Can i sue insurance company for not fixing my car information

Home » Trend » Can i sue insurance company for not fixing my car informationYour Can i sue insurance company for not fixing my car images are ready. Can i sue insurance company for not fixing my car are a topic that is being searched for and liked by netizens today. You can Find and Download the Can i sue insurance company for not fixing my car files here. Get all royalty-free images.

If you’re looking for can i sue insurance company for not fixing my car pictures information linked to the can i sue insurance company for not fixing my car keyword, you have come to the right blog. Our website always gives you suggestions for downloading the highest quality video and picture content, please kindly hunt and find more informative video articles and images that fit your interests.

Can I Sue Insurance Company For Not Fixing My Car. The prevalent general rule is that an automobile insurance company is not allowed to be made a named defendant to a lawsuit against the insurance policy holder, unless it is allowable through statute or by the policy itself. A state representative will conduct an. Your insurance company will generally declare your car a total loss if the cost to repair it exceeds a certain percentage of the car’s value you can dispute a total loss settlement, but you’ll need lots of evidence to back up your dispute usually, a totaled car goes to a salvage yard, but you can choose to keep your vehicle. Without an experienced attorney you can expect the process of suing an insurance company to be long and difficult.

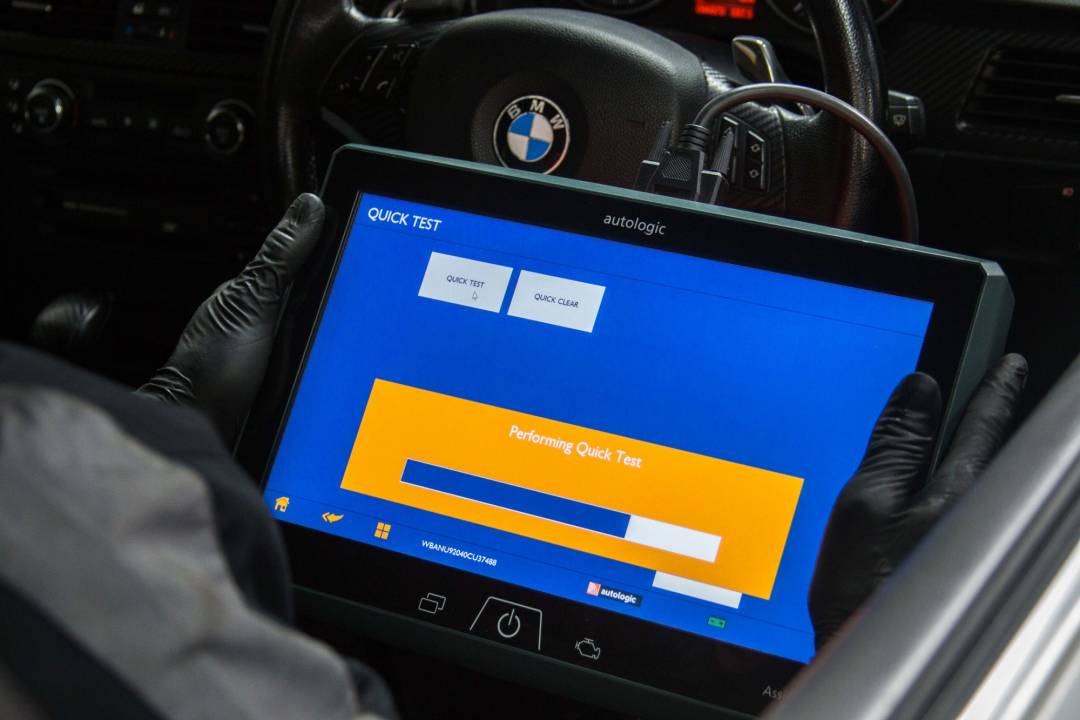

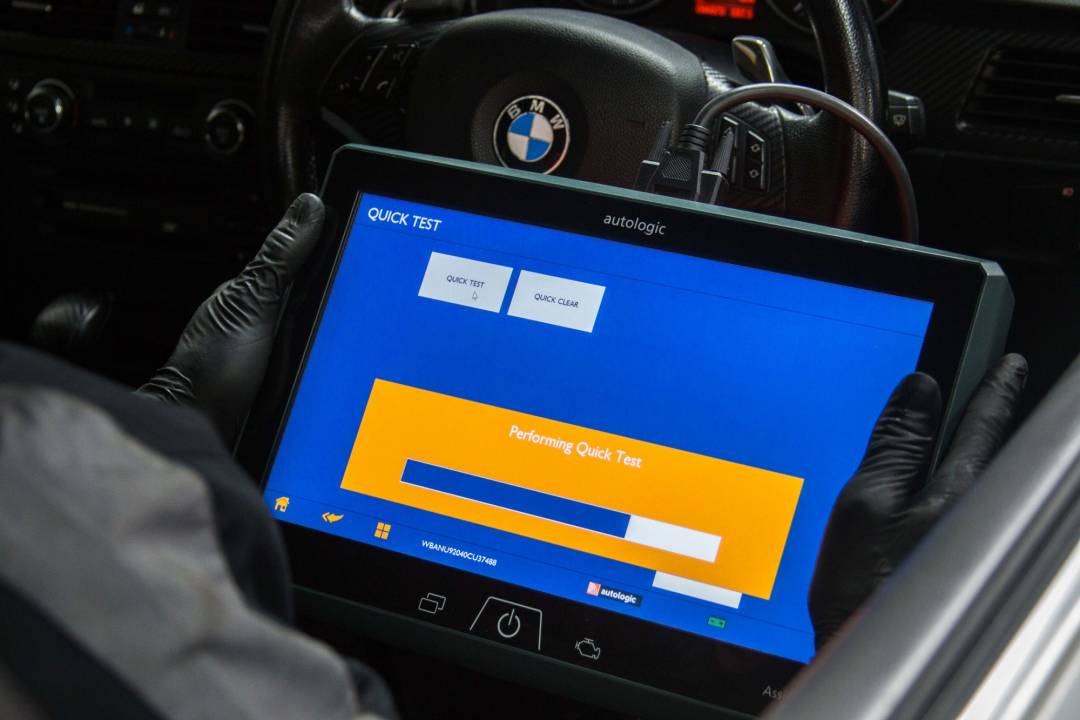

Car Computer Diagnostics SD European Waikato From sdeuropean.co.nz

Car Computer Diagnostics SD European Waikato From sdeuropean.co.nz

