Can i take 2 health insurance plans information

Home » Trend » Can i take 2 health insurance plans informationYour Can i take 2 health insurance plans images are ready. Can i take 2 health insurance plans are a topic that is being searched for and liked by netizens today. You can Get the Can i take 2 health insurance plans files here. Find and Download all royalty-free photos and vectors.

If you’re searching for can i take 2 health insurance plans pictures information connected with to the can i take 2 health insurance plans interest, you have visit the right blog. Our site frequently gives you hints for seeing the maximum quality video and image content, please kindly hunt and locate more enlightening video content and images that fit your interests.

Can I Take 2 Health Insurance Plans. Can i take health insurance plan for my parents who are senior citizen? Better to take a good health plan and all expenses for terminal illness after death can be paid from the assets one leaves behind withou burdening the children. In other words, he cannot profit from health insurance. If your plan through your own job is free, and your partner can add you to their plan for low cost, you should keep both plans.

How long does cobra insurance last insurance From greatoutdoorsabq.com

How long does cobra insurance last insurance From greatoutdoorsabq.com

Choosing term insurance based on one’s current liabilities that change with time is not only crucial but also aligning multiple insurance plans of varying covers and terms with various life stages is a wise idea that gives the policyholder the freedom to continue or discontinue policies upon reviewing one’s needs. But in other cases, the added premium payment and deductible might increase your overall health expenses and cause further complications. Can i take 2 health insurance plans. If you don’t find your drug on the formulary but your doctor says it’s medically necessary for you to take that specific […] Before these modifications, every health insurance plan included a contribution clause. Just to mention that amount of insurance normally depends on your income.

To answer simply, yes you can buy term insurance of 2 seperate companies of rs.1 cr each.

Can i take two policies and get claims under both of them? Just to mention that amount of insurance normally depends on your income. If your plan through your own job is free, and your partner can add you to their plan for low cost, you should keep both plans. The modifications have made the procedure easier and simpler. He can avail the benefits one at a time. The “formulary” is a list of prescription drugs the plan will cover.

Source: pinterest.com

Source: pinterest.com

Net net it is foolish to insure oneself when protection from loss has no meaning…like paying car insurance even after it. The “formulary” is a list of prescription drugs the plan will cover. Can i take two policies and get claims under both of them? They also provide me $500 towards my hsa account per year. The wider a policy is in terms of coverage and sum insured, the better it is for you as it would take care of your needs.

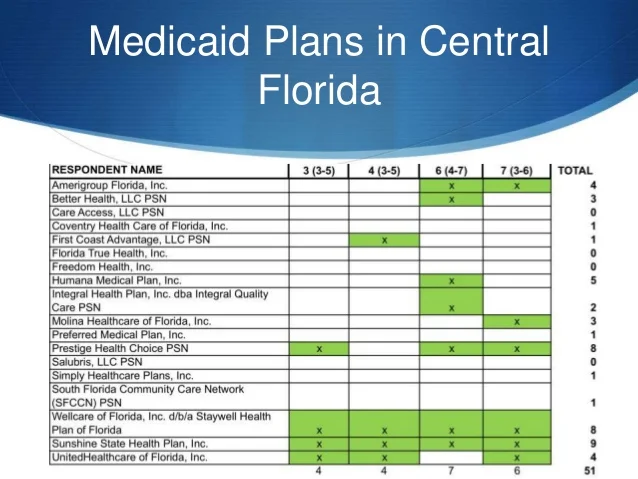

Source: slideshare.net

Source: slideshare.net

He can avail the benefits one at a time. The “formulary” is a list of prescription drugs the plan will cover. Read on to learn more about the pros and cons of having dual health insurance coverage. The wider a policy is in terms of coverage and sum insured, the better it is for you as it would take care of your needs. If you don’t find your drug on the formulary but your doctor says it’s medically necessary for you to take that specific […]

Source: pinterest.com

Source: pinterest.com

A term insurance policy is a specifically designed life insurance policy that protects an individual’s family and provides them financial security in case of any eventualities. Like most insurance plans, an individual pays a premium for a given term. However, not advisable to ha. It’s a delicate balance but you can sometimes find the right combination after careful research. Yes a person can be covered by two health insurance plans.

