Can i use hsa for spouse not on my insurance information

Home » Trend » Can i use hsa for spouse not on my insurance informationYour Can i use hsa for spouse not on my insurance images are available. Can i use hsa for spouse not on my insurance are a topic that is being searched for and liked by netizens now. You can Find and Download the Can i use hsa for spouse not on my insurance files here. Get all royalty-free vectors.

If you’re looking for can i use hsa for spouse not on my insurance images information connected with to the can i use hsa for spouse not on my insurance interest, you have come to the right site. Our site frequently gives you hints for seeking the highest quality video and picture content, please kindly hunt and locate more enlightening video articles and images that fit your interests.

Can I Use Hsa For Spouse Not On My Insurance. If your only coverage is a qualifying family hdhp, then you can still contribute the family maximum, which is $7200 next year. You can only contribute to your hsa as long as your hdhp is your only health insurance. The fsa could be spent on the spouse, therefore, it disrupts hsa eligibility. Spouses cannot have a joint hsa.

Is Life Insurance Premium Tax Deductible In Canada From ictsd.org

Is Life Insurance Premium Tax Deductible In Canada From ictsd.org

Yes, you can use your hsa to pay the qualified medical expenses for your spouse and dependents, as long as their expenses are not otherwise reimbursed. Additionally, they do not have to be with the same employer, but they can be. One perk of being over 65 with an hsa, is even if something is ‘not eligible’, you. This allows the employee’s hsa funds to be used for the spouse and other qualified dependents, while the adult child has his own funds to use for qualified expenses. Remember that each hsa account is owned by an individual, there are no joint or family accounts. If you have supplemental health insurance through your spouse’s plan, you are ineligible to contribute to your account while that coverage is still active.

Can i use my hsa funds to pay for my spouse’s medical expenses?

Even if your spouse is using your hsa for their qualified medical expenses. Yes, funds can cover eligible expenses for himself, spouse and any other dependents. However, this does not mean you cannot use your hsa to cover medical expenses incurred by your spouse or other tax dependents (see irs publication referenced above), just that the irs keeps track. As long as you qualify for an hsa, you can use it for your spouse. This benefit does not change when your insurance coverage changes, even when you enroll in medicare. Anything not covered by the primary can potentially get covered by the secondary plan, but the initial claim does not go toward the deductible of your spouses plan.

Source: revisi.net

Source: revisi.net

You can only open and contribute to a hsa if. Hsa can i use my hsa funds for my family members, although i only have insurance coverage for myself? You can�t use the funds in your hsa to cover medical expenses your spouse incurred before you were married even if you had the account. Your spouse can also use their own cash, debit, or credit card to pay and then reimburse themselves with the hsa funds. Remember that each hsa account is owned by an individual, there are no joint or family accounts.

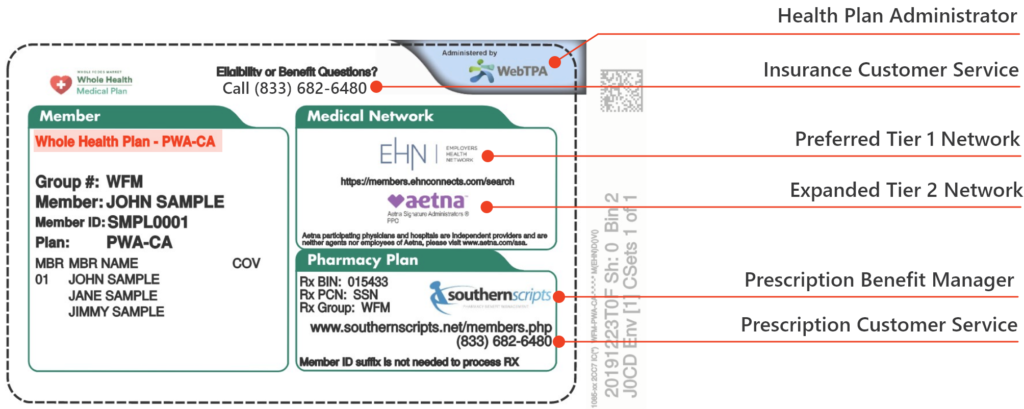

Source: wfm.employershealthnetwork.com

Source: wfm.employershealthnetwork.com

But you can only use your hsa funds to pay for your own medical care and your husband�s. Can that subscriber pay medicare premium or medicare supplement premium with his hsa funds? Is my hsa a joint account with my spouse? The reasoning behind this is that both the fsa and the hsa will reimburse expenses prior to the deductible being met. Each spouse who wants to contribute to an hsa must open a separate hsa.