If the private appraisal doesn�t persuade the insurer to change its position, you can turn to your local department of insurance. Even though it is their own insurance company. If you win at trial but the other driver’s company refuses to pay, you generally cannot sue the insurance company for “bad faith.” this is because the duty of good faith is owed to the insured, not to injured third parties. However insurance company is only liable for the vehicles value if it is a total loss which it appears in this case. If you run into this situation, where the insurance company will not pay, you can have your own insurance company fix the car, if you had collision coverage. If you did not have collision coverage, then hopefully you have enough.

If you win at trial but the other driver’s company refuses to pay, you generally cannot sue the insurance company for “bad faith.” this is because the duty of good faith is owed to the insured, not to injured third parties.

Your insurance company will then pursue the process of subrogation, where it recovers part or all of the claim. If your policy includes the collision coverage, your car insurance company should be able to pay the claim. If the private appraisal doesn�t persuade the insurer to change its position, you can turn to your local department of insurance. They are not required to buy you new car. Without an experienced attorney you can expect the process of suing an insurance company to be long and difficult. You can sue your insurance company if they violate or fail the terms of the insurance policy.

Source: anderson-cummings.com

Source: anderson-cummings.com

However, the insurance company may reduce the amount of your damages by the proportionate share that you are responsible for the accident. A state representative will conduct an. You were lawfully parked and your car was damaged, so they must pay. The cost of getting an appraisal from an expert varies (i charge $350), and when dealing with another person’s insurance company, there is no guarantee that getting an appraisal will change their mind about the value of your car. Dealing with insurance claim denial.