Source: bjsm.bmj.com

Source: bjsm.bmj.com

From the above illustration, it is evident that. If you don’t find your drug on the formulary but your doctor says it’s medically necessary for you to take that specific […] The “formulary” is a list of prescription drugs the plan will cover. A term insurance policy is a specifically designed life insurance policy that protects an individual’s family and provides them financial security in case of any eventualities. You can buy two or more term insurance plans to fulfill your insurance needs.

Source: singlecare.com

Source: singlecare.com

My parent�s plan premium is $3000/year to get: To answer simply, yes you can buy term insurance of 2 seperate companies of rs.1 cr each. It’s a delicate balance but you can sometimes find the right combination after careful research. Now, if the claim amount is less than the sum assured, the contribution clause is not. In addition to such a medical expenses insurance policy, i suggest you to buy a critical illness benefit insurance policy.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

It is possible to enhance your financial protection with two term life insurance policies. Benefits of two term insurance plans. The “formulary” is a list of prescription drugs the plan will cover. This is a great way to diversify across insurers and benefit from their coverage policies. If the individual passes away during that term because of an accident or due to health reasons, the.

Source: revisi.net

Source: revisi.net

Better to take a good health plan and all expenses for terminal illness after death can be paid from the assets one leaves behind withou burdening the children. Moreover, claims are settled as per the contribution clause, when the claim is higher than the sum insured for one policy. You can ensure coverage for the changing insurance needs at different stages and increase the chances of a successful claim settlement. So you need to check eligibility before going for rs.1cr. It is possible to enhance your financial protection with two term life insurance policies.

Source: blog.lingoapp.com

Source: blog.lingoapp.com

Like most insurance plans, an individual pays a premium for a given term. Can i take 2 health insurance plans. It is possible to have more than one beneficiary for the insurance plan. Just to mention that amount of insurance normally depends on your income. It is possible to enhance your financial protection with two term life insurance policies.

Source: pinterest.com

Source: pinterest.com

Is there any tax benefit available if i pay premium for them? You can ensure coverage for the changing insurance needs at different stages and increase the chances of a successful claim settlement. This is a great way to diversify across insurers and benefit from their coverage policies. What is a term insurance policy? Can i take health insurance plan for my parents who are senior citizen?

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

He can avail the benefits one at a time. However, make sure that you disclose all the information of the existing policy before buying the second one. If the sum insured is greater than the claim. My employer premium is about 1020$/year to get: In the case of a claim, each insurer will contribute an amount equivalent to the ratio of the sum assured.

