Can i switch life insurance companies information

Home » Trending » Can i switch life insurance companies informationYour Can i switch life insurance companies images are available in this site. Can i switch life insurance companies are a topic that is being searched for and liked by netizens today. You can Find and Download the Can i switch life insurance companies files here. Download all free photos and vectors.

If you’re searching for can i switch life insurance companies images information related to the can i switch life insurance companies keyword, you have visit the right blog. Our site always provides you with suggestions for seeing the maximum quality video and picture content, please kindly surf and locate more enlightening video articles and images that fit your interests.

Can I Switch Life Insurance Companies. Before making this move, there are just a few things you need to do beforehand. You can serve lic of india for the remaining period and then renew it. If you choose to switch life insurance companies, you will need to apply for cover. Contestable period a new policy may have a contestable period.

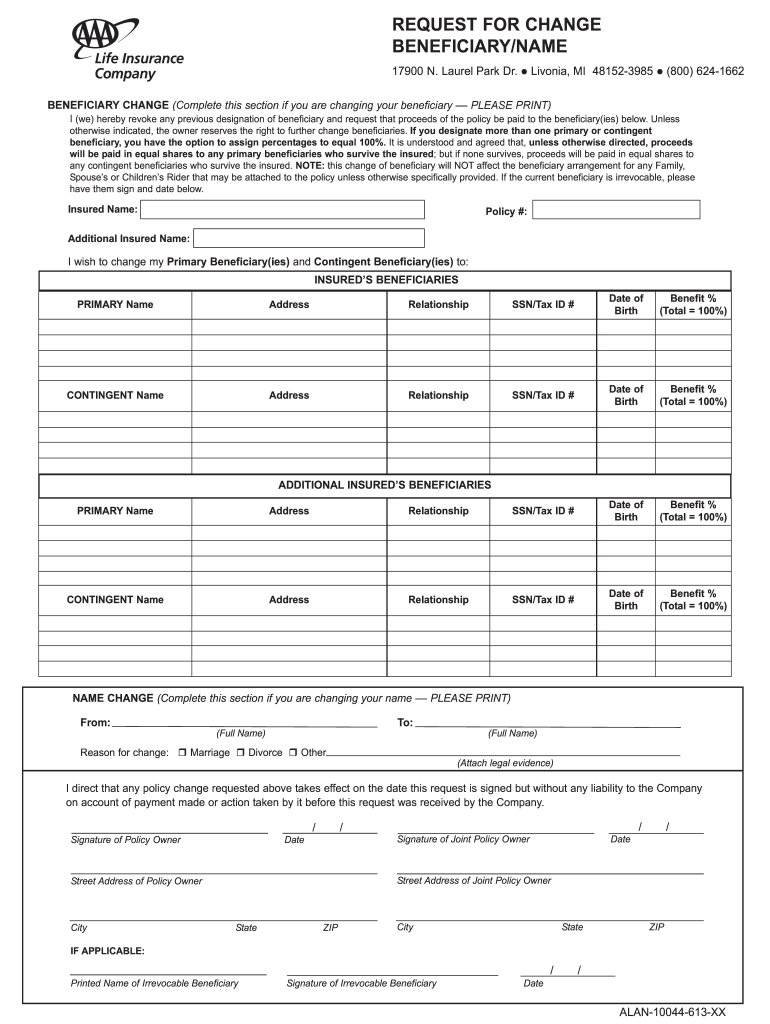

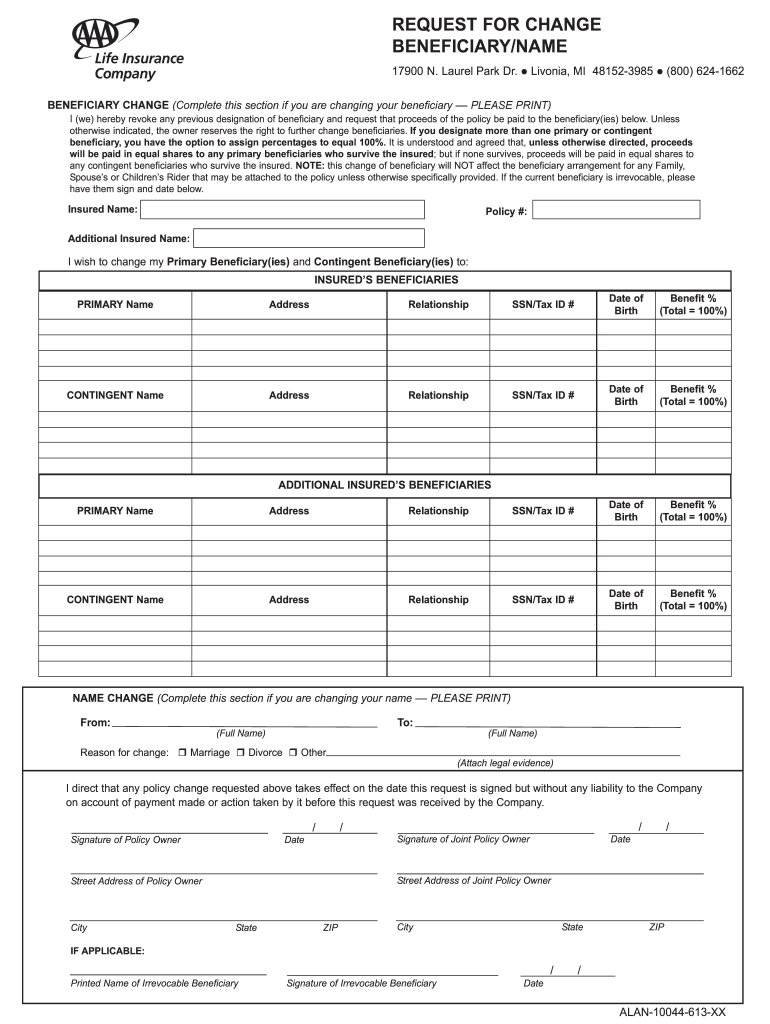

Aaa Life Insurance Company Change Of Beneficicary Form From signnow.com

Aaa Life Insurance Company Change Of Beneficicary Form From signnow.com

Before making this move, there are just a few things you need to do beforehand. Collect noc from bajaj allianz lic. Contestable period a new policy may have a contestable period. If you have permanent insurance with cash value, the replacement will involve a 1035 exchange to get the cash from one policy to another. This license will be with sponsor company (in your case bajaj allianz lic) and will be valid for 3 years. If it changes the cost of your premium, consider shopping around.

Your current provider is likely able to convert, replace or supplement your existing.

It is possible to transfer the essence of one life insurance policy from one company to another. The provider will assess your application and decide whether they can offer a policy, and on what terms. Before you change or cancel your life insurance as the policyholder of your life insurance policy, you are in control of your life insurance policy choices. In case, at a future point of time you find a better term insurance plan, you can surely shift to that plan. Contestable period a new policy may have a contestable period. You can switch life insurance policies if you need more coverage or lower premiums for your policy.

Source: revisi.net

Source: revisi.net

This license will be with sponsor company (in your case bajaj allianz lic) and will be valid for 3 years. The process involves the transfer of cash values from one policy contract to another so that the transaction qualifies under law. There are some other warning signs that you might consider as you think about switching life insurance companies. Nearly all insurance companies will allow you to switch your policy to a new vehicle and will alter the policy to reflect the change. If it changes the cost of your premium, consider shopping around.

