Can insurance affect your credit score Idea

Home » Trend » Can insurance affect your credit score IdeaYour Can insurance affect your credit score images are available in this site. Can insurance affect your credit score are a topic that is being searched for and liked by netizens now. You can Get the Can insurance affect your credit score files here. Download all royalty-free photos and vectors.

If you’re searching for can insurance affect your credit score images information related to the can insurance affect your credit score topic, you have come to the ideal site. Our site always provides you with hints for viewing the maximum quality video and image content, please kindly search and locate more informative video content and images that match your interests.

Can Insurance Affect Your Credit Score. So, can obtaining an auto insurance quote have a negative effect on your credit?. If you have a permanent life insurance policy and take out a policy loan, this loan is not reported to the bureau. A healthier credit score can lead to lower premiums and put money back into your pockets. Life insurance companies do not report payment history to credit bureaus.

In Oklahoma, avoiding credit card debt can hike your From okpolicy.org

In Oklahoma, avoiding credit card debt can hike your From okpolicy.org

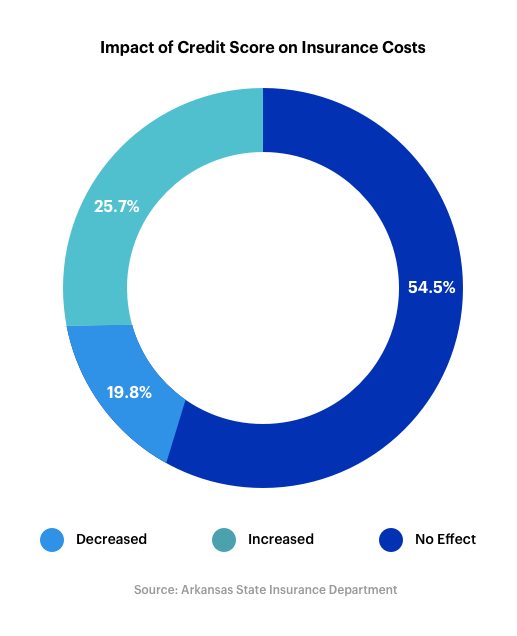

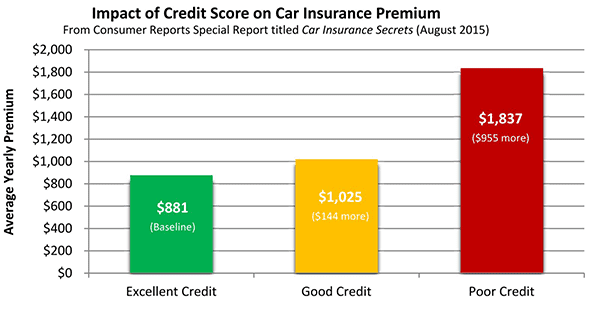

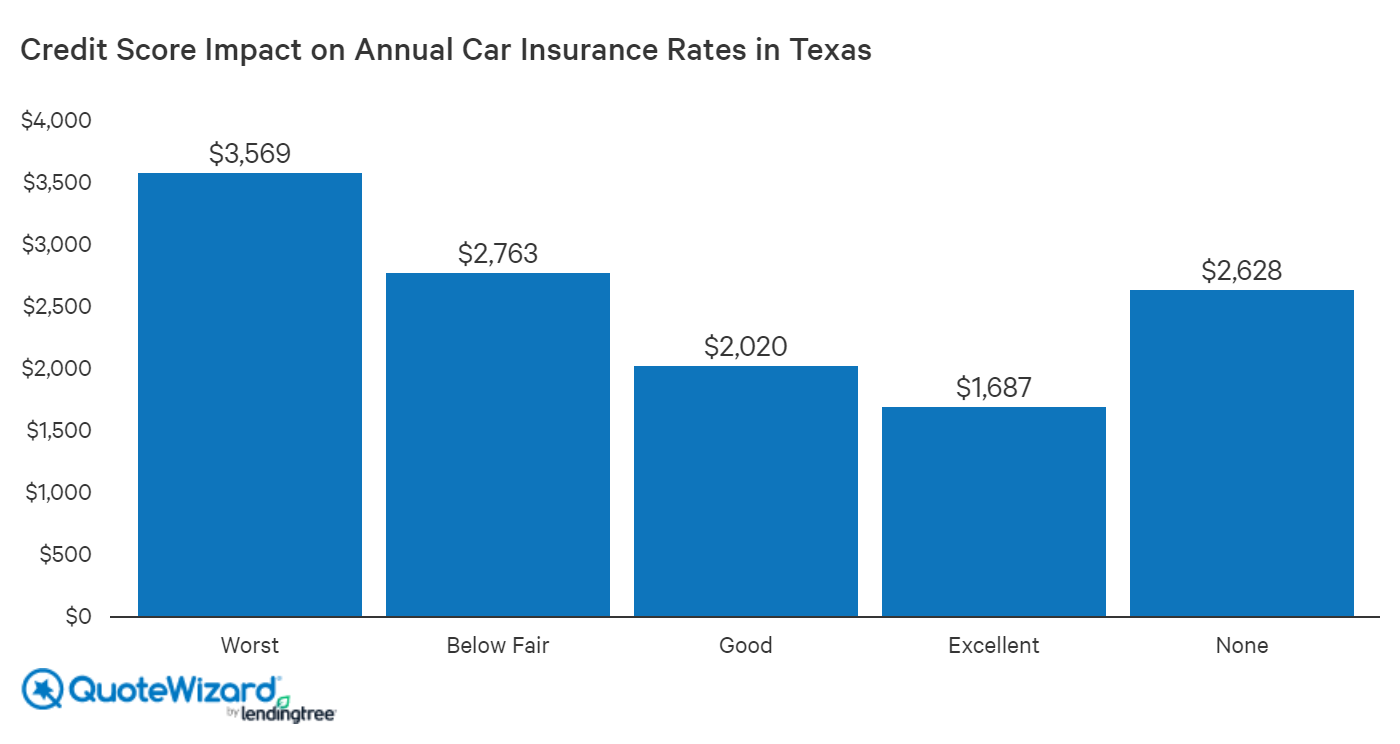