Source: documentshub.com

Source: documentshub.com

Instead, the insurance company indemnifies the defendant for some or all damages per their insurance policy guidelines. If you contact the police, they will tell you that it is a civil matter and to handle it in court. You could sue her in small claims and handle the matter yourself. They are not required to buy you new car. They can sue the other driver/owner to get their money back.

Update your profile answered on jan 10th, 2014 at 5:17 am you can always sue the insurance company. However insurance company is only liable for the vehicles value if it is a total loss which it appears in this case. The police left a note on my car saying they know the owner of the vehicle and it’s insurance company (progressive)… however the owner of the vehicle is saying that he did not do it and that his car was stolen.he also filed a police report.progressive is saying that they are most likely not going to pay for my car because the owner was. Answered on may 20th, 2015 at 2:20 pm. Without an experienced attorney you can expect the process of suing an insurance company to be long and difficult.

Source: ryanagency.com

Source: ryanagency.com

The challenge is that often the insurance company looks to find trivial or untrue reasons to deny a. If you own your car outright, you can choose to not repair your vehicle for financial reasons, or delay repairs with the money you receive from an auto insurance payout. Usually, you can collect damages from the insurance company if you are no more than 50 percent at fault for the accident, depending on state law. There are several factors to consider when determining if suing an auto insurance company is the best course of action. The insurance representative will not talk to you about the matter any further once a lawyer gets involved.

Source: carbrain.com

The best car accident lawyers in new york and california offer this advice, you need to file a. Simply put, you do not have to use any of the compensation you. The best car accident lawyers in new york and california offer this advice, you need to file a. In most cases, you have to be willing and able to get an appraisal, and sue the at fault person. A state representative will conduct an.

Source: dallasnews.com

Source: dallasnews.com

Write to the car insurance company asking them to continue working with you on. You were lawfully parked and your car was damaged, so they must pay. However insurance company is only liable for the vehicles value if it is a total loss which it appears in this case. If your policy includes the collision coverage, your car insurance company should be able to pay the claim. Who’s liable for the accident

Source: gravelylaw.com

Source: gravelylaw.com

Answered on may 20th, 2015 at 2:20 pm. The insurance representative will not talk to you about the matter any further once a lawyer gets involved. Filing a lawsuit will change the relationship you have with your auto insurance agent. You cannot sue the defendants’ insurance company directly. Whether or not the other driver is on the policy is irrelevant.

Source: revisi.net

Source: revisi.net

- you can file a claim with your own insurance company to cover the cost of damages, 2) sue the driver outright for the full cost of losses, including medical bills and towing costs, and 3) hire a car accident attorney to help. Common violations include not paying claims in a timely fashion, not paying properly filed claims, or making bad faith claims. The prevalent general rule is that an automobile insurance company is not allowed to be made a named defendant to a lawsuit against the insurance policy holder, unless it is allowable through statute or by the policy itself. If the deadline has come and gone, then you can sue them in court for the value of your vehicle at the time the repairs were started, plus the time for work missed, fees, rental, etc. It’s most common to sue a car insurance company if the at fault parties auto insurance company denies your claim or refuses to payout a fair settlement.

Source: valientemott.com

Source: valientemott.com

If you win at trial but the other driver’s company refuses to pay, you generally cannot sue the insurance company for “bad faith.” this is because the duty of good faith is owed to the insured, not to injured third parties. Working with the insurance company. The prevalent general rule is that an automobile insurance company is not allowed to be made a named defendant to a lawsuit against the insurance policy holder, unless it is allowable through statute or by the policy itself. Without an experienced attorney you can expect the process of suing an insurance company to be long and difficult. You were lawfully parked and your car was damaged, so they must pay.

