Can i interest you in some car insurance information

Home » Trending » Can i interest you in some car insurance informationYour Can i interest you in some car insurance images are ready. Can i interest you in some car insurance are a topic that is being searched for and liked by netizens now. You can Find and Download the Can i interest you in some car insurance files here. Download all free vectors.

If you’re looking for can i interest you in some car insurance pictures information connected with to the can i interest you in some car insurance topic, you have visit the right site. Our site frequently provides you with suggestions for viewing the highest quality video and image content, please kindly search and locate more informative video content and graphics that fit your interests.

Can I Interest You In Some Car Insurance. If you�re looking for the easiest way to insure a car that�s not in your name, you can add the owner of the vehicle to your insurance policy as an additional interest. Annual premiums can generally be paid by credit or debit card. You can get car insurance for a car you do not own in certain cases, though many states and auto insurance company are not willing to do so. That’s because you need to show insurable interest in the vehicle, which means you’re the one who will be financially responsible for any damages that occur to your car.

One day car insurance by NoDepositCarInsuranceQuote issuu From issuu.com

One day car insurance by NoDepositCarInsuranceQuote issuu From issuu.com

But to pay monthly, you’ll have to make an initial payment and set up a direct debit for the remaining payments. Most auto loans are simple interest loans, which means that the amount of interest you pay each month is based on your loan balance on the day your payment is due. If you can prove an insurable interest, even though you don’t own it, you can insure the vehicle, but that may a difficult feat to achieve. Insurance companies want you to have insurable interest in the car, but policy terms and state laws vary. If someone else owns the car, that can be hard to prove. Some people do not want to make a claim with their friend’s (the car owner) insurance company.

This is called having insurable interest in the vehicle.

It’s best to wait until someone else becomes the registered owner of the car before any cancellation requests are sent. In a moment, i will get into specifics. How do you prove insurable interest? If the company won’t issue a refund and you feel you deserve it, you can file a complaint with the national association of insurance commissioners (naic). Additionally, you can make a claim for pain, suffering, medical bills and lost wages against the other car’s insurance company. There are some auto insurers, such as esurance, which allow you to take a policy out on a car you do not own.

Source: reddit.com

Source: reddit.com

No matter which payment method you pick, send your payment in on time to keep you from losing your insurance. Insurance companies want you to have insurable interest in the car, but policy terms and state laws vary. How do you prove insurable interest? Where you live can also make a difference in your car insurance rate. You typically cannot insure a car you don�t own, because you don�t have what�s called insurable interest in the car.