Source: ictsd.org

Source: ictsd.org

Even if your spouse is using your hsa for their qualified medical expenses. You can only open and contribute to a hsa if. Each spouse who wants to contribute to an hsa must open a separate hsa. If your only coverage is a qualifying family hdhp, then you can still contribute the family maximum, which is $7200 next year. Anything not covered by the primary can potentially get covered by the secondary plan, but the initial claim does not go toward the deductible of your spouses plan.

Source: brandongaille.com

Source: brandongaille.com

Be sure to keep every receipt to justify the reimbursements. Each spouse who wants to contribute to an hsa must open a separate hsa. This benefit does not change when your insurance coverage changes, even when you enroll in medicare. An exception to this rule exists for limited purpose fsas (those that cover vision and dental expenses only) and you would be eligible for an hsa if your spouse had a limited purpose fsa. The plan owner does not have to be present when their spouse uses hsa funds.

Source: commeunefrancaise.com

Source: commeunefrancaise.com

Anything not covered by the primary can potentially get covered by the secondary plan, but the initial claim does not go toward the deductible of your spouses plan. Each spouse who wants to contribute to an hsa must open a separate hsa. Your spouse can also use their own cash, debit, or credit card to pay and then reimburse themselves with the hsa funds. The reasoning behind this is that both the fsa and the hsa will reimburse expenses prior to the deductible being met. Is my hsa a joint account with my spouse?

Source: pennypinchinmom.com

Source: pennypinchinmom.com

Your spouse does not have to have an hsa or even an hdhp. The fsa could be spent on the spouse, therefore, it disrupts hsa eligibility. However, one spouse may use withdrawals from their hsa to pay or reimburse the eligible medical expenses of the other spouse, without penalty. Your spouse can also use their own cash, debit, or credit card to pay and then reimburse themselves with the hsa funds. There is one thing to note, however.

Source: travel.stackexchange.com

Source: travel.stackexchange.com

However, this does not mean you cannot use your hsa. As long as you qualify for an hsa, you can use it for your spouse. So, the parent (your employee) could have an hsa and contribute the allowed maximum family contribution of $6,750 and the dependent adult child could contribute up to $6,750. Even if your spouse is using your hsa for their qualified medical expenses. To have separate hsas, one spouse must have insurance coverage just on himself/herself and the other person must have coverage just on himself/herself and the family.

Source: creativeupcycling.blogspot.com

Source: creativeupcycling.blogspot.com

You can�t use it to pay for your daughter�s care, because you can�t claim her as a tax dependent. Once you reach age 65, you can use your hsa dollars for any expense without penalty. This is a good example of how the tax rules (which pertain to hsa contributions and withdrawals) are separate from the insurance rules (which pertain to who is allowed to be covered under your. Hsa with spouse on second insurance. So, the parent (your employee) could have an hsa and contribute the allowed maximum family contribution of $6,750 and the dependent adult child could contribute up to $6,750.

Source: a.carex-eu.org

Source: a.carex-eu.org

But you can only use your hsa funds to pay for your own medical care and your husband�s. To have separate hsas, one spouse must have insurance coverage just on himself/herself and the other person must have coverage just on himself/herself and the family. If your only coverage is a qualifying family hdhp, then you can still contribute the family maximum, which is $7200 next year. This benefit does not change when your insurance coverage changes, even when you enroll in medicare. However, this does not mean you cannot use your hsa to cover medical expenses incurred by your spouse or other tax dependents (see irs publication referenced above), just that the irs keeps track.

Source: centurabk.com

Source: centurabk.com

Yes, funds can cover eligible expenses for himself, spouse and any other dependents. Once you reach age 65, you can use your hsa dollars for any expense without penalty. However, this does not mean you cannot use your hsa. Be sure to keep every receipt to justify the reimbursements. The fsa could be spent on the spouse, therefore, it disrupts hsa eligibility.