Source: dentmasters.com

Source: dentmasters.com

Your insurance company will generally declare your car a total loss if the cost to repair it exceeds a certain percentage of the car’s value you can dispute a total loss settlement, but you’ll need lots of evidence to back up your dispute usually, a totaled car goes to a salvage yard, but you can choose to keep your vehicle. However insurance company is only liable for the vehicles value if it is a total loss which it appears in this case. If you run into this situation, where the insurance company will not pay, you can have your own insurance company fix the car, if you had collision coverage. Update your profile answered on jan 10th, 2014 at 5:17 am you can always sue the insurance company. Who’s liable for the accident

Source: autoblog.com

Source: autoblog.com

Whether or not the other driver is on the policy is irrelevant. 1) you can file a claim with your own insurance company to cover the cost of damages, 2) sue the driver outright for the full cost of losses, including medical bills and towing costs, and 3) hire a car accident attorney to help. By the time a claim investigator formally refuses to pay for your bodily injury and/or property damages, he or she has already gathered enough. The insurance company will want to delay paying your claim, especially if they have grounds for denying the claim. Their insured might now be in jail or their insured may not talk to the insurance company at all;

Source: wikihow.com

Source: wikihow.com

You cannot sue the defendants’ insurance company directly. The cost of getting an appraisal from an expert varies (i charge $350), and when dealing with another person’s insurance company, there is no guarantee that getting an appraisal will change their mind about the value of your car. Even though it is their own insurance company. Posted on jul 30, 2012 yes, you could theoretically sue the lady, but not her insurance directly. The best car accident lawyers in new york and california offer this advice, you need to file a.

Source: kenyachambermines.com

Source: kenyachambermines.com

If the private appraisal doesn�t persuade the insurer to change its position, you can turn to your local department of insurance. The answer is not simple, as you own insurance carrier may not be the one responsible for repairing your car after an accident. You could sue her in small claims and handle the matter yourself. If you have other policies with the company, that may become a problem. Posted on jul 30, 2012 yes, you could theoretically sue the lady, but not her insurance directly.

Source: carwise.com

Source: carwise.com

There are several factors to consider when determining if suing an auto insurance company is the best course of action. Dealing with insurance claim denial. Usually, you can collect damages from the insurance company if you are no more than 50 percent at fault for the accident, depending on state law. Simply put, you do not have to use any of the compensation you. The following regulatory violations may support a lawsuit against your insurance company for treating you unfairly:

Source: sdeuropean.co.nz

Source: sdeuropean.co.nz

Working with the insurance company. Write to the car insurance company asking them to continue working with you on. The answer is not simple, as you own insurance carrier may not be the one responsible for repairing your car after an accident. Dealing with insurance claim denial. Usually, you can collect damages from the insurance company if you are no more than 50 percent at fault for the accident, depending on state law.

Source: philnews.ph

Source: philnews.ph

The insurance company will want to delay paying your claim, especially if they have grounds for denying the claim. Following a car accident, many people wonder if they can sue the insurance company for not fixing their car after an accident. Posted on jul 30, 2012 yes, you could theoretically sue the lady, but not her insurance directly. Instead, the insurance company indemnifies the defendant for some or all damages per their insurance policy guidelines. However, the insurance company may reduce the amount of your damages by the proportionate share that you are responsible for the accident.

Source: wissnerlaw.com

Source: wissnerlaw.com

Their insured might now be in jail or their insured may not talk to the insurance company at all; The cost of getting an appraisal from an expert varies (i charge $350), and when dealing with another person’s insurance company, there is no guarantee that getting an appraisal will change their mind about the value of your car. Who’s liable for the accident Usually, you can collect damages from the insurance company if you are no more than 50 percent at fault for the accident, depending on state law. You can sue your insurance company if the carrier treats you unfairly.

Source: npa1.org

Source: npa1.org

Common violations include not paying claims in a timely fashion, not paying properly filed claims, or making bad faith claims. It’s up to you to take action following an initial denial or refusal by the insurance company. The insurance representative will not talk to you about the matter any further once a lawyer gets involved. However, insurance companies are required by law to timely pay out a properly filed insurance claim. Who’s liable for the accident

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title can i sue insurance company for not fixing my car by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Craft insurance arab al Idea

- Colonial life insurance claims Idea

- Business insurance and benefits information

- Deans and homer insurance Idea

- Crown cost without insurance information

- Delmonico insurance syracuse ny Idea

- Department of insurance and financial services michigan duties information

- Cost of eye exam with insurance Idea

- Cashless hospital list under national insurance company Idea

- Crowel insurance agency information