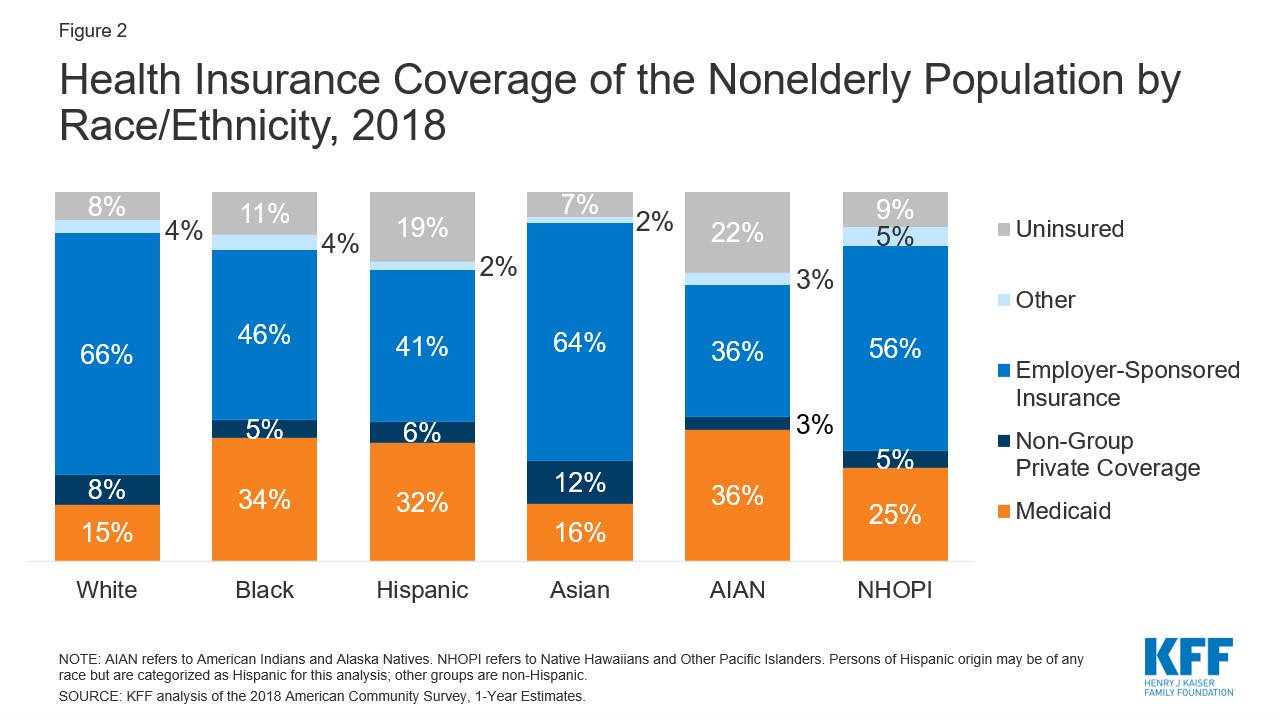

Source: kff.org

Source: kff.org

If your plan through your own job is free, and your partner can add you to their plan for low cost, you should keep both plans. Before these modifications, every health insurance plan included a contribution clause. It is possible to have more than one beneficiary for the insurance plan. You need to submit a. Buying separate health insurance plans can help mitigate your premium spending.

Source: sampletemplates.com

Source: sampletemplates.com

It is possible to have more than one beneficiary for the insurance plan. It is possible to enhance your financial protection with two term life insurance policies. A term insurance policy is a specifically designed life insurance policy that protects an individual’s family and provides them financial security in case of any eventualities. They also provide me $500 towards my hsa account per year. My employer premium is about 1020$/year to get:

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

So you need to check eligibility before going for rs.1cr. You can buy two or more term insurance plans to fulfill your insurance needs. Read on to learn more about the pros and cons of having dual health insurance coverage. If you don’t find your drug on the formulary but your doctor says it’s medically necessary for you to take that specific […] It is possible to have more than one beneficiary for the insurance plan.

Source: revisi.net

Source: revisi.net

You can buy two or more term insurance plans to fulfill your insurance needs. Can i take 2 health insurance plans. Can i take two policies and get claims under both of them? The “formulary” is a list of prescription drugs the plan will cover. You need to submit a.

Source: heart.bmj.com

Source: heart.bmj.com

The wider a policy is in terms of coverage and sum insured, the better it is for you as it would take care of your needs. Net net it is foolish to insure oneself when protection from loss has no meaning…like paying car insurance even after it. You can buy two or more term insurance plans to fulfill your insurance needs. Thus, it is advisable to take the insurance for the term required. The “formulary” is a list of prescription drugs the plan will cover.

Source: techcurry.co

Source: techcurry.co

Better to take a good health plan and all expenses for terminal illness after death can be paid from the assets one leaves behind withou burdening the children. Benefits of two term insurance plans. My employer premium is about 1020$/year to get: If your plan through your own job is free, and your partner can add you to their plan for low cost, you should keep both plans. He can avail the benefits one at a time.

Source: firstquotehealth.com

Source: firstquotehealth.com

The modifications have made the procedure easier and simpler. However, not advisable to ha. Better to take a good health plan and all expenses for terminal illness after death can be paid from the assets one leaves behind withou burdening the children. Net net it is foolish to insure oneself when protection from loss has no meaning…like paying car insurance even after it. Moreover, claims are settled as per the contribution clause, when the claim is higher than the sum insured for one policy.

Source: policybachat.com

Source: policybachat.com

Suppose you have two health. It is possible to enhance your financial protection with two term life insurance policies. Like most insurance plans, an individual pays a premium for a given term. Thus, it is advisable to take the insurance for the term required. However, make sure that you disclose all the information of the existing policy before buying the second one.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title can i take 2 health insurance plans by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Craft insurance arab al Idea

- Colonial life insurance claims Idea

- Business insurance and benefits information

- Deans and homer insurance Idea

- Crown cost without insurance information

- Delmonico insurance syracuse ny Idea

- Department of insurance and financial services michigan duties information

- Cost of eye exam with insurance Idea

- Cashless hospital list under national insurance company Idea

- Crowel insurance agency information