legal to have multiple life insurance policies at once. Some permanent life insurance policies have a cash value component, meaning the insurance company places a portion of your monthly or annual payments in a cash fund.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title can i have two life insurance policies by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Claims vs occurrence based insurance Idea

- Cheap tablet insurance Idea

- Calling insurance leads Idea

- Disability insurance for postal workers Idea

- Business insurance peoria il information

- Bright health insurance reviews Idea

- Carrier liability vs cargo insurance Idea

- Can you insure a written off car Idea

- Can convicted felons get life insurance information

- Car insurance administrator Idea