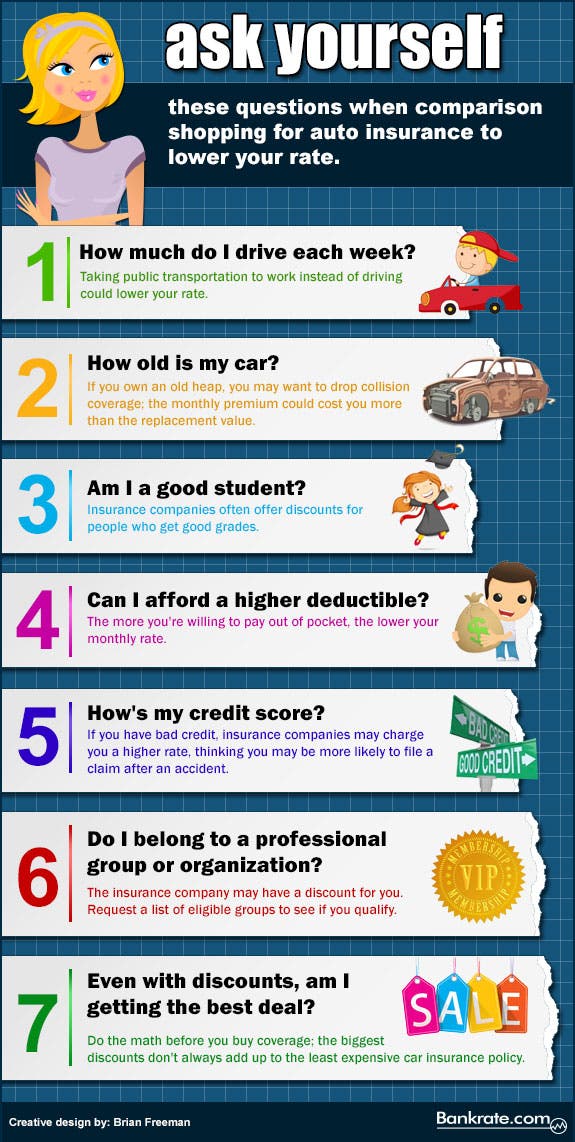

Source: bankrate.com

Source: bankrate.com

Once you select your plan, decide how you’ll pay. You may be offered the insurance by the dealership where you buy your car, by the bank or credit union where you finance your car, or through some auto insurance companies. If you can prove an insurable interest, even though you don’t own it, you can insure the vehicle, but that may a difficult feat to achieve. If you�re looking for the easiest way to insure a car that�s not in your name, you can add the owner of the vehicle to your insurance policy as an additional interest. With an amortized loan, part of.

Source: insurancewins.com

Source: insurancewins.com

Figuring out how to get car insurance on a car not in your name is often a tricky situation. Be sure to shop around for the best price, as it can vary. No, you cannot insure a car that is not registered under your name. Once you select your plan, decide how you’ll pay. And, some car insurance companies offer a commuter discount if you use public transportation during the week.

Source: pinterest.com

Source: pinterest.com

In a moment, i will get into specifics. Hello ladies i can save you money on your car insurance in 15 minutes or less. If you�re looking for the easiest way to insure a car that�s not in your name, you can add the owner of the vehicle to your insurance policy as an additional interest. Figuring out how to get car insurance on a car not in your name is often a tricky situation. Yes, you can take out an insurance policy on a car that’s already insured by someone else.

Source: directautoinsurance.org

Source: directautoinsurance.org

If you’re sold coverage you didn’t want, you can try for a refund from the car insurance company. Typically, the vehicle owner has an insurable interest because they have something to lose if the car is totaled, while someone who is not on the registration does not. Annual premiums can generally be paid by credit or debit card. If your car insurance company allows this, then you would still have to list. As such, you will pay interest on the amount borrowed, which will increase the total amount you pay for your car insurance.

Source: pinterest.com

Source: pinterest.com

No, you cannot insure a car that is not registered under your name. If your car insurance company allows this, then you would still have to list. As such, you will pay interest on the amount borrowed, which will increase the total amount you pay for your car insurance. It’s best to wait until someone else becomes the registered owner of the car before any cancellation requests are sent. If the policyholder’s estate and spouse no longer have an insurable interest in the car, you can cancel the policy entirely.

Source: issuu.com

Source: issuu.com

As such, you will pay interest on the amount borrowed, which will increase the total amount you pay for your car insurance. Most states allow insurance carriers to use credit scores as a factor in determining your car insurance premiums. You typically cannot insure a car you don�t own, because you don�t have what�s called insurable interest in the car. Typically, the higher your credit. However, where possible, it’s usually cheaper to add yourself to the car owner’s existing policy as a named driver.

Source: pinterest.com

Source: pinterest.com

In most cases, insurance companies won’t allow you to insure a car that’s not in your name. However, you may not get a full refund if you filed a claim. If you’re sold coverage you didn’t want, you can try for a refund from the car insurance company. And, some car insurance companies offer a commuter discount if you use public transportation during the week. You need to pay your premiums to keep your car insurance policy active.

Source: gingersnapcrafts.com

Source: gingersnapcrafts.com

With an amortized loan, part of. If you don’t have an insurable interest in a vehicle (meaning you’d be financially affected if anything happened to it) most car insurance companies will not allow you to insure it. Figuring out how to get car insurance on a car not in your name is often a tricky situation. Typically, the higher your credit. You need to pay your premiums to keep your car insurance policy active.

Source: en.dopl3r.com

Source: en.dopl3r.com

If you don’t have an insurable interest in a vehicle (meaning you’d be financially affected if anything happened to it) most car insurance companies will not allow you to insure it. However, where possible, it’s usually cheaper to add yourself to the car owner’s existing policy as a named driver. Yes, you can take out an insurance policy on a car that’s already insured by someone else. You can get car insurance for a car you do not own in certain cases, though many states and auto insurance company are not willing to do so. If you pay more than the minimum due, the interest you owe and your loan balance can decrease.