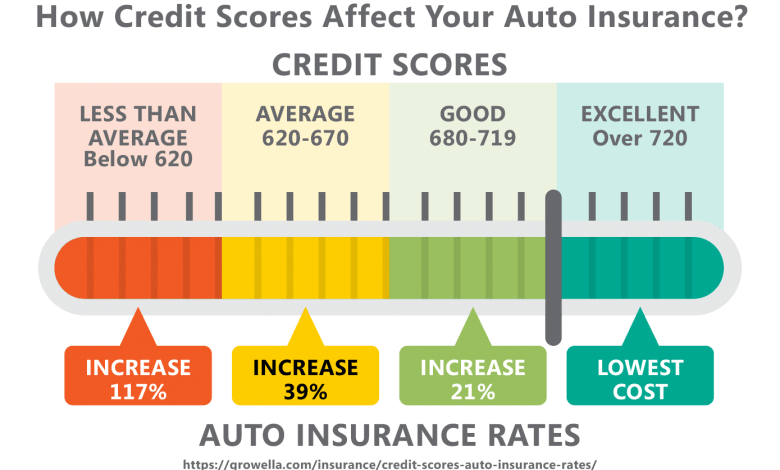

The use of credit scores to determine insurance rates is rooted in research that has shown individuals with lower credit scores had higher car insurance losses and higher claims payouts. Under normal circumstances, changing insurance companies will not affect your credit score. Life insurance does not directly affect your credit under any circumstances. If you can’t pay your policy premiums and it lapses, it won’t affect your credit score. The good answer is that no, getting a quote won’t have any effect on your score. No reports a late car insurance payment won�t directly affect a credit score because insurers don�t report their customers� payment histories to credit reporting agencies.

According to experian, one of the three major credit bureaus, insurance quotes do not affect your credit score:

According to experian, one of the three major credit bureaus, insurance quotes do not affect your credit score: That’s because insurance quotes do not affect your credit score, and you can apply for some quotes without credit. “your credit score impacts how much you Insurance is a competitive market, one of the reasons people and businesses change insurance companies all the time, in search of better coverage, better prices, or better service. Under normal circumstances, changing insurance companies will not affect your credit score. Life insurance companies do not report payment history to credit bureaus.

