Can i take 2 term insurance information

Home » Trending » Can i take 2 term insurance informationYour Can i take 2 term insurance images are ready in this website. Can i take 2 term insurance are a topic that is being searched for and liked by netizens now. You can Get the Can i take 2 term insurance files here. Download all royalty-free vectors.

If you’re searching for can i take 2 term insurance images information related to the can i take 2 term insurance topic, you have come to the ideal site. Our site frequently gives you hints for seeing the highest quality video and picture content, please kindly surf and find more informative video content and images that fit your interests.

Can I Take 2 Term Insurance. Choose the sum assured you wish to opt for along with the number of years you need it for on the term insurance calculator step 3: Can nri’s buy term insurance? In such case, if one is in doubt, one can take a policy for slightly higher term. It is possible to have more than one beneficiary for the insurance plan.

Secret life insurance policies Can someone take a life From pinterest.com

Secret life insurance policies Can someone take a life From pinterest.com

However, permanent insurance does not expire and provides coverage for. In such case, if one is in doubt, one can take a policy for slightly higher term. £25,000 family income benefit life insurance over 10 years will cost around £10 per month amounting to £1,200 over 10 years. Permanent life insurance is typically more expensive than term insurance. Term insurance provides coverage for only a specified duration. Know the risks, benefits and coverage of the plans.

Some other insurance policies will have an ‘excess clause’.

You can buy two or more term insurance plans to fulfill your insurance needs. They can, but there is a catch. Know the risks, ben… read more. Now there are two ways you can achieve this: Yes you can use two term insurance policies, but before buying the second policy you need to inform the company that you already have another policy from other company so than based on you income they will check if your eligible of second policy with the term amount of 1 cr, if your eligible you can go ahead and buy the second policy. Although the decision on the number of policies.

Source: stumbleforward.com

Source: stumbleforward.com

Can nri’s buy term insurance? £250,000 mortgage decreasing life insurance over 30 years will cost around £15 per month amounting to £5,400 over 30 years. And so does your insurance coverage needs. How much time does it take for a claim settlement? Buy a new term life insurance as your eligibility and responsibility (family) grows.

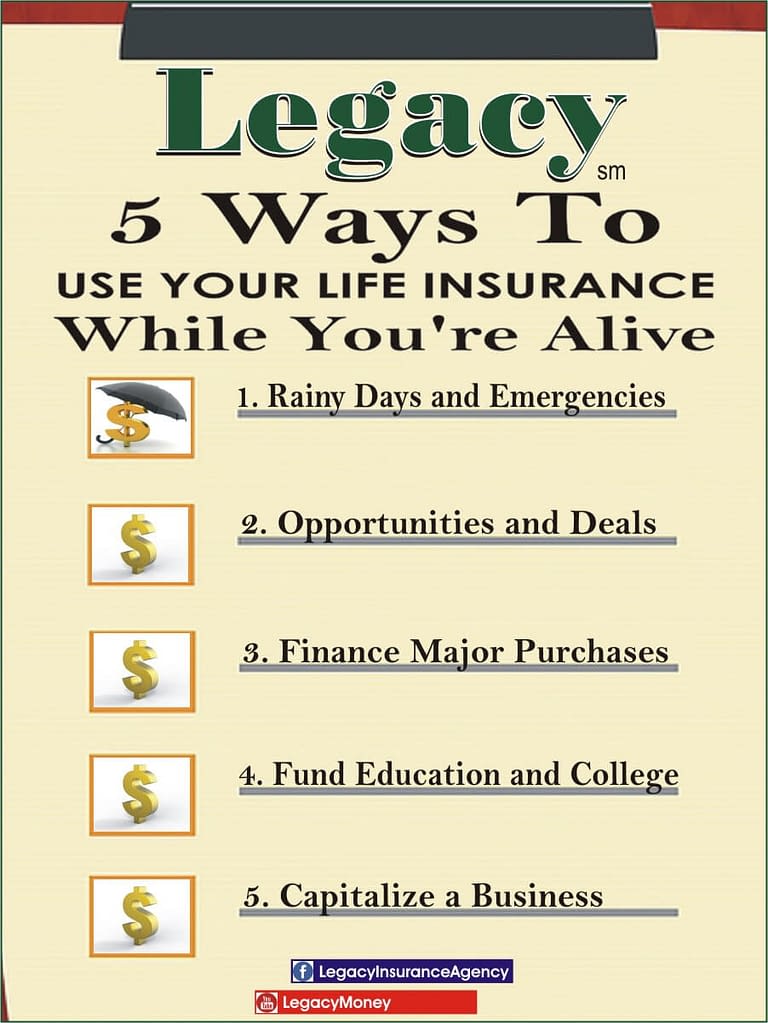

Source: legacyinsuranceagency.com

Source: legacyinsuranceagency.com

One can buy multiple term plans and each of these will be honoured by the insurance company. Can nri’s buy term insurance? No it is not possible to switch your term plan from one term insurance company to another. This gap can be filled by buying a second term insurance policy. Some other insurance policies will have an ‘excess clause’.