Source: ladblab.com

Source: ladblab.com

If your car insurance company allows this, then you would still have to list. You may be offered the insurance by the dealership where you buy your car, by the bank or credit union where you finance your car, or through some auto insurance companies. Typically, the vehicle owner has an insurable interest because they have something to lose if the car is totaled, while someone who is not on the registration does not. If you don’t have an insurable interest in a vehicle (meaning you’d be financially affected if anything happened to it) most car insurance companies will not allow you to insure it. Hello ladies i can save you money on your car insurance in 15 minutes or less.

Source: kappit.com

Source: kappit.com

You typically cannot insure a car you don�t own, because you don�t have what�s called insurable interest in the car. With an amortized loan, part of. If you’re sold coverage you didn’t want, you can try for a refund from the car insurance company. Typically, the vehicle owner has an insurable interest because they have something to lose if the car is totaled, while someone who is not on the registration does not. Where you live can also make a difference in your car insurance rate.

Source: dasherinsurance.com

Source: dasherinsurance.com

Additionally, you can make a claim for pain, suffering, medical bills and lost wages against the other car’s insurance company. The main issue comes down to ‘insurable interest’ in the vehicle. While you can often get a discount for paying in full, a payment plan might fit better in your budget. Where you live can also make a difference in your car insurance rate. Most states allow insurance carriers to use credit scores as a factor in determining your car insurance premiums.

Source: carinsurancecomparison.com

Source: carinsurancecomparison.com

No matter which payment method you pick, send your payment in on time to keep you from losing your insurance. No, you cannot insure a car that is not registered under your name. With an amortized loan, part of. If you don’t have an insurable interest in a vehicle (meaning you’d be financially affected if anything happened to it) most car insurance companies will not allow you to insure it. If you�re looking for the easiest way to insure a car that�s not in your name, you can add the owner of the vehicle to your insurance policy as an additional interest.

Source: soulwallet.com

Source: soulwallet.com

While you can often get a discount for paying in full, a payment plan might fit better in your budget. You need to pay your premiums to keep your car insurance policy active. Your friend’s car insurance should cover you. That’s because you need to show insurable interest in the vehicle, which means you’re the one who will be financially responsible for any damages that occur to your car. Hello ladies i can save you money on your car insurance in 15 minutes or less.

Source: etags.com

Source: etags.com

If you don’t have an insurable interest in a vehicle (meaning you’d be financially affected if anything happened to it) most car insurance companies will not allow you to insure it. If you pay more than the minimum due, the interest you owe and your loan balance can decrease. Once you select your plan, decide how you’ll pay. If you’re sold coverage you didn’t want, you can try for a refund from the car insurance company. Typically, the vehicle owner has an insurable interest because they have something to lose if the car is totaled, while someone who is not on the registration does not.

Source: pinterest.com

Source: pinterest.com

You need to pay your premiums to keep your car insurance policy active. While you can often get a discount for paying in full, a payment plan might fit better in your budget. Annual premiums can generally be paid by credit or debit card. If you’re sold coverage you didn’t want, you can try for a refund from the car insurance company. Your friend’s car insurance should cover you.

Source: etags.com

Source: etags.com

But to pay monthly, you’ll have to make an initial payment and set up a direct debit for the remaining payments. Typically, the vehicle owner has an insurable interest because they have something to lose if the car is totaled, while someone who is not on the registration does not. You need to pay your premiums to keep your car insurance policy active. If you don’t have an insurable interest in a vehicle (meaning you’d be financially affected if anything happened to it) most car insurance companies will not allow you to insure it. How do you prove insurable interest?

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title can i interest you in some car insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Claims vs occurrence based insurance Idea

- Cheap tablet insurance Idea

- Calling insurance leads Idea

- Disability insurance for postal workers Idea

- Business insurance peoria il information

- Bright health insurance reviews Idea

- Carrier liability vs cargo insurance Idea

- Can you insure a written off car Idea

- Can convicted felons get life insurance information

- Car insurance administrator Idea