Source: dcartwrightlaw.com

Source: dcartwrightlaw.com

A healthier credit score can lead to lower premiums and put money back into your pockets. If you have a permanent life insurance policy and take out a policy loan, this loan is not reported to the bureau. While your car insurance policy will never impact your credit score, the opposite may be true. Life insurance does not directly affect your credit under any circumstances. No reports a late car insurance payment won�t directly affect a credit score because insurers don�t report their customers� payment histories to credit reporting agencies.

Source: coverlink.com

Source: coverlink.com

A healthier credit score can lead to lower premiums and put money back into your pockets. In addition, the higher your credit score, the better terms you will receive on loans and credit cards. It is not a factor in your score. Even though insurance companies check your credit during the quote process, they use a type of inquiry called a soft pull that does not show up to. Under normal circumstances, changing insurance companies will not affect your credit score.

Source: youtube.com

Source: youtube.com

No reports a late car insurance payment won�t directly affect a credit score because insurers don�t report their customers� payment histories to credit reporting agencies. The short answer is no. “an inquiry will be added to your credit report each time an insurance company accesses your credit report. A healthier credit score can lead to lower premiums and put money back into your pockets. The use of credit scores to determine insurance rates is rooted in research that has shown individuals with lower credit scores had higher car insurance losses and higher claims payouts.

Source: ladodeladafocagem.blogspot.com

Source: ladodeladafocagem.blogspot.com

While shopping around for car insurance quotes, you may wonder how your recent inquiries will impact your credit score. It is not a factor in your score. Statistical analysis shows that those with a low insurance score are more likely to file a claim. What else do auto insurers look at to determine rates? In many states, car insurance companies will consider your credit history before providing you with a quote.

Source: pawson.com

Source: pawson.com

Life insurance does not directly affect your credit under any circumstances. A healthier credit score can lead to lower premiums and put money back into your pockets. Having poor credit affects insurance rates, but shopping around won’t have an impact on your credit score because there’s no hard credit pull when you compare car insurance quotes. If you can’t pay your policy premiums and it lapses, it won’t affect your credit score. Again, it’s a matter of risk assessment.

Source: thez.zeiler.com

Source: thez.zeiler.com

While your car insurance policy will never impact your credit score, the opposite may be true. As such, having a good credit score is helpful not. States where credit scores don�t affect premiums consumers are kept in the dark because insurance companies are under no obligation to tell you what score they have cooked up for you, you have no. The use of credit scores to determine insurance rates is rooted in research that has shown individuals with lower credit scores had higher car insurance losses and higher claims payouts. This is because, when you get a quote at most an insurance company will run a soft credit check, which will show up on your report only for you and not for insurers or banks.

Source: in.pinterest.com

Source: in.pinterest.com

Again, it’s a matter of risk assessment. As such, having a good credit score is helpful not. Insurance is a competitive market, one of the reasons people and businesses change insurance companies all the time, in search of better coverage, better prices, or better service. If you can’t pay your policy premiums and it lapses, it won’t affect your credit score. Even though insurance companies check your credit during the quote process, they use a type of inquiry called a soft pull that does not show up to.

Source: cover.com

Source: cover.com

No reports a late car insurance payment won�t directly affect a credit score because insurers don�t report their customers� payment histories to credit reporting agencies. You pay for the cover up front, so they don�t have any impact on your credit score. The short answer is no. Statistical analysis shows that those with a low insurance score are more likely to file a claim. If you can’t pay your policy premiums and it lapses, it won’t affect your credit score.

Source: park.ca

Source: park.ca

As such, having a good credit score is helpful not. If you can’t pay your policy premiums and it lapses, it won’t affect your credit score. As such, having a good credit score is helpful not. This is because, when you get a quote at most an insurance company will run a soft credit check, which will show up on your report only for you and not for insurers or banks. A healthier credit score can lead to lower premiums and put money back into your pockets.

Source: valchoice.com

Source: valchoice.com

Statistical analysis shows that those with a low insurance score are more likely to file a claim. If you can’t pay your policy premiums and it lapses, it won’t affect your credit score. Temporary car insurance policies usually last between 1 day and 1 month. While your car insurance policy will never impact your credit score, the opposite may be true. Insurance quotes do not affect credit scores.