Source: revisi.net

Some other insurance policies will have an ‘excess clause’. This is applicable even if you are assured better benefits in another plan. £25,000 family income benefit life insurance over 10 years will cost around £10 per month amounting to £1,200 over 10 years. Term insurance lasts for a specific, preset period. Canara hsbc obc life’s online term plan iselect star offers the second option to.

Source: worklife.coloniallife.com

Source: worklife.coloniallife.com

However, permanent insurance does not expire and provides coverage for. The procedures vary from one insurer to another. You can choose the policy you want to use and if it’s not enough, move on to the next to pay the difference. Thus, it is advisable to take the insurance for the term required. No it is not possible to switch your term plan from one term insurance company to another.

Source: revisi.net

Source: revisi.net

30 year old akshit buys a rs 2 crore term insurance policy till the age of 65. The term life insurance online calculator recommends ideal term insurance plans for you. Know the risks, benefits and coverage of the plans. Buy a new term life insurance as your eligibility and responsibility (family) grows. Know the risks, ben… read more.

Source: pinterest.com

Source: pinterest.com

However, as you grow older, you have additional responsibilities as you. Some other insurance policies will have an ‘excess clause’. Fully underwritten policies take 2 to 4 weeks on average to receive approval. No it is not possible to switch your term plan from one term insurance company to another. 30 year old akshit buys a rs 2 crore term insurance policy till the age of 65.

Source: revisi.net

Source: revisi.net

If an insured person has coverage under two indemnity insurance policies, he has the right to choose under which policy he wants to make the claim. You can have more than one policy through the same insurer or multiple companies. To prevent a situation where the coverage you have opted for is inadequate, you can invest in two term insurance policies. Let’s illustrate this with a simple example. Now there are two ways you can achieve this:

Source: strittmatterwealth.com

Source: strittmatterwealth.com

Canara hsbc obc life’s online term plan iselect star offers the second option to. Life insurance policies that cover each need for person a separately: Although the decision on the number of policies. On the other hand, in respect of benefit policies like the personal accident policy, where a fixed. Know the risks, benefits and coverage of the plans.

Source: noclutter.cloud

Source: noclutter.cloud

However, as you grow older, you have additional responsibilities as you. Can nri’s buy term insurance? Canara hsbc obc life’s online term plan iselect star offers the second option to. As a general rule, a person has to be resident in india to take up insurance policy from an indian company, reason being the documents required by the company like address proof/age proof are. One can buy multiple term plans and each of these will be honoured by the insurance company.

Source: revisi.net

Source: revisi.net

This gap can be filled by buying a second term insurance policy. One can buy multiple term plans and each of these will be honoured by the insurance company. Canara hsbc obc life’s online term plan iselect star offers the second option to. Some other insurance policies will have an ‘excess clause’. You can buy two or more term insurance plans to fulfill your insurance needs.

Source: life.futuregenerali.in

Source: life.futuregenerali.in

Permanent life insurance is typically more expensive than term insurance. Permanent life insurance is typically more expensive than term insurance. However, permanent insurance does not expire and provides coverage for. How much time does it take for a claim settlement? Term insurance provides coverage for only a specified duration.

Source: pinterest.com

Source: pinterest.com

Let’s illustrate this with a simple example. And so does your insurance coverage needs. In such case, if one is in doubt, one can take a policy for slightly higher term. Here are the benefits of investing in more than one term insurance: If you have two insurance plans, there is no stipulation of nominating the same beneficiary for both insurance plans.

Source: revisi.net

Source: revisi.net

When you use two policies to pay for a. They can, but there is a catch. Thus, it is advisable to take the insurance for the term required. Basically a highest amount is available for each individual for which the term plan can be taken, irrespective of number of policies and the companies. You might decide a term life policy helps in case you need to cover debts over the short term and also have a permanent or whole life policy to protect your beneficiaries with financial assistance after your death.

Source: pinterest.com

Source: pinterest.com

One can buy multiple term plans and each of these will be honoured by the insurance company. Permanent life insurance is typically more expensive than term insurance. The term life insurance online calculator recommends ideal term insurance plans for you. However, permanent insurance does not expire and provides coverage for. Life insurance companies use evidence of insurability to determine the amount of life insurance you can reasonably purchase based on your financial situation.

Source: xithemes.com

Source: xithemes.com

In such case, if one is in doubt, one can take a policy for slightly higher term. Yes, you can buy multiple term insurance plans from same or different insurance companies. Buy a new term life insurance as your eligibility and responsibility (family) grows. To prevent a situation where the coverage you have opted for is inadequate, you can invest in two term insurance policies. You can have more than one policy through the same insurer or multiple companies.

Source: absoluteinsurance.com.au

Source: absoluteinsurance.com.au

Thus, it is advisable to take the insurance for the term required. On the other hand, in respect of benefit policies like the personal accident policy, where a fixed. This is applicable even if you are assured better benefits in another plan. Although the decision on the number of policies. Thus, it is advisable to take the insurance for the term required.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title can i take 2 term insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Claims vs occurrence based insurance Idea

- Cheap tablet insurance Idea

- Calling insurance leads Idea

- Disability insurance for postal workers Idea

- Business insurance peoria il information

- Bright health insurance reviews Idea

- Carrier liability vs cargo insurance Idea

- Can you insure a written off car Idea

- Can convicted felons get life insurance information

- Car insurance administrator Idea