Source: scottzlateff.com

Source: scottzlateff.com

But there are a few things to consider before you go ahead and change your insurance policy provider. Switching life insurance is easy and straightforward and it’s possible to do at any time. No, changing your life insurance provider is not illegal. If you have permanent insurance with cash value, the replacement will involve a 1035 exchange to get the cash from one policy to another. In case, at a future point of time you find a better term insurance plan, you can surely shift to that plan.

Source: revisi.net

Source: revisi.net

Yes, you can switch life insurance companies by the process of replacement, or by dropping your old policy and purchasing a new one. Neither beneficiaries nor life insurance policies can be changed without your consent. Nearly all insurance companies will allow you to switch your policy to a new vehicle and will alter the policy to reflect the change. Once you’ve found your new policy, you can contact your previous insurer and cancel the policy. It’s worth researching and comparing your options — you might decide to add coverage or keep multiple policies instead.

Source: dsdinsurance.com

Source: dsdinsurance.com

Can i switch life insurance companies and is it easy? Just remember to check the price of premiums before you move. Approach any do from life insurance corp. Yes, you can switch life insurance companies by the process of replacement, or by dropping your old policy and purchasing a new one. If you choose to switch life insurance companies, you will need to apply for cover.

Source: templateroller.com

Source: templateroller.com

Neither beneficiaries nor life insurance policies can be changed without your consent. But the replacement of a policy from one company with a policy from a different company is regulated, so you’ll want to work with an insurance agent to make sure the process goes smoothly and according to the rules. The process involves the transfer of cash values from one policy contract to another so that the transaction qualifies under law. Of india with that noc and your irda license copy. When you buy a home insurance policy, it’s not a contract for life.

Source: noclutter.cloud

Source: noclutter.cloud

Life insurance is the passing of the risk of financial loss on your death from you to the insurer in exchange for a few quid. Before settling on a choice that matches your needs, there are some important things that you need to take into consideration. Yes, you can change life insurance companies and take out a policy with another provider. The process involves the transfer of cash values from one policy contract to another so that the transaction qualifies under law. However, you could pay more with a new policy or hand more tax responsibility to your loved ones.