Source: badcredit.org

Source: badcredit.org

According to experian, one of the three major credit bureaus, insurance quotes do not affect your credit score: While there is not a direct effect, you can leverage a life insurance policy to your benefit in a number of ways to maintain a good credit score. According to experian, one of the three major credit bureaus, insurance quotes do not affect your credit score: As such, having a good credit score is helpful not. Comparing multiple insurance quotes from.

Source: cardrates.com

Source: cardrates.com

This is because, when you get a quote at most an insurance company will run a soft credit check, which will show up on your report only for you and not for insurers or banks. Under normal circumstances, changing insurance companies will not affect your credit score. It is not a factor in your score. In addition, the higher your credit score is, the better terms you will receive on loans and credit cards. Named drivers don�t get credit checked, either.

Source: carmudi.com.ph

Source: carmudi.com.ph

According to experian, one of the three major credit bureaus, insurance quotes do not affect your credit score: No reports a late car insurance payment won�t directly affect a credit score because insurers don�t report their customers� payment histories to credit reporting agencies. The national association of insurance commissioners, or naic, says similar insurance claim rates exist for policies on personal property as for those on vehicles. The use of credit scores to determine insurance rates is rooted in research that has shown individuals with lower credit scores had higher car insurance losses and higher claims payouts. In addition, the higher your credit score, the better terms you will receive on loans and credit cards.

Source: tdi.texas.gov

Source: tdi.texas.gov

Additional things to know regarding life insurance and your credit report: According to experian, one of the three major credit bureaus, insurance quotes do not affect your credit score: That’s because insurance quotes do not affect your credit score, and you can apply for some quotes without credit. If you can’t pay your policy premiums and it lapses, it won’t affect your credit score. Life insurance companies do not report payment history to credit bureaus.

Source: quotewizard.com

Source: quotewizard.com

States where credit scores don�t affect premiums consumers are kept in the dark because insurance companies are under no obligation to tell you what score they have cooked up for you, you have no. Life insurance companies do not report payment history to credit bureaus. In addition, the higher your credit score is, the better terms you will receive on loans and credit cards. Temporary car insurance policies usually last between 1 day and 1 month. Having poor credit affects insurance rates, but shopping around won’t have an impact on your credit score because there’s no hard credit pull when you compare car insurance quotes.

Source: okpolicy.org

Source: okpolicy.org

The national association of insurance commissioners, or naic, says similar insurance claim rates exist for policies on personal property as for those on vehicles. “an inquiry will be added to your credit report each time an insurance company accesses your credit report. That’s because insurance quotes do not affect your credit score, and you can apply for some quotes without credit. Insurance is a competitive market, one of the reasons people and businesses change insurance companies all the time, in search of better coverage, better prices, or better service. While your car insurance policy will never impact your credit score, the opposite may be true.

Source: myrandombrainfarts.blogspot.com

Source: myrandombrainfarts.blogspot.com

So, can obtaining an auto insurance quote have a negative effect on your credit?. Life insurance companies do not report payment history to credit bureaus. Named drivers don�t get credit checked, either. Life insurance does not directly affect your credit under any circumstances. A healthier credit score can lead to lower premiums and put money back into your pockets.

Source: badcreditwizards.com

Source: badcreditwizards.com

Having poor credit affects insurance rates, but shopping around won’t have an impact on your credit score because there’s no hard credit pull when you compare car insurance quotes. Your credit score can also impact how much you pay for homeowners or renters insurance. In addition, the higher your credit score is, the better terms you will receive on loans and credit cards. While your car insurance policy will never impact your credit score, the opposite may be true. Under normal circumstances, changing insurance companies will not affect your credit score.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title can insurance affect your credit score by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Craft insurance arab al Idea

- Colonial life insurance claims Idea

- Business insurance and benefits information

- Deans and homer insurance Idea

- Crown cost without insurance information

- Delmonico insurance syracuse ny Idea

- Department of insurance and financial services michigan duties information

- Cost of eye exam with insurance Idea

- Cashless hospital list under national insurance company Idea

- Crowel insurance agency information