Source: pennypinchinmom.com

Source: pennypinchinmom.com

However, this does not mean you cannot use your hsa. Can i use my hsa funds to pay for my spouse’s medical expenses? Can i use my hsa funds for my family members, although i only have insurance coverage for myself? Your hsa can be used to cover your spouse. If your only coverage is a qualifying family hdhp, then you can still contribute the family maximum, which is $7200 next year.

Source: military.com

Source: military.com

However, one spouse may use withdrawals from their hsa to pay or reimburse the eligible medical expenses of the other spouse, without penalty. Yes, funds can cover eligible expenses for himself, spouse and any other dependents. This is a good example of how the tax rules (which pertain to hsa contributions and withdrawals) are separate from the insurance rules (which pertain to who is allowed to be covered under your. Even if your spouse is using your hsa for their qualified medical expenses. To have separate hsas, one spouse must have insurance coverage just on himself/herself and the other person must have coverage just on himself/herself and the family.

Source: forthefamily.org

Source: forthefamily.org

I often here, “but my spouse doesn’t spend their fsa $ on me”….that doesn’t matter. This means when you file your claim, it goes on your primary insurance plan. There is one thing to note, however. The fsa could be spent on the spouse, therefore, it disrupts hsa eligibility. This is a good example of how the tax rules (which pertain to hsa contributions and withdrawals) are separate from the insurance rules (which pertain to who is allowed to be covered under your.

Source: noclutter.cloud

Source: noclutter.cloud

You can always use hsa funds to pay for out of pocket medical expenses for yourself, your spouse, and your dependents, no matter what kind of insurance they have. However, this does not mean you cannot use your hsa to cover medical expenses incurred by your spouse or other tax dependents (see irs publication referenced above), just that the irs keeps track. This is a good example of how the tax rules (which pertain to hsa contributions and withdrawals) are separate from the insurance rules (which pertain to who is allowed to be covered under your. Can i use my hsa funds to pay for my spouse’s medical expenses? This benefit does not change when your insurance coverage changes, even when you enroll in medicare.

Source: healthequity.com

Source: healthequity.com

Is my hsa a joint account with my spouse? I often here, “but my spouse doesn’t spend their fsa $ on me”….that doesn’t matter. Be sure to keep every receipt to justify the reimbursements. This allows the employee’s hsa funds to be used for the spouse and other qualified dependents, while the adult child has his own funds to use for qualified expenses. However, this does not mean you cannot use your hsa.

Source: wifeteachermommy.com

Source: wifeteachermommy.com

The fsa could be spent on the spouse, therefore, it disrupts hsa eligibility. As long as you qualify for an hsa, you can use it for your spouse. Yes, you can use your hsa to pay the qualified medical expenses for your spouse and dependents, as long as their expenses are not otherwise reimbursed. However, this does not mean you cannot use your hsa to cover medical expenses incurred by your spouse or other tax dependents (see irs publication referenced above), just that the irs keeps track. One perk of being over 65 with an hsa, is even if something is ‘not eligible’, you.

Source: dr-jim.com

Source: dr-jim.com

There can only be one hsa per health insurance plan. Once you reach age 65, you can use your hsa dollars for any expense without penalty. Yes, funds can cover eligible expenses for himself, spouse and any other dependents. If you�re on your companies hsa, that�s your primary coverage, and your spouses plan counts as secondary. This allows the employee’s hsa funds to be used for the spouse and other qualified dependents, while the adult child has his own funds to use for qualified expenses.

Source: wifeteachermommy.com

Source: wifeteachermommy.com

If he’s over 65, premiums are eligible, but supplemental insurance like medigap is not. Even though you are not covered by your spouse’s health insurance, the irs has determined that your spouse’s fsa is considered “other insurance” that makes you ineligible for an hsa. Otherwise, your spouse�s coverage decisions don�t affect your eligibility to open and fund a health savings account. There can only be one hsa per health insurance plan. An exception to this rule exists for limited purpose fsas (those that cover vision and dental expenses only) and you would be eligible for an hsa if your spouse had a limited purpose fsa.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title can i use hsa for spouse not on my insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Craft insurance arab al Idea

- Colonial life insurance claims Idea

- Business insurance and benefits information

- Deans and homer insurance Idea

- Crown cost without insurance information

- Delmonico insurance syracuse ny Idea

- Department of insurance and financial services michigan duties information

- Cost of eye exam with insurance Idea

- Cashless hospital list under national insurance company Idea

- Crowel insurance agency information