Source: sappscarpetcare.com

Source: sappscarpetcare.com

You could amend your life cover with your current insurer, or switch by cancelling your insurance and looking for a better deal. If you have permanent insurance with cash value, the replacement will involve a 1035 exchange to get the cash from one policy to another. The process involves the transfer of cash values from one policy contract to another so that the transaction qualifies under law. This article describes the steps involved. The only exception to this may be if the beneficiary on your life insurance policy is irrevocable.

Source: mywisefinances.com

Source: mywisefinances.com

In case, at a future point of time you find a better term insurance plan, you can surely shift to that plan. The first thing you should do is review your current insurance policy. You can serve lic of india for the remaining period and then renew it. But there are a few things to consider before you go ahead and change your insurance policy provider. Before settling on a choice that matches your needs, there are some important things that you need to take into consideration.

Source: univistainsuranceorlando.com

Source: univistainsuranceorlando.com

The process involves the transfer of cash values from one policy contract to another so that the transaction qualifies under law. The only exception to this may be if the beneficiary on your life insurance policy is irrevocable. It’s worth researching and comparing your options — you might decide to add coverage or keep multiple policies instead. You can switch life insurance policies if you need more coverage or lower premiums for your policy. How can i change my insurance company?

Source: noclutter.cloud

Source: noclutter.cloud

If it changes the cost of your premium, consider shopping around. Consider setting aside the additional money you’re willing to put toward higher premiums into your hsa until you can switch plans. Switching to a new provider means you will have to pay the upfront fees again. Can you change life insurance providers? This article describes the steps involved.

Source: locallifeagents.com

Source: locallifeagents.com

The only exception to this may be if the beneficiary on your life insurance policy is irrevocable. Consider setting aside the additional money you’re willing to put toward higher premiums into your hsa until you can switch plans. You can switch life insurance policies if you need more coverage or lower premiums for your policy. Before settling on a choice that matches your needs, there are some important things that you need to take into consideration. There may be a small administration fee involved.

Source: noclutter.cloud

Source: noclutter.cloud

Before settling on a choice that matches your needs, there are some important things that you need to take into consideration. The provider will assess your application and decide whether they can offer a policy, and on what terms. But the replacement of a policy from one company with a policy from a different company is regulated, so you’ll want to work with an insurance agent to make sure the process goes smoothly and according to the rules. It’s worth researching and comparing your options — you might decide to add coverage or keep multiple policies instead. Your current provider is likely able to convert, replace or supplement your existing.

Source: foxivision.com

Source: foxivision.com

However, it is illegal for a life insurance agent to steer a consumer into changing a policy that. Switching to a new provider means you will have to pay the upfront fees again. What happens if you switch life insurance companies? Life insurance is the passing of the risk of financial loss on your death from you to the insurer in exchange for a few quid. However, please bear in mind that it will be like buying a new policy.

Source: signnow.com

Source: signnow.com

Switching life insurance is easy and straightforward and it’s possible to do at any time. Yes, you can change life insurance companies and take out a policy with another provider. However, it is illegal for a life insurance agent to steer a consumer into changing a policy that. No, changing your life insurance provider is not illegal. You could amend your life cover with your current insurer, or switch by cancelling your insurance and looking for a better deal.

Source: techjaun.com

Source: techjaun.com

You could amend your life cover with your current insurer, or switch by cancelling your insurance and looking for a better deal. However, it is illegal for a life insurance agent to steer a consumer into changing a policy that. Life insurance is the passing of the risk of financial loss on your death from you to the insurer in exchange for a few quid. If you choose to switch life insurance companies, you will need to apply for cover. There may be a small administration fee involved.

Source: briefly.co.za

Source: briefly.co.za

Just remember to check the price of premiums before you move. Before settling on a choice that matches your needs, there are some important things that you need to take into consideration. What happens if you switch life insurance companies? If it changes the cost of your premium, consider shopping around. Mar 4th 2019 2 min read

Source: slideshare.net

Source: slideshare.net

This license will be with sponsor company (in your case bajaj allianz lic) and will be valid for 3 years. Before you change or cancel your life insurance as the policyholder of your life insurance policy, you are in control of your life insurance policy choices. Your current provider is likely able to convert, replace or supplement your existing. Approach any do from life insurance corp. When you buy a home insurance policy, it’s not a contract for life.

Source: 5.websitesbyica.com

Source: 5.websitesbyica.com

This article describes the steps involved. The provider will assess your application and decide whether they can offer a policy, and on what terms. You can switch life insurance policies if you need more coverage or lower premiums for your policy. No, changing your life insurance provider is not illegal. Nearly all insurance companies will allow you to switch your policy to a new vehicle and will alter the policy to reflect the change.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title can i switch life insurance companies by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Claims vs occurrence based insurance Idea

- Cheap tablet insurance Idea

- Calling insurance leads Idea

- Disability insurance for postal workers Idea

- Business insurance peoria il information

- Bright health insurance reviews Idea

- Carrier liability vs cargo insurance Idea

- Can you insure a written off car Idea

- Can convicted felons get life insurance information

- Car insurance administrator Idea